StatOasis – Algo Trading Masterclass

$2,997.00 Original price was: $2,997.00.$20.00Current price is: $20.00.

StatOasis Algo Trading Masterclass [Instant Download]

What is StatOasis Algo Trading Masterclass:

StatOasis Algo Trading Masterclass teaches you how to build profitable algorithmic trading systems without coding knowledge.

The course provides a systematic approach to developing, testing, and implementing automated trading strategies across multiple markets.

It focuses on practical tools like StrategyQuant X, helping traders create data-driven systems that work in real market conditions.

👉 More Quant Trading Courses:

- The Wall Street Quants BootCamp

- The Python Quants – CPF PROGRAM (2024)

- Rajandran R – QuantZilla

- Quantra Quantinsti – All Courses Bundle

- AlgoTrading101 Courses

📚 PROOF OF COURSE

What you’ll learn in Algo Trading Masterclass:

This comprehensive course transforms beginners and experienced traders into systematic algo traders. Here’s what you’ll master:

- Strategy Development: Create robust trading algorithms without programming

- Market Analysis: Identify profitable edges across different markets

- Backtesting: Learn advanced testing methods for strategy validation

- Portfolio Management: Master position sizing and risk management

- Strategy Automation: Implement automated trading systems effectively

- Performance Optimization: Fine-tune strategies for consistent results

By the end, you’ll have the skills to build and manage a portfolio of algorithmic trading strategies.

Algo Trading Masterclass Course Curriculum:

The Algo Trading Masterclass takes you step-by-step through everything you need to build profitable trading systems. The course curriculum includes:

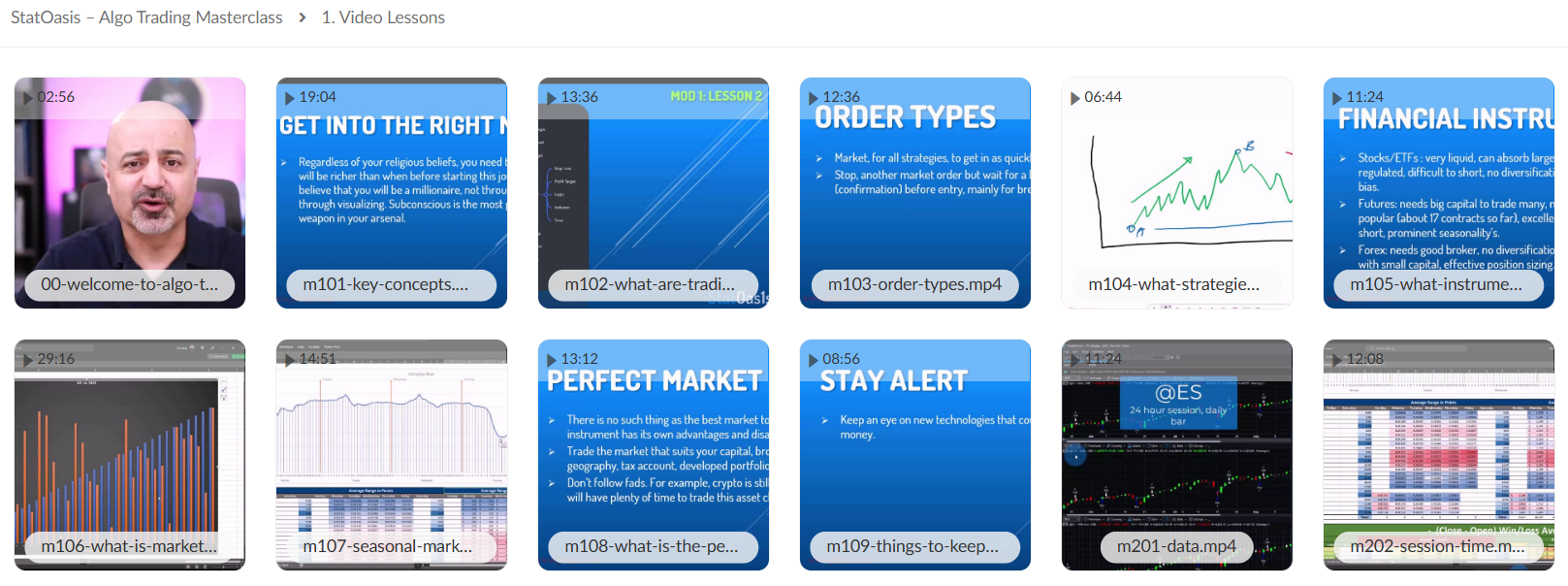

✅ Video Lessons

- Key Concepts

- What Are Trading Strategy Basic Components

- Order Types

- What Strategies To Trade

- What Instrument To Trade

- What Is Market Edge

- Seasonal Market Edges

- What Is The Perfect Market To Trade

- Things To Keep An Eye On

- Data

- Session Time

- Time Frame

- Signal Window

- Is Oos Hold Out Period

- Mult Time Frame Sqx Nuances

- Setup Example

- Entry Blocks Market Order

- Entry Blocks Stop Limit Order

- Exit Blocks Example

- Filter Types Side Volume Time

- Filter Types Indexes Volatility Patterns

- Filter Types Seasonality

- Filter Types Higher Timeframe Alternative Data

- Filter Type Market Regime

- Ranking Filters

- Multiple Symbol Time Frame

- Strategy From Template

- Stop Loss Profit Target

- Bars Exit

- General Guidelines

- Single Algo Manual Guidelines

- Seasonal Bias Edge Example Natural Gas

- Simple Strategy Example Sp500

- Simple Strategies

- Walk Forward Optimization

- Walk Forward Matrix

- System Parameter Permutation

- Final Verdict

- Intraday Breakout Template

- I Random Group Vs Custom Blocks

- Intraday Mean Reversion Template

- I How To Fix Template Import Error

- More Templates

- Bollinger Bands Mean Reversion

- Custom Project Daily Breakout

- Custom Project Daily Mean Reversion

- Filtering Correlated Strategies

- Custom Project Intraday Template

- Organization Tips

- Portfolio Construction

- Capitalization

- Live Trading

- Strategy Monitoring

- I Standard Deviation Sheet

- Maintenance

✅ Q_A Sessions [3 MP4s]

✅ Bonus Code Indicators Template [PDF]

The course organizes everything logically, helping you build your skills from basic to advanced trading concepts.

Who is Ali Casey?

Ali Casey is the founder of StatOasis and a veteran algorithmic trader with over a decade of market experience.

Through StatOasis, he has mentored thousands of traders worldwide, focusing on systematic trading methods and emotional bias elimination.

Ali actively shares trading insights through the StatOasis YouTube channel, making complex algorithmic trading concepts accessible to everyone.

His teaching emphasizes practical, data-driven approaches that help traders achieve consistent results across various market conditions.

Be the first to review “StatOasis – Algo Trading Masterclass” Cancel reply

Related products

Forex Trading

Trading Courses

Trading Courses

Investment Management

Forex Trading

Trading Courses

Trading Courses

Trading Courses

![Mike Aston - Learn to Trade [Trading Template]](https://coursehuge.com/wp-content/uploads/2023/09/Mike-Aston-Learn-to-Trade-Trading-Template-300x300.jpg)

Reviews

There are no reviews yet.