Tradinganalysis – Elliott Wave Mastery Course

$997.00 Original price was: $997.00.$52.00Current price is: $52.00.

TradingAnalysis Elliott Wave Mastery Course [Instant Download]

What is TradingAnalysis Elliott Wave Mastery Course:

TradingAnalysis Elliott Wave Mastery is a course by Todd Gordon teaches you market analysis and trading strategies. It helps traders understand and predict market trends in volatile conditions.

Gordon’s expertise in Elliott Wave Theory provides a foundation for new and experienced traders. The course aims to help participants anticipate and profit from market movements.

👉 Read more: Tradinganalysis – Fibonacci Mastery Course

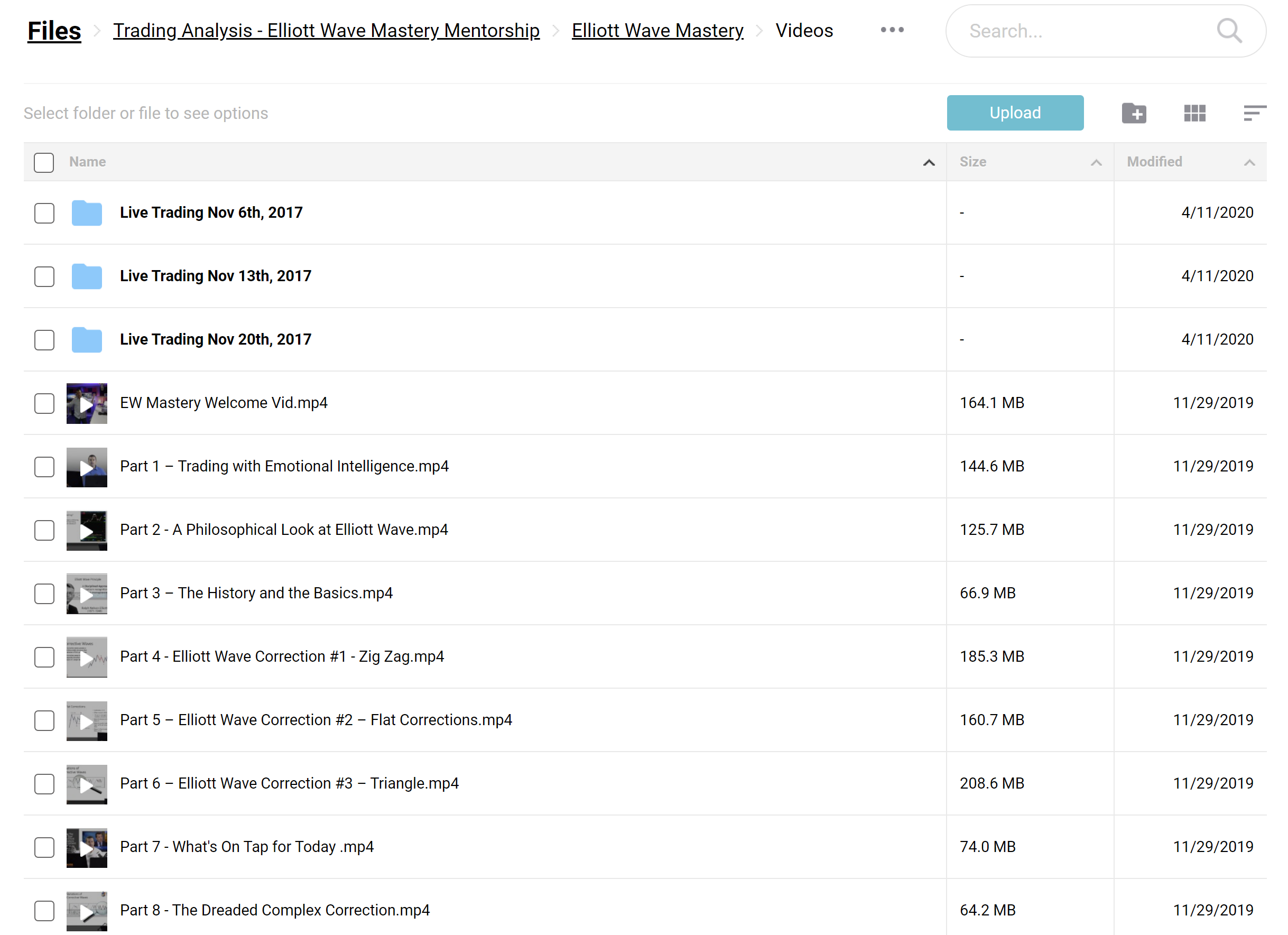

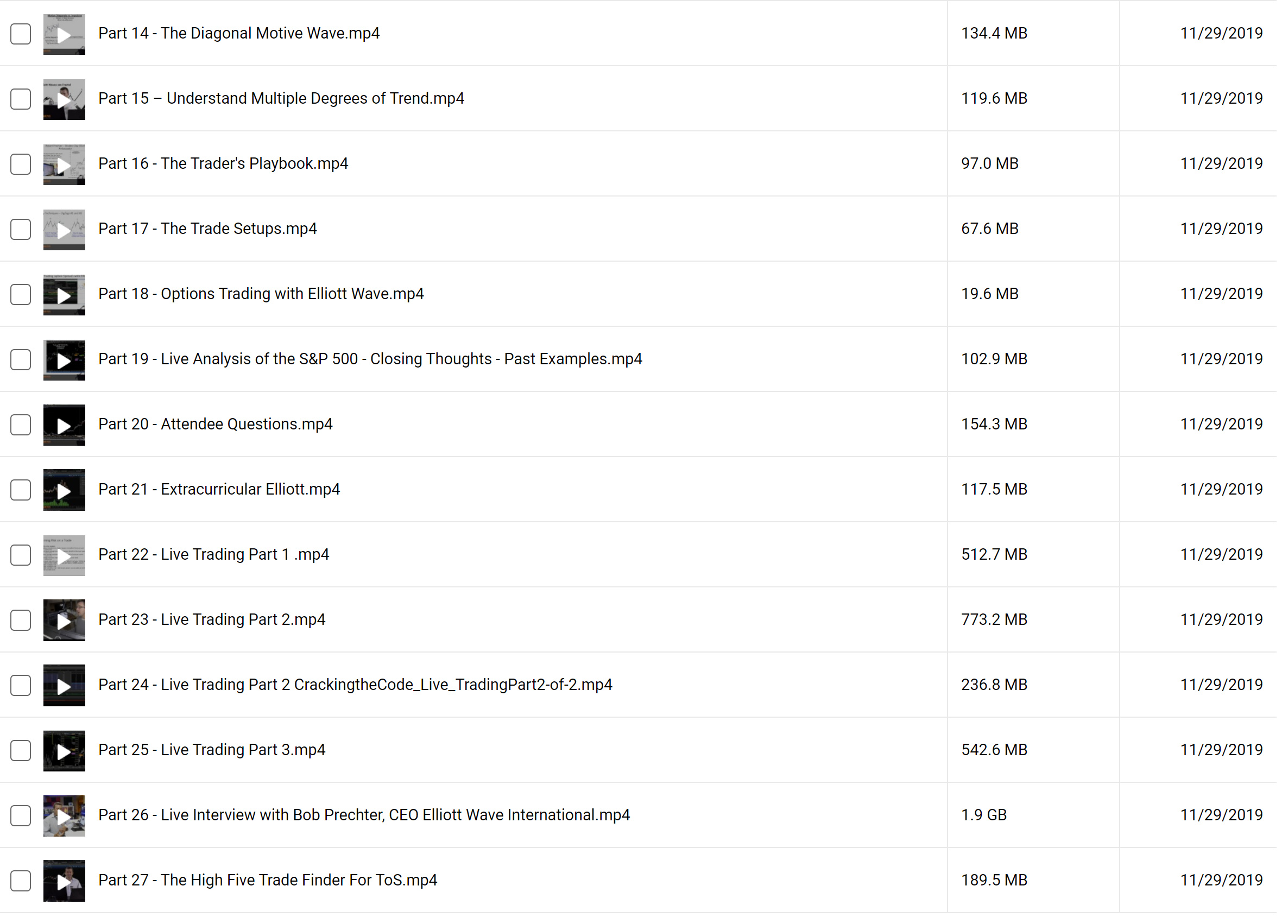

📚 PROOF OF COURSE

What you will learn in Elliott Wave Mastery Course:

- Understanding the basics of Elliott Wave Theory and its application in the stock market.

- Techniques to analyze and predict market trends for profitable trading.

