ITPM Super Conference Premium Series

$3,417.00 Original price was: $3,417.00.$89.00Current price is: $89.00.

ITPM Super Conference Premium Series [Instant Download]

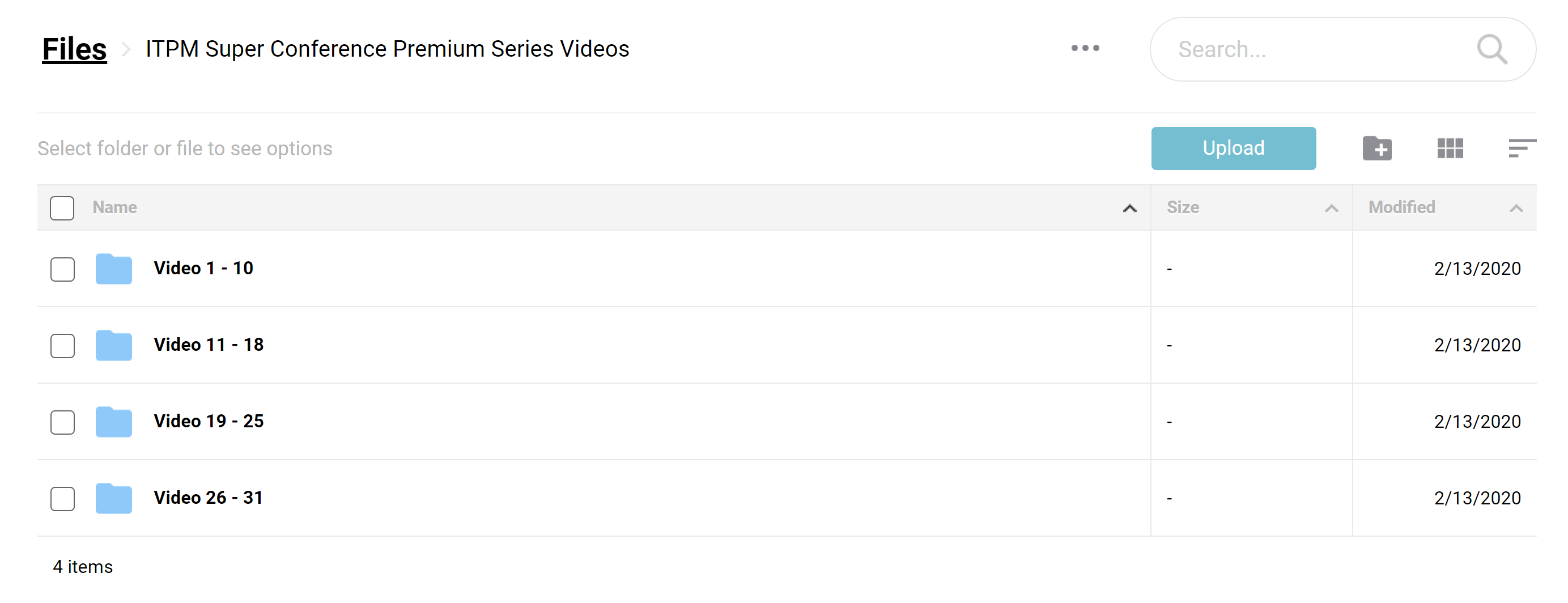

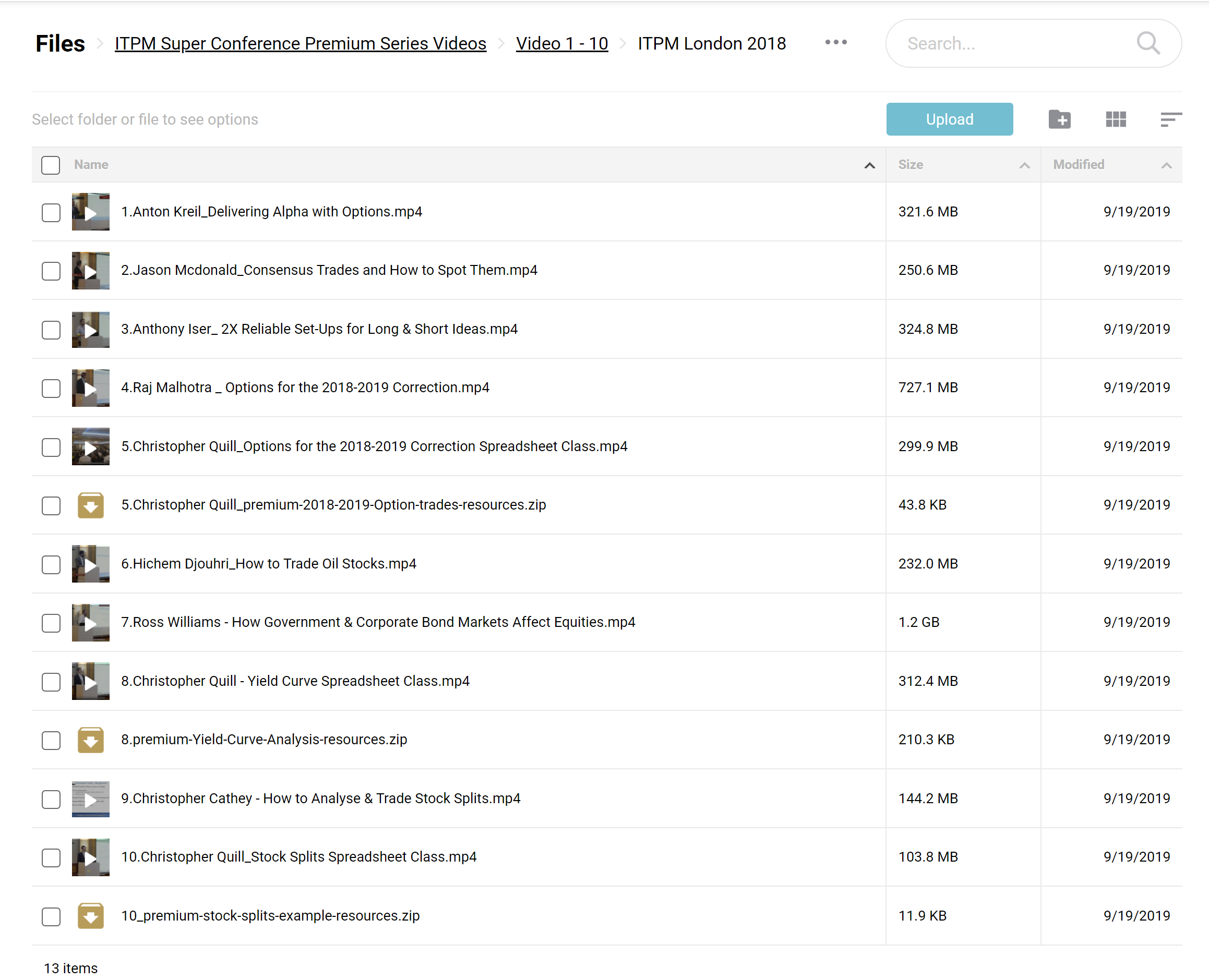

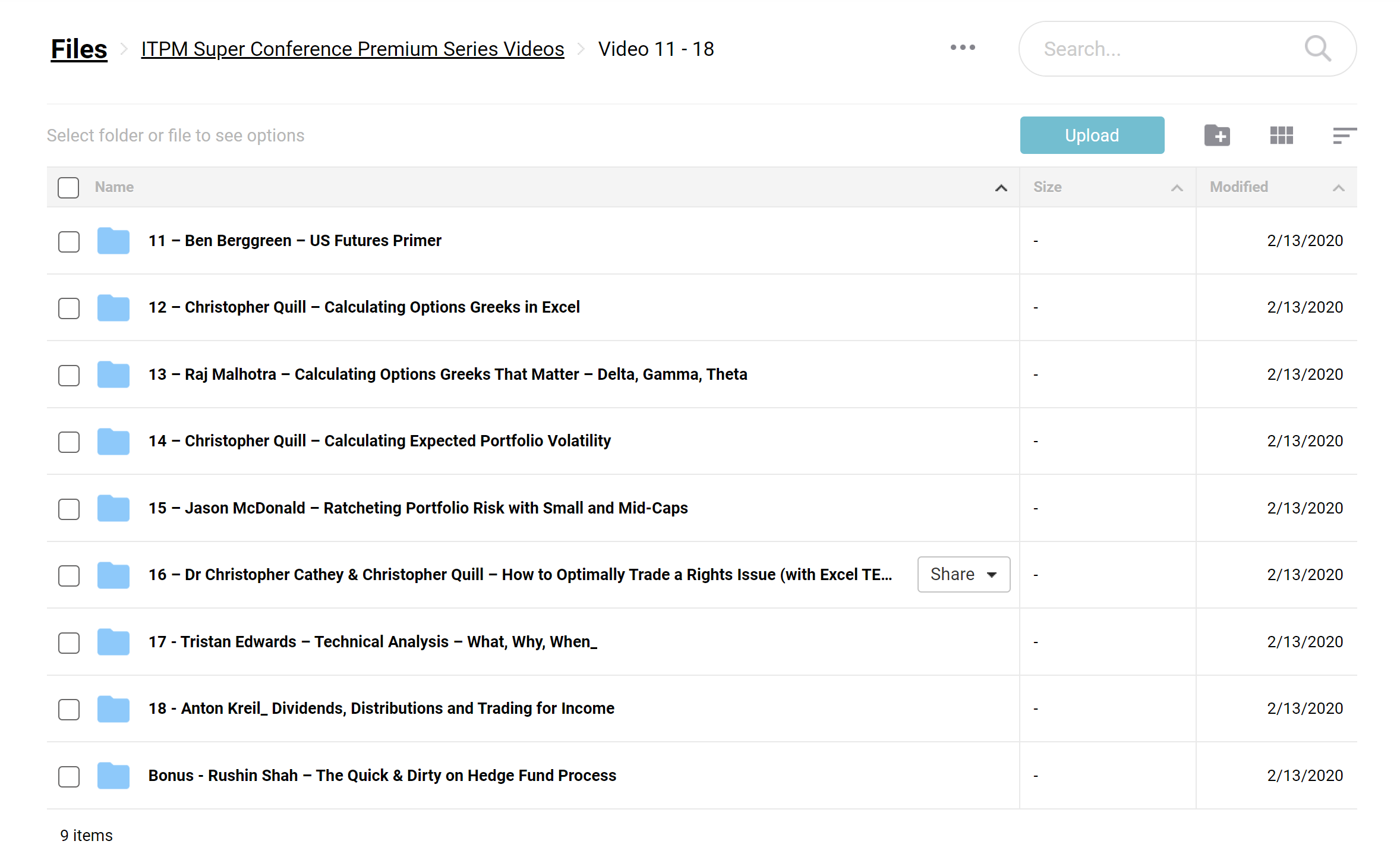

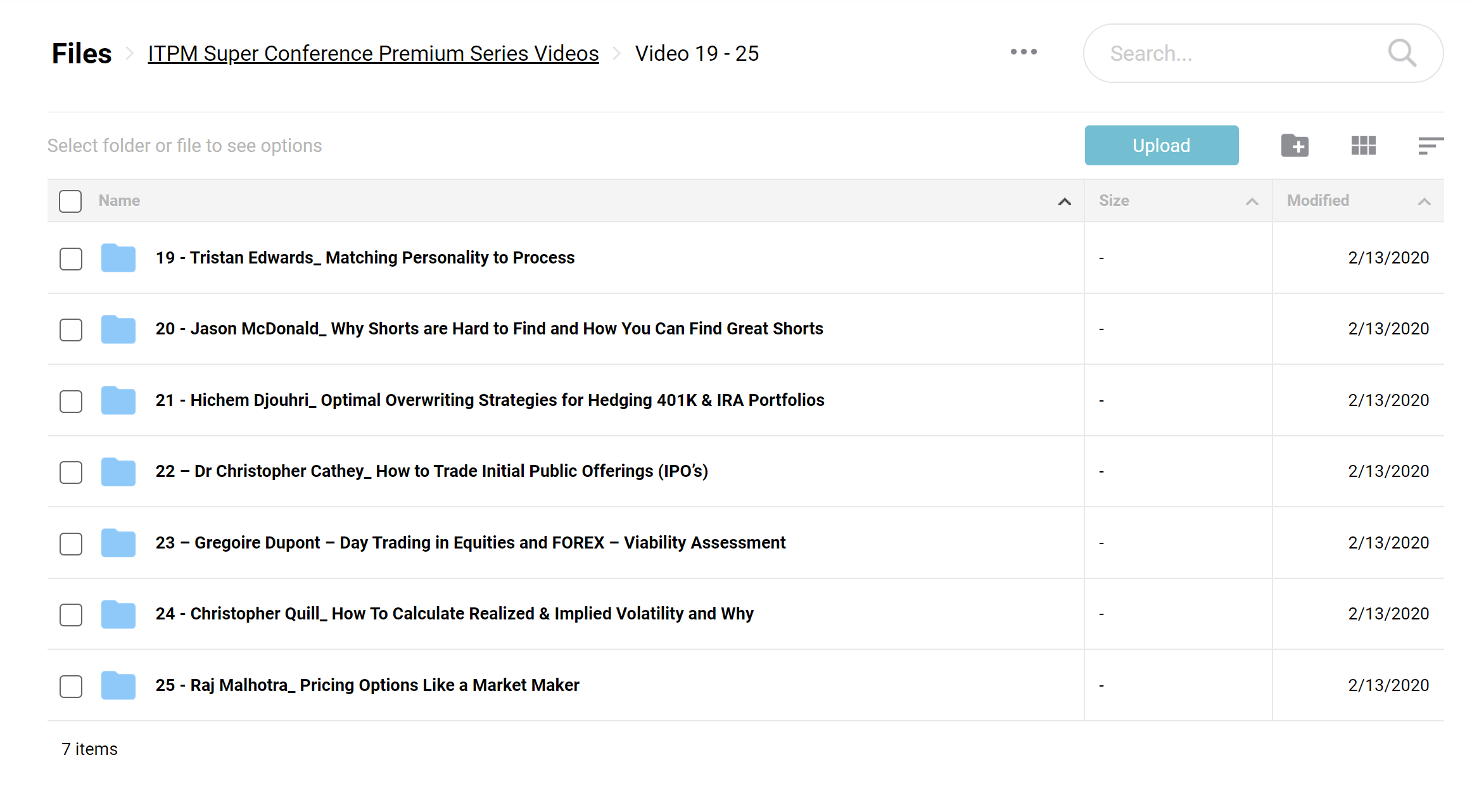

📚 PROOF OF COURSE

What is ITPM Super Conference Premium Series:

The ITPM Super Conference Premium Series is an advanced online course created by the Institute of Trading and Portfolio Management (ITPM).

This program is designed to equip everyday traders with the insights and methods used by the pros. Through this course, students dive deeply into financial markets, learning key trading and portfolio management skills.

The series mixes book smarts with real-world know-how, ensuring learners grasp the ideas and use them in actual trading situations. Whether you aim to sharpen your trading abilities or create a strong investment portfolio, this series provides the essential tools and knowledge to help you succeed.

What you will learn in ITPM Super Conference:

In the ITPM Super Conference Premium Series, you will gain comprehensive insights into:

- Fundamental and Technical Analysis: Understand the key indicators that drive market movements and how to interpret them for informed trading decisions.

- Risk Management Strategies: Learn to protect your capital and manage risk effectively to ensure long-term trading sustainability.

- Portfolio Optimization: Discover how to diversify and optimize your portfolio for maximum efficiency and potential returns.

- Trading Psychology: Grasp the psychological aspects of trading and how to maintain discipline and emotional control.

- Market Trends and Economic Indicators: Stay ahead with knowledge on how to analyze and respond to market trends and economic indicators.

