Majorleaguetrading – Major League Trading Basic Trading Course

$697.00 Original price was: $697.00.$44.00Current price is: $44.00.

Majorleaguetrading Major League Trading Basic Trading Course [Instant Download]

What is Major League Trading Basic Trading Course?

Major League Trading Basic Trading Course is a comprehensive trading course that teaches you how to make money in financial markets.

The course focuses on technical analysis, fibonacci retracements, and risk management to help you become a profitable trader. You’ll learn how to read charts, identify market levels, and control your losses.

Jack Gleason and Eric Marcus teach proven strategies through 12 detailed lessons covering everything from basic setup to advanced trading psychology. The program transforms losing traders into winners using systematic approaches that work in real markets.

📚 PROOF OF COURSE

What you’ll learn in Major League Trading course:

This trading course teaches you everything needed to become a profitable trader. Here’s what you’ll learn:

- Technical analysis skills: Read charts, spot trends, and find profitable trading opportunities using proven methods.

- Fibonacci trading methods: Master fibonacci retracements and extensions for precise entry and exit points in any market.

- Risk management techniques: Control losses and protect your trading capital with smart money management strategies.

- Trading psychology: Stop emotional trading mistakes and develop a winning trader mindset that keeps you profitable.

- Market level identification: Find key support and resistance levels for better trade timing and higher success rates.

- Futures trading strategies: Learn specific techniques for trading futures markets with confidence and consistency.

This course works for beginners and struggling traders alike. You’ll build the skills and confidence needed to trade successfully in any market condition.

