FusionFX Pro – Advanced Forex, Crypto & Stock Trading

$19.00

FusionFX Pro Advanced Forex, Crypto & Stock Trading Course [Instant Download]

1️⃣. What is Advanced Forex, Crypto & Stock Trading?

FusionFX Pro teaches advanced trading strategies for forex, crypto, and stock markets using institutional methods.

The course combines Wyckoff methodology and supply-demand analysis to help traders develop a professional edge in the markets.

You’ll learn why most traders fail and master proven strategies through real-world case studies and practical applications. The program focuses on institutional trading techniques that work across all financial markets.

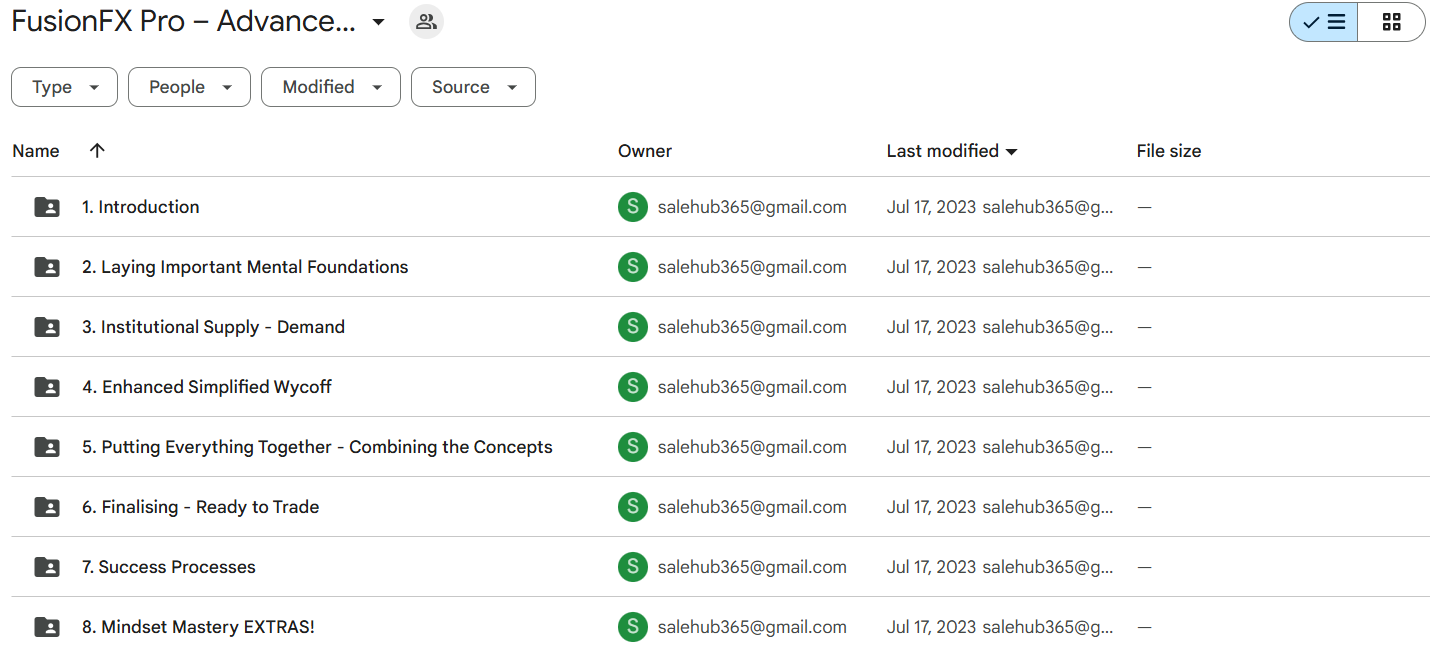

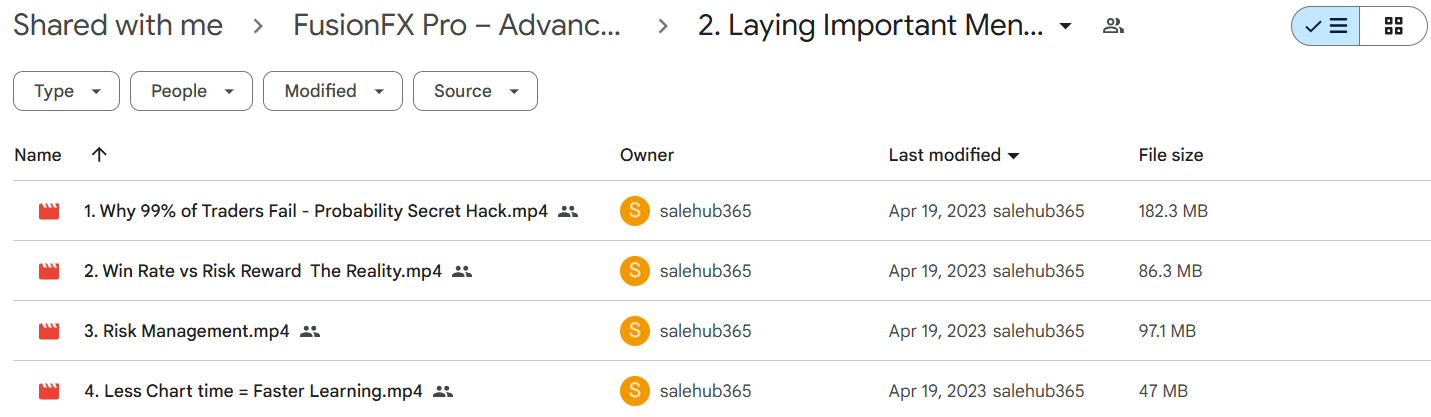

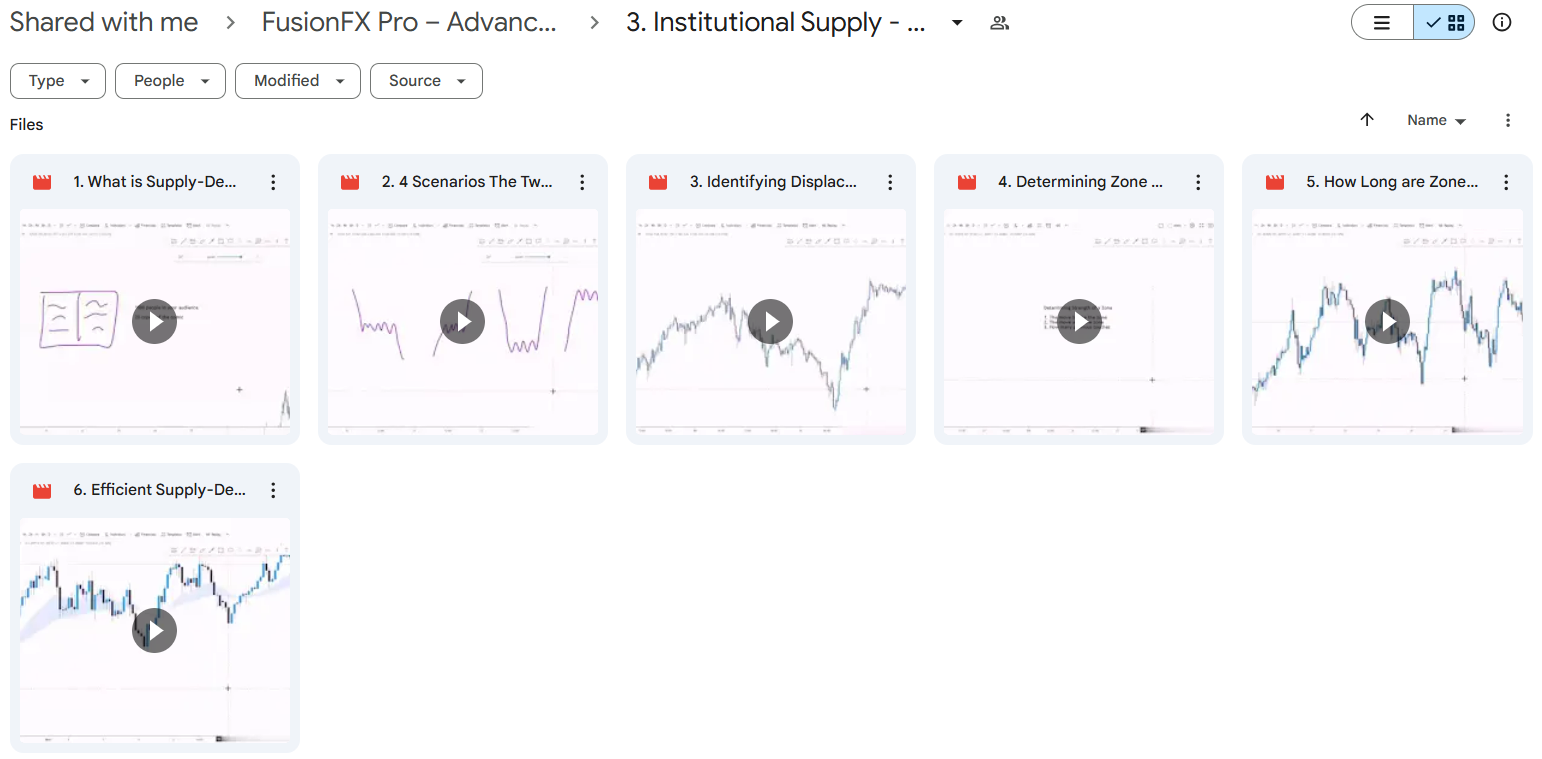

📚 PROOF OF COURSE

2️⃣. What you’ll learn in Advanced Forex, Crypto & Stock Trading:

Learn professional trading strategies and master the psychology of successful trading. Here’s what you’ll learn:

- Trading Psychology: Discover why traders fail and build habits for consistent profits

- Supply and Demand: Find institutional price levels and learn to trade them effectively

- Wyckoff Method: Understand market cycles and use volume to time your trades better

- Professional Strategies: Learn how institutions trade and develop your market edge

- Risk Control: Learn proper position sizing and protect your trading account

- Chart Analysis: Master price action reading and key trading indicators

After completing the course, you’ll have a proven trading system that combines market knowledge with trading psychology.ou’ll have a complete trading system that combines technical expertise with psychological mastery.

