Jeff Tompkins – How I Get Paid $1,000 Every Friday Trading Options

$114.00 Original price was: $114.00.$15.00Current price is: $15.00.

[Download] Jeff Tompkins – How I Get Paid $1,000 Every Friday Trading Options Course

📚 PROOF OF COURSE

Jeff Tompkins Options Trading Course Overview:

In the How I Get Paid $1,000 Every Friday Trading Options course, Jeff Tompkins reveals a straightforward yet powerful strategy for earning consistent weekly income through options trading.

This course is designed to help beginners quickly navigate the complexities of options trading.

You’ll learn how to turn potential losses into wins with Jeff’s unique adjustment techniques, ensuring a high success rate in your trades. The course promises theoretical knowledge and practical skills to generate income immediately without requiring extensive market analysis or experience.

What you will learn in this course:

In this course, you will learn:

- The Strategy Basics: Understand the core principles of the options trading strategy.

- Trade Structuring: Learn the best ways to structure your trades for maximum profitability.

- Success Odds: A simple trick to know your odds of success before placing any trade.

- Profitable Ticker Symbols: Discover the most profitable ticker symbols to trade.

- Choosing the Right Contracts: How to select the exact option contracts that could lead to success.

- Fixing Losing Trades: Master the art of turning losing trades into winners.

- Consistent Home Income: Strategies to create a steady income stream from home.

- And More: Additional insights and techniques to enhance your trading skills.

