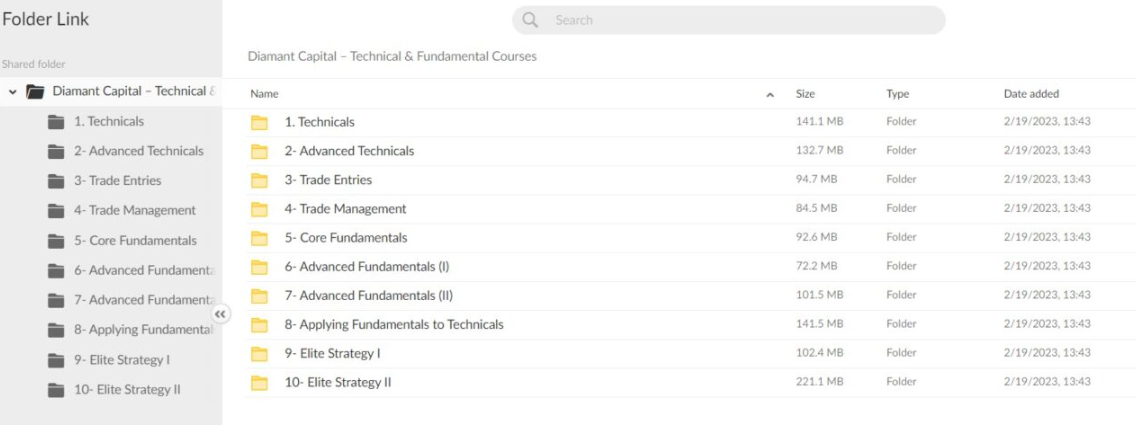

Diamant Capital – Technical & Fundamental Courses 2023

$500.00 Original price was: $500.00.$15.00Current price is: $15.00.

[Download] Diamant Capital Technical & Fundamental Courses 2023

What is Diamant Technical & Fundamental Course 2023

Feeling lost in the stock market? Our Technical & Fundamental Courses 2023 by Diamant Capital make it simple.

We teach you the basics of how to look at charts and understand market news so you can start trading with confidence. Join us to learn the trading essentials and get ahead in the game.

What You Will Learn in This Course

- Technicals: Grasp the basics and advanced concepts of technical analysis.

- Advanced Technicals: Dive deeper into complex technical analysis techniques.

- Trade Entries: Learn how to identify and execute effective trade entries.

- Trade Management: Understand the strategies for managing your trades to maximize profits and minimize risks

What Included in Diamant Technical & Fundamental Course:

The curriculum is extensive and detailed, ensuring you receive a well-rounded education in both technical and fundamental aspects of trading.

- Core Fundamentals: Get to grips with the economic factors that affect the markets.

- Advanced Fundamentals I & II: Delve into sophisticated fundamental analysis techniques.

- Applying Fundamentals to Technicals: Combine these two critical areas to enhance your trading strategies.

- Elite Strategy I & II: Gain access to top-tier trading strategies that can propel your trading to new heights.