3️⃣. Advanced Forex, Crypto & Stock Trading Course Curriculum:

✅ Section 1: Course Introduction

This section provides students with an overview of the comprehensive trading program ahead. The introduction establishes expectations and outlines the learning journey for mastering institutional trading concepts.

Module 1.1: Program Overview

Introduction (Video) – A comprehensive overview of the course structure and learning objectives.

✅ Section 2: Mental Framework Development

This section addresses critical foundational concepts that distinguish successful traders from unsuccessful ones. Students learn essential probability concepts and risk management principles that form the basis of professional trading.

Module 2.1: Trading Foundations

Students explore why most traders fail, understand the relationship between win rates and risk-reward ratios, and learn efficient learning techniques. The module emphasizes practical risk management strategies and efficient chart analysis methods.

✅ Section 3: Institutional Supply And Demand

This section introduces professional supply and demand analysis techniques. Students learn to identify and utilize institutional order flow concepts for trading advantage.

Module 3.1: Supply Demand Analysis

Comprehensive coverage of supply-demand zones, displacement analysis, and probability assessment. Students learn exact timescales for zone validity and efficient tools for implementation. The module focuses on four key scenarios, emphasizing the two most profitable patterns.

✅ Section 4: Enhanced Wyckoff Methodology

This section presents a refined version of Wyckoff market analysis. Students learn a modernized approach to this classical trading methodology.

Module 4.1: Wyckoff Application

Students master simplified Wyckoff concepts, enhanced formulas, and phase identification. The module includes extensive examples and fractal analysis techniques, culminating in refined setup identification.

✅ Section 5: Strategy Integration

This section teaches students to combine multiple analysis techniques into a coherent trading approach. The focus is on practical application and market behavior understanding.

Module 5.1: Concept Integration

Students learn to fuse phase analysis with supply-demand concepts, select appropriate timeframes, and develop advanced directional bias through the Price Range Matrix. The module includes step-by-step analysis procedures.

✅ Section 6: Trade Execution

This section focuses on practical trade implementation and strategy refinement. Students learn specific entry, exit, and position management techniques.

Module 6.1: Trade Implementation

Comprehensive coverage of entry techniques, stop loss placement, and target setting. Students learn scalping methods, volume profile analysis, and proper trade planning. The module includes live analysis and setup breakdowns.

✅ Section 7: Performance Optimization

This section addresses the crucial aspects of becoming a consistently successful trader through proper testing and analysis methods.

Module 7.1: Trading Process Development

Students learn effective backtesting procedures, proper journaling techniques, and advanced trade analysis methods. The module emphasizes successful trading habits and self-review processes.

✅ Section 8: Psychology And Mindset

This final section focuses on developing the mental strength required for consistent trading success. Students receive advanced psychological training and resources.

Module 8.1: Mental Mastery

Students master emotional control and learn to prevent psychological mistakes. The module includes recommended reading materials:

“Becoming Supernatural” (PDF)

“Letting Go: The Pathway of Surrender” (PDF)

“Trading in the Zone” by Mark Douglas (PDF)

Each section includes video lessons and practical exercises. The curriculum progresses logically from foundational concepts through advanced strategy implementation, emphasizing both technical proficiency and psychological development.

4️⃣. What is FusionFX Pro?

FusionFX Pro teaches advanced trading strategies that work in real market conditions.

Their team combines professional trading techniques with practical methods to help traders succeed. They show why common trading approaches don’t work and teach better alternatives.

The program focuses on both technical skills and trading psychology, helping traders develop a reliable edge in forex, crypto, and stock markets.

Students learn institutional trading methods that work across all financial markets, backed by practical examples and case studies.

5️⃣. Who should take FusionFX Pro Course?

This trading course helps serious traders who want to improve their results in the markets:

- New Traders who want to learn why their trades aren’t working and master professional methods

- Regular Traders ready to learn institutional trading strategies for better results

- Experienced Traders looking to add Wyckoff method and supply-demand trading to their skills

- Active Traders who want to use professional trading techniques in their daily trading

This course requires dedication to learning and practice. It’s not for those looking for quick profits or trading shortcuts.

6️⃣. Frequently Asked Questions:

Q1: What are advanced trading strategies?

Q2: How do institutional traders influence the market?

Q3: What is the role of risk management in advanced trading?

Q4: How does technical analysis help in trading?

Q5: Why is trading psychology important?

Be the first to review “FusionFX Pro – Advanced Forex, Crypto & Stock Trading” Cancel reply

Related products

Trading Courses

Forex Trading

Base Camp Trading – Explosive Growth Options – Stocks (EGOS) Program – EGOS MINI BUNDLE)

Trading Courses

Stock Trading

Trading Courses

Trading Courses

Forex Trading

Trading Courses

![Mike Aston - Learn to Trade [Trading Template]](https://coursehuge.com/wp-content/uploads/2023/09/Mike-Aston-Learn-to-Trade-Trading-Template-300x300.jpg)

Reviews

There are no reviews yet.