What is include in ITPM Super Conference Premium Series:

- Video 1: Anton Kreil: Delivering Alpha with Options – $129

- Video 2: Jason McDonald: Consensus Trades and How to Spot Them – $89

- Video 3: Anthony Iser: 2X Reliable Set-Ups for Long & Short Ideas – $99

- Video 4: Raj Malhotra: Options for the 2018-2019 Correction – $169

- Video 5: Christopher Quill: Options for the 2018-2019 Correction Spreadsheet Class – $99

- Video 6: Hichem Djouhri: How to Trade Oil Stocks (KPI’s & Resources) – $99

- Video 7: Ross Williams: How Government & Corporate Bond Markets Affect Equities – $139

- Video 8: Christopher Quill: Yield Curve Spreadsheet Class – $99

- Video 9: Christopher Cathey: How to Analyse & Trade Stock Splits – $89

- Video 10: Christopher Quill: Stock Splits Spreadsheet Class – $49

- Video 11: Ben Berggreen: US Futures Primer – $79

- Video 12: Christopher Quill: Calculating Options Greeks in Excel – $179

- Video 13: Raj Malhotra: Calculating Options Greeks That Matter – Delta, Gamma, Theta – $199

- Video 14: Christopher Quill: Calculating Expected Portfolio Volatility – $129

- Video 15: Jason McDonald: Ratcheting Portfolio Risk with Small and Mid-Caps – $79

- Video 16: Dr Christopher Cathey & Christopher Quill: How to Optimally Trade a Rights Issue (with Excel TERP Calculation) – $59

- Video 17: Tristan Edwards: Technical Analysis – What, Why, When? – $59

- Video 18: Anton Kreil: Dividends, Distributions and Trading for Income – $89

- Video 19: Tristan Edwards: Matching Personality to Process – $79

- Video 20: Jason McDonald: Why Shorts are Hard to Find and How You Can Find Great Shorts – $89

- Video 21: Hichem Djouhri: Optimal Overwriting Strategies for Hedging 401K & IRA Portfolios – $149

- Video 22: Dr Christopher Cathey: How to Trade Initial Public Offerings (IPO’s) – $79

- Video 23: Gregoire Dupont: Day Trading in Equities and FOREX – Viability Assessment – $79

- Video 24: Christopher Quill: How To Calculate Realized & Implied Volatility and Why it’s Important – $199

- Video 25: Raj Malhotra: Pricing Options Like a Market Maker – $199

- Video 26: Gregoire Dupont: The Most Crucial Parts of a Trading Plan – $79

- Video 27: Raj Malhotra: Marginal Benefits of Directional Options Trading – $199

- Video 28: Dr Christopher Cathey: How To Ace Investment Bank and Hedge Fund Interviews – $69

- Video 29: Tristan Edwards: How To Set Up A Hedge Fund – $97

- Video 30: Jason McDonald: Best and Worst Career Trades and What You Can Learn From Them – $79

- Video 31: Anton Kreil: What Sets Apart the Best and the Worst Retail Traders? – $89

Who is ITPM?

The Institute of Trading and Portfolio Management (ITPM) was established by Anton Kreil in 2011. Anton, a renowned figure in the trading world, brought together a team of professional traders to share their expertise with retail traders, aiming to bridge the knowledge gap between the amateur and the professional trading world. Operating globally, ITPM reflects Anton’s extensive trading experience and vision of providing top-notch education to traders at all levels.

Anton Kreil, the mastermind behind ITPM, embarked on a trading journey with Goldman Sachs before deciding to share his knowledge through ITPM. His approach combines practical trading insights with theoretical knowledge, making complex trading concepts accessible to all. Anton’s dedication to teaching is evident in the comprehensive curriculum offered by ITPM, covering everything from fundamental analysis to risk management and psychological resilience in trading.

ITPM stands out for its commitment to real-world trading education, emphasizing practical experience and hands-on learning. The institute offers a range of courses, including the ITPM Super Conference Premium Series, designed to equip traders with the skills needed to navigate the financial markets successfully. With a global presence and a community of dedicated traders, ITPM continues to set the standard for trading education worldwide.

Be the first to review “ITPM Super Conference Premium Series” Cancel reply

Related products

Crypto Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.