Orderflows – The Orderflows Delta Trading Course

$990.00 Original price was: $990.00.$19.00Current price is: $19.00.

Michael Valtos Orderflows Delta Trading Course [Instant Download]

What is Michael Valtos Orderflows Delta Trading Course?

Orderflows Delta Trading Course is a trading program that teaches you how to use order flow delta to improve your market decisions.

Order flow delta shows the difference between buying and selling pressure, revealing what big traders are doing before price changes happen.

In this course, Michael Valtos explains how to read delta patterns to spot trend changes early and find better trade entries.

You’ll learn 7 specific delta trade setups that help you identify high-probability trading opportunities. These professional setups would cost hundreds of dollars if bought separately.

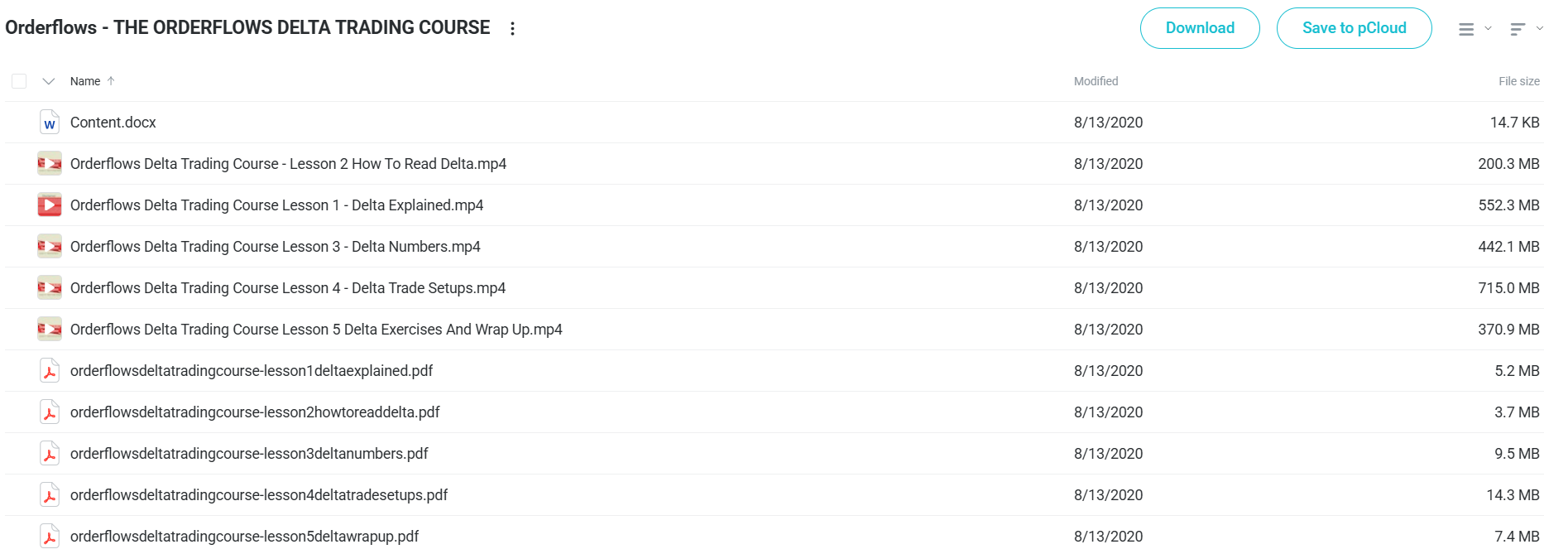

📚 PROOF OF COURSE

What you’ll learn in Orderflows Delta Trading Course:

The Orderflows Delta Trading Course gives you professional-level insights into the forces that actually move markets. Here’s what you’ll master:

- Delta interpretation: Learn to read different types of delta information and identify who’s truly in control of price movement.

- Trend analysis: Recognize crucial signs when trends are strengthening or weakening before most traders notice.

- Market psychology: Understand the importance of what doesn’t occur in markets – a powerful insight most retail traders miss.

- Continuation patterns: Monitor trades effectively to stay in profitable positions longer.

- Trade setups: Master 7 different delta-related trade setups that professionals use daily.

- Market positioning: Learn to recognize institutional footprints and position yourself alongside smart money.

This comprehensive course bridges the gap between retail and institutional trading approaches, giving you powerful tools to improve your market understanding and trading decisions.

Orderflows Delta Trading Course Curriculum:

✅ Lesson 1: Delta Explained

This first lesson introduces delta in trading and explains why it’s an important market indicator. Students learn how delta measures buying and selling pressure in the market, setting up the basic knowledge needed for later lessons.

The lesson shows how price movement relates to delta readings, helping traders see the true strength or weakness behind price changes. Students learn how delta can show hidden market patterns that price charts alone can’t reveal, giving early signs of possible market turns or trends.

