Michael S. Jenkins – Day Trading For 50 Years

$525.00 Original price was: $525.00.$12.00Current price is: $12.00.

Michael S. Jenkins Day Trading For 50 Years Course [Instant Download]

1️⃣. What is Day Trading For 50 Years:

Michael S. Jenkins’ Day Trading For 50 Years teaches you how to trade stocks profitably using proven market timing techniques.

The course shows you step-by-step how to read price action, spot market cycles, and use Gann methods for precise trade entries and exits.

Based on Jenkins’ five decades as an NYSE specialist and fund manager, you’ll learn practical day trading from basic chart reading to advanced timing strategies that work in any market condition.

📚 PROOF OF COURSE

2️⃣. What you’ll learn in Day Trading For 50 Years:

This day trading course teaches you Jenkins’ proven market strategies. Here’s what you’ll learn:

- Market timing basics: Learn price action reading, trends, and retracements

- Advanced trade setups: Master momentum trading and time-price alignment

- Stock selection skills: Find the best stocks for daily profits

- Market cycles: Use seasonal patterns and cycles for better entries

- Gann methods: Apply number harmonics for precise trading

By the end of the course, you’ll know how to spot profitable trades and manage them effectively using Jenkins’ time-tested system.

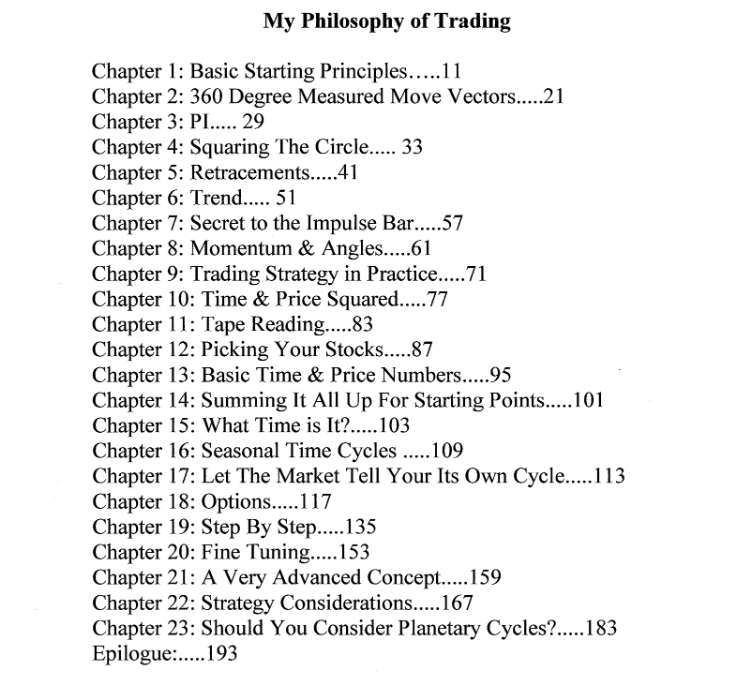

3️⃣. Day Trading For 50 Years Course Curriculum:

Day Trading For 50 Years brings you Jenkins’ complete trading system, developed over five decades on Wall Street. The course starts with basic concepts and builds up to advanced trading techniques, making it easy to follow no matter your experience level. The course curriculum includes:

