Colin Matthew – Business Credit Mastery

$997.00 Original price was: $997.00.$42.00Current price is: $42.00.

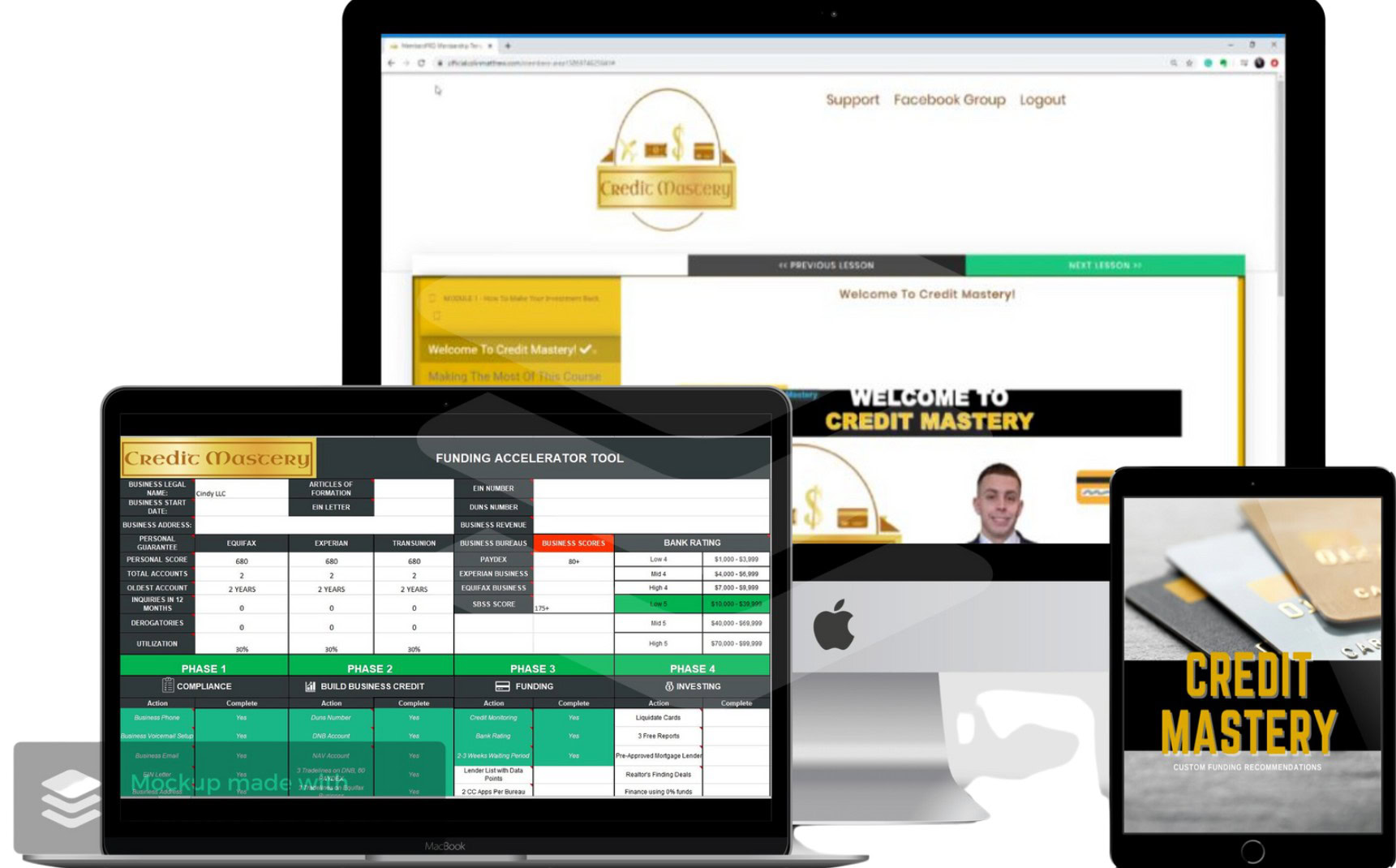

Colin Matthew Business Credit Mastery Course [Instant Download]

What is Colin Matthew Business Credit Mastery Course:

Colin Matthew Business Credit Mastery is a course that teaches entrepreneurs how to secure $100,000 in 0% business credit within 7 days without an established business. It covers acquiring business credit, investing in passive income assets like real estate and automated Walmart stores, and using Other People’s Money.