- Strategies for risk management to protect your investments.

- Learning the art of trading without emotion, using sound strategies and backup plans.

- Insights into position sizing are one of the critical aspects of professional trading.

This course is meticulously structured to ensure that you understand the theoretical aspects of Elliott Wave Theory and how to apply these concepts in real-world trading scenarios.

Elliott Wave Mastery Course Curriculum:

The Elliott Wave Mastery Course curriculum includes:

- Detailed analysis of Elliott Wave Theory and its practical application in stock trading.

- Real-world trading examples to demonstrate the application of Elliott Wave Analysis.

- In-depth lessons on market trends, trading strategies, and investment techniques.

- Guidance on using Fibonacci levels for precise profit-taking targets.

- Training on developing emotional intelligence for trading, crucial for decision-making in uncertain market conditions.

- Comprehensive coverage of position sizing, enabling you to tailor your trading size according to market conditions.

- A set of rules and guidelines for Elliott Wave trading to make informed decisions.

Content breakdown:

- Live Trading Nov 6th, 2017

- Live Trading Nov 13th, 2017

- Live Trading Nov 20th, 2017

- EW Mastery Welcome Vid.mp4

- Part 1 – Trading with Emotional Intelligence.mp4

- Part 2 – A Philosophical Look at Elliott Wave.mp4

- Part 3 – The History and the Basics.mp4

- Part 4 – Elliott Wave Correction #1 – Zig Zag.mp4

- Part 5 – Elliott Wave Correction #2 – Flat Corrections.mp4

- Part 6 – Elliott Wave Correction #3 – Triangle.mp4

- Part 7 – What’s On Tap for Today.mp4

- Part 8 – The Dreaded Complex Correction.mp4

- Part 9 – Simplifying the Complex Corrections.mp4

- Part 10 – Spotting the Complex Corrections.mp4

- Part 11 – Live Market Analysis.mp4

- Part 12 – Motive Waves and Corrective Waves.mp4

- Part 13 – Motive Waves – The Impulse and Extension.mp4

- Part 14 – The Diagonal Motive Wave.mp4

- Part 15 – Understand Multiple Degrees of Trend.mp4

- Part 16 – The Trader’s Playbook.mp4

- Part 17 – The Trade Setups.mp4

- Part 18 – Options Trading with Elliott Wave.mp4

- Part 19 – Live Analysis of the S&P 500 – Closing Thoughts – Past Examples.mp4

- Part 20 – Attendee Questions.mp4

- Part 21 – Extracurricular Elliott.mp4

- Part 22 – Live Trading Part 1 .mp4

- Part 23 – Live Trading Part 2.mp4

- Part 24 – Live Trading Part 2 CrackingtheCode_Live_TradingPart2-of-2.mp4

- Part 25 – Live Trading Part 3.mp4

- Part 26 – Live Interview with Bob Prechter, CEO of Elliott Wave International.mp4

- Part 27 – The High Five Trade Finder For ToS.mp4

This curriculum is designed to provide a deep dive into Elliott Wave Analysis, ensuring a thorough understanding of the methodology and its effective application in trading.

Who is Todd Gordon (TradingAnalysis)?

Todd Gordon is the founder and CEO of TradingAnalysis.com and a CNBC contributor. He specializes in stock market trading and analysis.

Gordon’s approach combines Elliott Wave Theory, Intermarket, and fundamental analysis. He’s known for simplifying complex concepts into clear trading strategies.

His career spans from college trading to Wall Street analysis. He gained prominence during the global financial crisis, leading to the creation of TradingAnalysis.com.

Gordon appears on major media platforms to share market insights. He applies his analysis to his own accounts, building client trust.

Based in Saratoga Springs, NY, Gordon balances his professional life with interests like cycling, golfing, and skiing.

Be the first to review “Tradinganalysis – Elliott Wave Mastery Course” Cancel reply

Related products

Trading Courses

Options Trading

Trading Courses

Trading Courses

Forex Trading

Trading Courses

Forex Trading

Base Camp Trading – Explosive Growth Options – Stocks (EGOS) Program – EGOS MINI BUNDLE)

![Mike Aston - Learn to Trade [Trading Template]](https://coursehuge.com/wp-content/uploads/2023/09/Mike-Aston-Learn-to-Trade-Trading-Template-100x100.jpg)

Reviews

There are no reviews yet.