Tradinganalysis – Fibonacci Mastery Course

$618.00 Original price was: $618.00.$39.00Current price is: $39.00.

[Instant Download] Tradinganalysis Fibonacci Mastery Course: Complete Guide to Trading with Fib

📚 PROOF OF COURSE

What is TradingAnalysis Fibonacci Mastery Course?

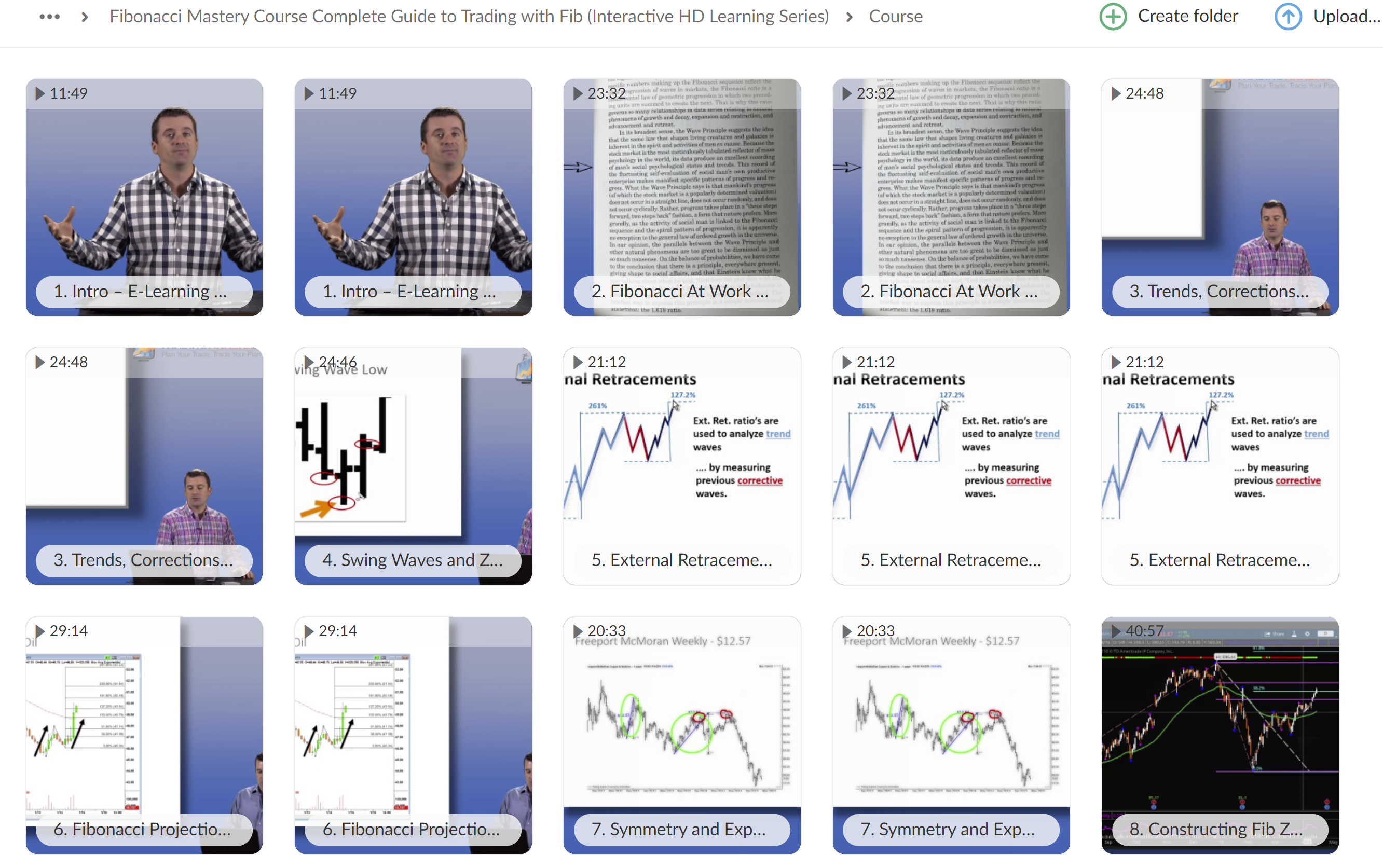

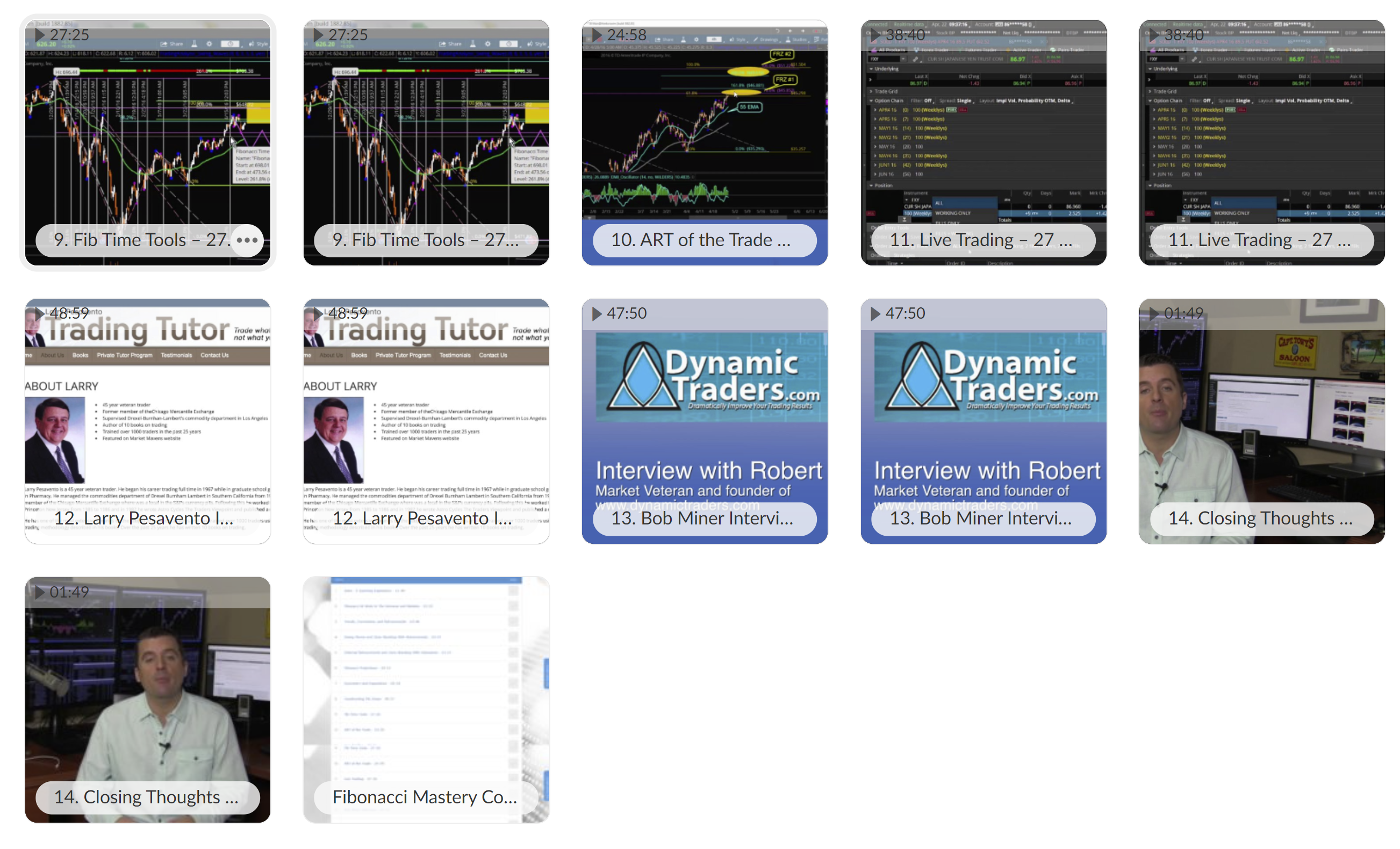

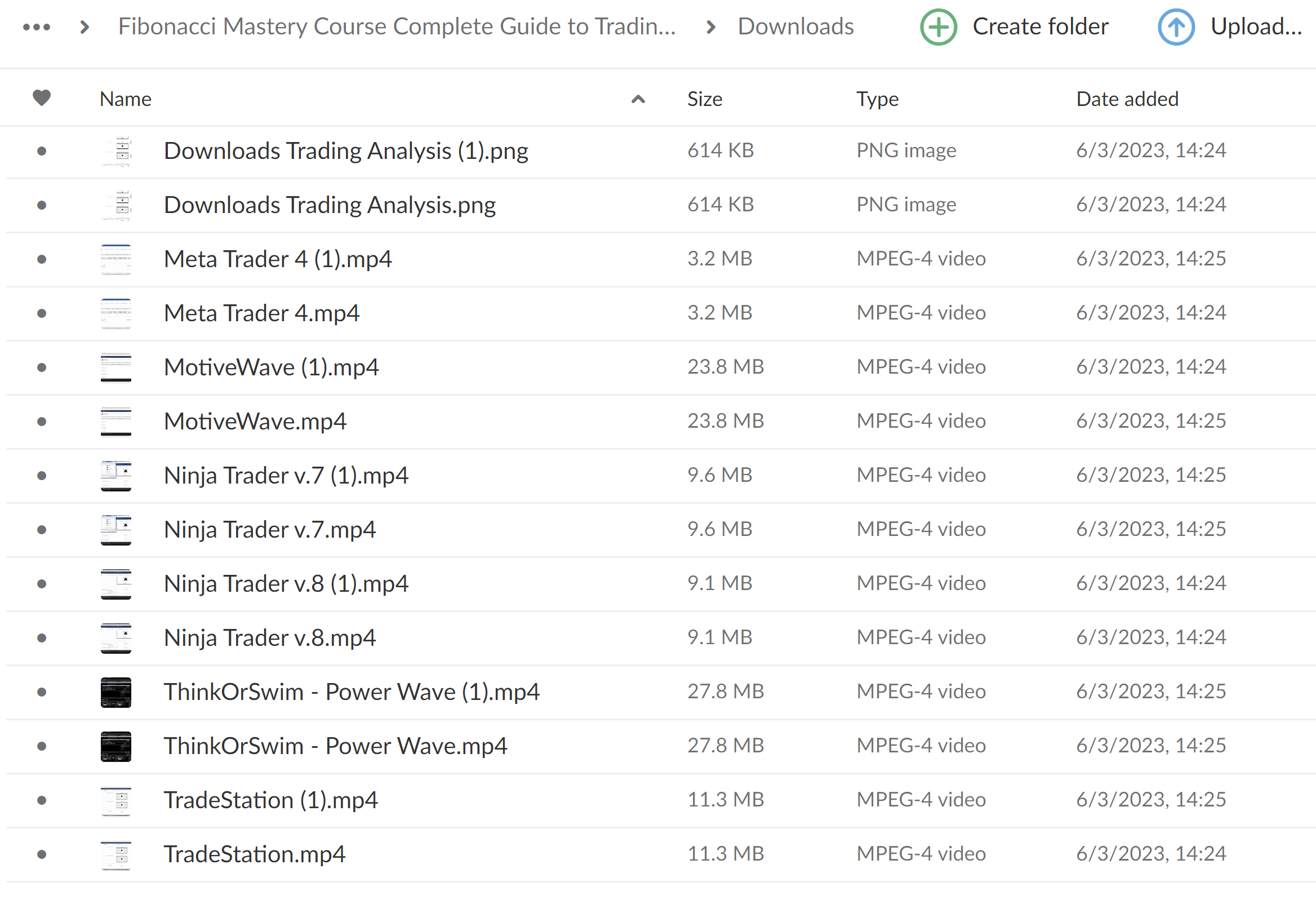

The TradingAnalysis Fibonacci Mastery Course is a comprehensive 6-hour professional trading program taught by Todd Gordon, CNBC contributor and CEO of TradingAnalysis.com. This 14-module course teaches advanced Fibonacci trading techniques through high-quality video lessons, live trading demonstrations, and expert interviews.

The course covers Fibonacci retracements, extensions, projections, and time ratio analysis. You learn Todd Gordon’s zone stacking methodology to build strong support and resistance areas, plus his A.R.T. trading system for account, risk, and trade management.

Key features include lifetime access, professional studio production, interactive learning platform, and exclusive interviews with Fibonacci experts Larry Pesavento and Bob Miner.