The course includes 4 modules with 30+ video lessons, Colin’s $247,000 funding case study, and a lender database for NO-DOCUMENT lenders. It aims to help build and fund a six-figure business and generate passive income.

📚PROOF OF COURSE

What you will learn in Business Credit Mastery Course:

This course will teach you powerful strategies to build and leverage business credit. You’ll gain practical skills to secure funding and invest wisely.

You’ll learn how to:

- Acquire $100,000 in business credit with and without personal guarantees

- Use the 3 Cs to qualify for cash credit products

- Invest Other People’s Money (OPM) in passive income-producing assets

- Set up your business for optimal credit-building

- Navigate the business credit landscape effectively

- Implement smart investment strategies with acquired funds

By mastering these skills, you’ll be equipped to grow your business and create lasting financial success.

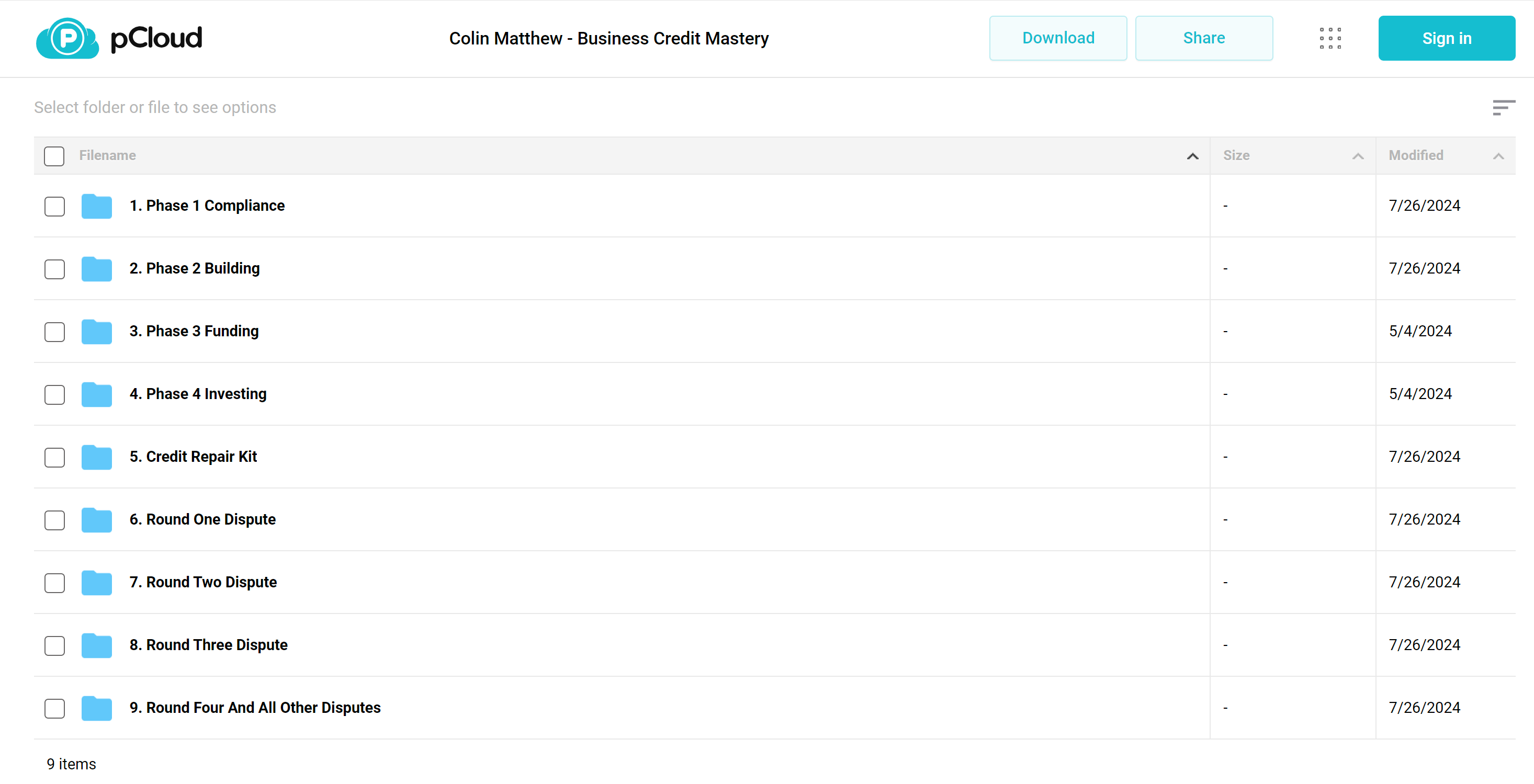

Business Credit Mastery Course curriculum:

This comprehensive course guides students through the process of building and leveraging business credit. It is structured in four main phases:

✅ Phase 1: Compliance

- 1. Welcome and Introduction

- 2. Making Your Investment Back

- 3. Personalized Funding Action Plan

- 4. Business Funding Essentials

- 5. Phone Listing, Business Address, and Website Creation

- 6. Incorporation and EIN Acquisition

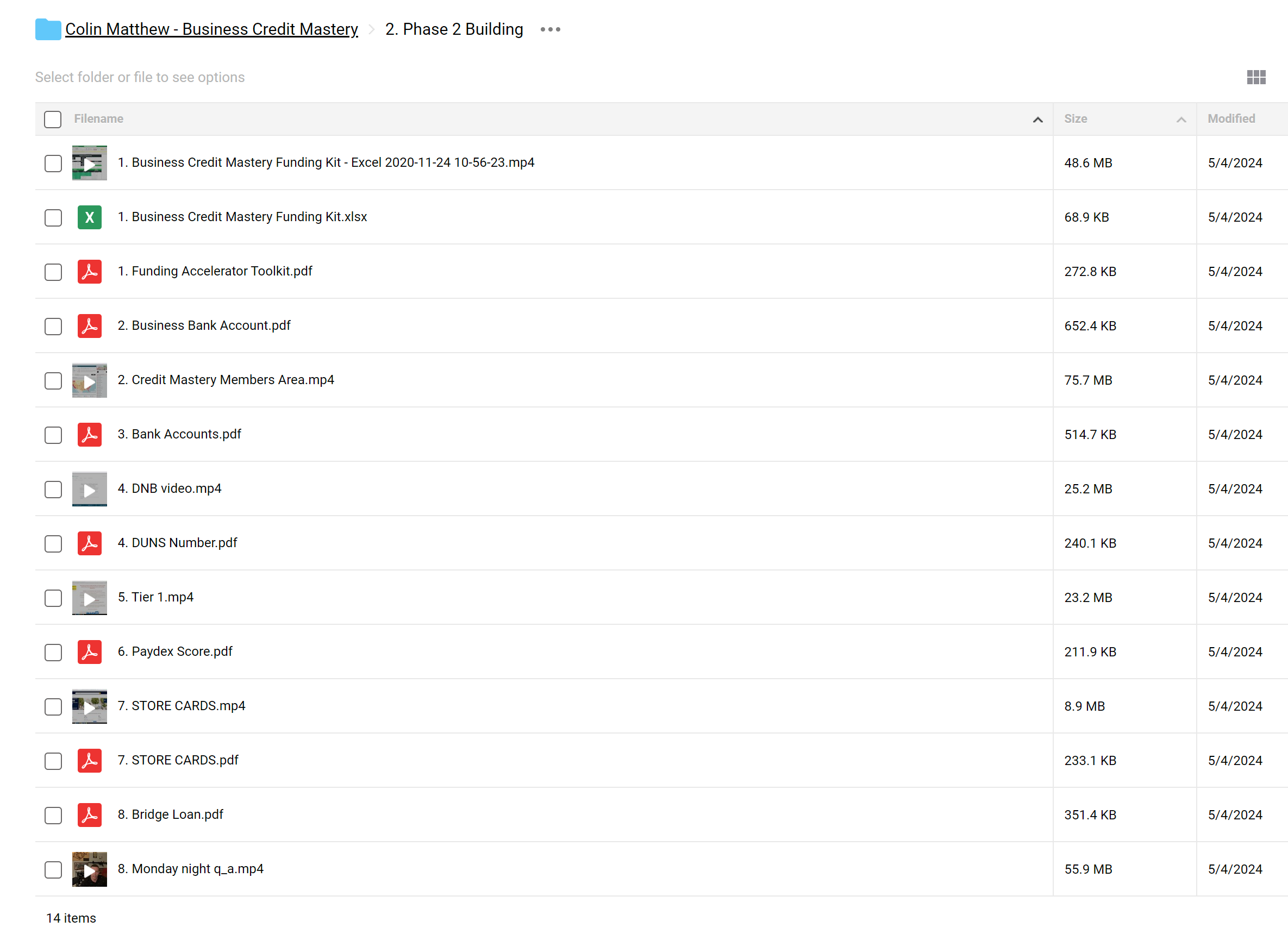

✅ Phase 2: Building

- 1. Funding Accelerator Toolkit

- 2. Business Bank Account Setup

- 3. DUNS Number and Paydex Score Acquisition

- 4. Engaging with Tier 1 Vendors

- 5. Store Cards, Bridge Loan, and More

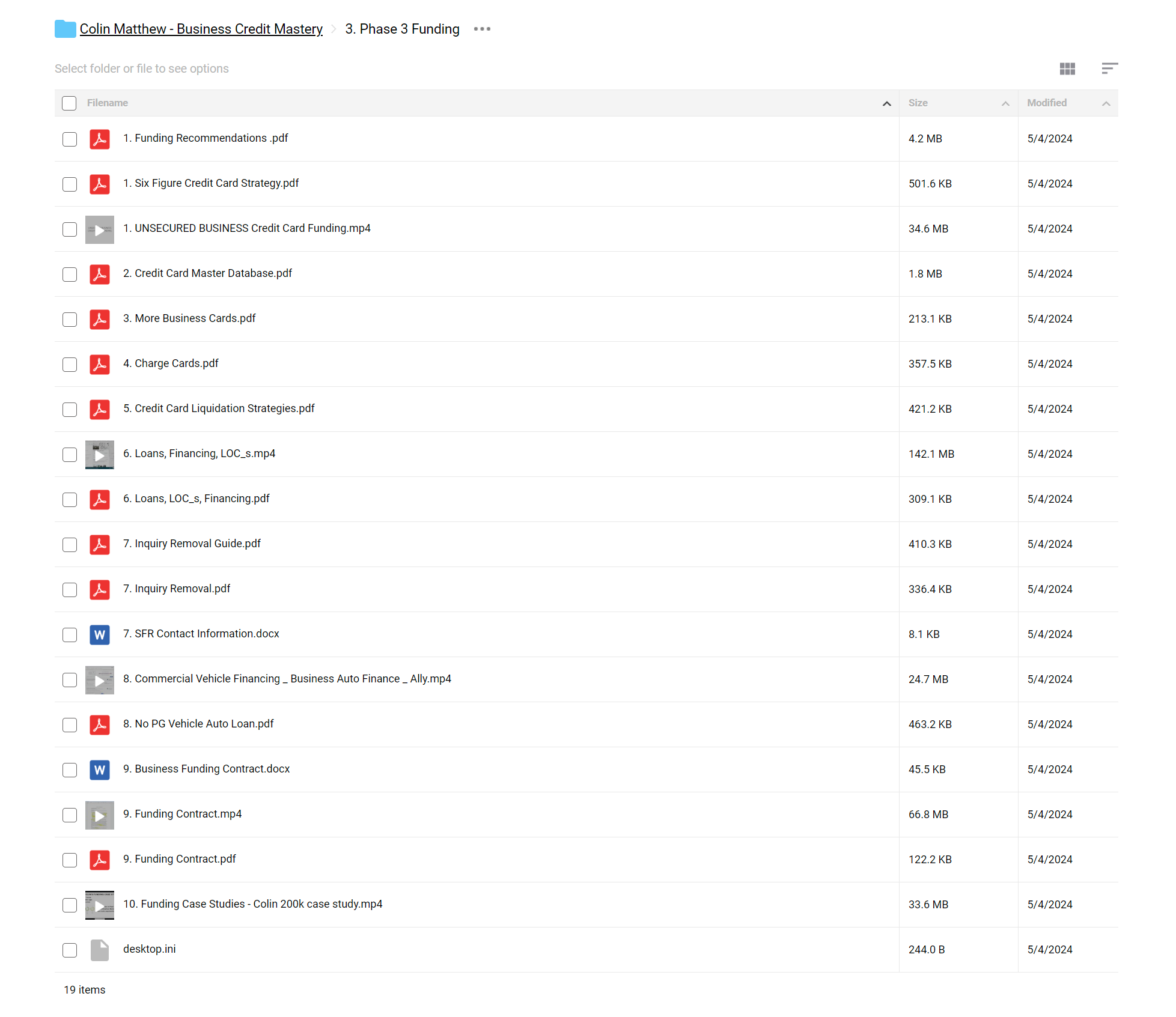

✅ Phase 3: Funding

- 1. Six Figure Credit Card Strategy

- 2. Comprehensive Credit Card Master Database

- 3. Exploring More Business Cards and Charge Cards

- 4. Credit Card Liquidation Strategies

- 5. Loans, Financing, LOC’s, and Inquiry Removal

