Learning

What is Smart Money Concepts? A Complete Guide

Highlight:

- Understanding the Core: Smart Money Concepts (SMC) provide a strategic approach to trading by analyzing institutional investors’ actions, offering insights into market trends and movements.

- Key Strategies and Tools: Essential SMC strategies include Break of Structure, Order Blocks, and Fair Value Gap, with tools like volume indicators and trend lines enhancing analysis.

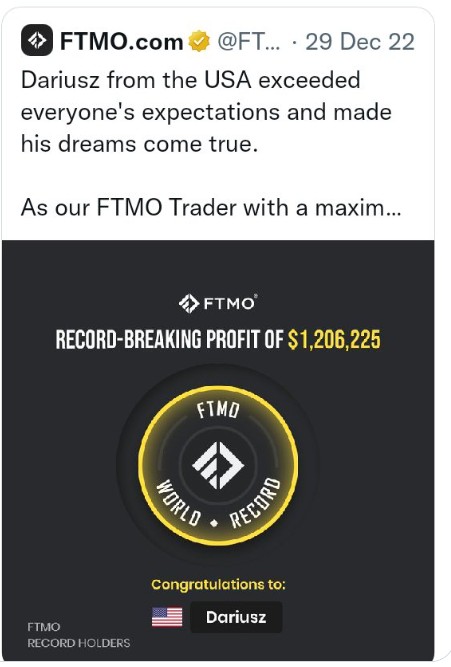

- Real-World Success: In 2022, Dariusz, a trader from the USA, demonstrated the effectiveness of Smart Money Concepts by earning $1,206,225 on FTMO.

- Practical Application: Effective SMC trading involves continuous learning, combining various strategies and tools, and adapting to dynamic market conditions for long-term success.

1️⃣. Introduction

Trading can be tricky, but Smart Money Concepts (SMC) make it easier. Think of SMC as a way to follow the lead of the big players in the market. It’s not just about different techniques; it’s about understanding the market better and making smarter decisions.

In this guide, we’ll explain SMC in a way that’s easy to get. Whether you’re new to trading or have been at it for a while, this guide will help you see things more clearly and give you a fresh perspective on how to trade smarter.

2️⃣. Understanding Smart Money Concepts

2.1. What is Smart Money Concepts in trading?

Smart Money Concepts (SMC) is a way of trading that focuses on understanding how big players like banks and hedge funds move in the market.

It’s more than just a set of rules; it’s a whole way of thinking about how markets work. SMC uses familiar ideas from Forex trading, like supply and demand, price patterns, and support and resistance.

The twist is that SMC looks at these ideas through the lens of how these big players might be trying to influence the market.

As a regular trader, you should consider what these big players are doing. By following their lead, you can make smarter trading decisions.

2.2. Who created Smart Money Concepts?

Smart Money Concepts (SMC) in Forex trading are attributed to Michael J. Huddleston, who introduced these concepts through his Inner Circle Trader (ICT) program. Huddleston, a seasoned trader, developed SMC to educate traders about the strategies and movements of institutional investors in the Forex market.

His teachings have significantly influenced how retail traders approach and understand market dynamics, particularly the actions of large financial entities like banks and hedge funds.

2.3. Big Players, Big Moves: The Impact of Institutional Trading

Institutional investors, like big banks and hedge funds, are the power players in the trading world. Their actions are like major waves that can shift the market’s direction. When they trade, they do so in large volumes, significantly impacting stock or currency values. For instance, if they start buying a lot, the price may rise, signalling their confidence in that stock or currency.

To illustrate, consider an ‘accumulation phase.’ This is when these major players quietly buy up large amounts of a particular stock. Initially, they do this subtly, but as their holdings increase, other traders notice, and the stock’s price begins to climb, indicating a bullish (upward) market trend.

Conversely, there’s the ‘distribution phase,’ where these big investors gradually sell off their stock. As they offload more, it becomes noticeable to others, potentially leading to a price drop, signifying a bearish (downward) market trend.

By observing these phases and understanding the movements of these institutional investors, regular traders can gain insights into potential market directions. It’s like having a preview of the market’s next moves, enabling more informed buying or selling decisions. Break down some small content into bullet points.