Who teaches it?

Todd Gordon brings 20+ years of Wall Street trading experience and serves as a CNBC contributor with a 10-year contract. He regularly appears on Fast Money, Squawk on the Street, and Power Lunch, demonstrating his market expertise to millions of viewers.

Gordon holds a Bachelor of Arts in Economics and has authored published trading materials. His professional background includes Senior Technical Strategist at FOREX.com and trader at GAIN Capital Asset Management, where he managed over $25 million in assets.

He currently operates Inside Edge Capital wealth management firm and speaks internationally on trading topics. Gordon specializes in Elliott Wave Theory, Fibonacci analysis, and intermarket analysis with proven real-world application.

What you learn in Fibonacci Mastery Course?

Core Fibonacci Techniques:

- Fibonacci retracements, extensions, and projections

- Todd Gordon’s 4-favorite Fibonacci price analysis tools

- Zone stacking methodology for robust support/resistance areas

- Fibonacci time ratio analysis for market timing

- Symmetry patterns and expansions

Trading Systems:

- A.R.T. system (Account, Risk, Trade Management)

- Live trading demonstrations with real capital

- High-probability setup identification

- Elliott Wave integration with Fibonacci analysis

- Multi-timeframe analysis techniques

Practical Application:

- Constructing Fibonacci zones (40+ minute detailed module)

- Real market examples across stocks, forex, and commodities

- Entry and exit timing strategies

- Risk management protocols

- Professional trading psychology

Is Tradinganalysis Fibonacci Mastery Course worth it?

The course provides legitimate educational value for intermediate to advanced traders seeking professional-grade Fibonacci education. Todd Gordon’s CNBC credibility and 20+ years Wall Street experience add substantial weight to the instruction quality.

Strengths:

- Comprehensive 6+ hours of professional content

- Instructor with proven CNBC media presence

- Lifetime access with high production quality

- Practical live trading demonstrations

- Expert interviews adding industry perspectives

- No ongoing subscription fees required

Considerations:

- Premium pricing reflects professional positioning

- Content targets intermediate to advanced traders

- Limited beginner-friendly explanations

- Requires existing basic trading knowledge

Value Comparison:

- More credible than budget Udemy courses ($10-200)

- More accessible than premium institutes ($1,000+)

- Professional middle-ground with strong credentials

- Free preview content available through TradingAnalysis.com

The course suits serious traders wanting advanced Fibonacci techniques from an established market professional with ongoing media presence and real trading experience.

Be the first to review “Tradinganalysis – Fibonacci Mastery Course” Cancel reply

Related products

Forex Trading

Trading Courses

Trading Courses

Trading Courses

Options Trading

Trading Courses

Best 100 Collection

![Mike Aston - Learn to Trade [Trading Template]](https://coursehuge.com/wp-content/uploads/2023/09/Mike-Aston-Learn-to-Trade-Trading-Template-300x300.jpg)

Reviews

There are no reviews yet.