Jigsaw Orderflow Training Course

$880.00 Original price was: $880.00.$12.00Current price is: $12.00.

Jigsaw Trading Orderflow Training Course [Instant Download]

What is Jigsaw Orderflow Training Course:

Jigsaw Trading Orderflow Training Course teaches you how to read and trade using real-time order flow data in financial markets.

You’ll learn tape reading and order book analysis through practical drills, helping you spot institutional trading patterns and market moves before they happen.

Designed by prop traders, this course shows you how to identify market reversals, manage positions, and execute trades with precision – skills used daily by professional traders.

📚 PROOF OF COURSE

What you’ll learn in Orderflow Training Course:

This professional-level order flow training will transform how you understand and trade the markets. Here’s what you’ll master:

- Order Flow Fundamentals: Learn tape reading, order book analysis, and market participant behavior

- Real-Time Analysis: Develop skills to read and react to live market conditions

- Trade Management: Master position sizing, risk control, and trade execution

- Market Dynamics: Understand how institutional orders affect price movements

- Practical Application: Apply order flow strategies across different market conditions

- Advanced Techniques: Learn proprietary trading methods used by professional traders

By the end of this course, you’ll have the skills to trade confidently using order flow analysis, whether you’re a beginner or experienced trader.

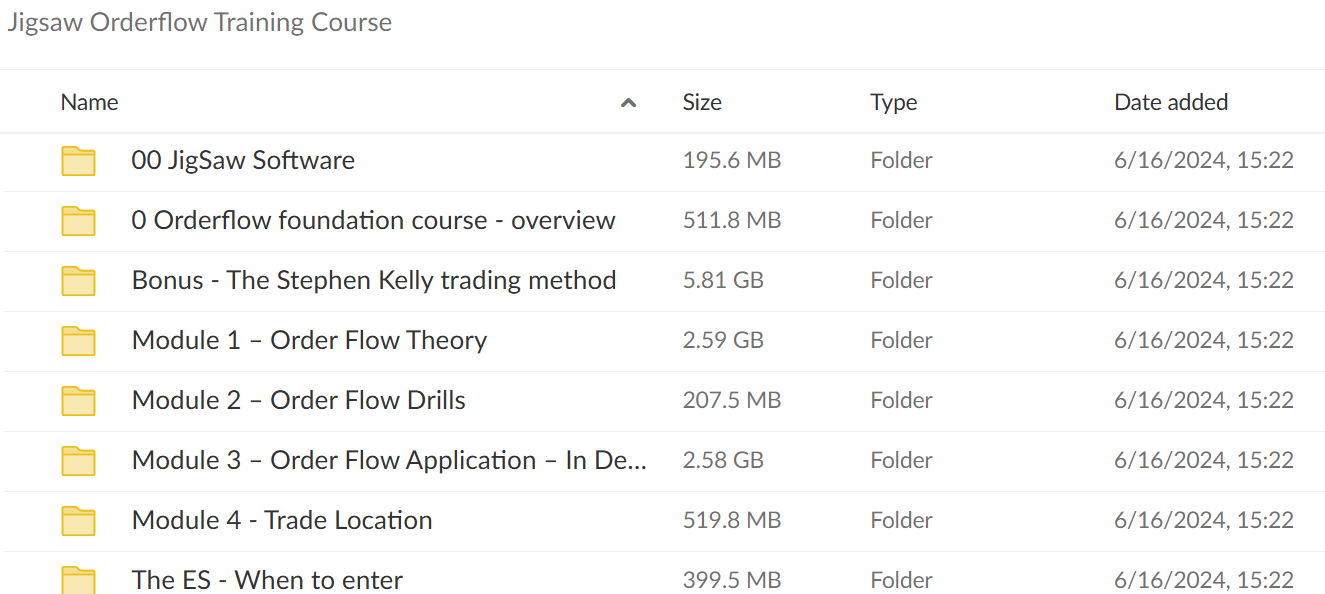

Course Structure:

- JigSaw Software

- Orderflow Foundation Course – Overview

- Bonus – The Stephen Kelly Trading Method

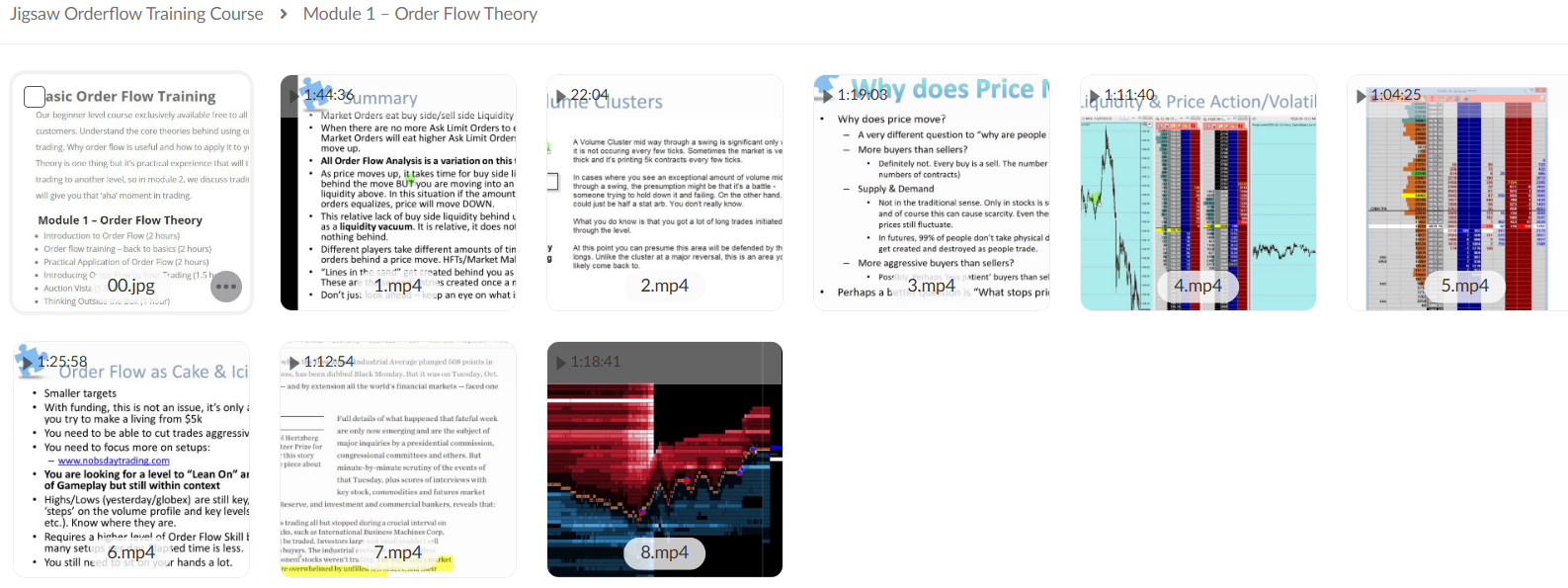

- Module 1: Order Flow Theory

- Module 2: Order Flow Drills

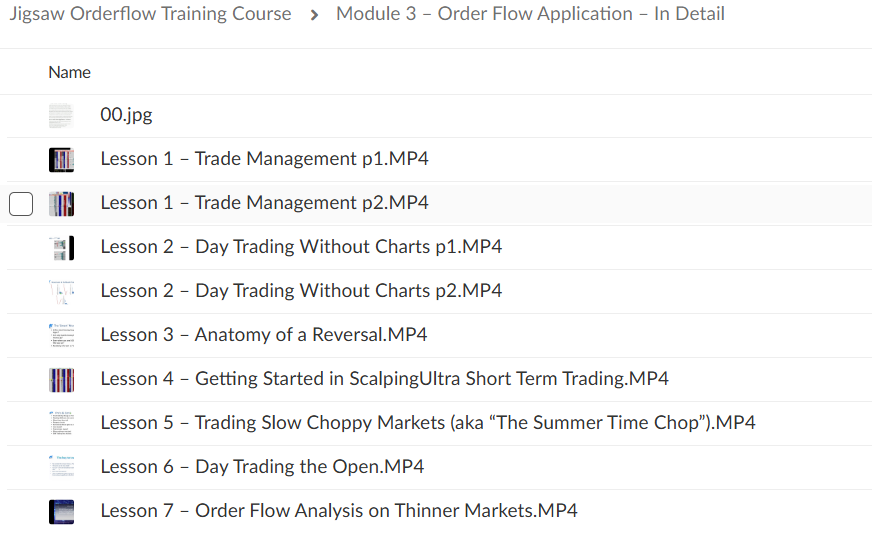

- Module 3: Order Flow Application – In Detail

- Module 4: Trade Location

- The ES – When To Enter

By the time you finish this course, you’ll know how to read market data, spot trading opportunities, and execute trades like professional traders. Every concept is explained with real market examples and practice drills.

What is Jigsaw Trading?

Jigsaw Trading, founded in 2011 by Peter Davies, is a leading provider of tools and educational resources for traders specializing in order flow analysis. Based on years of experience in stocks and futures markets, Jigsaw has built a reputation for its innovative solutions and trader-focused support.

Key Achievements:

- Jigsaw daytradr™: An award-winning platform for real-time market analytics.

- Journalytix: A performance tracking and journaling tool to enhance trader performance.

- Global Community: A thriving network of traders sharing strategies and insights.

Jigsaw Trading continues to set the standard for order flow trading education and tools.

Be the first to review “Jigsaw Orderflow Training Course” Cancel reply

Related products

Investment Management

Best 100 Collection

Trading Courses

Forex Trading

Forex Trading

Trading Courses

Forex Trading

Reviews

There are no reviews yet.