2.4. Key Terms of SMC Trading:

✅ Term 1: Break of Structure (BOS):

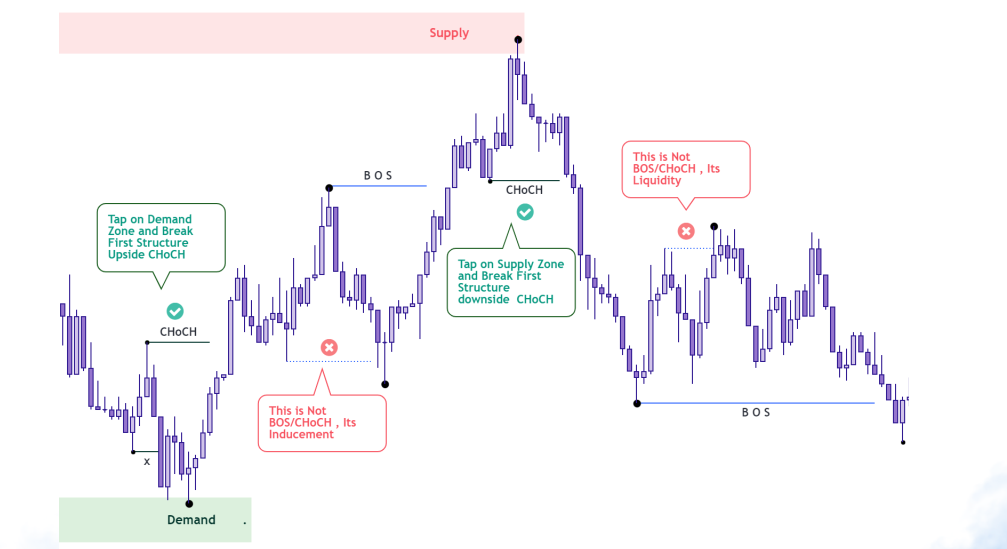

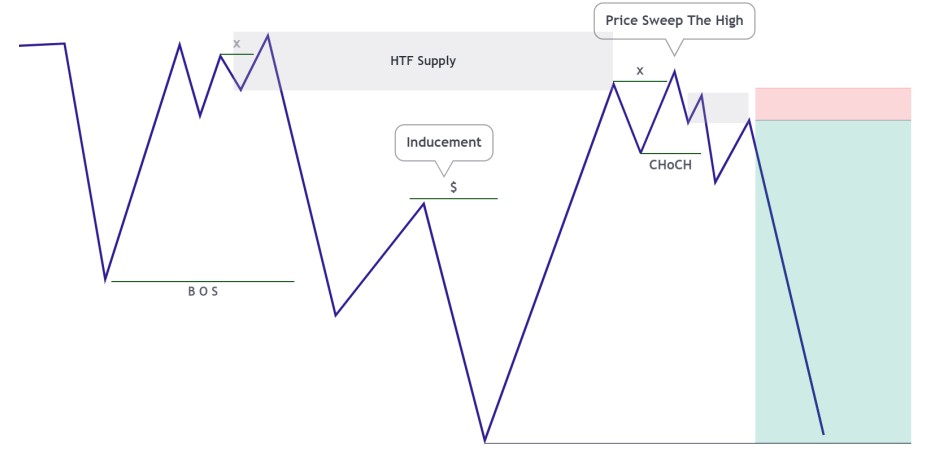

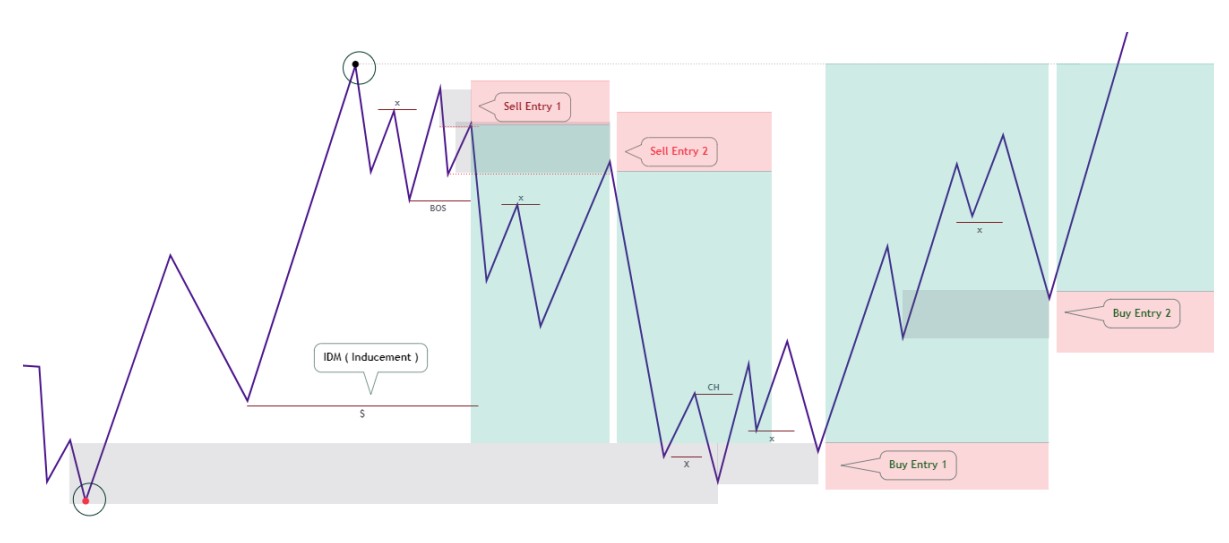

Break of Structure (BOS) in trading refers to a point where the market shows a clear shift from its current trend, either bullish or bearish. This happens when the price creates a new low or high that disrupts the existing market structure.

