Trading with Rayner – The Ultimate Systems Trader (UST) Advanced

$2,499.00 Original price was: $2,499.00.$74.00Current price is: $74.00.

Rayner Teo The Ultimate Systems Trader (UST) Advanced Course [Instant Download]

What is The Ultimate Systems Trader (UST) Advanced?

Rayner Teo’s Ultimate Systems Trader Advanced is a trading course that teaches how to make consistent profits using three proven systems in 20 minutes a day.

The course reveals how to combine Momo stocks, Mean Reversion, and Trend Following strategies so you can profit in any market – bull, bear, or even during a recession.

You don’t need to read financial reports or study complex charts. These rule-based systems have worked for 22 years and are easy to follow.

By trading these uncorrelated systems together, you’ll have fewer losing periods and more stable returns year after year.

📚 PROOF OF COURSE

What you’ll learn in The Ultimate Systems Trader Advanced:

The Ultimate Systems Trader Advanced gives you proven trading systems that work in all market conditions. Here’s what you’ll learn:

The 3 different trading systems:

- Momo Stock Trading: Find hidden stocks that could grow up to 594%

- Mean Reversion Trading: Make steady profits with a system that wins about 70% of the time

- Systematic Trend Following: Make money in rising and falling markets, even during bad economic times

The course also shows you how to:

- Split your money smartly across these systems

- Use the UST scanner to find trading opportunities quickly

- Track how well you’re doing with the UST Performance Tracker

- Protect your money with proper risk management

- Build the right mindset for successful system trading

When you finish this course, you’ll be able to trade with confidence using multiple systems that help you make more reliable profits with fewer losses.

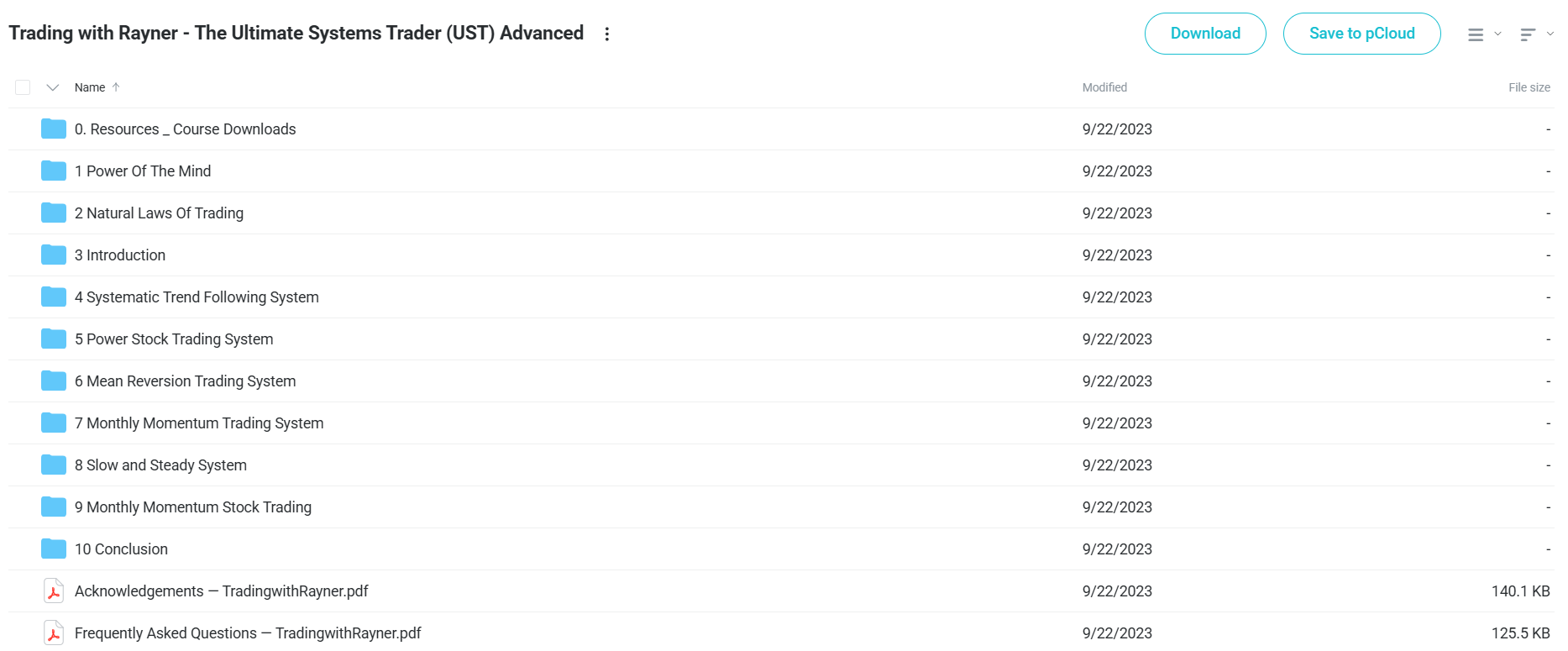

The Ultimate Systems Trader Advanced Course Curriculum:

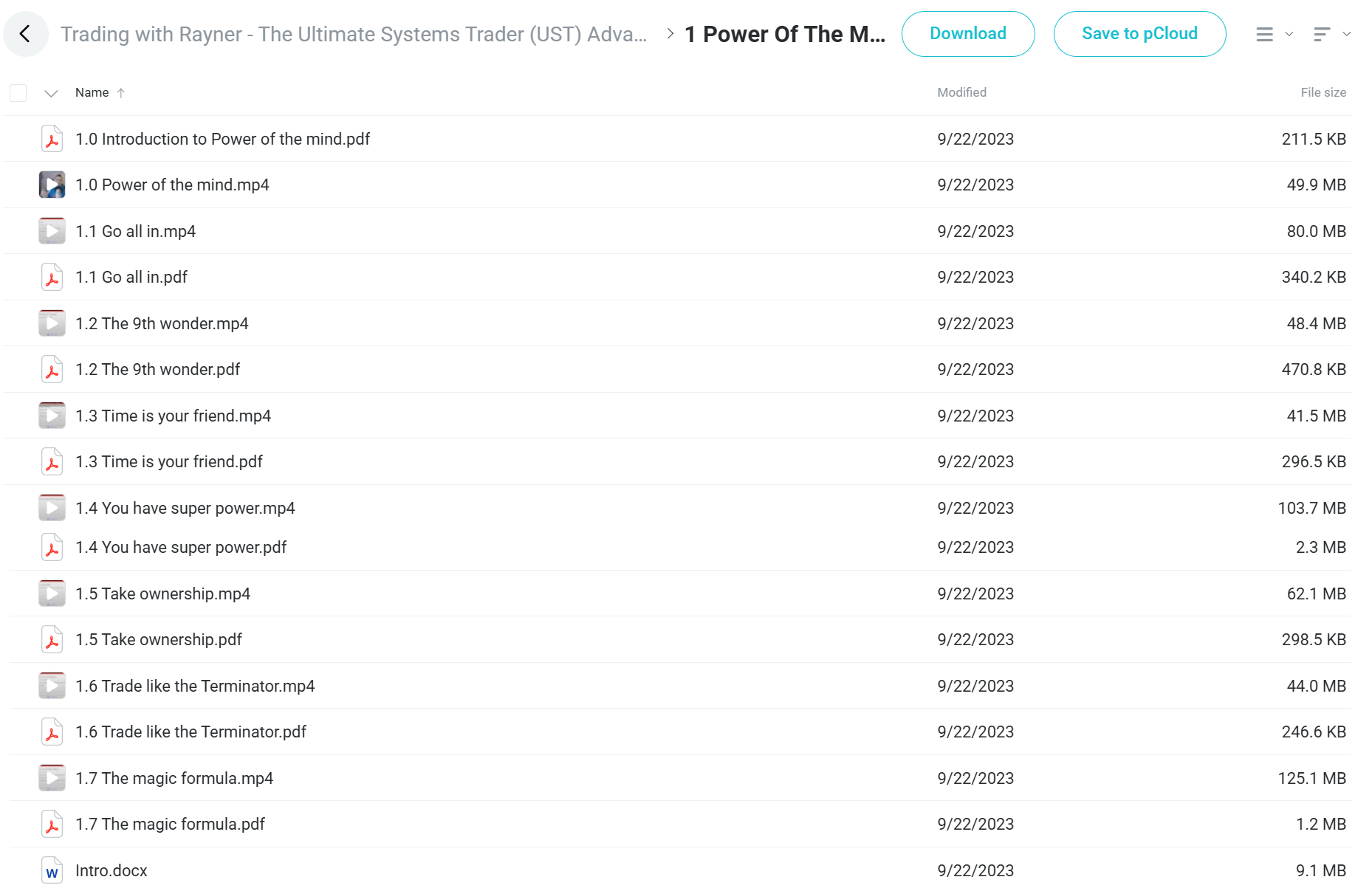

✅ Module 1: Power of the Mind

This section focuses on the mental foundations needed for successful trading. It teaches the importance of mental preparation, patience, and developing the right mindset before learning technical strategies.

