Jim Dalton Trading Foundation Application of the Market Profile

$1,149.00 Original price was: $1,149.00.$12.00Current price is: $12.00.

Jim Dalton Foundation Application of the Market Profile Course [Instant Download]

1️⃣. What is Foundation Application of the Market Profile?

Jim Dalton’s Foundation Application of the Market Profile is a trading course that teaches you how to read and trade markets using the Market Profile methodology.

This 11.5-hour course shows you how to identify profitable trading opportunities by understanding price movement, value areas, and market structure through auction theory.

You’ll learn to spot trading patterns and reduce risk by analyzing real market examples. The course combines Dalton’s proven Market Profile techniques with practical trading applications.

📚 PROOF OF COURSE

2️⃣. What you’ll learn in this course:

Learn the key parts of Market Profile trading to make better trading decisions. Here’s what the course covers:

- Market Auction Process: Learn how the two-way auction works and why prices move the way they do

- Value Area Analysis: Find the best entry and exit points by understanding where value exists in the market

- Pattern Recognition: Learn to spot different Profile patterns – Inside, Rotational, Trend, and Hybrid – for better trades

- Risk Management: Trade with higher success rates by understanding market context

- Advanced Techniques: Use chunking to spot trading opportunities quickly and adapt to market changes

- Real Market Examples: Watch Jim analyze actual trading days step by step

After completing this course, you’ll know how to use Market Profile in your daily trading and make more informed decisions.