BOS is a crucial concept in trend continuation, helping traders identify when a current trend is likely to continue. Unlike CHoCH, which is more about trend reversals, BOS focuses on continuing the current market trend.

✅ Term 2: Change in Character (CHOCH):

Change of Character (CHoCH) occurs in trading when there’s a noticeable shift in the market, particularly after the price interacts with a supply or demand zone and then breaks through the most recent minor or significant high or low point.

This key signal in Smart Money Concepts indicates a potential trend reversal. CHoCH is different from BOS (Break of Structure) as it relates explicitly to supply and demand zones and is used to identify possible trend reversals rather than just the continuation of an existing trend.

✅ Term 3: Shift of Market Structure (SMS):

SMS refers to a significant change in market dynamics, like a shift from an bullish trend to a bearish trend, indicated by patterns such as a lower high and lower low.

✅ Term 4: Order Blocks:

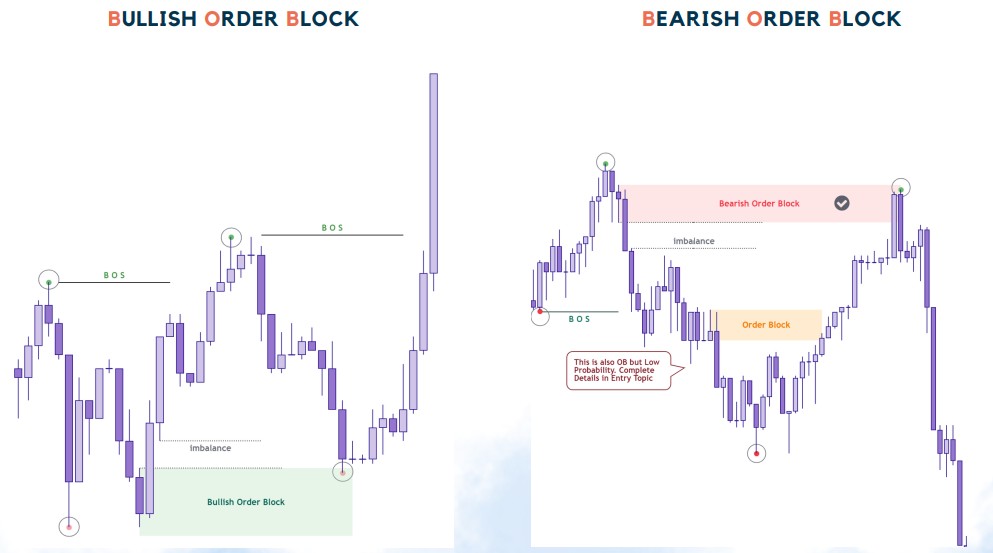

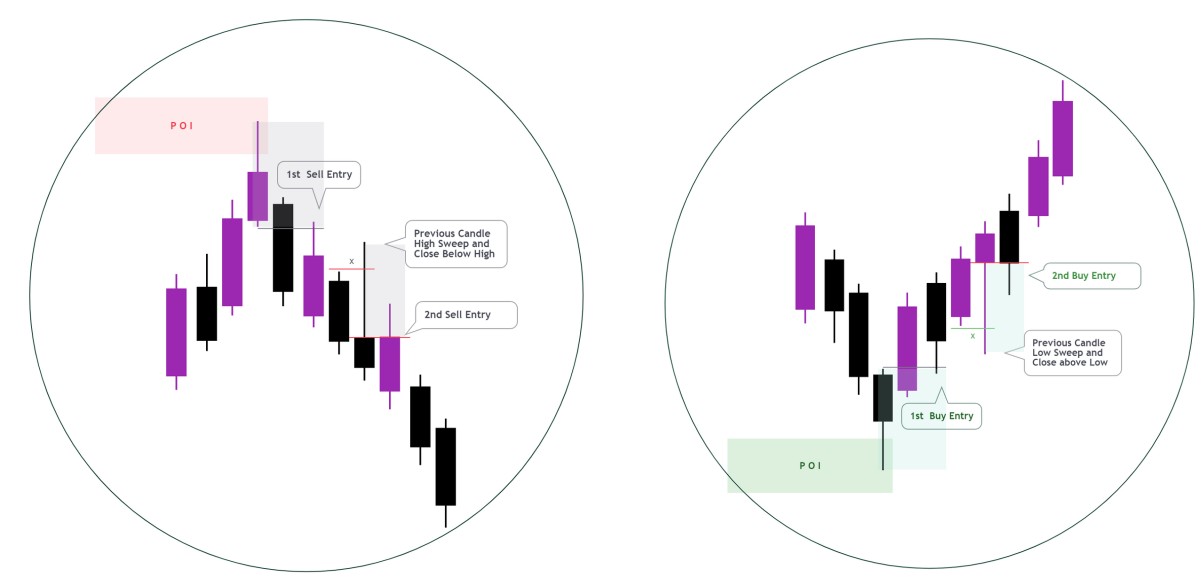

These are clusters of orders from major financial institutions. They create significant support or resistance levels in the market, influencing price movements.

