The Hedge Bundle – SpotGamma Academy

$997.00 Original price was: $997.00.$12.00Current price is: $12.00.

SpotGamma Academy The Hedge Bundle Course [Instant Download]

What is SpotGamma The Hedge Bundle?

SpotGamma Academy The Hedge Bundle is a complete options trading course that teaches you how to trade like a professional. This 3-part series covers everything from basic calls and puts to advanced volatility trading.

Created by options experts Brent Kochuba and Imran Lakha, the course shows you how to read market signals and manage risk using Greeks. You’ll learn to trade spreads, analyze volatility, and understand how big market makers influence prices.

Each part builds on the previous one – starting with options basics, moving to Greeks and risk management, then advancing to professional portfolio strategies used by Wall Street traders.

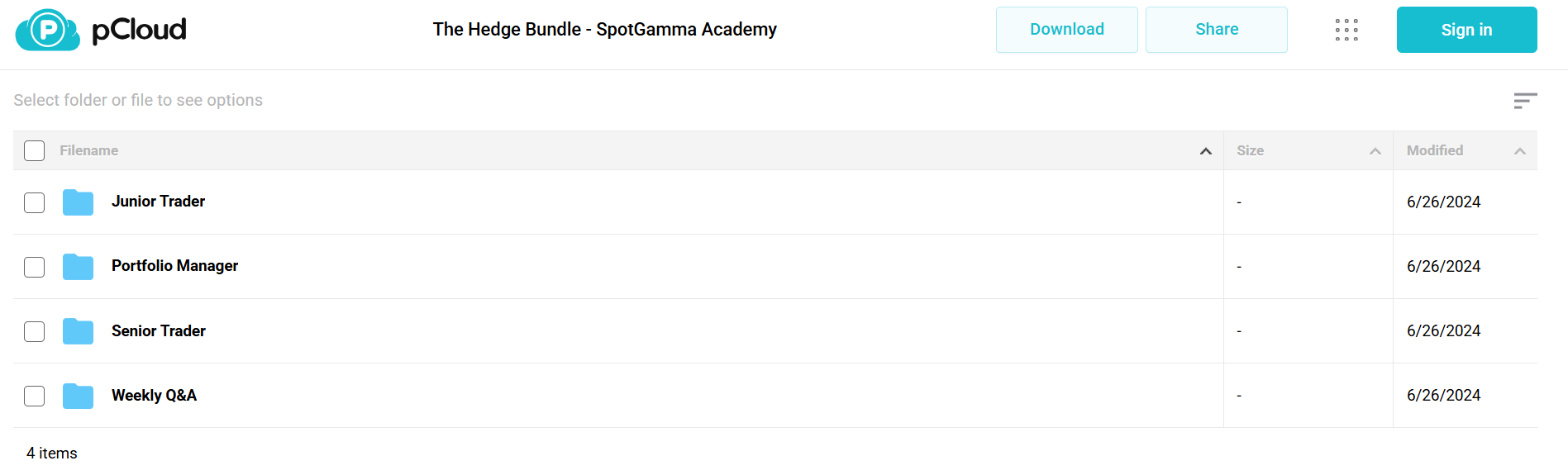

📚 PROOF OF COURSE

What you’ll learn from SpotGamma The Hedge Bundle:

The Hedge Bundle takes you from beginner to professional options trader through three levels. Here’s what you’ll learn:

- Options Basics: Learn how calls and puts work, understand how options are priced, and read options chains effectively

- Understanding Greeks: Learn to use delta, gamma, vega, and theta to manage your trades and control risk

- Trading Strategies: Master volatility trading, spread trades, and learn how market makers influence prices

- Portfolio Skills: Create trading plans, build better positions, and protect your account in different market conditions

- Market Understanding: Learn to read term structure, use implied volatility, and find good trading opportunities

After completing the course, you’ll know how to trade options confidently – from simple trades to advanced portfolio strategies.

The Hedge Bundle Course Curriculum:

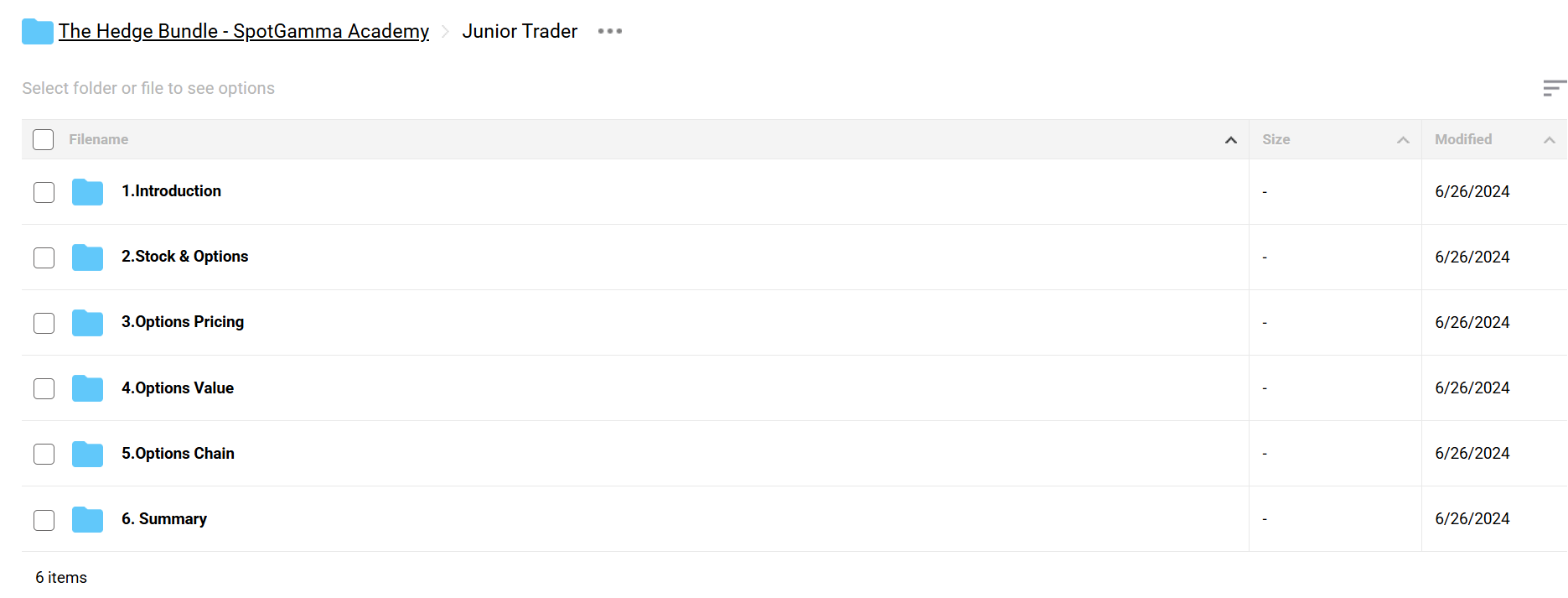

✅ Section 1: Junior Trader Track

The Junior Trader track provides foundational knowledge in stocks and options trading. Students learn essential concepts and terminology needed to understand market mechanics and basic trading strategies.