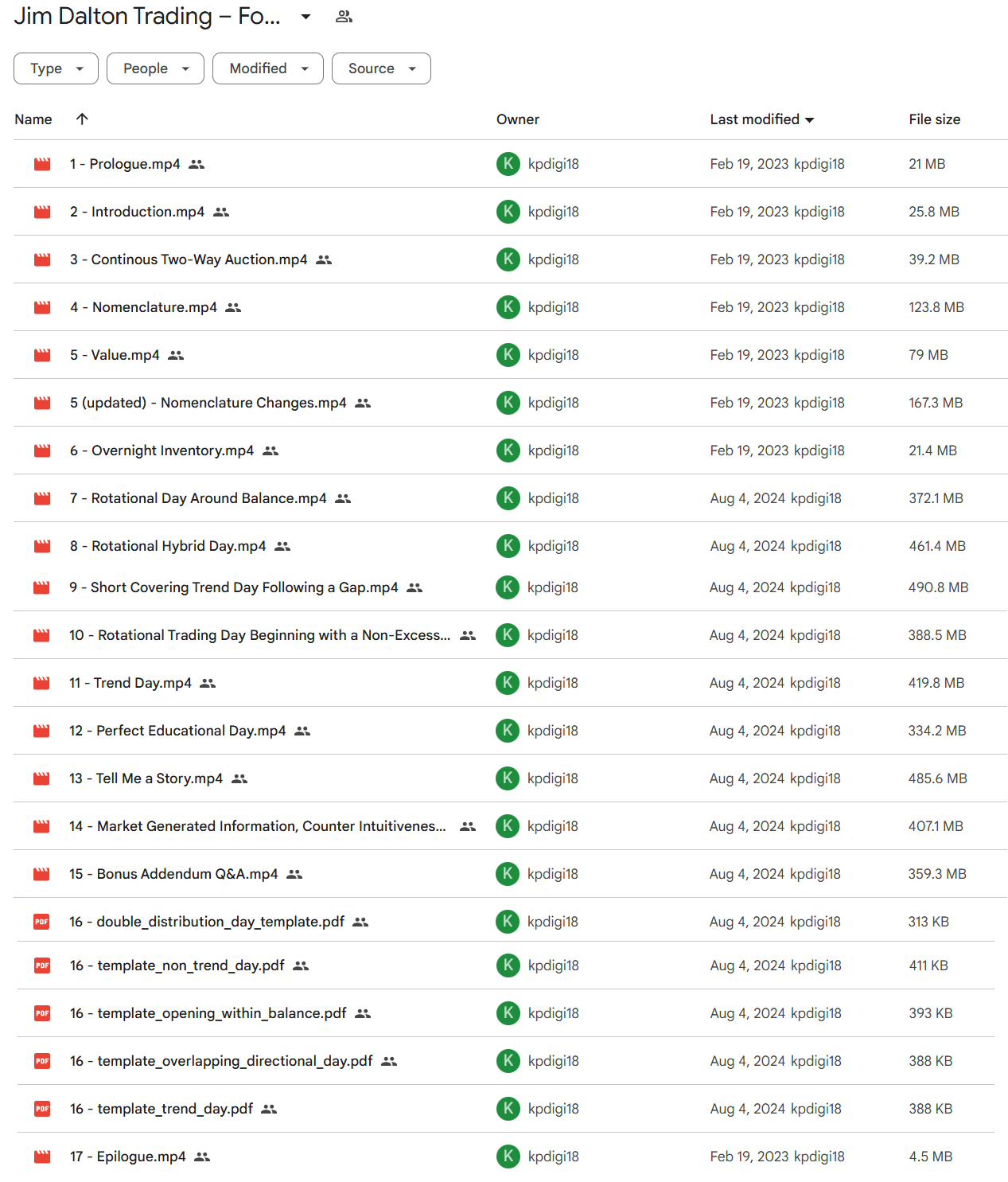

3️⃣. Course Curriculum:

This comprehensive curriculum provides a structured approach to understanding market profile analysis and auction market theory. The course progresses from foundational concepts through advanced market structure analysis, with each section building upon previous knowledge.

✅ Section 1: Foundational Concepts

This section establishes the essential theoretical framework for understanding market profile analysis. Students learn the fundamental principles of auction market theory and key terminology that forms the basis for all subsequent analysis.

“Prologue” (Video)

Introduces the course structure and learning objectives, setting expectations for the educational journey ahead.

“Introduction” (Video)

Overview of market profile analysis and its significance in understanding market behavior.

“Continuous Two-Way Auction” (Video)

Explores the fundamental concept of markets as two-way auctions, establishing the theoretical foundation for market profile analysis.

“Nomenclature” (Video)

Detailed coverage of essential market profile terminology and concepts. Includes updated nomenclature changes in a separate video for clarity and completeness.

✅ Section 2: Market Structure Analysis

This section delves into the core concepts of value area analysis and inventory management. Students learn to identify and interpret key market structures that influence price movement.

“Value” (Video)

Comprehensive exploration of value area analysis and its importance in market profile interpretation.

“Overnight Inventory” (Video)

Analysis of overnight inventory positions and their impact on subsequent market behavior.

✅ Section 3: Market Day Types

This section examines various types of market days and their characteristics. Students learn to identify and respond to different market conditions through detailed case studies.

“Rotational Day Around Balance” (Video)

Analysis of balanced market conditions and rotational price behavior.

“Rotational Hybrid Day” (Video)

Study of complex market structures combining rotational and directional elements.

“Short Covering Trend Day Following a Gap” (Video)

Detailed examination of trend days initiated by short covering after gaps.

“Rotational Trading Day Beginning with a Non-Excess High” (Video)

Analysis of specific market conditions and their implications for trading decisions.

“Trend Day” (Video)

Comprehensive study of trending market conditions and their characteristics.

✅ Section 4: Advanced Concepts

This section focuses on synthesizing previous knowledge and developing advanced analytical skills.

“Perfect Educational Day” (Video)

Case study of ideal market conditions for applying course concepts.

“Tell Me a Story” (Video)

Advanced narrative analysis of market behavior and structure.

“Market Generated Information, Counter Intuitiveness, & Mental Flexibility” (Video)

Exploration of advanced concepts in market analysis and trader psychology.

