Larry williams – Swing Trading Futures & Commodities with the COT

$1,695.00 Original price was: $1,695.00.$29.00Current price is: $29.00.

Larry Williams Swing Trading Futures & Commodities with the COT Course [Instant Download]

1️⃣. What is Swing Trading Futures & Commodities with the COT?

Larry Williams’ Swing Trading Futures & Commodities is a trading course that teaches you how to profit from futures markets using the COT (Commitment of Traders) report.

The course shows you how to combine technical analysis with market mood to spot profitable swing trading opportunities. You’ll learn to use Williams’ proven indicators for timing market entries and exits.

With this system, you’ll master futures swing trading using the same strategies Larry used to turn $10,000 into $1.1 million in the World Cup Championship of Futures Trading.

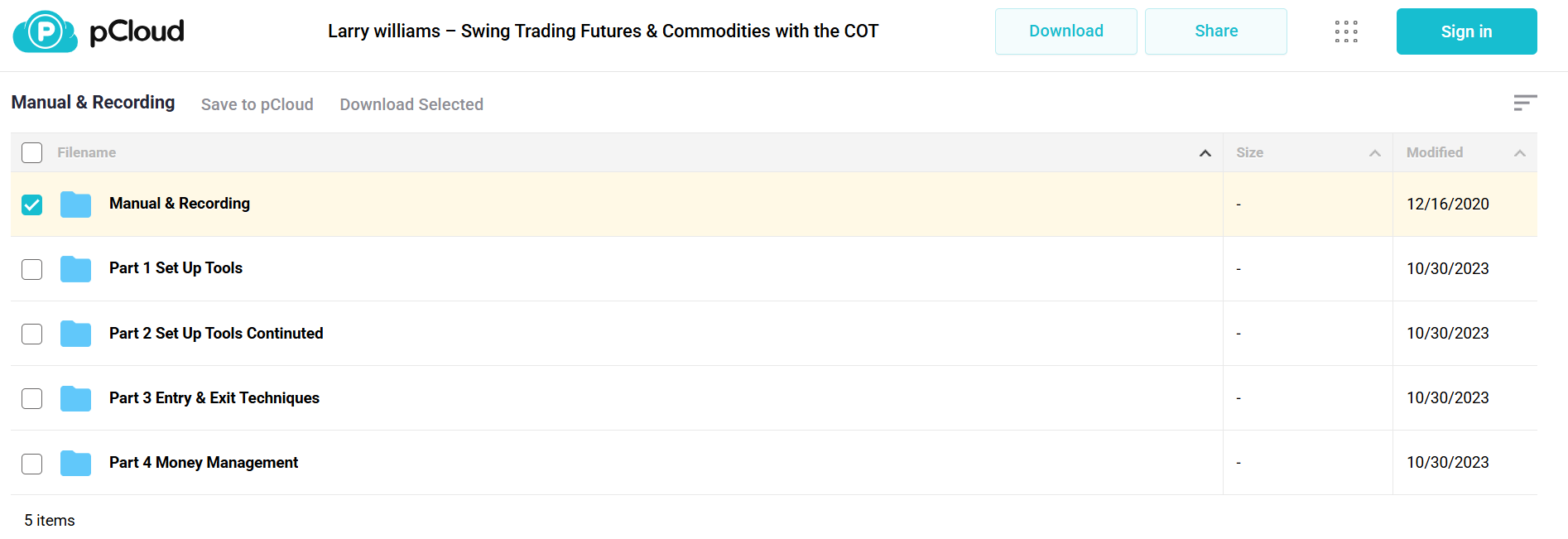

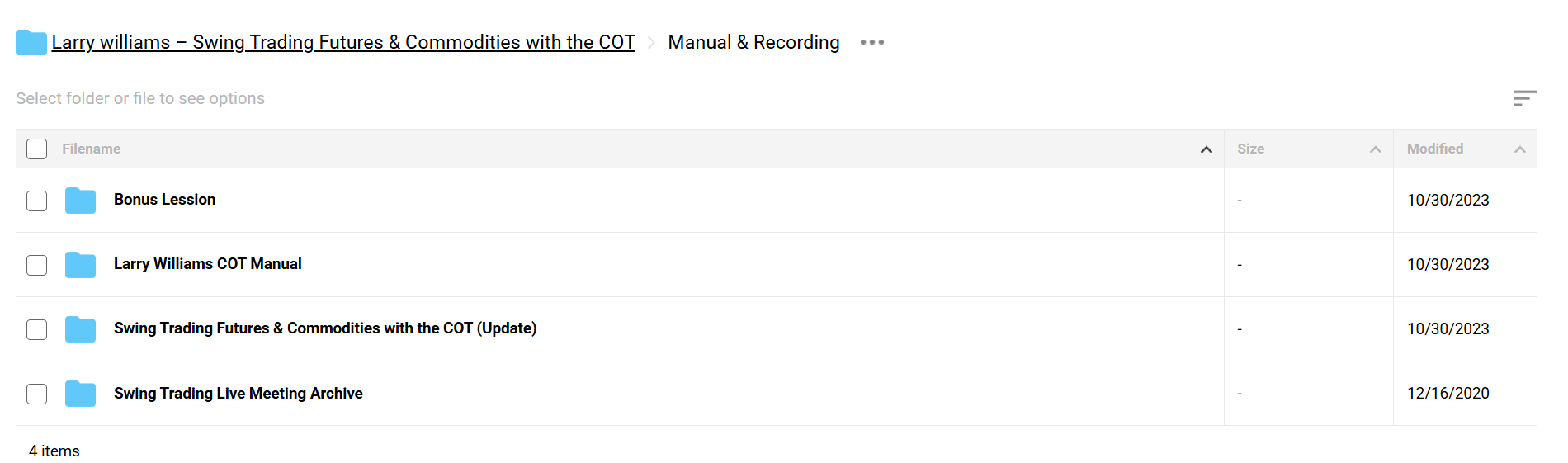

📚 PROOF OF COURSE

2️⃣. What you’ll learn in this course:

Learn Larry’s complete swing trading system that has proven successful for over 50 years. Here’s what you’ll learn:

- Market Analysis: Master the COT report, Williams Sentiment, and ADX to time your trades better

- Entry Methods: Learn powerful strategies like Turtle Trading, 12-Bar and 18-Bar entries to spot the best trading opportunities

- Exit Tactics: Know exactly when to exit using protective stops, 3-Bar exits, and target shooting

- Money Management: Protect and grow your account with professional risk control methods

- Trading Mindset: Build the psychology of a successful trader

- Pro Techniques: Learn four entry patterns plus the Specialist Trap strategy

This course gives you everything needed to trade futures and commodities with confidence.

3️⃣. Course Curriculum:

✅ Section 1: Trading Tools Foundation

This comprehensive section establishes the foundational tools and concepts for successful swing trading. Students learn essential setup techniques and analytical tools through detailed video instruction and practical applications.

Module 1.1: Basic Trading Tools

The initial module introduces core trading tools and setup procedures through sixteen detailed video lessons. Students develop proficiency in basic market analysis and trading platform configuration.

- Setup Tools Videos 1-16 (Video)

- Implementation Guides (PDF)

- Platform Configuration (Video)

Module 1.2: Advanced Trading Tools

Building on basic concepts, this module explores sophisticated trading tools and analysis techniques through seventeen additional video lessons.

- Advanced Setup Videos 17-33 (Video)

- Tool Integration Methods (PDF)

- Advanced Analysis Techniques (Video)

✅ Section 2: Professional Trading Techniques

This section focuses on practical entry and exit strategies, incorporating Larry Williams’ proven methodologies for market timing and trade execution.

Module 2.1: Trade Execution

Comprehensive coverage of entry and exit techniques, featuring sixteen specialized video lessons on trade timing and execution.

- Entry and Exit Videos 34-50 (Video)

- Trade Execution Framework (PDF)

- Market Timing Strategies (Video)

✅ Section 3: Risk Management

The section addresses crucial aspects of money management and risk control in swing trading operations. Students learn systematic approaches to position sizing and risk mitigation.

Module 3.1: Money Management

Detailed instruction on financial management and risk control through fourteen focused video lessons.

- Money Management Videos 51-64 (Video)

- Risk Control Systems (PDF)

- Position Sizing Strategies (Video)

✅ Section 4: Live Trading Applications

This extensive section provides real-world trading examples and ongoing education through monthly live sessions spanning multiple years.

Module 4.1: Live Trading Sessions

Monthly live trading meetings with Larry Williams, providing current market analysis and real-time trading applications from 2012-2015.

- Monthly Live Meeting Recordings (FLV)

- Trading Documentation (PDF)

- Market Analysis Archives (PDF)

Module 4.2: Special Topics

Bonus content and specialized trading techniques focusing on specific aspects of successful trading.

- Better Entries Guide (Video, PDF)

- COT Analysis Manual (PDF)

- Secrets to Successful Swing Trading (PDF)

The curriculum includes comprehensive supporting materials and documentation, ensuring students have access to both theoretical knowledge and practical applications. Regular live sessions provide ongoing education and real-time market analysis, allowing students to witness the application of course concepts in current market conditions.

4️⃣. Who is Larry Williams?

Larry Williams is a world-renowned trader with over 50 years of market experience. His biggest achievement came in 1987 when he turned $10,000 into $1.1 million to win the World Cup Championship of Futures Trading – a record that still stands today.

He created important trading tools like the Williams %R and Ultimate Oscillator, which traders worldwide use daily. His trading methods are so effective that his daughter Michelle Williams also won a trading championship using them.

Larry has written many popular trading books and teaches his strategies through live demonstrations at seminars worldwide. Since 1964, he has helped thousands of students become successful traders by sharing his proven trading methods.

Through decades of real trading and teaching, Larry has shown that his strategies work in any market condition. His track record of success makes him one of the most respected teachers in the trading world.

5️⃣. Who should take Larry Williams Course?

This futures and commodities trading course teaches Larry’s proven swing trading methods. The course is perfect for:

- New Futures Traders wanting to learn profitable swing trading from a trading champion

- Experienced Traders ready to use COT analysis and better market timing in their trades

- Chart Traders looking to add sentiment indicators and smarter entry/exit methods

- Daily Traders who want a complete system for futures and commodities trading

If you’re serious about trading futures and willing to follow a tested trading system, this course will give you the tools to succeed. Larry has taught these same methods to thousands of successful students worldwide.

6️⃣. Frequently Asked Questions:

Q1: How can I profit from futures markets?

Q2: What are the best strategies for futures swing trading?

Q3: How important is risk management in futures trading?

Q4: What role does fundamental analysis play in futures trading?

Q5: How much capital is needed to start trading futures?

Be the first to review “Larry williams – Swing Trading Futures & Commodities with the COT” Cancel reply

Related products

Trading Courses

Trading Courses

Trading Courses

Futures Trading

Investment Management

Trading Courses

Trading Courses

![Mike Aston - Learn to Trade [Trading Template]](https://coursehuge.com/wp-content/uploads/2023/09/Mike-Aston-Learn-to-Trade-Trading-Template-300x300.jpg)

Reviews

There are no reviews yet.