Order Block is similar to Order Flow, but a single candle’s behaviour specifically identifies it. The last buying candle before a sell-off determines a Bearish Order Block, indicating potential selling interest.

Conversely, a Bullish Order Block is marked by the previous selling candle before a price increase, suggesting buying interest. For an Order Block to be considered valid and high probability, it must show a clear imbalance in trading activity.

While the shape of the candle might vary slightly, the key is to observe the overall behaviour of the candle and the market context around it to determine its significance.

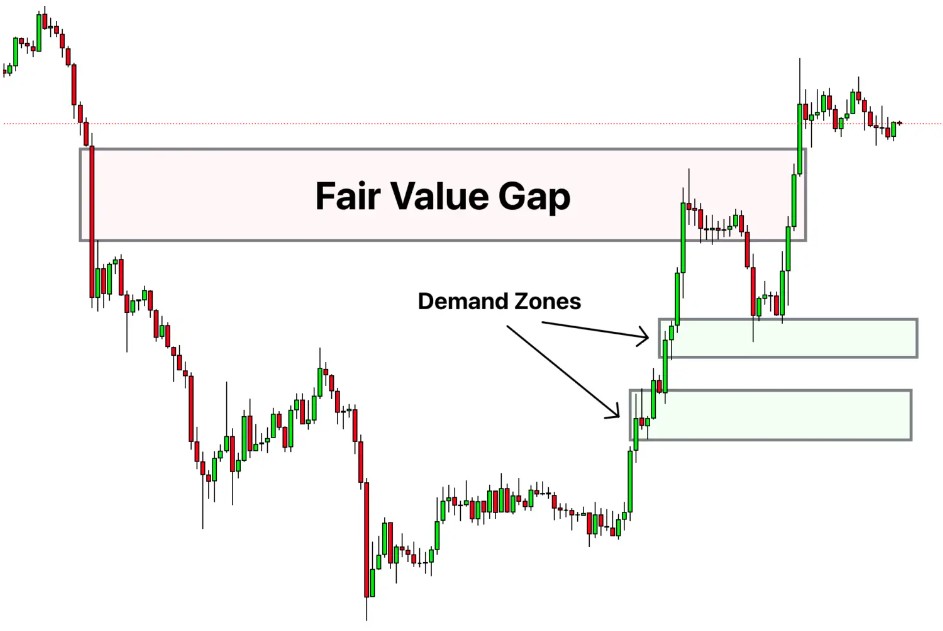

✅ Term 5: Fair Value Gap (FVG):

This concept identifies market inefficiencies where buying and selling are not balanced. FVGs can act as magnets for future price movements, providing potential entry points for traders.

Applying SMC in Trading:

SMC involves understanding these concepts and applying them to trading strategies. It’s about recognizing liquidity grabs, mitigation blocks, and other SMC terms that, while sounding complex, are rooted in traditional trading approaches.

By mastering these concepts, traders can align their strategies with the influential moves of institutional investors, potentially leading to more informed and successful trading decisions.

