The Python Quants – CPF PROGRAM (2024)

$3,249.00 Original price was: $3,249.00.$20.00Current price is: $20.00.

The Python Quants CPF Program Course [Instant Download]

What is The Python Quants CPF Program?

The Python Quants CPF Program teaches you how to use Python for trading and investing. You’ll learn to build automated trading systems and manage investment portfolios using Python code.

The program includes 330+ hours of training in algorithmic trading, financial data analysis, and AI-powered investment strategies. You’ll master essential tools like pandas and NumPy for analyzing financial markets.

Students learn by doing – you’ll write Python code to create trading algorithms, analyze market data, and develop investment strategies that can run automatically. The course combines finance knowledge with practical coding skills you can use immediately.

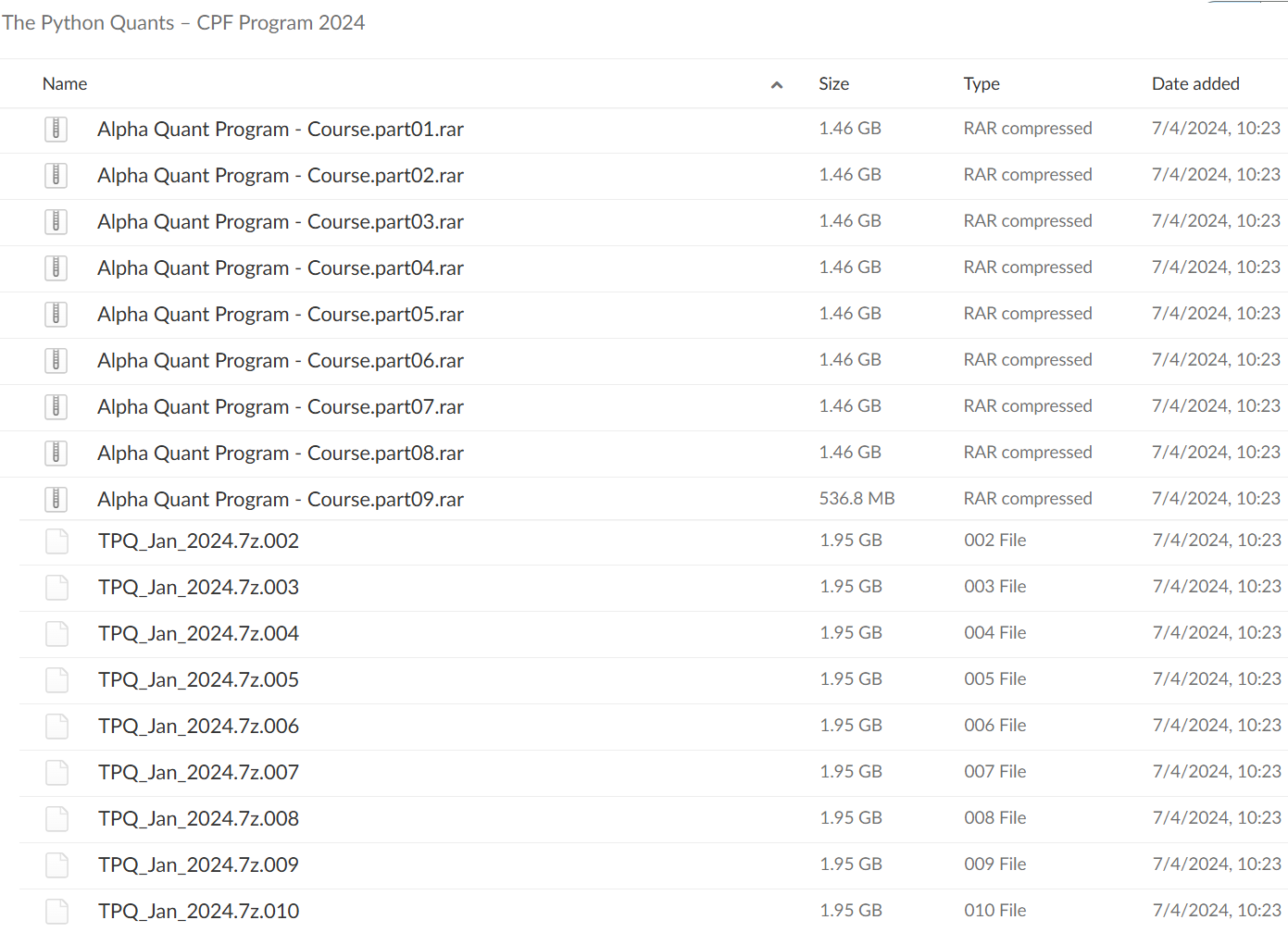

📚 PROOF OF COURSE

What you’ll learn in CPF Program?