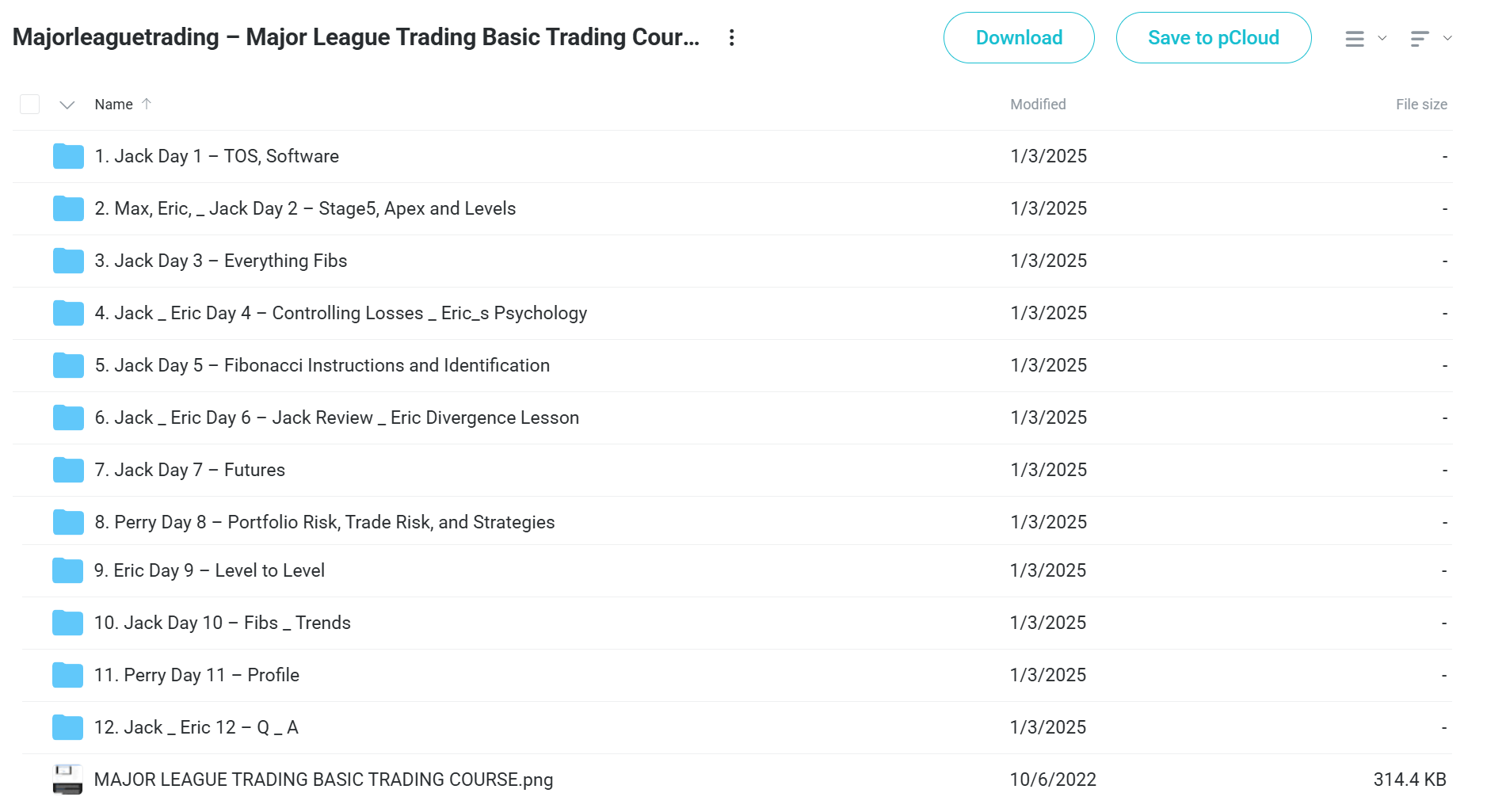

3️⃣. Major League Trading Basic Trading Course Curriculum:

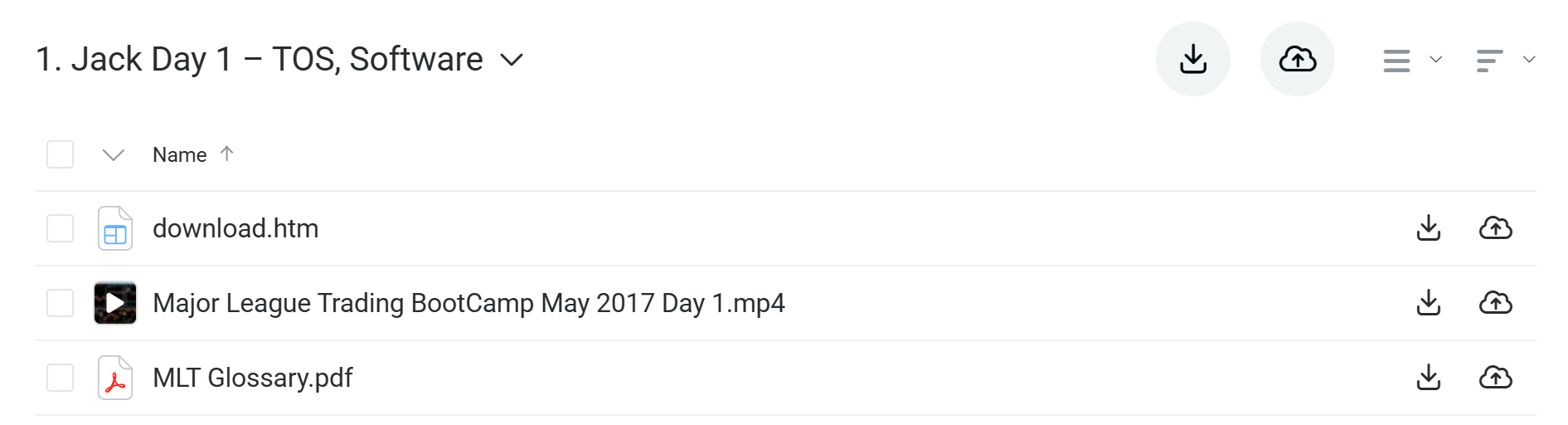

✅ Day 1: Foundation Setup with Jack

Students begin their trading journey by mastering the Think or Swim (TOS) platform and essential trading software. Jack guides learners through platform navigation, chart setup, and basic functionality that forms the backbone of all future trading activities.

The session includes comprehensive software tutorials and introduces the MLT Glossary, establishing the technical vocabulary students will use throughout the course. This foundational day ensures all participants start with identical technical setups and understanding.

✅ Day 2: Market Structure Fundamentals

Max, Eric, and Jack collaborate to introduce Stage 5 analysis, Apex trading concepts, and critical support/resistance levels. Students learn to identify market phases and understand how institutional money flows create predictable patterns in price movement.