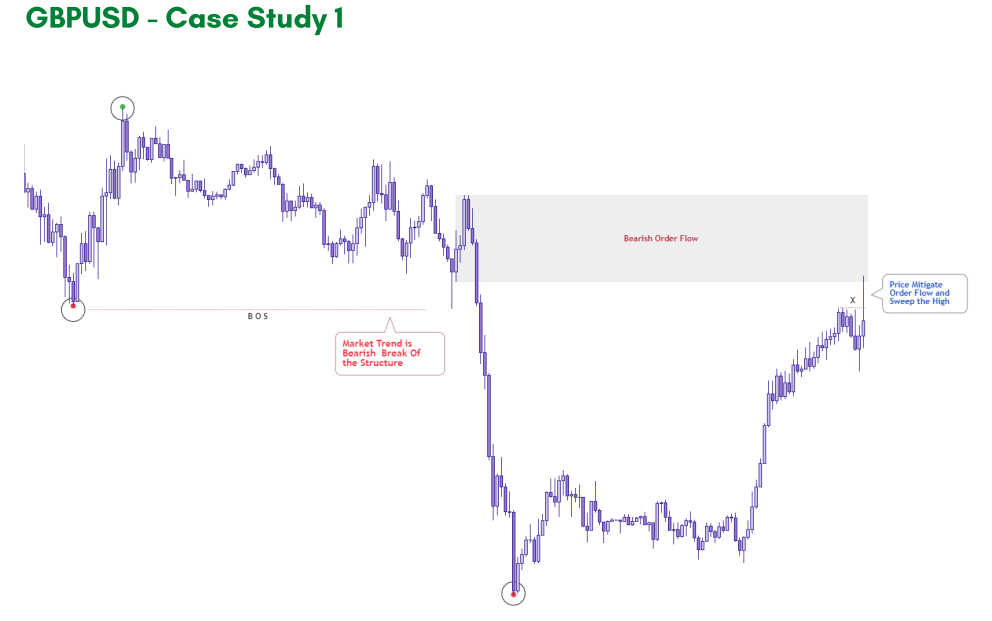

From Trading Hub 2.0

GBP/USD Case Study 2

2.5. Trade Entries in SMC:

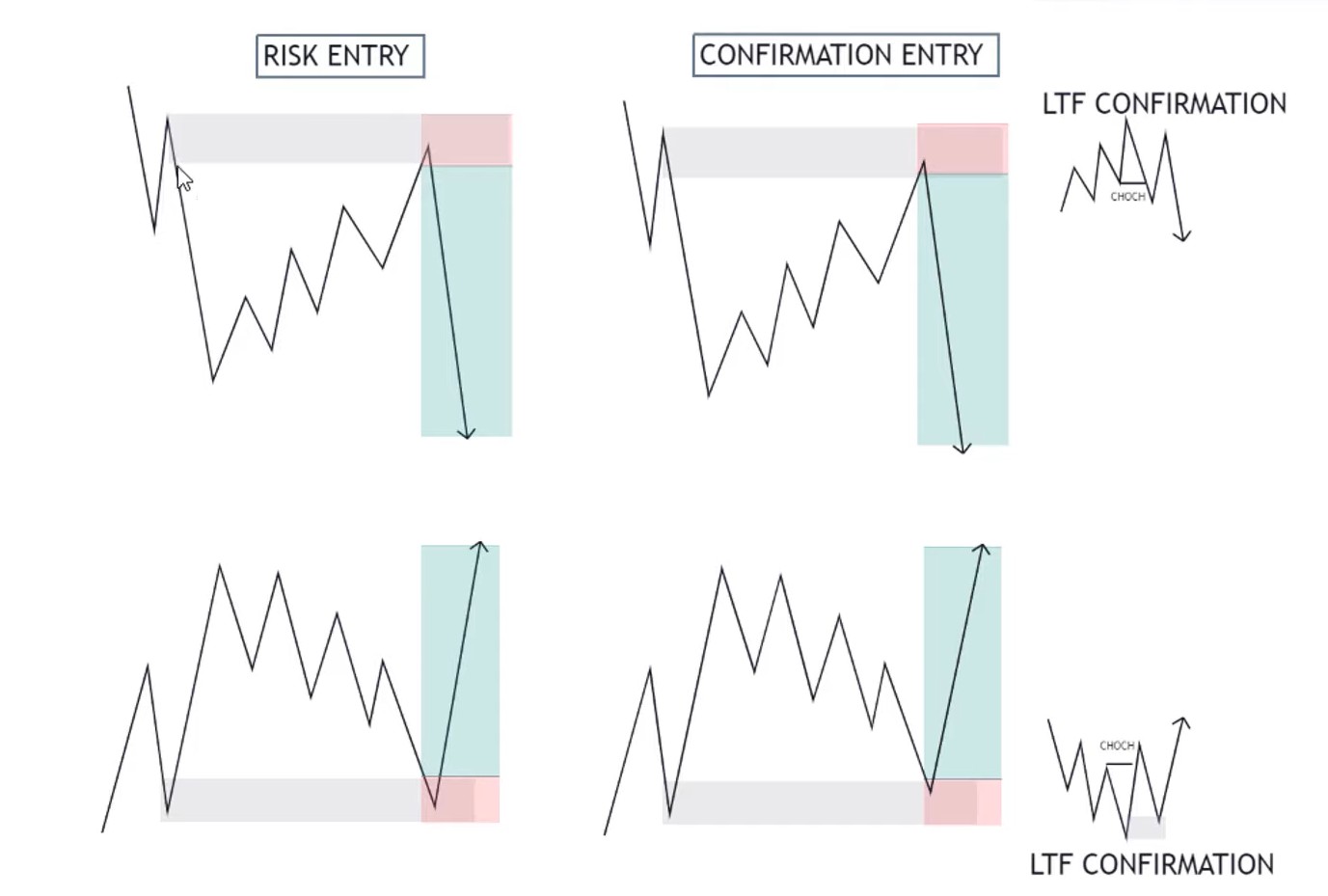

Risk Entry vs Confirmation Entry

Risk Entry: In Smart Money Concepts, a risk entry refers to a trading decision before fully confirming a trade setup. This entry type is characterized by entering a trade based on the anticipation or early signs of a market move, often at key levels identified through SMC analysis. The approach is considered aggressive as it involves taking a position before the market provides clear confirmation signals.