✅ Lesson 2: How To Read Delta

Building on the basics, this lesson teaches the hands-on skill of reading delta information on trading charts. Students learn to spot important delta patterns and understand what different delta readings tell us about current market conditions.

The lesson covers delta divergences, which happen when price movement doesn’t match delta readings, often signaling possible market reversals. Students learn to analyze delta in context, understanding how readings change meaning based on market conditions, time frames, and the specific markets being traded.

✅ Lesson 3: Delta Numbers

This practical lesson covers the number side of delta analysis, teaching students how to understand specific delta values across different markets and timeframes. Traders learn to set useful delta benchmarks that can trigger trading decisions based on market conditions.

The course shows how delta numbers shift during different market phases, helping students adapt their approach accordingly. Special focus is given to spotting significant delta volume spikes and understanding what they mean for likely price direction and momentum.

✅ Lesson 4: Delta Trade Setups

This hands-on lesson turns delta knowledge into specific trading strategies. Students learn to combine delta readings with price action and other technical tools to find high-probability trade opportunities with clear entry points, stop levels, and profit targets.

The lesson covers several delta-based strategies, including delta divergence trades, delta accumulation setups, and delta reversal patterns. Each strategy includes specific entry signals, risk management guidelines, and expected outcomes to prepare traders for real market trading.

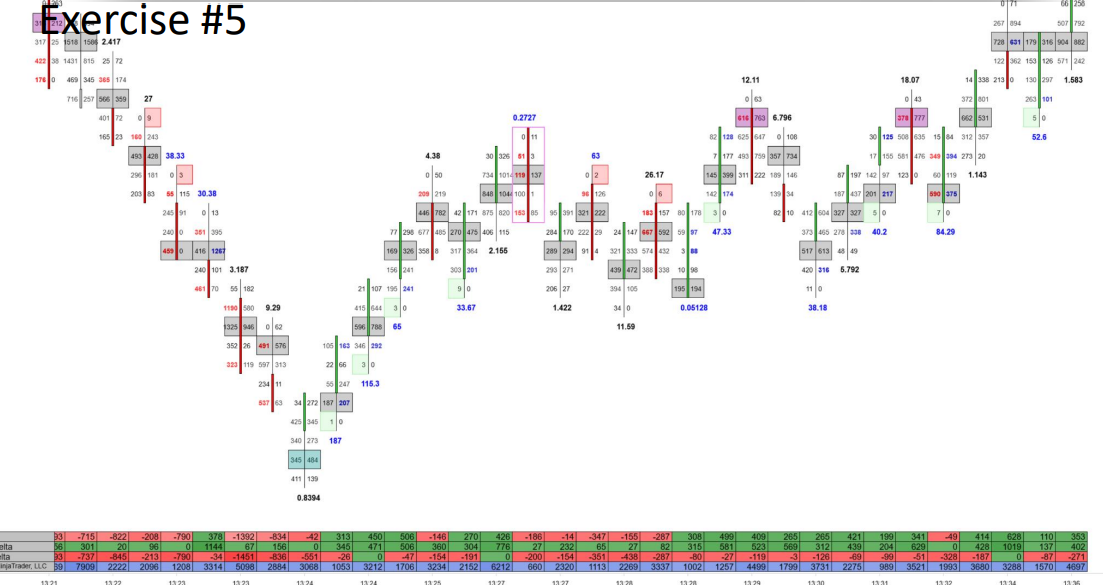

✅ Lesson 5: Delta Exercises And Wrap Up

The final lesson reinforces learning through practical exercises and real-world trading examples. Students apply their delta trading knowledge to chart examples and practice scenarios to build confidence and skill.

The course ends with ways to combine delta analysis with other trading methods. Students get advice on continuing their delta trading practice, including suggested routines and ways to track their trading progress.

Who is Michael Valtos?

Michael Valtos has over 20 years of experience as an institutional trader. He worked at top financial firms including JP Morgan (8 years), Commerzbank (3 years), Cargill (4 years), and EDF Man (2 years).

In 2013, he started Orderflows.com to help regular traders learn what the big institutions know. His goal was to teach retail traders how to read order flow data instead of just using technical indicators.

Valtos is known as a leading expert in Order Flow trading. He understands market structure and can spot the footprints that large institutions leave in the markets. He has taught thousands of traders how to apply these skills through his courses and software.

What makes Michael special is his ability to turn complex trading concepts into simple strategies anyone can use. He teaches traders to understand real market forces rather than relying on lagging indicators, giving them an edge in today’s markets.

Be the first to review “Orderflows – The Orderflows Delta Trading Course” Cancel reply

Related products

Trading Courses

Forex Trading

Forex Trading

Trading Courses

Forex Trading

Trading Courses

Investment Management

Trading Courses

Reviews

There are no reviews yet.