- Chapter 1: Basic Starting Principles

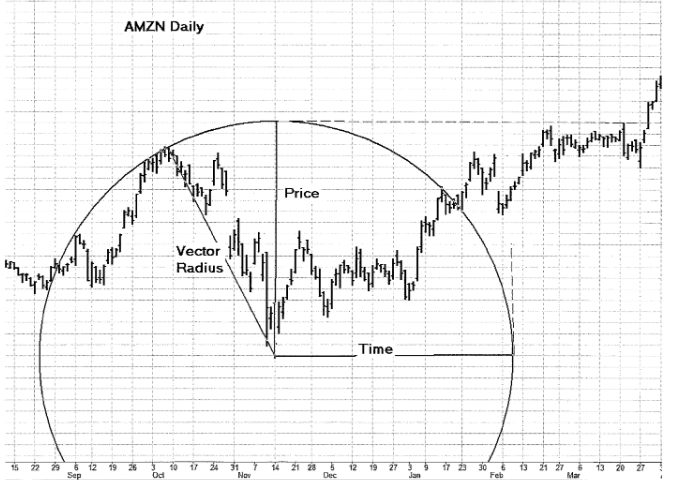

- Chapter 2: 360 Degree Measured Move Vectors

- Chapter 3: PI

- Chapter 4: Squaring the Circle

- Chapter 5: Retracements

- Chapter 6: Trend

- Chapter 7: Secret to the Impulse Bar

- Chapter 8: Momentum & Angles

- Chapter 9: Trading Strategy in Practice

- Chapter 10: Time & Price Squared

- Chapter 11: Tape Reading

- Chapter 12: Picking Your Stocks

- Chapter 13: Basic Time & Price Numbers

- Chapter 14: Summing It All Up for Starting Points

- Chapter 15: What Time is It?

- Chapter 16: Seasonal Time Cycles

- Chapter 17: Let the Market Tell Your Its Own Cycle

- Chapter 18: Options

- Chapter 19: Step By Step

- Chapter 20: Fine Tuning

- Chapter 21: A Very Advanced Concept

- Chapter 22: Strategy Considerations

- Chapter 23: Should You Consider Planetary Cycles?

By the time you finish this course, you’ll have a complete understanding of Jenkins’ trading system, from basic chart reading to advanced market timing. Each chapter builds on the previous one, helping you develop strong trading skills step by step.

4️⃣. Who is Michael S. Jenkins?

Michael S. Jenkins is a professional trader with 50 years of market experience. He started as a portfolio manager and became one of the top ten fund managers globally in the early 1980s.

From 1984, Jenkins traded at NYSE specialist firms and spent 12 years as a CNBC market expert. He holds an MBA from George Mason University and runs the Stock Cycles Forecast newsletter.

His trading record includes correctly predicting major market moves like the 1987 crash and 2000 bear market. Jenkins combines technical analysis with Gann methods to forecast market moves.

Today, he teaches traders through Skype sessions, sharing his expertise in market timing and Gann trading techniques. His trading methods have helped thousands of students worldwide.

5️⃣. Who should take Michael S. Jenkins Course?

Day Trading For 50 Years helps you master the stock market using Jenkins’ proven methods. This course is perfect for:

- New traders who want to learn time-tested trading strategies

- Active traders who want to improve their chart reading skills

- Full-time traders looking to master market cycles and timing

- Chart analysts wanting to learn Gann methods and market geometry

Whether you’re just starting or already trading, this course teaches you Jenkins’ complete system for spotting profitable trades.

6️⃣. Frequently Asked Questions:

Q1: How can I trade stocks profitably?

To trade stocks profitably, focus on strategies like trend analysis, proper risk management, and understanding market cycles. Consistency and discipline are key.

Q2: What are the best practices for professional day trading?

Professional day traders use techniques like technical analysis, momentum strategies, and precise entry and exit points. Staying informed and maintaining a trading plan is essential.

Q3: How much capital is required for day trading?

The capital needed depends on your trading goals, but U.S. regulations require a minimum of $25,000 for pattern day trading. Start small to manage risks effectively.

Q4: What tools do day traders use?

Day traders rely on charting software, news feeds, and indicators like moving averages and RSI. Advanced tools like algorithmic trading platforms can also help.

Q5: Is day trading suitable for everyone?

Day trading demands time, focus, and a strong understanding of the market. It may not suit everyone, especially those unable to handle high risk or emotional trading.

Be the first to review “Michael S. Jenkins – Day Trading For 50 Years” Cancel reply

Related products

Forex Trading

Trading Courses

Forex Trading

Forex Trading

Base Camp Trading – Explosive Growth Options – Stocks (EGOS) Program – EGOS MINI BUNDLE)

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Reviews

There are no reviews yet.