Confirmation Entry: A confirmation entry, in contrast, is a more conservative trading approach within SMC where the trader waits for clear market signals or confirmation of a trade setup before entering a trade. This type of entry is characterized by its cautious nature, as traders wait for additional evidence or confirmation that a predicted market move is occurring before committing to a position.

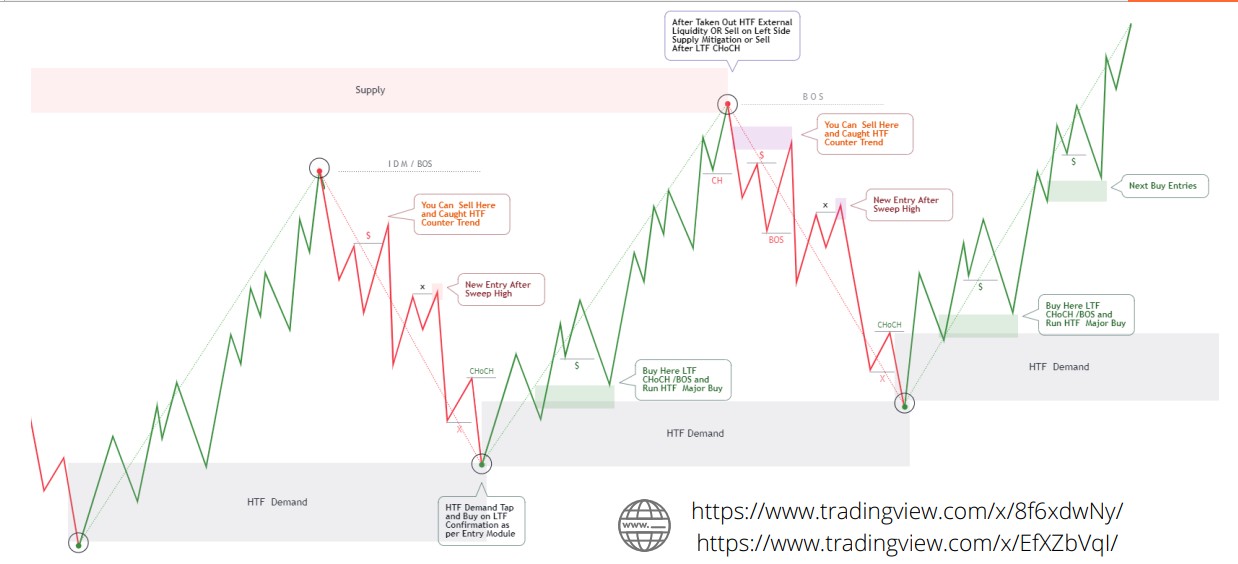

✅ Type 1: CHOCH/BOS Entry

When the price reaches a valid supply or demand level, wait for lower timeframe (LTF) confirmations like BOS/CHoCH before making a buy/sell decision. The choice of higher timeframe (HTF) and LTF isn’t fixed and varies based on the situation. The development of the structure before buying or selling will be further explained in the Multiple Time Frame Analysis section.

✅ Type 2: Single Candle Mitigation Entry

✅ Type 3: Ping Pong Entry

Ping pong in trading refers to playing both sides of the market, often used for hedging. It involves analyzing charts and diagrams to make informed decisions. However, it’s a strategy best suited for experienced traders. Beginners should first backtest and study price action thoroughly before attempting ping-pong entries in live trading. It’s crucial to gain experience and an understanding of the market dynamics before engaging in this advanced strategy.

3️⃣. How to Trade Multi-Timeframe in Smart Money Concepts (SMC)?

Trading multi-timeframes in Smart Money Concepts involves analyzing different timeframes to get a comprehensive view of the market. Here’s how you can do it:

Step 1: Start with a Higher Timeframe: Begin your analysis with a higher timeframe, like the daily or weekly chart. This gives you an overview of the market trend and key support and resistance levels. Understanding the big picture in SMC is crucial as it sets the context for your trades.

Step 2: Identify Key Levels: Identify significant levels where institutional investors might have placed their orders on the higher timeframe. These could be areas of high liquidity or previous points of solid market reactions.

Step 3: Drill Down to Lower Timeframes: Once you have the broader picture, move to lower timeframes (like 4-hour or 1-hour charts) to fine-tune your entry points. Here, you’re looking for specific signs of smart money activity, such as accumulation, distribution patterns, or reactions to key levels identified in the higher timeframe.

Step 4: Look for Confluence: The goal is to find confluence between timeframes – where signals on the lower timeframe align with the broader trend or key levels identified on the higher timeframe. This increases the probability of successful trades.

Step 5: Entry and Exit Points: Use the lower timeframe to determine precise entry and exit points. For instance, you might enter a trade when you see a breakout or reversal pattern on the lower timeframe that aligns with a key level on the higher timeframe.

