Anton Kreil – Professional Forex Trading Masterclass (PFTM)

$2,999.00 Original price was: $2,999.00.$12.00Current price is: $12.00.

Anton Kreil Professional Forex Trading Masterclass Course [Instant Download]

What is Anton Kreil Professional Forex Trading Masterclass:

Anton Kreil ‘s Professional Forex Trading Masterclass teaches institutional-level forex trading strategies used by Wall Street traders. The course shows you how to analyze market fundamentals and spot major trading opportunities.

Anton Kreil, ex-Goldman Sachs trader, shares professional methods through 30 hours of training. You’ll learn to use macroeconomic data, Excel models, and risk management tools to trade like an institutional investor.

This program focuses on high-impact trades that appear 1-2 times yearly, based on fundamental analysis rather than frequent day trading. Each lesson includes practical Excel templates for real-world application.

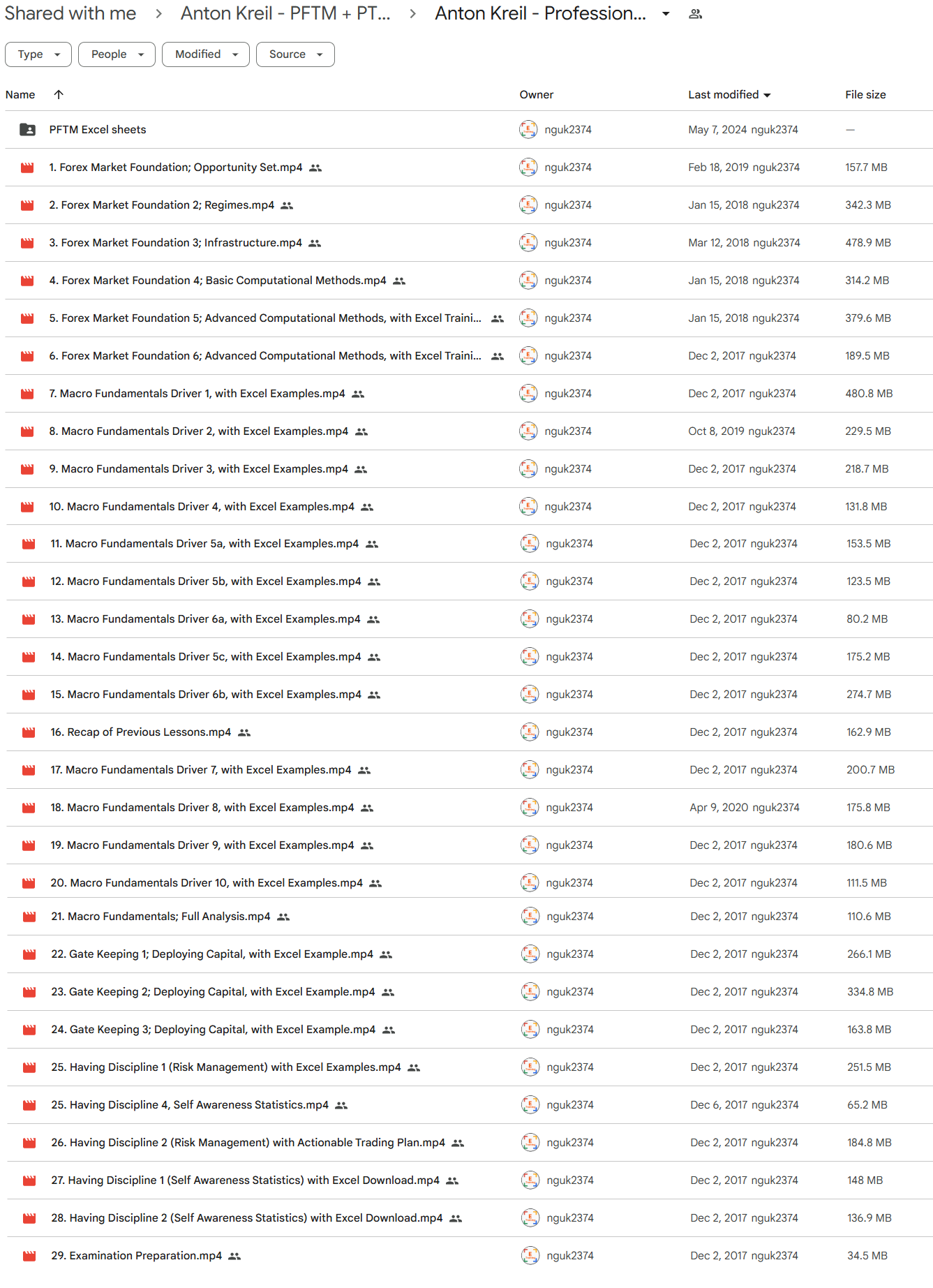

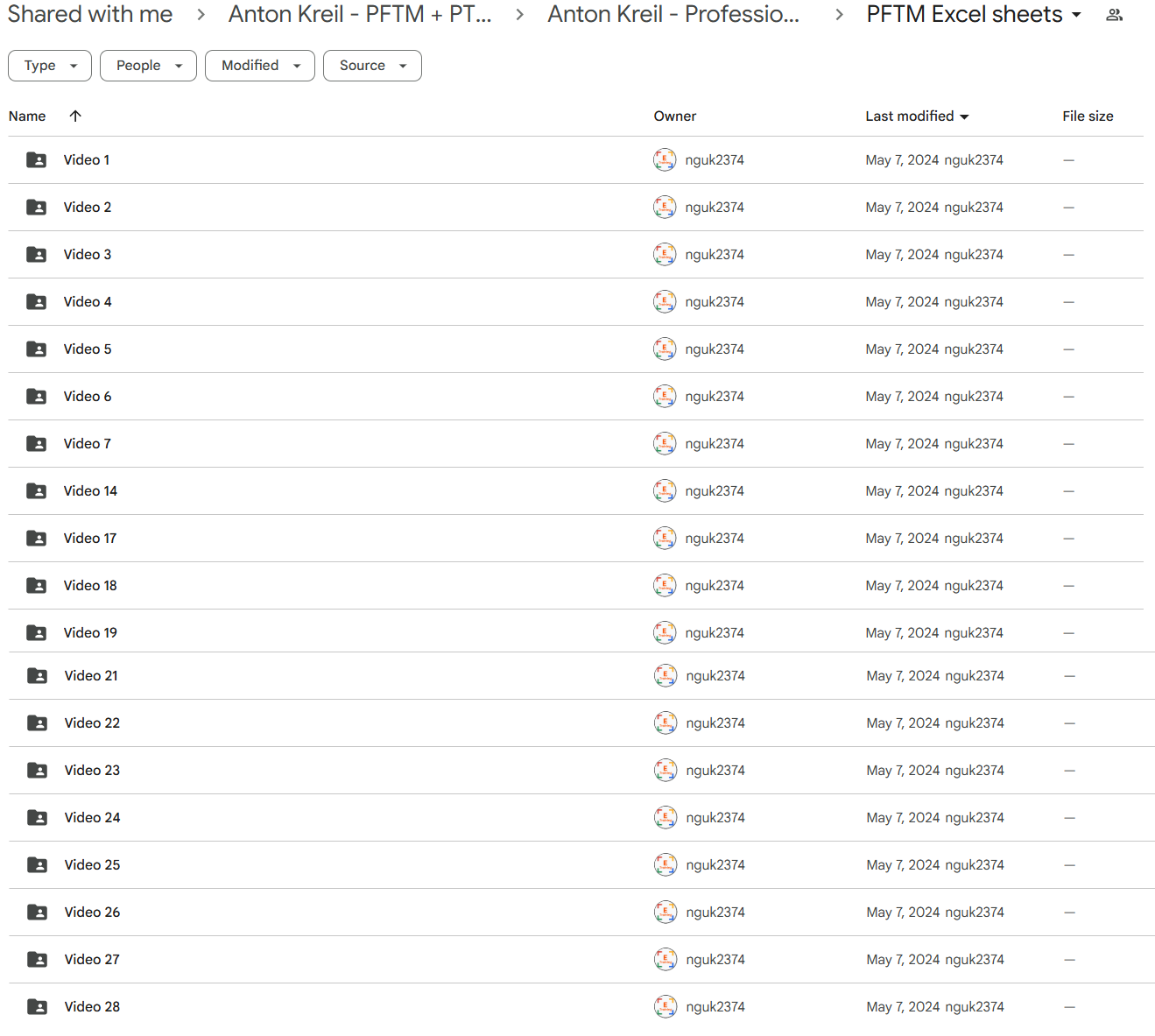

📚 PROOF OF COURSE

What you’ll learn in Professional Forex Trading Masterclass:

The Professional Forex Trading Masterclass transforms everyday traders into professional forex traders. Here’s what you’ll learn:

- Market Analysis: Learn to analyze forex markets using institutional tools and data-driven methods

- Risk Control: Master proven risk management and position sizing used by bank traders

- Macro Strategy: Read global economic signals to spot major trading opportunities

- Excel Tools: Build professional trading models to analyze market data

- Money Management: Learn how to manage your trading capital like institutional pros

- Trading Mindset: Develop disciplined decision-making for consistent results

After completing this course, you’ll have the skills to trade forex using professional analysis and risk management methods that top institutions use.

