TRADEPRO ACADEMY – Futures Day Trading and Order Flow Course

$1,999.00 Original price was: $1,999.00.$22.00Current price is: $22.00.

TRADEPRO ACADEMY Futures Day Trading and Order Flow Course [Instant Download]

What is Futures Day Trading and Order Flow Course:

Futures Day Trading and Order Flow is a course by TRADEPRO ACADEMY, it teaches you how to trade futures using order flow analysis and volume patterns.

The course focuses on three key tools: Volume Profile, Market Profile, and Depth of Market. You’ll learn to spot institutional trading activity and capitalize on market imbalances.

Instead of indicators, you’ll master how to read real market data through order flow – seeing exactly how big money moves and trades. This helps you identify high-probability trades and market direction more accurately.

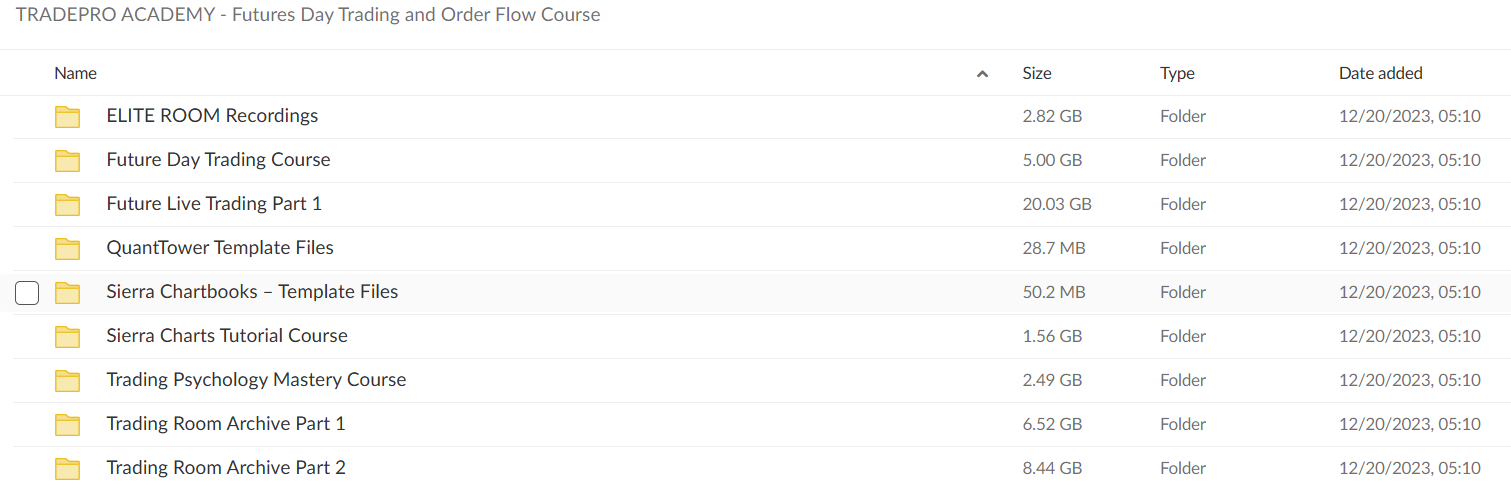

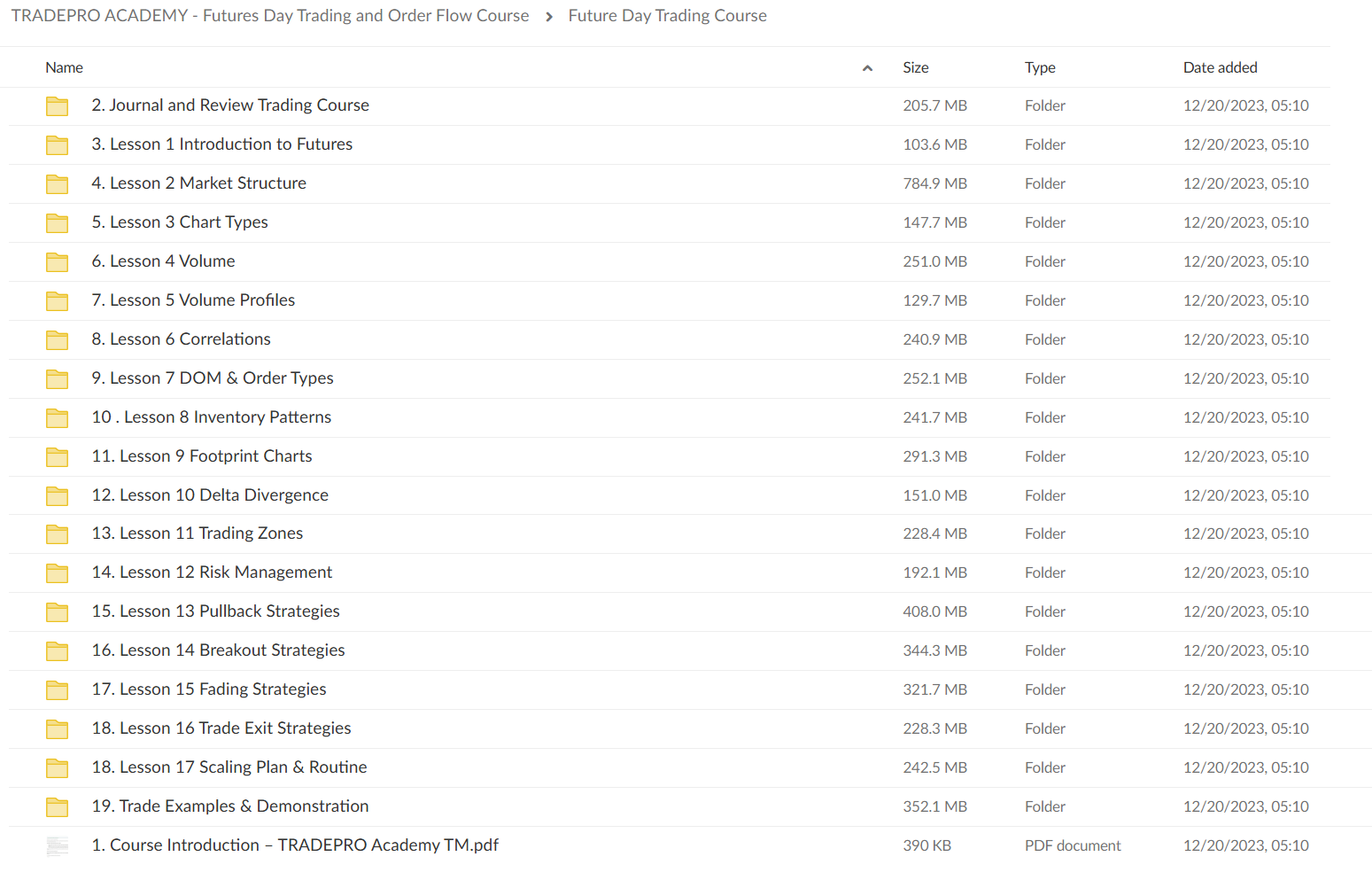

📚 PROOF OF COURSE

What you’ll learn in TRADEPRO ACADEMY course

This advanced futures trading program teaches you institutional-grade trading methods. Here’s what This program teaches you how to trade futures like professional traders. Here’s what you’ll learn:

- Order Flow Reading: Learn to read market depth to see how big money moves

- Volume Analysis: Find important price levels where institutions trade actively

- Market Direction: Use auction theory to spot high-probability trading opportunities

- Stop Loss Hunting: Identify where traders get trapped and market turns around

- Risk Control: Master position sizing and protect your trading account

- Real Practice: Trade in live market conditions using professional tools