The instruction focuses on recognizing market structure changes and understanding how different market stages require different trading approaches. Students develop skills in identifying when markets transition between trending and consolidating phases.

✅ Day 3: Fibonacci Analysis Deep Dive

Jack delivers an intensive session covering “Everything Fibs,” teaching students how Fibonacci retracements and extensions predict price targets with remarkable accuracy. Students learn to identify key Fibonacci levels that act as magnets for price action across all timeframes.

The lesson covers practical application of multiple Fibonacci tools, including how to layer different Fibonacci levels to create high-probability trade setups. Students practice identifying confluence zones where multiple Fibonacci levels align.

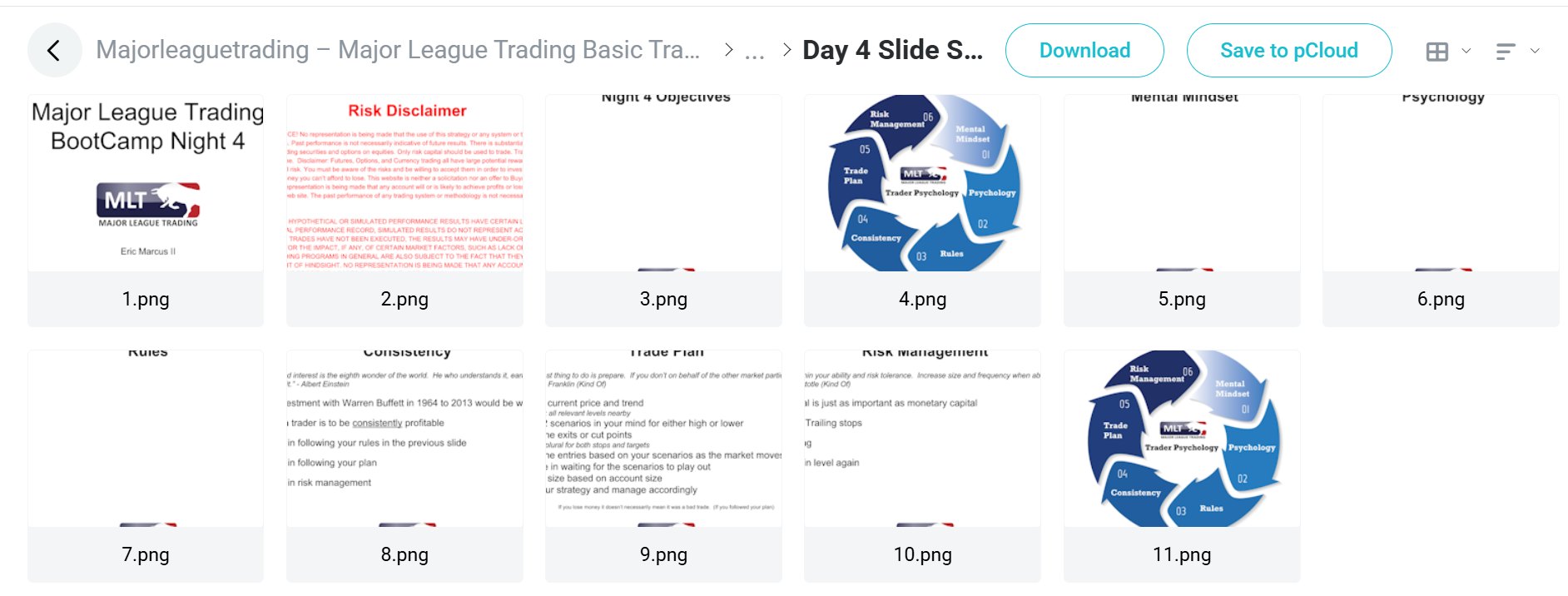

✅ Day 4: Loss Control & Trading Psychology

Jack and Eric address the psychological challenges of trading while teaching systematic loss control methods. Eric’s psychology segment helps students understand how emotions sabotage trading decisions and provides practical techniques for maintaining discipline.

Students learn position sizing rules, stop-loss placement strategies, and how to manage trades when they move against them. The session includes real-world examples of how poor psychology leads to account destruction and how proper mindset protects capital.

