Jim Dalton – Mind Over Markets Expanded Intensive Series 2018

$19.00

Jim Dalton Mind Over Markets Expanded Intensive Series 2018 Course [Instant Download]

What is Mind Over Markets Expanded Intensive Series 2018?

Jim Dalton Mind Over Markets Expanded Intensive Series 2018 is a trading course that teaches you how to read markets like Wall Street professionals.

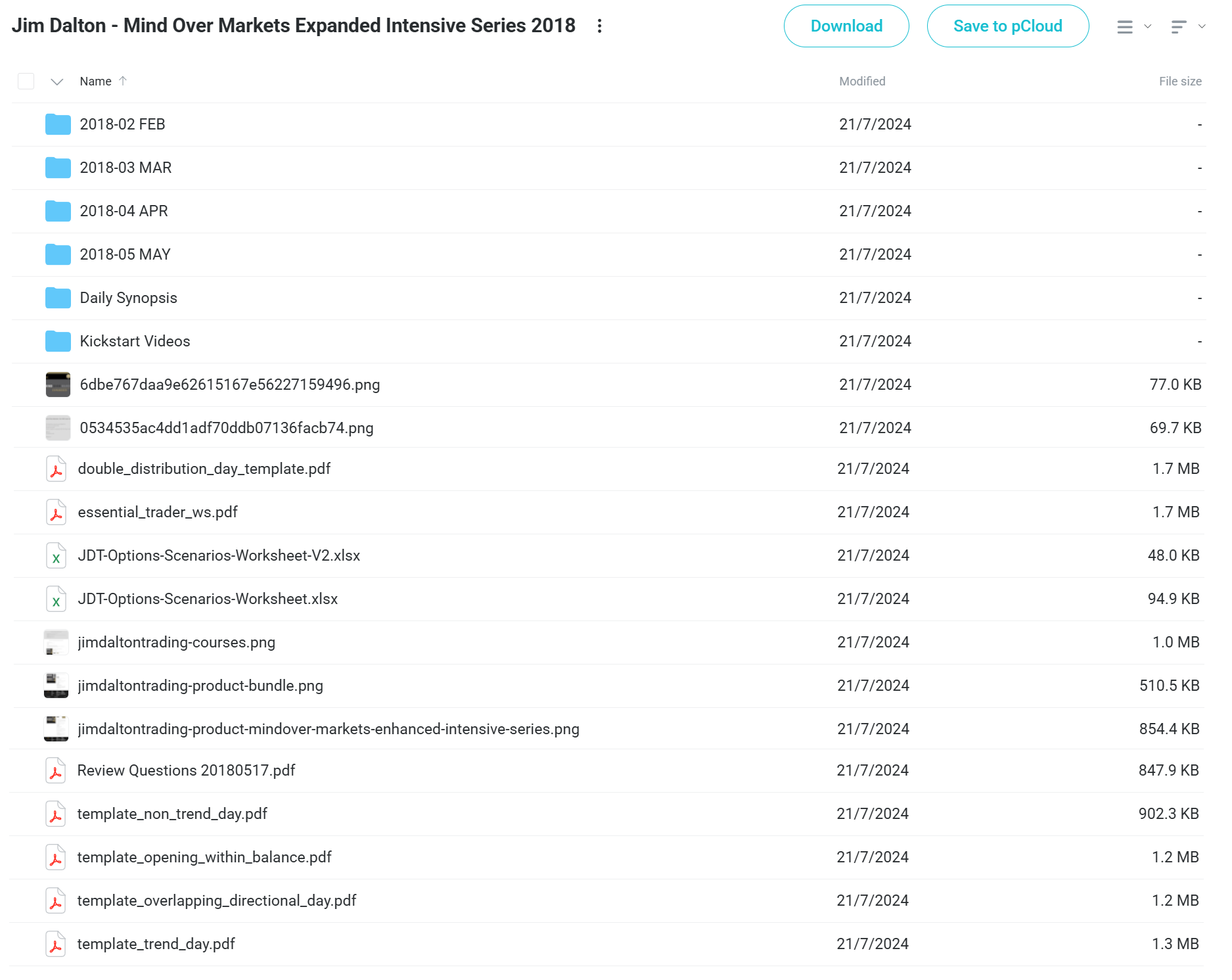

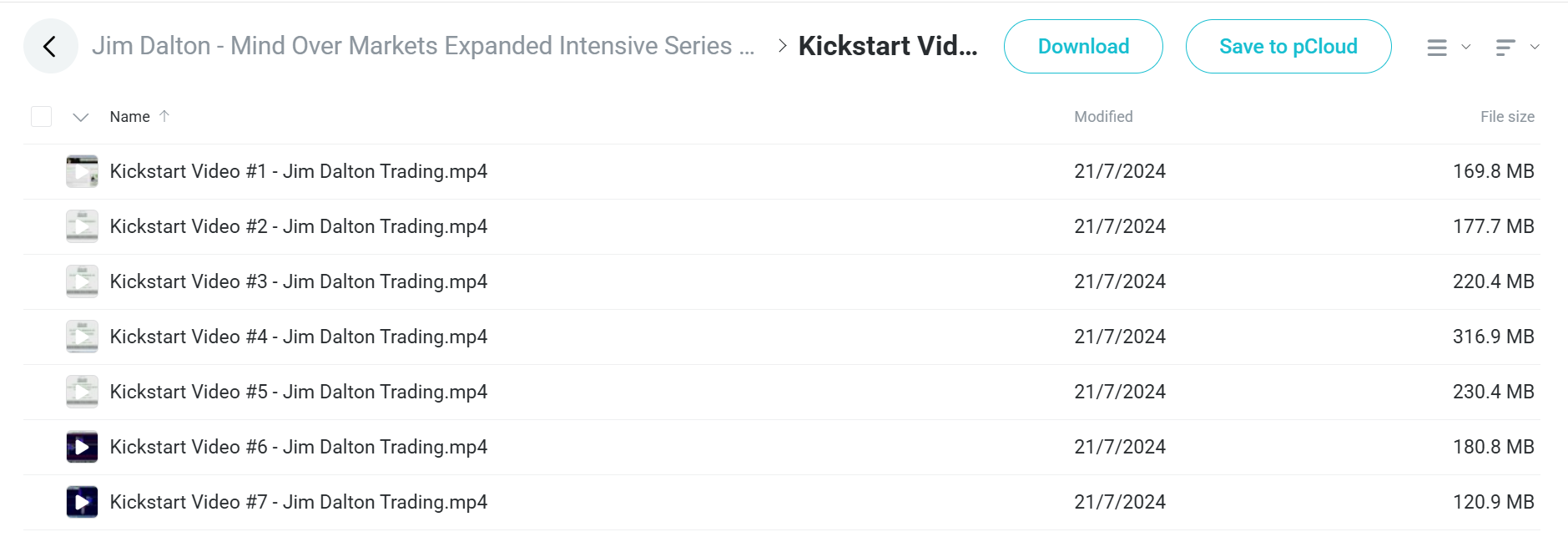

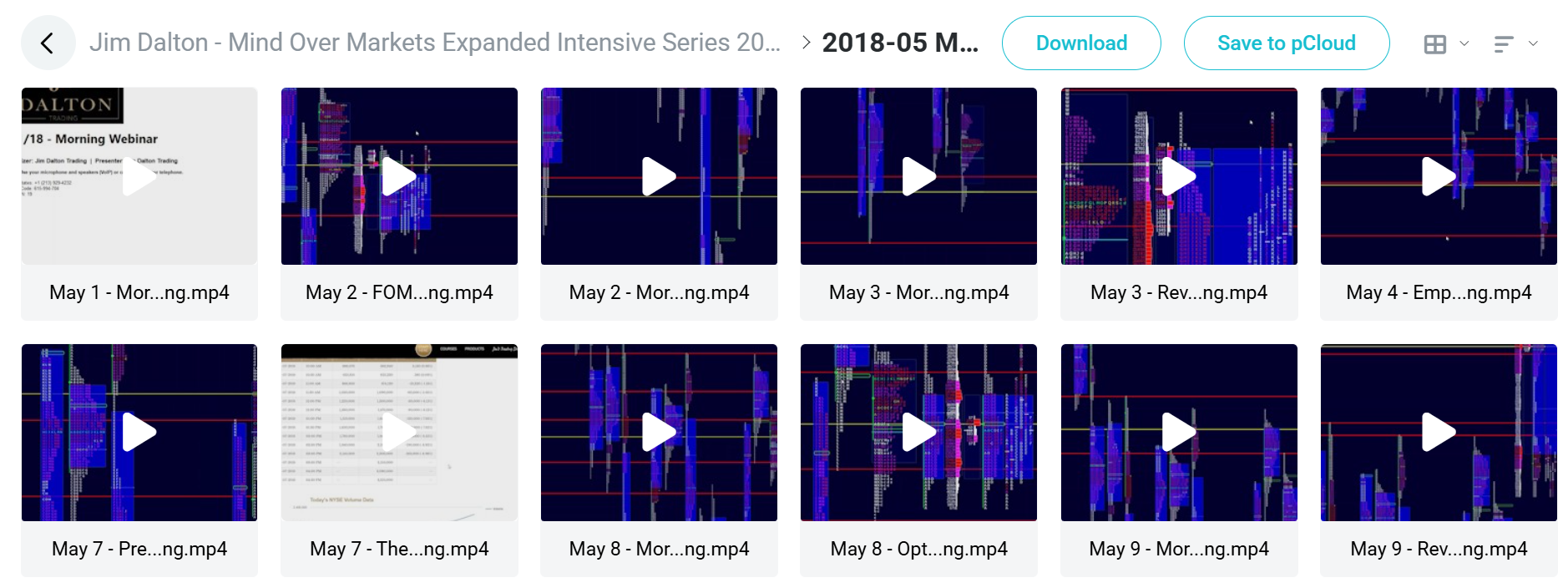

The program includes 45GB of live trading sessions where Dalton breaks down real market movements as they happen.

