WWA Trading 2023 (Download)

$2,000.00 Original price was: $2,000.00.$12.00Current price is: $12.00.

WWA Trading 2023 Course [Instant Download]

What is WWA Trading 2023?

WWA Trading 2023 course teaches precision-based forex trading using institutional order flow and smart money concepts.

The bootcamp shows you how to identify market structure, analyze Wyckoff schematics, and execute trades across multiple timeframes.

Students learn through live trading sessions and case studies, mastering everything from block structure analysis to portfolio management. The course includes mentorship and community support to accelerate your trading development.

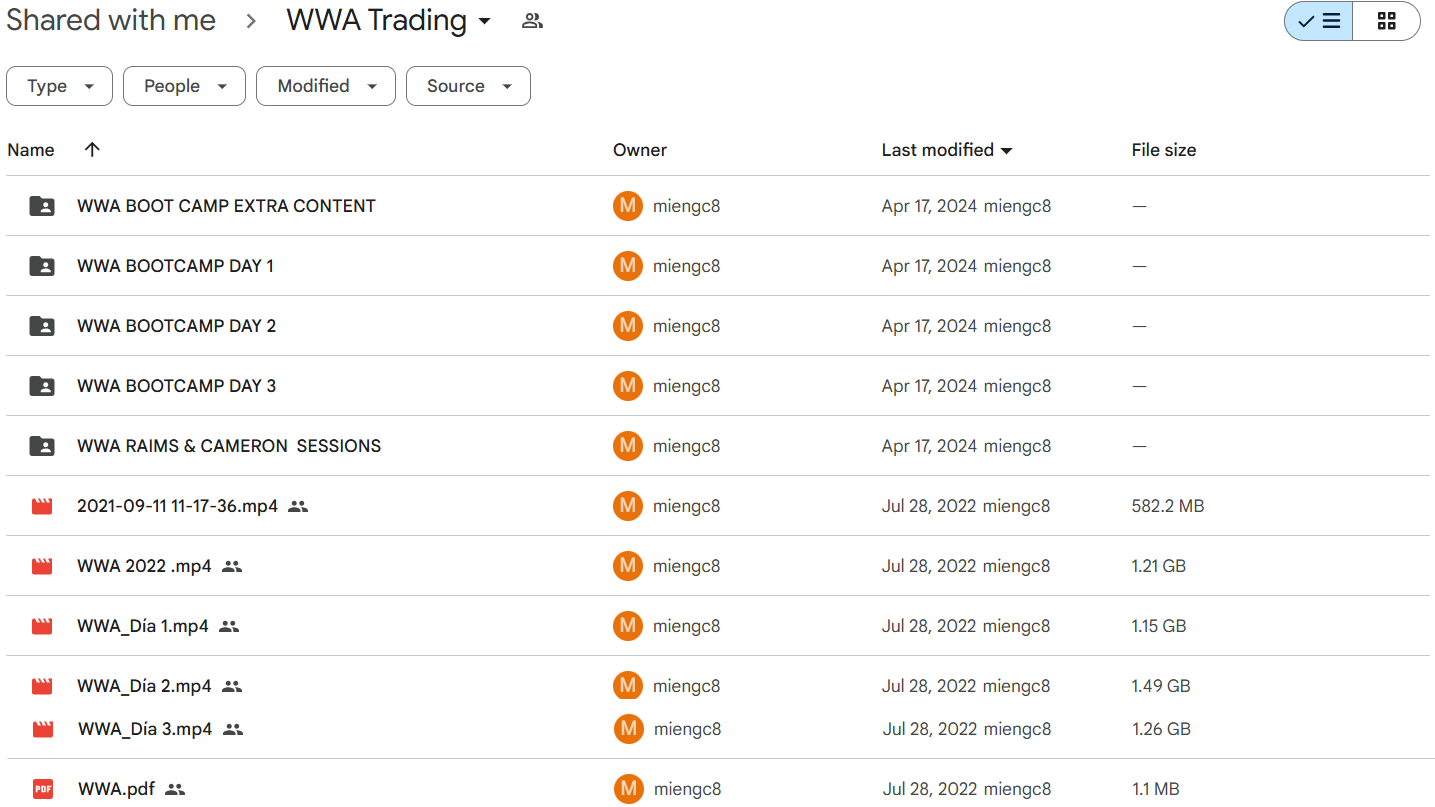

📚 PROOF OF COURSE

What you’ll learn in WWA Trading 2023:

The WWA Trading bootcamp teaches you how to trade forex like institutions do. Here’s what you’ll learn:

- Smart Money Concepts: Spot how big players move the market and find the best entry points

- Advanced Wyckoff Method: Read market structure and use schematics to time your trades

- Portfolio Management: Learn when to enter trades and how much money to risk

- Precision Trading: Use WWA’s trading system on any timeframe

- Live Practice: Trade alongside experts and learn from real market examples

After finishing the course, you’ll know how to find trades like professionals do and manage them properly.

WWA Trading 2023 Course Curriculum:

The WWA Trading bootcamp gives you step-by-step training from basic market concepts to advanced trading strategies. Each day builds on what you learned before, helping you understand how the forex market really works. The course curriculum includes:

✅ WWA Boot Camp Extra Content

- Case Studys

- Community Case Study

- Extra Content

✅ WWA Bootcamp Day 1

- Bootcamp Block Strcuture And HTF Entries Theory 2

- (PART 2) IMBALANCE

- Institutions Theory Waqar 2

- Waqar WWA Advance Smart Money FU IFC LIQUIDITY 2

- WWA Bootcamp Day 2

- IFC Engulfing POI FU Candles OrderFlow

- Wycoff Schematic Intro Waqar Part 1

- Wycoff Schematic Intro Waqar Part 2

- Lower Timeframes Entries Theory Alex

✅ WWA Bootcamp Day 3

- WWA Advance LTF Entries Section 1

- WWA Advance LTF Entries Section 2

- Trade & Portfolio Management

- Advance WWA Wyckoff

- WWA Final Strategy Summary + Application Process

✅ WWA Raims & Cameron Sessions

- Case Study

- Cameron Stocks Group Zoom Aug 22, 2020

- Reim 1

- Reim Asia… IFC

✅ Additional Section [5 MP4s & 1 PDF]

By the end of this course, you’ll know exactly how to spot trading opportunities and manage your positions like professional traders do.

What is WWA Trading?

WWA Trading teaches forex traders how to trade like institutions do. They focus on smart money concepts and precision-based trading methods.

Their team of active traders shares real market experience and proven strategies with students. They’ve helped thousands of traders worldwide learn institutional trading.

WWA Trading runs live trading sessions where students can watch how professional traders work. Their community gives ongoing support to help traders succeed.

The platform stands out for teaching practical trading skills that work in real market conditions. Students learn not just theory, but how to actually trade profitably.

Be the first to review “WWA Trading 2023 (Download)” Cancel reply

Related products

Forex Trading

Best 100 Collection

Trading Courses

Forex Trading

Trading Courses

Trading Courses

Trading Courses

Reviews

There are no reviews yet.