The CPF Program teaches everything needed to use Python for finance and trading. Here’s what you’ll learn:

- Python for Finance: Build a strong foundation in Python and its financial libraries

- Trading Systems: Create and run your own automated trading strategies

- Portfolio Management: Use AI to make smarter investment decisions

- Market Analysis: Learn to analyze financial data with professional tools

- Machine Learning: Apply AI to predict market movements

- Financial Computing: Master the math behind trading strategies

This program gives you real skills to build and run trading systems using Python. Each topic includes hands-on practice with actual market data.

CPF Program Curriculum:

The Certificate in Python for Finance (CPF) Program teaches financial professionals how to use Python programming for modern finance applications. Students learn both traditional finance concepts and new AI techniques through hands-on coding.

✅ Finance with Python (9h)

This introductory course provides the essential groundwork by connecting basic financial principles with Python programming fundamentals. Students receive a gentle introduction to Python based on extensive documentation (170+ pages), establishing the programming mindset needed for financial applications.

✅ Python for Financial Data Science (20h)

Based on the second edition of the “Python for Finance” O’Reilly book released in 2018, this central class builds upon an updated code base. Students learn how to manipulate, analyze, and visualize financial data sets using Python’s data science libraries, developing the skills to extract meaningful insights from financial information.

✅ Python for Algorithmic Trading (50h)

As a core component of the program, this extensive course dives deep into automated trading strategy development. With approximately 450 pages of documentation and over 3,000 lines of Python code, students learn to design, backtest, and implement algorithmic trading systems, covering everything from market microstructure to execution algorithms.

✅ Python for Computational Finance (20h)

This core course focuses primarily on derivatives analytics, built around the “Derivatives Analytics with Python” textbook (Wiley). Students master the mathematical models underlying financial derivatives and implement them in Python, with the course featuring more than 5,000 lines of Python code for practical applications.

✅ Python for Asset Management (26h)

This comprehensive course covers Python techniques for modern portfolio management, including important AI concepts. Students learn to implement portfolio optimization strategies, risk management frameworks, and asset allocation models using computational approaches.

✅ Python for Finance Basics (>30h)

Designed as an ideal starting point, this class systematically covers essential Python techniques, idioms, and skills. It provides a simplified yet thorough framework to rapidly build programming competence before the program officially begins.

✅ AI & RL in Finance (55h)

This advanced course explores cutting-edge machine learning applications in finance. One class focuses specifically on deep learning techniques for market prediction, teaching students how to build neural networks from scratch and apply packages like Keras. Other classes cover reinforcement learning for trading strategies, drawing from the “AI in Finance” book.

✅ Crypto Basics (15h)

This specialized class introduces the main technological components underlying the cryptocurrency ecosystem. Students gain practical understanding of concepts like hashing, encryption, blockchain architecture, and mining operations, preparing them to work with digital assets.

✅ Tools & Skills (20h)

This practical course covers essential topics for setting up a professional Python development environment. Students learn to use tools like IPython, VIM, Sublime Text, and Linux, while mastering coding best practices that improve efficiency and collaboration.

✅ Additional Program Components

- Tutorials (15h): Exercises and test projects across difficulty levels for skill practice

- Add-On Resources (>40h): Specialized classes on Python for databases (SQL/NoSQL) and Excel integration

- Natural Language Processing: Techniques for language processing and Large Language Models

- Data Science Basics: Tools and techniques specific to financial data science

- Mathematics Basics (>40h): Practical approach to mathematical concepts (sets, logic, derivatives, integrals)

- Final Project: Optional capstone project to earn a prestigious university certificate

Graduates of the CPF Program gain the technical skills needed for modern finance jobs. The program prepares students to use Python for trading systems, portfolio management, and risk analysis in an industry that increasingly relies on computational methods.

About Instructor: The Python Quants

The Python Quants was founded by Dr. Yves J. Hilpisch, an expert in using Python for finance and trading.

Dr. Hilpisch wrote two important books that many finance professionals use: “Python for Finance” and “Artificial Intelligence in Finance.” He leads all the training programs and keeps them updated with the latest trading technology.

The company has trained thousands of students and professionals in using Python for trading and investing. They work closely with financial firms to make sure their training matches what the industry actually needs.

Their teaching methods combine real market experience with practical Python coding skills. This helps students quickly apply what they learn to actual trading and investment work.

Be the first to review “The Python Quants – CPF PROGRAM (2024)” Cancel reply

Related products

Trading Courses

Trading Courses

Trading Courses

Forex Trading

Base Camp Trading – Explosive Growth Options – Stocks (EGOS) Program – EGOS MINI BUNDLE)

Trading Courses

Forex Trading

Trading Courses

Trading Courses

Reviews

There are no reviews yet.