Professional Forex Trading Course Curriculum:

Section 1: Forex Market Foundations

This section establishes core market concepts and structural understanding of the forex markets. Students progress from basic organizational principles to advanced computational methods, building a comprehensive foundation for forex trading analysis.

Module 1.1: Market Organization and Structure

The initial module introduces fundamental forex market organization through organized spreadsheets and market analysis tools. Covers basic market structure and introduces primary currency relationships. (FOREX_Markets_Organised.xlsx)

Module 1.2: Market Universe and Trading Opportunities

Explores the complete tradable universe of forex pairs and cross-rates, introducing opportunity ranking methodologies. Focuses on identifying viable trading opportunities across different market complexities. (FOREX_Universe_Tradable_Complex.xlsx, Tradeable_Crosses_Opportunity_Ranked.xlsx)

Module 1.3: Banking and Market Infrastructure

Examines core market infrastructure including corporate forex calculations, fractional reserve banking, and money supply mechanics. Provides essential context for understanding market dynamics. (Corporate_Sales_Margin_FOREX_Calculator.xlsx, related PDF resources)

Module 1.4: Computational Foundations

Introduces carry and rollover calculations, establishing basic computational methods necessary for forex trading. (Carry_Rollover.xlsx)

Module 1.5: Statistical Analysis and Returns

Advances into distribution rankings and return analysis, building statistical foundations for market analysis. (Distribution_Rankings.xlsx, FX Distribution of Returns Tutorial.pdf)

Module 1.6: Volatility Analysis

Comprehensive coverage of volatility analysis across major and minor currency pairs, including both commercial and ex-commercial float analysis. (Multiple volatility analysis spreadsheets)

Section 2: Macro Fundamentals and Drivers

This section delves into the fundamental drivers of forex markets, combining theoretical understanding with practical analysis tools. Students learn to identify and analyze both endogenous and exogenous market factors.

Module 2.1: Economic Indicators

Focuses on key economic indicators including unemployment data and GDP analysis. (Initial_Continuing_Claims.xlsx, Unemployment_Rate.xlsx)

Module 2.2: Currency Pair Analysis

Detailed examination of specific currency pairs, using AUD/USD as a case study. Includes comprehensive data sets covering various market influences. (Multiple AUD/USD related files)

Module 2.3: Market Analysis Integration Combines endogenous and exogenous analysis techniques, teaching students to synthesize multiple analytical approaches. (Endo_Exo_Analysis_USD_AUD.xlsx)

Section 3: Advanced Trading Strategies

This section focuses on practical trading implementation, risk management, and performance analysis. Students learn to develop and execute comprehensive trading strategies.

Module 3.1: Capital Deployment

Covers Commitment of Traders (COT) analysis and technical trading strategies. (COT_AUD_USD_Analysis.xlsx, Price_Action_Watchlist.xlsx)

Module 3.2: Risk Management

Focuses on exposure, margin calculations, and position sizing using the Kelly Criterion. (Exposure_Margin.xlsx, Kelly_Criterion.xlsx)

Module 3.3: Performance Analysis

Concludes with comprehensive portfolio performance statistics and self-awareness development. (Portfolio Performance Statistics.xlsx)

The curriculum follows a logical progression from foundational concepts through advanced trading strategies, with each section building upon previous knowledge. Practical applications are emphasized throughout, with extensive use of Excel-based tools and real-world data analysis.

Who is Anton Kreil?

Anton Kreil started trading at Goldman Sachs at age 20, becoming their youngest Pan European Equities trader. He later traded at Lehman Brothers and JP Morgan, mastering institutional trading strategies.

He gained fame on BBC’s “Million Dollar Traders” show in 2008, where he taught complete beginners to trade successfully. This led him to create the Institute of Trading and Portfolio Management (ITPM).

Kreil now teaches retail traders the same methods used by bank traders. Through ITPM, he has helped over 25,000 students learn professional trading strategies that work in real markets.

Be the first to review “Anton Kreil – Professional Forex Trading Masterclass (PFTM)” Cancel reply

Related products

Forex Trading

Forex Trading

Trading Courses

Forex Trading

Trading Courses

Stock Trading

Trading Courses

Reviews

There are no reviews yet.