Key lessons include “The 9th Wonder” which talks about growth over time, “Time is Your Friend” teaching patience in trading, and “Trade Like the Terminator” which focuses on removing emotions from trading decisions. Students learn to take responsibility for their trading results and build mental toughness for long-term success.

✅ Module 2: Natural Laws of Trading

This module covers the basic principles that govern successful trading regardless of strategy. It sets up the core concepts that all the later trading systems are built on.

Students learn about gaining an edge in the markets, understanding how win rates relate to risk-reward, and why the law of large numbers matters in trading. Risk management is highlighted as critical, along with understanding consistency in trading performance. This section prepares students for the trading systems that follow.

✅ Module 3: Introduction

This section serves as an overview of the course’s approach to trading systems. It outlines how different trading strategies are judged and introduces the tools needed to use them effectively.

Notable lessons include “The Tools Required” which lists the needed software and resources, “Benchmark to Beat” which sets performance standards, and “Holy Grail of the Holy Grail” which likely addresses myths about perfect trading systems. Students learn how to evaluate and choose suitable trading approaches.

✅ Module 4: Systematic Trend Following System (STF)

This detailed module teaches a trend following strategy designed to capture big market moves. It includes step-by-step implementation guides, results analysis, and weekly timeframe applications.

The system is fully explained with specific rules, implementation steps across multiple parts, and performance results. It includes comparisons to professional fund performance and answers to common questions. This appears to be one of the main systems taught in the course.

✅ Module 5: Power Stock Trading System (PST)

This section presents a stock-specific trading method with clear entry and exit rules. The system is explained with chart examples, implementation guidance, and past performance data.

A special feature of this module is the “Gap Filter” bonus content, which helps traders filter certain price gap setups for better results. The multi-part implementation videos suggest this is a detailed system with specific execution requirements.

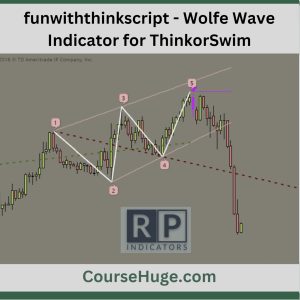

✅ Module 6: Mean Reversion Trading System (MRT)

This module teaches strategies for profiting from price movements that return to the average. It includes specific scanning techniques using the thinkorswim (TOS) platform and position sizing calculations for Interactive Brokers.

Students learn detailed trade management techniques and receive bonus content on a “Closing Range” version of the system. The inclusion of platform-specific implementation guidance makes this section very practical for immediate use.

✅ Module 7: Monthly Momentum Trading System (MMT)

This section teaches a longer-term strategy that works on monthly timeframes. It covers various markets suitable for this approach and provides detailed implementation instructions.

The system focuses on capturing larger trends with less frequent trading activity. Implementation is broken into multiple parts, showing how to execute across different market conditions and scenarios.

✅ Module 8: Slow and Steady System (SST)

As the name suggests, this module presents a safer trading approach focused on consistency and protecting capital. The implementation is split into two parts, with clear rules and past performance data provided.

This system is designed for more cautious traders who prefer steady returns over aggressive strategies. The approach emphasizes high-probability setups with careful risk management rules.

✅ Module 9: Monthly Momentum Stock Trading (MST)

Building on the momentum concept, this section applies momentum principles specifically to stocks on a monthly timeframe. Implementation is broken into three parts with additional improvements provided.

Students learn specific stock selection criteria and execution guidelines tailored for this longer-term approach. The section includes performance results and various ways to enhance the basic strategy.

✅ Module 10: Conclusion

The course ends with practical guidance on choosing and implementing the taught strategies. It addresses how to improve trading results and provides a roadmap for getting started with the systems.

A valuable addition is content on automating the trading process, which can help reduce emotional decision-making and ensure consistent execution. The section connects the mindset principles from the beginning with the technical systems presented throughout the course.

Who is Rayner Teo?

Rayner Teo is a Singapore-based trader and founder of TradingwithRayner, a popular trading education platform with over 300,000 followers.

After losing money early in his trading career, Rayner created a systematic approach that made him consistently profitable. He now teaches this method to traders worldwide.

Unlike other trading teachers who focus on complex charts, Rayner teaches simple rule-based systems, smart risk management, and trading psychology. He explains difficult concepts in easy-to-follow steps.

Rayner openly shares his trading results and performance numbers. This honesty has earned him trust from traders around the world.

He has written several trading guides and courses that have helped thousands of traders. His methods help people make consistent profits without watching charts all day or making emotional decisions.

Be the first to review “Trading with Rayner – The Ultimate Systems Trader (UST) Advanced” Cancel reply

Related products

Forex Trading

Best 100 Collection

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.