- 6. No PG Vehicle Guide, Funding Contract, and Case Studies

✅ Phase 4: Investing

- 1. Investing Fundamentals

- 2. 4-Step Real Estate Investing

- 3. Mergers & Acquisitions and Amazon Automation

✅ Credit Repair Kit:

- Welcome and Introduction

- Understanding Credit Score Vs Credit Report

- Credit Repair Flow Chart and Acquiring Scores and Reports

- Reading Your Credit Report and Removal Prep

- Updating Personal Information and Round One Dispute

- Freezing Secondary Credit Reporting Agencies

- Dispute Letter Introduction and Preparation

- Round One Dispute Letter (Credit Bureau)

- Round Two and Three Dispute Strategies

✅ Round One Dispute

- 1. Freeze Secondary Credit Reporting Agencies

- 2. Dispute Letter Introduction

- 3. Dispute Letter Preparation

- 4. Round One Dispute Letter (Credit Bureau)

✅ Round Two Dispute

- 1. Round Two Dispute Letter Introduction

- 2. Round Two No Response Letter

- 3. Round Two Re-investigation Letter

✅ Round Three Dispute

- 1. Round Three Dispute Letter Introduction

- 2. Round Three No Response Dispute Letter

- 3. Round Three Warning Letter

The course also includes a Credit Repair Kit to help students improve their personal credit scores alongside their business credit-building efforts.

Who is Colin Matthew?

Colin Matthew, a Brooklyn native and former U.S. Marine, created the “Business Credit Mastery” course after discovering his passion for finance at 16. During his 7-year military service, he led Marines, deployed overseas, and taught credit classes to fellow servicemembers. Now a Credit Consultant, Colin helps entrepreneurs and investors secure funding.

His course teaches how to set up businesses for credit, obtain funding, and invest wisely. It combines Colin’s military discipline, financial expertise, and teaching experience, offering practical steps to effectively build and use business credit.