By the end, you’ll trade futures using order flow and volume – the same way institutional traders do it.

Course Structure:

- ELITE ROOM Recordings [MP4s & PDFs]

- Future Day Trading Course [MP4s & PDFs]

- Future Live Trading Part 1 [MP4s]

- QuantTower Template Files [MP4s & PDFs]

- Sierra Chartbooks – Template Files [MP4s & PDFs]

- Sierra Charts Tutorial Course [MP4s]

- Trading Psychology Mastery Course [MP4s & PDFs]

- Trading Room Archive Part 1 [MP4s]

- Trading Room Archive Part 2 [MP4s]

All content is available instantly after enrollment, letting you learn at your own pace while practicing with professional trading tools.

What is TRADEPRO ACADEMY?

TRADEPRO ACADEMY teaches futures trading using professional methods. Their team of experienced proprietary traders shows you how to trade using order flow and volume analysis.

Unlike other platforms that teach indicator-based trading, TRADEPRO focuses on institutional trading techniques. They show you exactly how big money trades the futures market.

The academy has helped thousands of traders learn professional futures trading. Their teaching combines theory with real market practice, based on years of proprietary trading experience.

Each lesson focuses on practical trading skills using volume, order flow, and market depth analysis – the tools professional traders use daily.

Be the first to review “TRADEPRO ACADEMY – Futures Day Trading and Order Flow Course” Cancel reply

Related products

Trading Courses

Stock Trading

Forex Trading

Trading Courses

Best 100 Collection

Forex Trading

Options Trading

Investment Management

Reviews

There are no reviews yet.