Oz Konar – Business Credit Success Blueprint

$697.00 Original price was: $697.00.$22.00Current price is: $22.00.

Business Credit Success Blueprint Course by Oz Konar [Instant Download]

What is Oz Konar Business Credit Success Blueprint?

Oz Konar’s Business Credit Success Blueprint is the course that teaches you how to get high-limit business credit with no personal guarantees.

You’ll learn how to monitor your business credit scores with D&B, Equifax, and Experian in real time, and get your business credit profiles activated quickly.

The course covers entity formation secrets and the 7 steps to corporate compliance that help your business meet lender standards for automatic approvals.

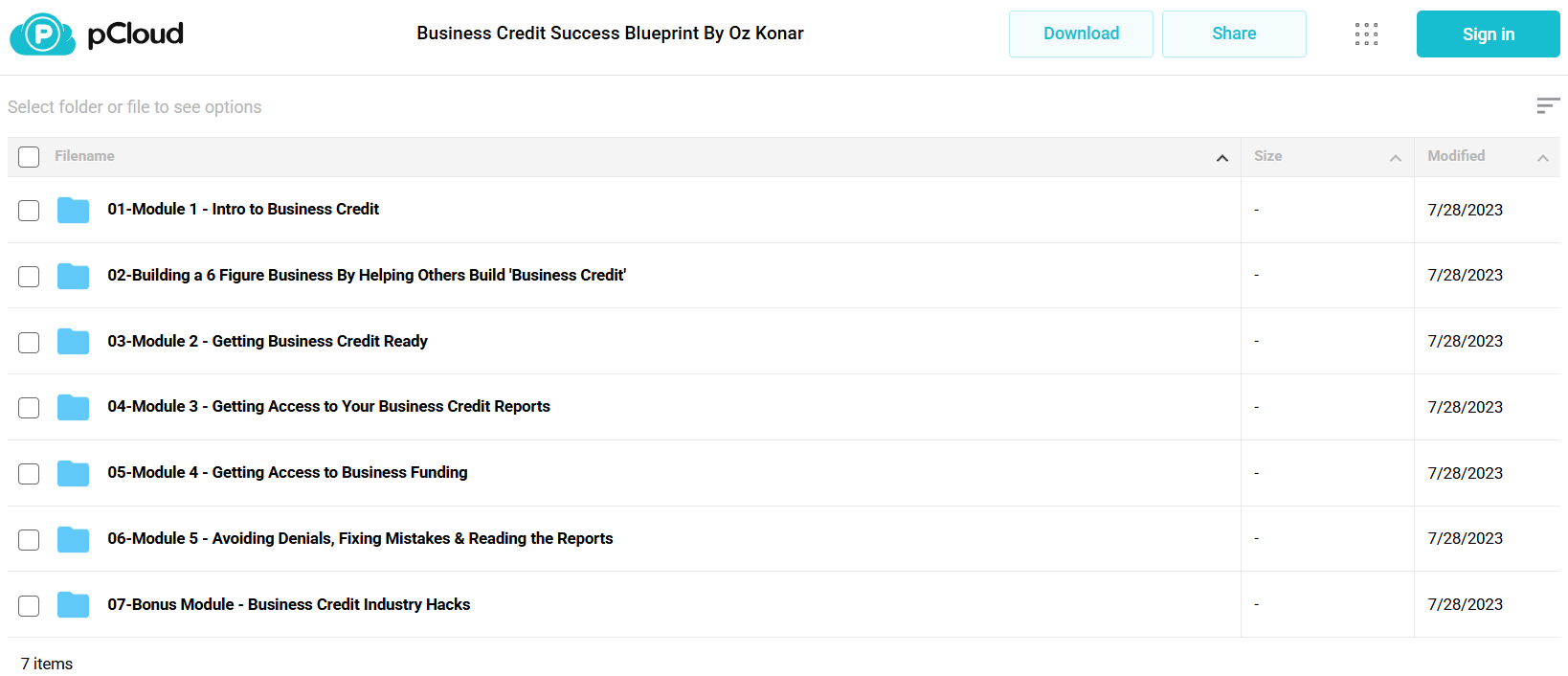

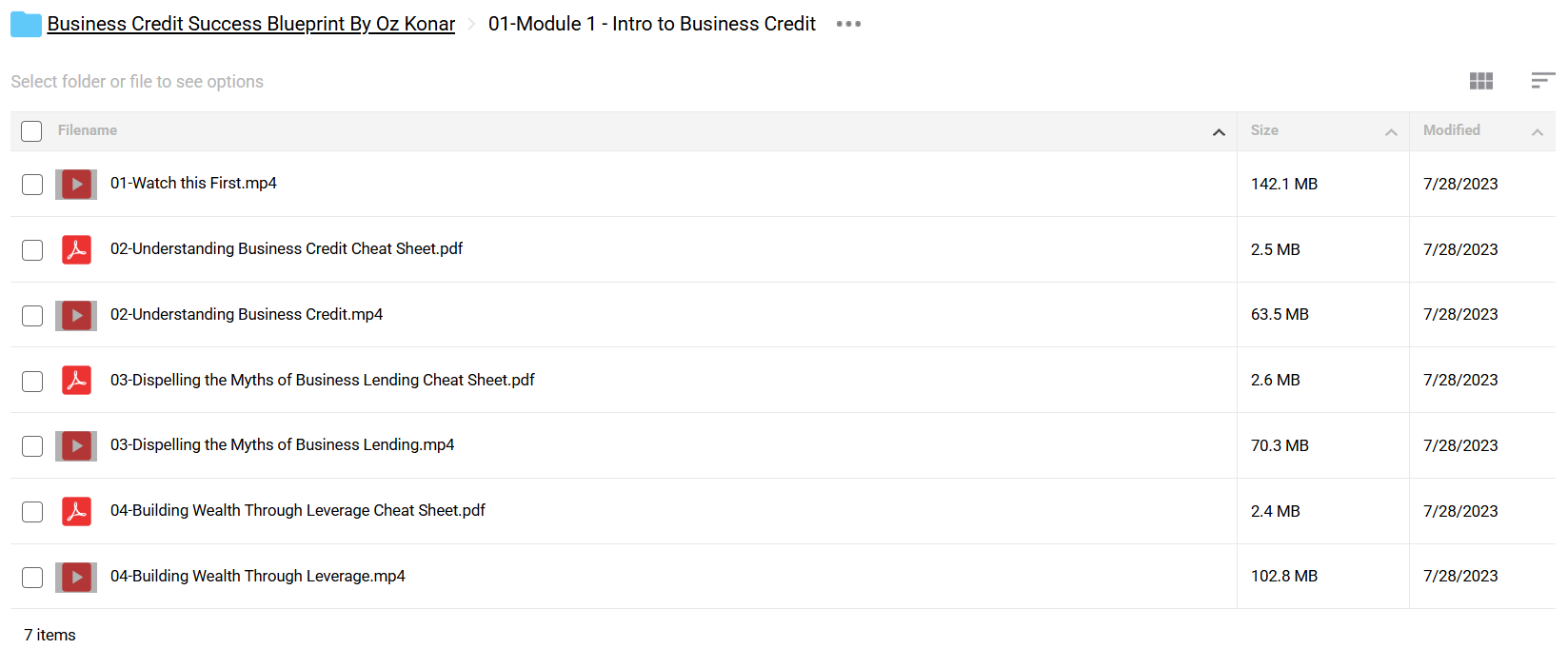

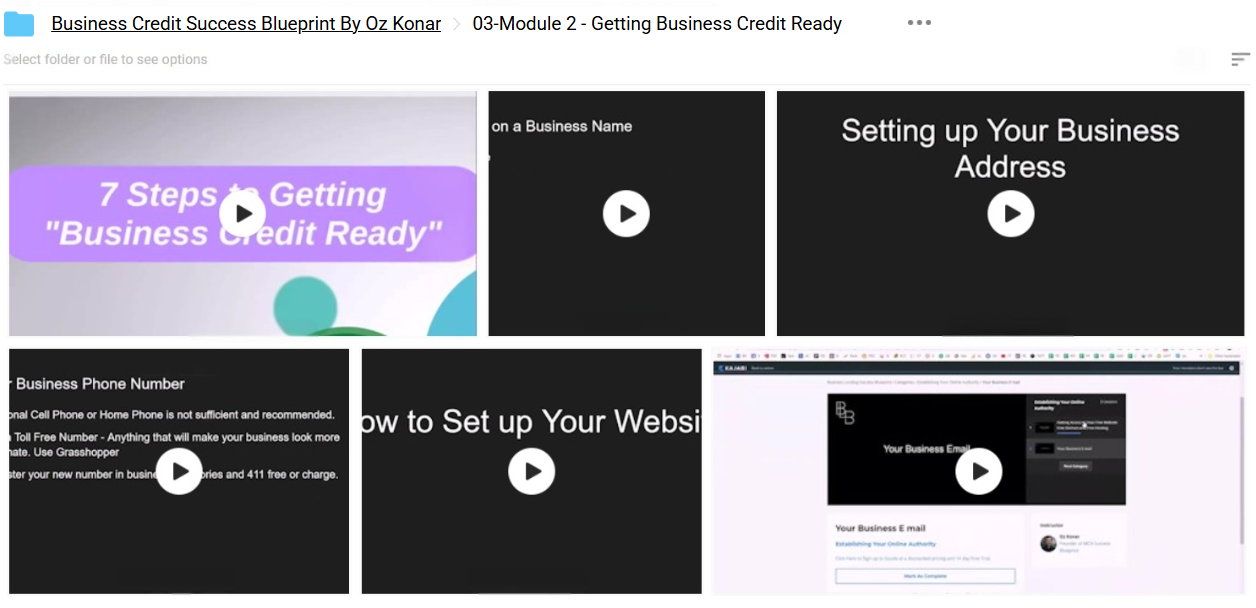

📚 PROOF OF COURSE

What you’ll learn in Business Credit Success Blueprint:

Business Credit Success Blueprint teaches you how to build business credit and get funding without personal guarantees. Here’s what you’ll learn:

- Business credit fundamentals: Learn how business credit works and clear up common myths about business lending

- Corporate compliance: Master the 7 steps to meet lender credibility standards for automatic approvals