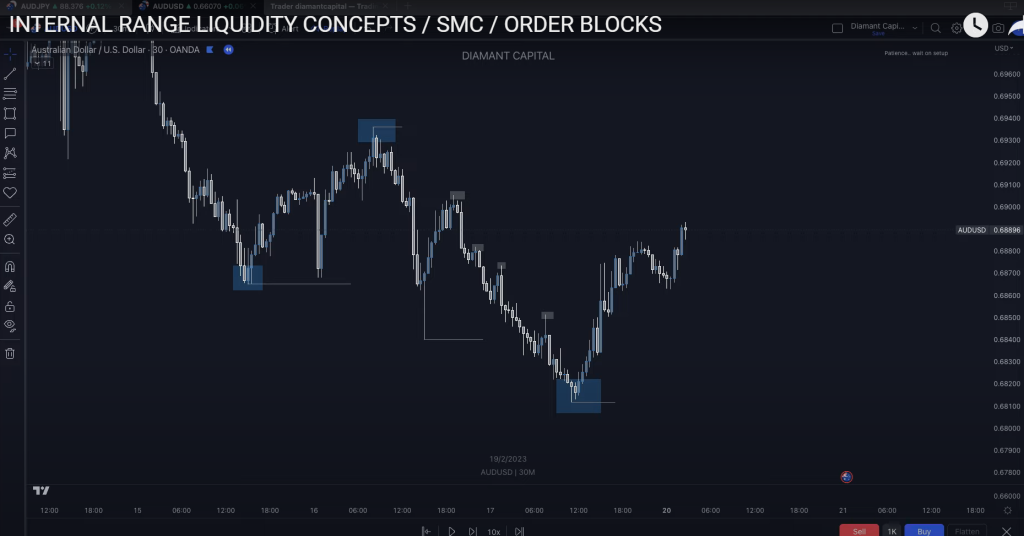

Module 1: Technicals

- Introduction

- Market structure

- Premium and discount

- Institutional order flow

- Order Block types

- Liquidity

- Voids & Imbalances

- BOS & Liquidity grabs

- Consolidations

- Expansions

- Piecing everything together

Module 2: Advanced Technicals

- Time price weekly

- Time and price daily

- 3 Types of Volume Strategies

- Divergences

- Insitutional Swing Point

- Market Cycles

- Laws of wyckoff & volume divergence

- Accumulation Schematic

- Distribution Schematic

- Re-accumulation and re-distribution schematics

- Application of wyckoff

- Improving win rate with wyckoff

Module 3: Trade Entries

- Risk vs confirmation trades

- Invalidation

- Currency correlation divergence

- Currency volatility and data

- Entry refinement

- Inducements

- Introduction to optimum trades

- Optimum trade entry 1

- Optimum trade entry 2

- Optimum trade entry 3

Module 4: Trade Management

- Risk management plan

- Taking profits

- Increasing probability with confirmations

- Deciding which pairs

- Preparing for the week

- Backtesting

- Trading Live & Funded

- Trading Plan

- Intro to fundamentals

Module 5: Core Fundamentals

- Introduction

- Economic train

- GDP

- Interest rates

- Inflation & Deflation

- Measures of Inflation

- Asset class Introduction

- Risk on vs risk off

- Implications of Imports & Exports

- Endogenous & Exogenous Differentials

Module 6: Advanced Fundamentals (I)

- Money supply

- Economic Cycles

- Monetary Policies

- Fiscal Policies

- Budget Deficits

- Quantitative Easing

- Reduction of Asset Purchases

- Low interest rate market

- High interest rate environment

Module 7: Advanced Fundamentals (II)

- Federal Funds Rate

- FED Funds rate indicators

- Types of interest rates and GDP

- Bonds and yields

- Yield Curves

- Economic drivers

- NFP & Employment

Module 8: Applying Fundamentals to Technicals

- Links to Key Websites

- Bloomberg terminal

- Trading news events

- Confirmations; institutional orders and volatility

- Resources to learn

- Asset class correlation stocks and bonds

- Asset classes currency commodities

- Fundamental Divergences

- Applying fundamentals to technicals

- Final words

Diamnt Capital Reviews

If you want to get better at trading, Diamant Capital’s Technical & Fundamental Courses 2023 is a decent place to start. Here’s my honest opinion on it, plus what some fellow learners think.

Simple Breakdown of the Course

- Learning to Read Charts: The course teaches you how to understand charts and numbers, which is excellent. But remember, it takes practice to get good at it.

- Understanding Market News: They show you how to make sense of financial news and why prices go up or down, which is super helpful. Sometimes, there’s a lot to take in, but it’s all important.

What You Might Get Out of It

- Feeling More Sure When Trading: I feel more sure about making trades now. Others in the class say the same, but we all know there’s more to learn.

- Doing Better with Your Money: I’ve seen some good changes in how my investments are doing. It’s not like I’m rich overnight, but I’m heading in a good direction.

The Real Scoop on the Lessons

- Fancy Strategies: They teach some cool strategies for when you’re ready to step up your game. They’re not mind-blowing, but they give you a solid plan to work with.

- Trying It Out for Real: The best part is to try what you’ve learned in actual trades. It’s tough, but it helps you learn.

Straight Talk from Other Learners

Getting Better Slowly: “This course helped me get a clearer picture of trading. I’m not making big bucks yet, but I feel like I’m doing better,” says Emma L., who finished the course.

> Wishing for More Chat Time: Some of us think it would be great to have more time to discuss things with the teachers, especially when the going gets tough.

My Final Take

The Technical & Fundamental Courses 2023 by Diamant Capital is a good starting point if you’re new to trading or want to get more serious about it. It’s not a magic solution, but it’s an excellent way to learn the ropes.

Overall Rating: ⭐⭐⭐✩✩: 3/5

It’s a course that asks you to put in the effort, and if you do, you’ll learn a lot. Just don’t expect to become a trading star overnight.

Read more our Top Trading Courses:

- FX SpeedRunner 2023

- Breaking Into Wall Street 2022 – BIWS Platinum

- John Keppler – Market Profile Trading Strategies: Beyond the Basics

Instructor Profile: Who Is Diamant Capital?

Diamant Capital has established itself as a pillar in the financial education sector, mainly known for its Technical and fundamental Courses for 2023. The group’s educational approach is grounded in the SMC framework and fundamentally driven strategies, ensuring a comprehensive learning experience.

Education and Approach:

Diamant Capital’s educational philosophy is rooted in the SMC (Strategic Market Conditions) approach, which emphasizes the importance of understanding market dynamics. Their courses are designed to provide a fundamentally driven perspective, giving students the analytical tools to decipher the financial markets.

Reach and Influence:

With a robust following of over 39,000 subscribers on YouTube, Diamant Capital has a significant online presence, making complex trading concepts accessible to a broad audience. Their educational content is not only informative but also engaging, which has helped them build a community of over 550 students worldwide.

1 review for Diamant Capital – Technical & Fundamental Courses 2023

Add a review Cancel reply

Related products

Forex Trading

Trading Courses

Trading Courses

Forex Trading

Base Camp Trading – Explosive Growth Options – Stocks (EGOS) Program – EGOS MINI BUNDLE)

Trading Courses

Forex Trading

Trading Courses

Trading Courses

![Mike Aston - Learn to Trade [Trading Template]](https://coursehuge.com/wp-content/uploads/2023/09/Mike-Aston-Learn-to-Trade-Trading-Template-300x300.jpg)

Mobeen Y. (verified owner) –

Highly impressed by the service I was provided . Easy to get hold of the seller who replied very promptly. This will be my go to place in future for buying any courses for sure as they are authentic and provide great service.