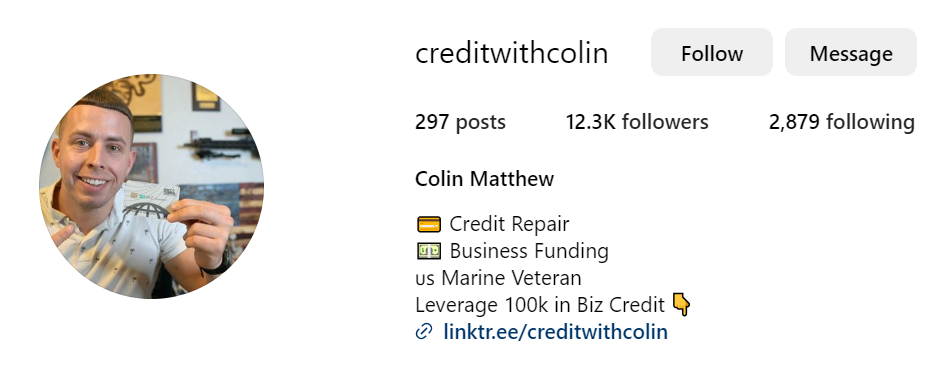

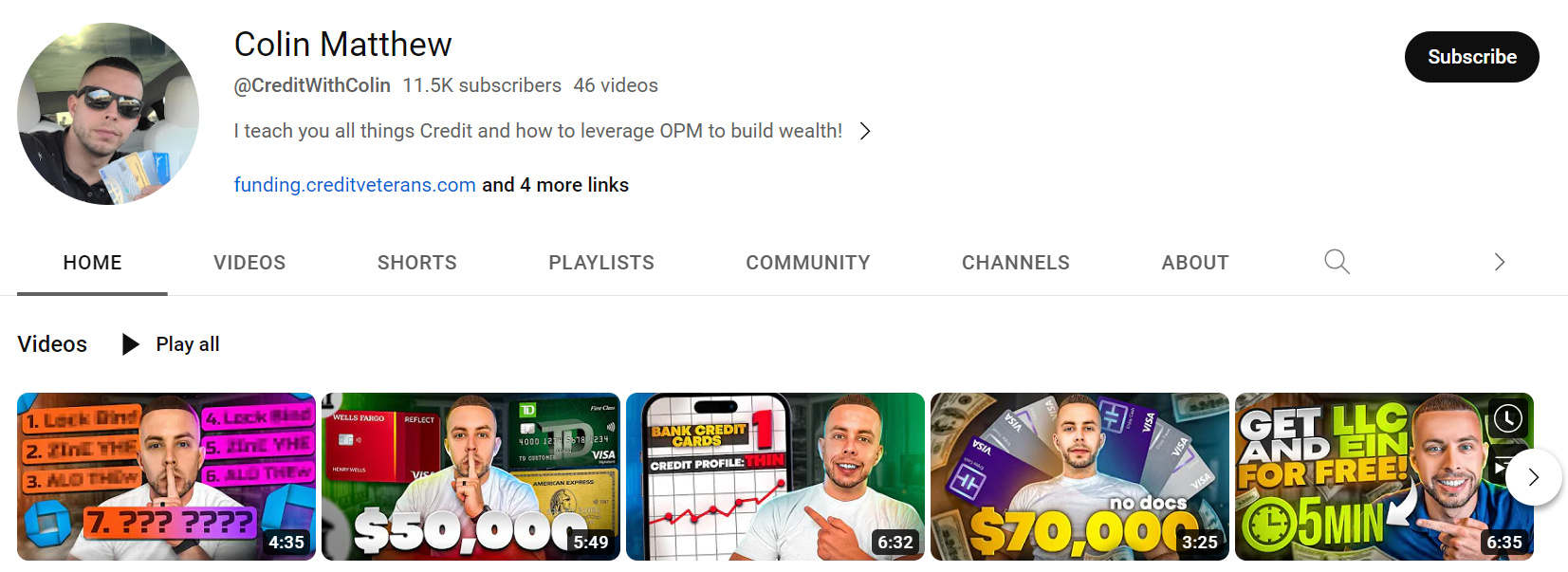

Colin’s methods have helped many entrepreneurs improve their finances. His expertise is evident in his robust social media following, with over 12,900 Instagram followers and 11,600 YouTube subscribers. His videos regularly attract more than 10,000 views, demonstrating the value of his knowledge in business credit mastery.

Is Colin Matthew a scam?

Based on my research about the course content & social proof, my answer is NO. But, you still need to consider any other possible information to ensure the course suits you

Who should buy Colin Matthew Business Credit Mastery?

- Aspiring Entrepreneurs: Individuals looking to dive into the business world, seeking financial strategies to fund and sustain their ventures.

- Existing Business Owners: Entrepreneurs who aim to elevate their financial strategies, enhance their business credit, and explore new investment avenues.

- Real Estate Investors: Those who wish to leverage business credit to expand their real estate investments and optimize their financial portfolios.

- Individuals Seeking Passive Income: Anyone looking to understand and utilize business credit to establish and grow passive income through various investment strategies.

3 reviews for Colin Matthew – Business Credit Mastery

Add a review Cancel reply

Related products

Business Credit

Business Credit

Business Credit

Business Credit

Business & Finance

Business Credit

Business Credit

Joseph Edward –

How long will it take to receive the course

Ying Tan –

After payment, we will send you the download link in 12 hours.

Do you have any other questions?

Joseph E. Edwards –

Not bad.

I received the course after 6 hours.

I couldn’t access the original sale page, but the downloadable course provides everything I need.

I will suggest this website to my friends.

Ely Sepulveda (verified owner) –

I’m happy with the investment I made. I paid a fraction of the cost. But, it wasn’t complete. Missing videos from each of the 4 sections. I didn’t expect all the original bonuses or other incentives from original offer, but did expect the 4 sections in its entirety.

David (verified owner) –

High quality – full course nothing missing – zero hassles!