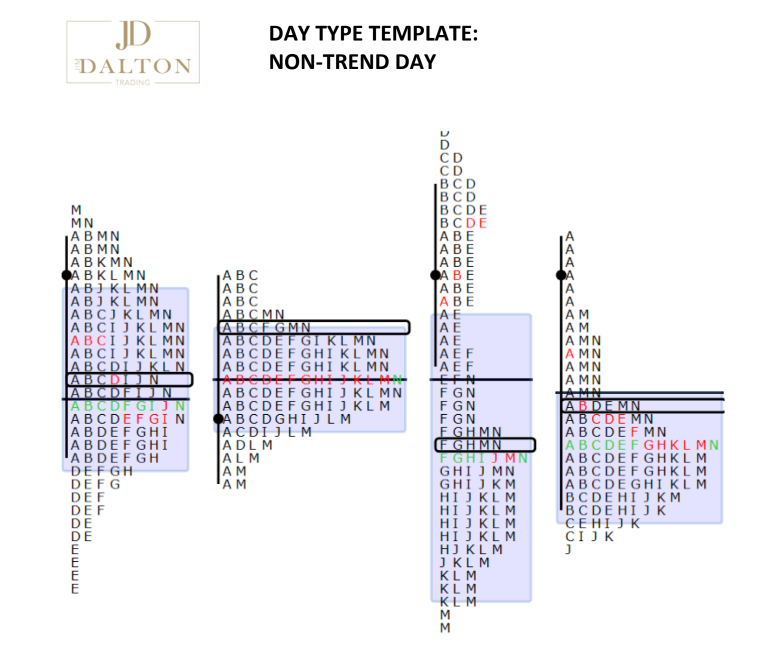

✅ Section 5: Implementation Resources

This section provides practical templates and additional resources for applying course concepts.

Templates and Resources:

- Double Distribution Day Template (PDF)

- Non-Trend Day Template (PDF)

- Opening Within Balance Template (PDF)

- Overlapping Directional Day Template (PDF)

- Trend Day Template (PDF)

“Bonus Addendum Q&A” (Video)

Additional insights and answers to common questions about course concepts.

“Epilogue” (Video)

Final synthesis of course concepts and guidance for continued development.

Learning Outcomes

Upon completion of this curriculum, students will be able to:

- Understand and apply market profile analysis concepts

- Identify and interpret various market day types

- Analyze market structure using profile analysis tools

- Develop flexible analytical approaches to market understanding

- Apply templates and frameworks to real market conditions

The course emphasizes practical application through templates and case studies while maintaining a strong theoretical foundation in auction market theory.

4️⃣. Who is Jim Dalton?

Jim Dalton has traded and taught trading for over 50 years. He was a member of the Chicago Board of Trade and served as Senior Executive Vice President at the Chicago Board Options Exchange.

He created the Market Profile trading education system and wrote two important trading books: “Mind Over Markets” (2013) and “Markets in Profile” (2007). These books help traders worldwide understand market behavior.

Dalton teaches traders how to use Market Profile to understand auction process and market-generated information. His methods have changed how many traders analyze and trade markets.

Today, he continues teaching traders through his courses, sharing his knowledge of market dynamics and risk management.

5️⃣. Who should take Jim Dalton Course?

Jim Dalton’s Market Profile course helps traders improve their market understanding and trading results. This course is perfect for:

- Active Traders who want to get better at analyzing markets and making trading decisions

- Professional Investors who want to add Market Profile methods to their trading

- Financial Professionals who need to understand market structure and the auction process better

- Trading Educators who want to learn advanced market analysis methods

Whether you’re just starting or have been trading for years, this course will help you understand markets better and trade more effectively. If you want to learn a proven trading approach, this course is for you.

6️⃣. Frequently Asked Questions:

Q1: How can I start reading and trading markets effectively?

Q2: What is Market Profile trading?

Q3: How does Market Profile help in trading?

Q4: Can beginners learn Market Profile trading?

Q5: What tools are needed for Market Profile trading?

Be the first to review “Jim Dalton Trading Foundation Application of the Market Profile” Cancel reply

Related products

Stock Trading

Crypto Trading

Trading Courses

Forex Trading

Trading Courses

Trading Courses

Forex Trading

Reviews

There are no reviews yet.