You learn to spot value areas, read volume at price, and predict where markets will move next. The course shows you auction market theory through daily examples and live trading analysis.

Dalton teaches you to identify trend days, rotational days, and balanced markets using the same methods institutional traders use. This intensive series transforms how you see and trade financial markets.

📚 PROOF OF COURSE

What you’ll learn in this course:

This trading course teaches you Jim Dalton’s Market Profile techniques through live market analysis. Here’s what you’ll learn:

- Live trading sessions: Watch real-time market analysis and trading decisions as they happen

- Daily market synopsis: Get detailed breakdowns of market behavior and key turning points

- Options trading strategies: Learn advanced options scenarios and risk management techniques

- Auction market theory: Understand price discovery, value area, and point of control concepts

- Market structure analysis: Spot trend days, rotational days, and balanced market conditions

- Trading psychology: Learn from book discussions on trading mindset and decision-making

This intensive series mixes theory with real trading examples. You’ll learn to read market structure like professional traders and make better trading decisions.

Course Structure:

✅ February 2018: Foundation Building

The program starts with basic trading mindset and market introduction ideas, building the main principles that support all future learning. Students get their first look at options trading basics while joining fun “Happy Hour” sessions that mix educational content with real market discussions.

This opening month focuses on building proper mental frameworks for trading success, introducing students to the mental blocks that commonly hurt traders. The foundation work includes morning preparation routines and basic market reading that will become daily habits throughout the intensive series.

✅ March 2018: Core Market Structure Development

March is the heaviest learning period, with daily morning webinars plus special modules on market time frames and rotation trading ideas. Students go deep into job report analysis, learning to handle high-stress news events while keeping disciplined trading approaches.

The Options series starts for real during this month, moving from basic ideas through middle-level strategies across three structured sessions. Students also join regular Q&A sessions and “Open Mic” discussions, allowing for personal guidance and learning from other students.

A key part during this phase involves understanding “Other Than Day Time frame” ideas and delayed trading strategies, expanding students’ analysis skills beyond same-day patterns. The month ends with complete preparation techniques for managing final-hour trading moves.

✅ April 2018: Advanced Applications and Case Studies

April changes focus toward real-world use through detailed market reviews and live trading analysis. Students look at specific trading days, including the complete breakdown of April 3rd’s “Traditional Rotation Day,” learning to spot and profit from classic market patterns.

The Options education gets deeper with advanced webinars while introducing money psychology ideas through Daniel Kahneman’s “Thinking Fast and Slow” principles. This mixing of trading psychology with technical analysis creates a more complete understanding of market moves and personal decision-making processes.

Students join extensive review and replay sessions, studying recent trading days to strengthen pattern recognition and decision-making skills. Daily summary sessions provide ongoing market commentary while building students’ ability to combine complex market information into actionable insights.

✅ May 2018: Integration and Advanced Strategies

The program’s end focuses on bringing together all previously learned ideas while introducing special event trading, particularly around FOMC meetings and job reports. Students learn to prepare for and handle high-impact economic announcements with confidence and structured approaches.

Advanced options strategies reach their peak during this month, with the fifth and final Options webinar completing the complete derivatives education part. Students practice managing complex market scenarios while keeping the mental discipline developed throughout the course.

The month focuses on real-world use through extensive review sessions and “Final Hour” trading workshops, making sure students can use their learning in real market conditions. Weekly preparation sessions continue to strengthen the importance of structured planning in successful trading outcomes.

Who is Jim Dalton?

Jim Dalton is a trader and educator with over 40 years of experience in financial markets. He created Market Profile analysis and auction market theory for individual traders.

Dalton wrote the books “Mind Over Markets” and “Markets in Profile.” These books became must-reads for professional traders worldwide. His methods focus on understanding market behavior through volume, time, and price.

He founded Jim Dalton Trading to teach institutional-level market analysis to regular traders. His students include hedge fund managers, prop traders, and retail investors in 50+ countries.

Dalton’s approach focuses on the “who” and “why” behind market movements instead of just technical indicators. He teaches traders to think like market makers and understand auction market dynamics.

His live trading sessions have helped thousands of traders improve their market reading skills. Dalton still trades actively while teaching through intensive courses and mentorship programs.

Be the first to review “Jim Dalton – Mind Over Markets Expanded Intensive Series 2018” Cancel reply

Related products

Trading Courses

Stock Trading

Trading Courses

Jim Dalton Trading Foundation Application of the Market Profile

Forex Trading

Options Trading

Trading Courses

Forex Trading

Forex Trading

Reviews

There are no reviews yet.