Module 1.1: Introduction

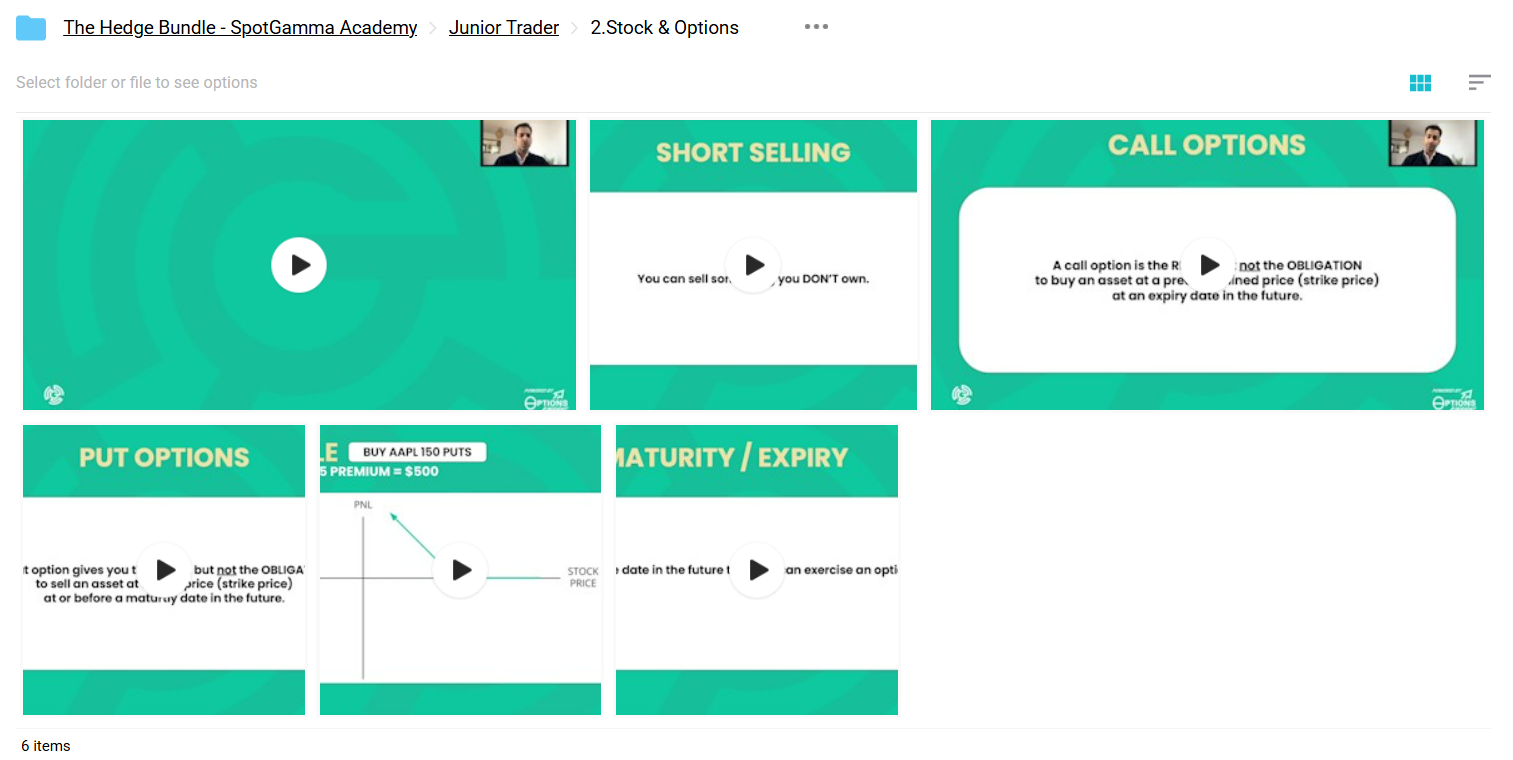

Welcome (Video) – Course overview and learning objectives for the junior trader pathway.Module 1.2: Stock And Options Fundamentals

A comprehensive introduction to basic trading instruments and concepts. Students learn stock buying, shorting, call options, put options, and option characteristics including moneyness and expiration types.Module 1.3: Options Pricing

Core concepts in options pricing theory including forward price calculation, time to maturity effects, and implied volatility fundamentals.Module 1.4: Options Value Analysis

Detailed exploration of intrinsic and time value components. Students learn to analyze different moneyness scenarios through practical examples of ITM, ATM, and OTM options.Module 1.5: Options Chain Reading

Practical instruction on interpreting options chains, including strike price selection and expiration date analysis.

✅ Section 2: Portfolio Manager Track

The Portfolio Manager track advances into sophisticated volatility trading concepts and portfolio-level strategy implementation.

Module 2.1: Term Structure Analysis

Advanced study of volatility term structure, including contango and backwardation scenarios, weighted vega trading approaches, and forward volatility concepts.Module 2.2: Skew Analysis

Comprehensive coverage of volatility skew, dynamic Greeks, and implied skew trading opportunities.Module 2.3: Trading Strategies

Practical implementation of volatility strategies, spread trading, and risk management techniques using collars and risk reversals.Module 2.4: Advanced Options Strategies

Complex multi-leg options strategies including butterflies, condors, and calendar spreads, with practical trade examples.Module 2.5: SpotGamma Key Levels

Technical analysis focusing on key market levels including Call Walls, Vol Triggers, and Put Walls, with practical trading applications.Module 2.6: Second Order Greeks

Advanced Greek analysis including Vanna, Charm, and their impact on dealer positioning and market dynamics.

✅ Section 3: Senior Trader Track

The Senior Trader track focuses on advanced Greeks analysis and professional trading techniques.

Module 3.1: Delta Analysis

Comprehensive study of delta, including practical hedging techniques and implementation of the HIRO indicator.Module 3.2: Gamma Analysis

Advanced examination of gamma, theta decay relationships, and market pinning effects near expiration.Module 3.3: Vega And Volatility

In-depth analysis of volatility measurements, the Rule of 16, and the relationship between realized and implied volatility.Module 3.4: Integrated Greeks Application

Practical application of combined Greeks analysis through real trading examples and market scenarios.

✅ Section 4: Weekly Q&A Sessions

Regular question and answer sessions providing ongoing support and practical application guidance. These sessions allow students to clarify concepts and discuss real-market applications.

Each track includes:

- Comprehensive video lessons

- Practice exercises and examples

- Final examination

- Glossary of technical terms

The curriculum progresses from fundamental concepts through advanced trading strategies, emphasizing practical application and risk management throughout each level.

What is SpotGamma Academy?

SpotGamma Academy was created by two options trading experts – Brent Kochuba and Imran Lakha.

Brent Kochuba founded SpotGamma and is known for his deep understanding of how options affect stock prices. He developed special tools to analyze options market data that traders use daily.

Imran Lakha ran options trading teams at major banks like BofA Merrill Lynch and Citibank for almost 20 years. With degrees in Math and Economics, he now teaches traders how to use professional options strategies.

Together, they teach real trading methods – not just textbook theory. Their courses show you the same techniques used by professional options traders on Wall Street.

Be the first to review “The Hedge Bundle – SpotGamma Academy” Cancel reply

Related products

Trading Courses

Crypto Trading

Trading Courses

Forex Trading

Trading Courses

Forex Trading

Best 100 Collection

Trading Courses

Reviews

There are no reviews yet.