Step 6: Risk Management: Always ensure your risk management aligns with the higher timeframe analysis. This might mean setting more comprehensive stop losses or taking more minor positions to account for the more significant swings on higher timeframes.

Step 7: Continuous Monitoring: Keep an eye on both timeframes during your trade. Changes in the higher timeframe can impact your trade, and you may need to adjust your strategy accordingly.

Combining insights from multiple timeframes allows you to make more informed decisions, aligning your trades with immediate price action and the broader market trends influenced by institutional investors.

4️⃣. Why Smart Money Concepts is Top Picked Strategy in 2023?

In Forex, there are many strategies that work, for example, you can find about 71 different trading systems on Forexfactory, But lately, more and more traders are choosing Smart Money Concepts (SMC), here’s why:

- Following the Market Leaders: SMC is all about understanding and following the moves of institutional investors – the big players in the market. These investors have significant resources and information, meaning their actions often set the market’s direction. With SMC, traders can align their strategies with these influential moves, increasing their chances of success.

- Early Warning System: SMC acts like an early warning system. It helps traders spot market trends and changes before they become obvious to everyone. For example, if big investors start moving away from a currency, it could signal a future drop in its value. Traders using SMC can see these signs early and adjust their strategies accordingly.

- Beyond Basic Trend Following: While many strategies focus on following trends, SMC goes deeper. It’s about understanding why these trends are happening. This deeper insight allows traders to make more informed decisions, not just following the crowd but understanding the market’s underlying dynamics.

- Real-World Success: The effectiveness of SMC is more than just theoretical. It has been proven in real-world scenarios, like the 2008 financial crisis. Traders who understood SMC could read the signs and make moves that protected their investments or even profited from the market downturn.

- Strategic Edge: In the competitive world of Forex trading, having an edge is crucial. SMC provides this by offering a more nuanced understanding of the market. It’s like having an insider’s view of what the market’s most influential players are doing, giving traders a strategic advantage.

Is Smart Money Concepts profitable? 💰

As someone who’s explored the dynamic world of Forex trading, I’ve encountered a variety of strategies, but Smart Money Concepts (SMC) has particularly caught my attention for its distinctive approach. Drawing from my journey and observations in the industry, here’s my perspective on the effectiveness of SMC:

Effectiveness of SMC:

- Alignment with Market Influencers: SMC stands out because it focuses on aligning with the strategies of major market players like banks and hedge funds. This approach can be highly effective, as it taps into the moves of the market’s most influential forces.

- Dependent on Skill and Understanding: However, its effectiveness hinges on a trader’s ability to understand and skillfully apply its principles deeply.

Key Insights from My Experience:

- Enhanced Market Insight: My foray into SMC has given me a deeper understanding of market trends, leading to more informed trading decisions.

- Not for Novices: SMC demands a robust grasp of market analysis and the capability to interpret complex market signals.

- Flexibility and Adaptation: I’ve learned that SMC is not a rigid strategy. Adapting it to various market conditions and personal trading styles is crucial.

- Critical Risk Management: Effective risk management is vital in SMC, just as in any trading strategy. It requires a disciplined approach to navigate market volatility.

Proof of successful traders with Smart Money Concepts:

In 2022, Dariusz, a trader from the USA, used SMC method and got a payout of $1,206,225 on FTMO. His remarkable achievement was publicly shared on Twitter and FTMO’s platforms, including a QR code for anyone to verify the authenticity of this claim.

This success story is a strong example of how integrating SMC into trading strategies can lead to significant profits. When applied correctly, Dariusz’s approach combined SMC with other analytical methods, showcasing the strategy’s potential.

While Dariusz’s story is inspiring, it’s crucial to remember that SMC requires a deep understanding and careful application. There have been cases where traders have not achieved the desired results due to misinterpretation or incorrect application of SMC principles. This underscores the need for thorough knowledge and disciplined application in trading.

In conclusion, Smart Money Concepts have become prominent in Forex trading because they offer a comprehensive, insightful, and strategic approach to understanding and navigating the market. This makes them an invaluable tool for traders looking to stay ahead in 2023.

5️⃣. Tools and Indicators for SMC Trading

In Smart Money Concepts (SMC) trading, specific tools and indicators are indispensable for identifying market trends and potential turning points. Key among these are volume indicators, trend lines, moving averages, and the Fibonacci retracement tool.

✅ Tool 1: Volume Indicators: These help in understanding the strength behind price movements. A popular choice is the Volume Weighted Average Price (VWAP), which gives an average price a security has traded at throughout the day, based on both volume and price. It is particularly useful in identifying whether a price movement is supported by substantial volume or speculative trading.

✅ Tool 2:Trend Lines: Simple yet powerful, trend lines are drawn on charts to connect a series of prices. They help identify the direction of the market trend and potential reversal points.