✅ Day 5: Advanced Fibonacci Application

Jack provides detailed instructions on Fibonacci identification and implementation across different market conditions. Students learn to distinguish between valid and invalid Fibonacci setups, understanding when these tools provide the highest probability signals.

The comprehensive slide presentation covers Fibonacci trading in trending markets, range-bound conditions, and during breakout scenarios. Students develop the ability to quickly identify the most relevant Fibonacci levels for any given market situation.

✅ Day 6: Integration & Divergence Analysis

Jack reviews previous concepts while Eric introduces divergence analysis as a powerful timing tool. Students learn how oscillator divergences signal potential reversals and how to combine this analysis with previously learned techniques.

The session demonstrates how divergence analysis confirms or invalidates other technical signals, creating a more robust trading framework. Students practice identifying regular and hidden divergences across multiple timeframes.

✅ Day 7: Futures Market Dynamics

Jack expands the curriculum to include futures trading, teaching students how leverage and margin requirements differ from stock trading. Students learn about futures contract specifications, margin requirements, and how to adapt their analysis techniques to futures markets.

The instruction covers sector rotation concepts and how futures markets often lead stock market movements. Students understand how to use futures analysis to anticipate broader market direction changes.

✅ Day 8: Comprehensive Risk Management

Perry delivers crucial instruction on portfolio risk management, individual trade risk assessment, and strategic position sizing. Students learn mathematical approaches to determining appropriate position sizes based on account size and risk tolerance.

The session covers correlation analysis, showing how seemingly different trades can create concentrated risk exposure. Students develop systematic approaches to managing multiple positions and understanding when to reduce overall market exposure.

✅ Day 9: Level-to-Level Trading Mastery

Eric teaches the signature “Level to Level” trading methodology that identifies high-probability entry and exit points. Students learn to identify key price levels where institutional activity creates predictable price reactions.

The instruction focuses on understanding how price moves between significant levels and how to position trades to capture these movements. Students practice identifying the most significant levels that consistently produce trading opportunities.

✅ Day 10: Advanced Fibonacci & Trend Analysis

Jack combines Fibonacci analysis with trend identification techniques, showing students how to adapt their analysis to different market environments. Students learn to modify their Fibonacci application based on trend strength and market volatility.

The session covers advanced concepts like Fibonacci channels, time-based Fibonacci analysis, and how to use Fibonacci levels to set realistic profit targets. Students develop skills in projecting price movements using multiple Fibonacci techniques simultaneously.

✅ Day 11: Market Profile Analysis

Perry introduces market profile concepts, teaching students how volume and time analysis reveal market sentiment and potential turning points. Students learn to interpret market profile graphics and understand how auction theory applies to financial markets.

The instruction covers how market profile analysis complements technical analysis and provides additional confirmation for trade entries and exits. Students learn to identify value areas and understand how price acceptance or rejection at these levels signals future direction.

✅ Day 12: Integration & Live Application

Jack and Eric conduct a comprehensive Q&A session that ties together all previous concepts and addresses specific student questions. Students receive guidance on combining different analytical techniques and developing their personal trading methodology.

The final session focuses on practical implementation, helping students understand how to prioritize different signals when they conflict and how to develop consistency in their trading approach. Students leave with a complete framework for analyzing markets and executing trades with confidence.

What is Majorleaguetrading?

Major League Trading is a financial education platform founded by experienced traders Jack Gleason and Eric Marcus. Both have years of real trading experience in futures, options, and financial markets.

Jack Gleason specializes in technical analysis and fibonacci trading methods. He has helped thousands of traders master chart reading and profitable entry techniques. His expertise in market levels and trend analysis forms MLT’s core teaching approach.

Eric Marcus focuses on trading psychology and risk management strategies. He teaches traders how to control emotions and manage portfolio risk. His background in divergence patterns helps traders avoid common mistakes.

Together, they created Major League Trading to share proven strategies that work in real markets. The platform has educated traders worldwide through practical training programs.

Their method combines technical analysis with proper risk management. This helps traders build consistent profits while protecting their capital from major losses.

Be the first to review “Majorleaguetrading – Major League Trading Basic Trading Course” Cancel reply

Related products

Trading Courses

Trading Courses

Crypto Trading

Forex Trading

Trading Courses

Stock Trading

Investment Management

Reviews

There are no reviews yet.