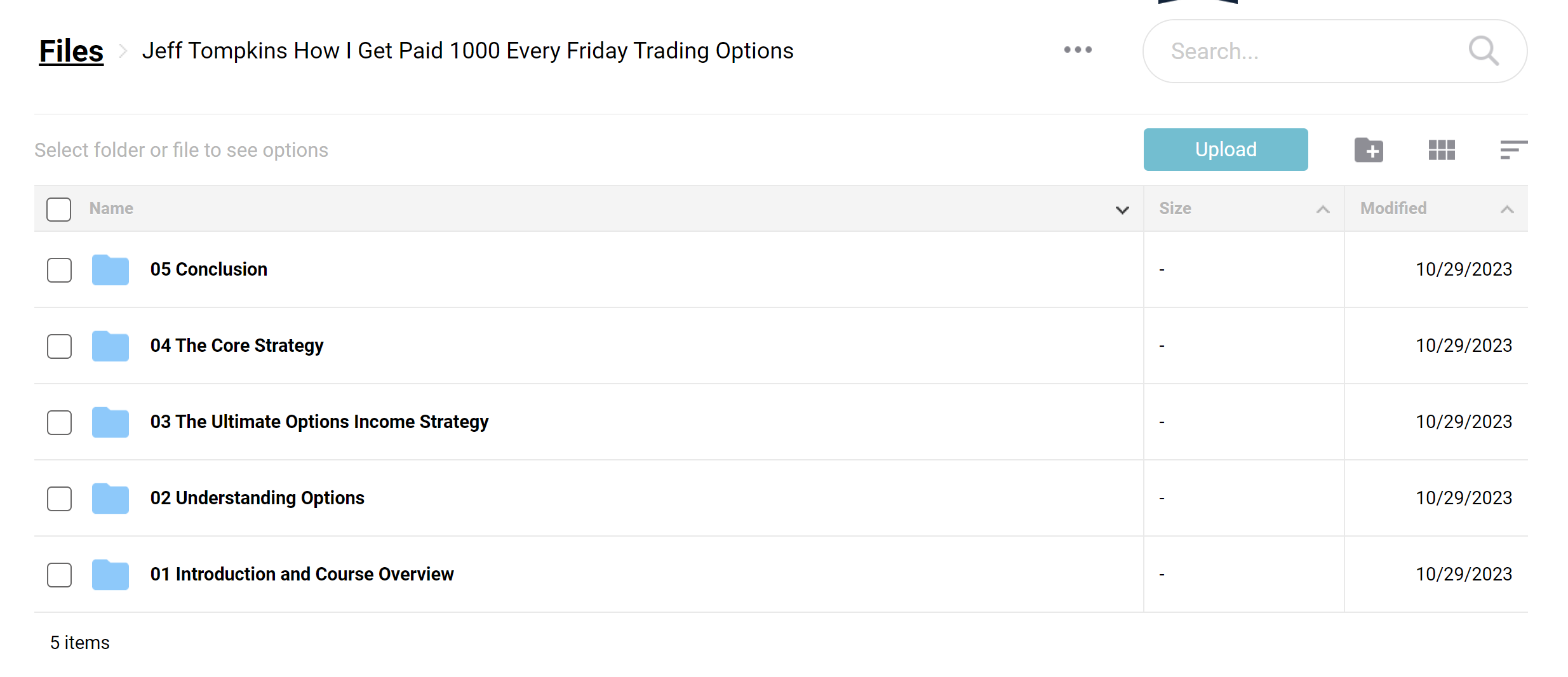

Course curriculum:

The course curriculum includes:

- Over 26 lectures and 1 hour of content.

- Detailed instructions on executing a consistent options trading strategy.

- Techniques to get paid upfront for executing options trades.

- Methods to win over 85% of your options trades.

- Strategies to adjust losing trades and turn them into winners.

- Insights into little-known techniques to reduce risk and maximize profits.

- Guidance on trading weekly options for more frequent income.

- Target audience insights: Ideal for anyone looking to earn extra income from home, both beginners and experienced traders.

Modules Breakdown:

Module 1: Introduction and Course Overview

- Introduction.mp4

- Activity Test Your Knowledge Quiz.html

- Proof of Profits.mp4

- Disclaimer.mp4

Module 2: Understanding Options

- Options Basics.mp4

- Activity Test Your Knowledge Quiz.html

- Selling Options vs. Buying Options.mp4

- The Anatomy of a Credit Spread.mp4

- An Example Options Chain.mp4

Module 3: The Ultimate Options Income Strategy

- Activity Test Your Knowledge Quiz.html

- Why Iron Condors Are Your Best Bet.mp4

- An Example of How to Execute the Trade.mp4

- Money Management – How to Calculate Margin Requirements.mp4

- How to Calculate Maximum Gain and Loss.mp4

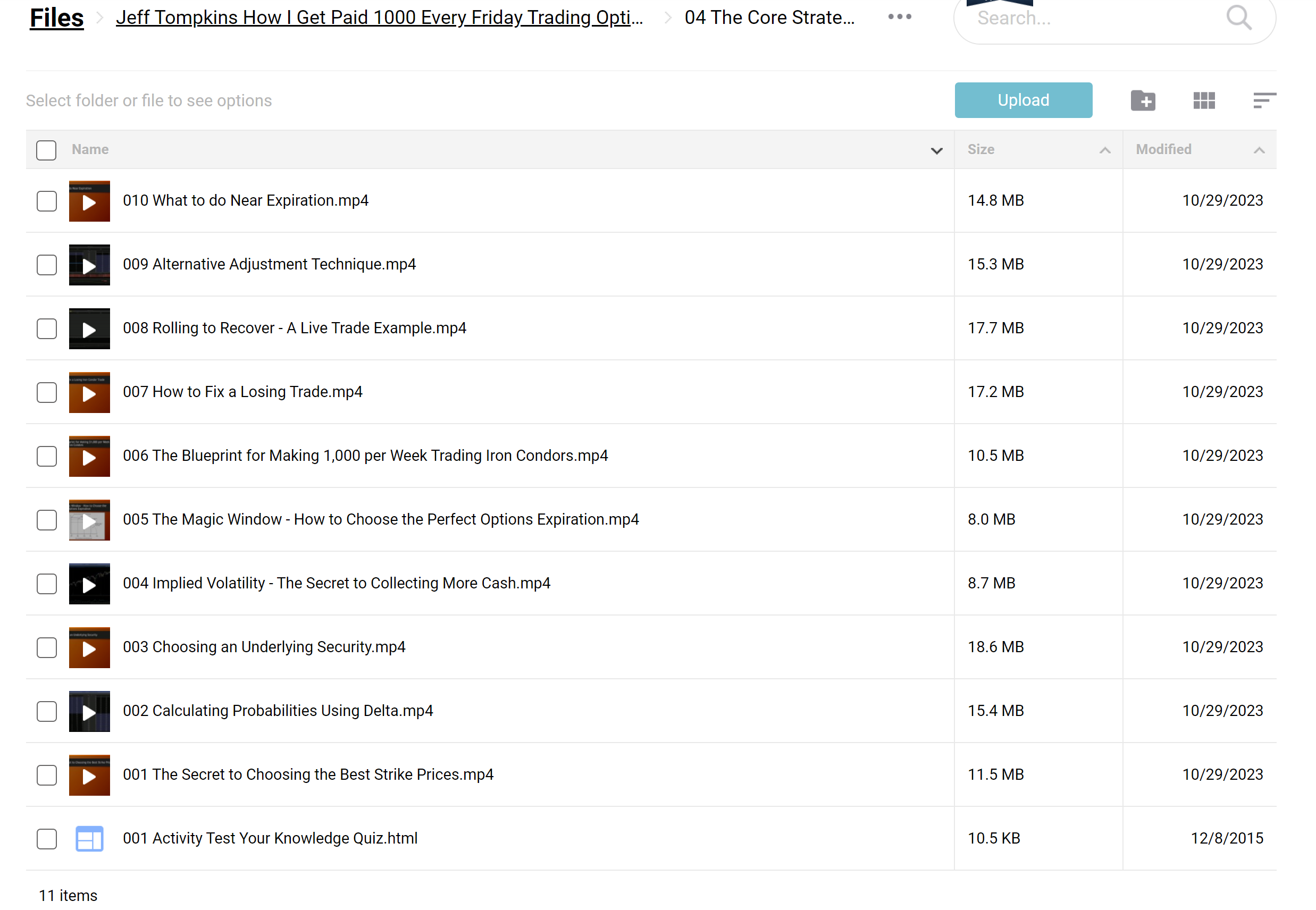

Module4: The Core Strategy

- Activity Test Your Knowledge Quiz.html

- The Secret to Choosing the Best Strike Prices.mp4

- Calculating Probabilities Using Delta.mp4

- Choosing an Underlying Security.mp4

- Implied Volatility – The Secret to Collecting More Cash.mp4

- The Magic Window – How to Choose the Perfect Options Expiration.mp4

- The Blueprint for Making 1,000 per Week Trading Iron Condors.mp4

- How to Fix a Losing Trade.mp4

- Rolling to Recover – A Live Trade Example.mp4

- Alternative Adjustment Technique.mp4

- What to do Near Expiration.mp4

Who is Jeff Tompkins?

Jeff Tompkins, a renowned trading expert, equips his students with disciplined and proven strategies for trading success. His practical and insightful approach makes him a sought-after mentor in the trading community.

Based in Boise, ID, Jeff Tompkins is the Chief Investment Strategist and President of Altos Trading, LLC. His firm is committed to helping individuals harness profitable and consistent trading strategies, leading them toward financial independence. Tompkins has founded Altos Trading on robust, time-tested strategies, providing the necessary insights and expertise for long-term success in the stock and options markets.

Experience: President & Chief Investment Strategist at The Trading Profit, LLC

- January 2014 – Present | Boise, Idaho

- With over two decades of trading experience, Jeff Tompkins offers professional courses and coaching at The Trading Profit, LLC. He established this platform to impart essential training, education, and skills to aspiring traders to help them achieve their trading goals and financial freedom. Since its inception in 2014, The Trading Profit has educated over 12,000 students.

Education: Santa Clara University

- 1999 – 2003

- Bachelor of Science in Finance

Jeff Tompkins is deeply involved in options, stock, and FOREX trading. His business acumen and trading expertise are central to his professional pursuits and educational offerings.

Be the first to review “Jeff Tompkins – How I Get Paid $1,000 Every Friday Trading Options” Cancel reply

Related products

Stock Trading

Trading Courses

Investment Management

Forex Trading

Forex Trading

Base Camp Trading – Explosive Growth Options – Stocks (EGOS) Program – EGOS MINI BUNDLE)

Trading Courses

Forex Trading

Forex Trading

Reviews

There are no reviews yet.