✅ Tool 3:Moving Averages: These are used to smooth out price action and filter out the noise from random short-term fluctuations. The 50-day and 200-day moving averages are commonly used to identify mid- to long-term trends.

# Tool 4:Fibonacci Retracement Tool: This tool is used to identify potential support and resistance levels. It’s based on the idea that markets will retrace a predictable portion of a move, after which they will continue to move in the original direction.

How to Trade SMC Effectively

Like any trading method, smart Money Concepts (SMC) require a blend of skill, understanding, and rigorous testing. Applying trading tools in SMC is not enough to effectively use them; you need to deeply understand their role and limitations in the broader market context.

- Contextual Analysis is Key: Always interpret signals from your tools within the larger market context. For example, a moving average might suggest a buying opportunity, but this signal could be misleading if the overall market trend is downward.

- Combine Tools for Better Insights: No tool is a standalone solution. Use a combination of tools for a more comprehensive view. For instance, merging trend lines with volume indicators can offer a more robust signal than either tool alone.

- Adapt to Market Changes: Markets are dynamic, and your strategies should be. Relying on a single tool or approach in varying market conditions can lead to inaccurate readings. Be flexible and adjust your tool usage as market dynamics shift.

- Backtesting and Forward Testing: Testing your SMC strategies over several years and across different Forex pairs is crucial. This extensive testing helps refine and adapt your approach to other market conditions. I highly recommend each trader back testing each forex pair for at least 10 years before going into actual trading.

- Continuous Learning and Updating: The trading world is constantly evolving. Stay informed about new tools and techniques, and be ready to incorporate them into your strategy. What works today might need tweaking tomorrow.

Mastering SMC is more than just using tools; it’s about integrating them into a comprehensive, adaptable strategy informed by market trends and personal experience. Combined with continuous learning and testing, this approach is the key to success in SMC trading.

6️⃣. Smart Money Concepts Vs. Supply and Demand Trading

Smart Money Concepts (SMC) and Supply and Demand about both popular methodologies in trading. While they share some similarities, there are distinct differences in their approach and application. Here’s a simplified breakdown of how they differ and what sets each apart:

| Aspect | Smart Money Concepts (SMC) | Supply and Demand Trading |

|---|---|---|

| Core Idea | ✔️ Focuses on tracking and understanding the moves of institutional investors like banks and hedge funds. | ✔️ Based on the economic principles of supply and demand. |

| Focus | ✔️ Tracks ‘smart money’ to predict market trends. | ✔️ Identifies price change areas due to supply and demand imbalances. |

| Techniques | ✔️ Involves analyzing big money movements, volume changes, and market sentiment. | ✔️ Centers on finding and reacting to fresh supply and demand zones. |

| Timeframe and Markets | ✔️ Versatile across various markets and suitable for both short-term and long-term trading. | ✔️ Applicable in both short-term and long-term trading, effectiveness reliant on clear zone identification. |

| Risk Management | ✔️ Aligns strategies with institutional risk management behaviors. | ✔️ Focuses on the strength of supply and demand zones for risk assessment. |

Which is Better?

It depends on your trading style and goals. SMC is great for those who want to align with institutional strategies and understand market psychology. Supply and Demand Trading suits traders who prefer a more straightforward, zone-based approach. Both have their strengths, and the best choice varies from trader to trader.

7️⃣. Conclusion

Smart Money Concepts (SMC) provide a valuable perspective for traders to navigate the market. This guide has covered SMC’s basics, strategies, and mental aspects, giving you a good starting point to improve your trading.

Remember, mastering SMC is a continuous journey. Keep learning and applying these ideas, and let them help you make smarter, more strategic trading choices.

8️⃣. Further learning resources for Smart Money Concepts:

- FREE SMC GUIDE 2022 | SMT: A simple guide on approaching the Forex Markets using Smart Money Concepts, focusing on Orderblocks and Supply & Demand.

- Smartmonics by Educator Manny Q: Features two video series on the Smartmonics Strategy, covering various aspects of trading.

- Inner Circle Trader – ICT Membership by Michael Huddleston

- Raja Bank – Smart Raja Concepts (SRC) – Forex 101

8️⃣. Frequently Asked Questions about Smart Money Concepts:

Q1: Does the Smart Money Concept work?

The effectiveness of SMC lies in its ability to decode these movements, offering traders insights into potential market shifts. A study by the Journal of Financial Economics revealed that institutional trades impact prices significantly, validating the core principle of SMC. However, its success hinges on the trader’s skill in interpreting and applying these concepts correctly.

Q2: What is the best SMC strategy?

Q3: Why do SMC traders fail?

Q4: How to learn SMC trading?

– Educational Resources: Start with comprehensive guides and courses focused on SMC principles.

– Market Analysis: Practice analyzing market trends and institutional behaviours.

– Simulated Trading: Use demo accounts to apply SMC strategies without financial risk.

– Mentorship: Seek guidance from experienced SMC traders for practical insights and tips.