- Credit monitoring: Track your business credit scores with D&B, Equifax, and Experian in real-time

- Business setup: Learn entity formation secrets and how to structure your business for better credit approval

- Funding access: Discover over 10 different lending options for both new and existing businesses

- Wealth building: Use business credit strategies to build long-term wealth

This course works for both beginners and experienced business owners. By the end, you’ll know how to get high-limit funding without risking your personal assets.

Business Credit Success Blueprint Course Curriculum:

✅ Building a 6 Figure Business By Helping Others Build Business Credit

This module reveals how students can not only build their own business credit but also create a profitable business helping others do the same. It teaches automation strategies to scale this business model efficiently.

Students learn how to set up systems for success with full automation, reducing the need for constant hands-on management. The module also provides detailed instructions on accessing and utilizing the affiliate dashboard, enabling students to track their progress and maximize their earnings while helping other entrepreneurs access business credit.

✅ Module 1: Introduction to Business Credit

This foundational module introduces the concept of business credit and dispels common myths about business lending. Students learn the fundamental differences between personal and business credit while discovering how to build wealth through strategic leverage.

The module begins with essential orientation to prepare students for success, followed by in-depth lessons on business credit fundamentals. A key focus is correcting misconceptions about business lending that prevent many entrepreneurs from accessing capital. The module concludes by teaching wealth-building strategies through proper leverage, showing how business credit can be used as a powerful financial tool.

✅ Module 2: Getting Business Credit Ready

This comprehensive module walks students through the seven essential steps to prepare their business for credit applications. It covers everything from selecting a business name to opening a dedicated business bank account.

Students receive detailed guidance on establishing a professional business presence, including setting up a business address, phone number, website, and professional email. The module provides specific resources for each step of the process. A significant portion focuses on choosing the right business entity and properly registering the business, crucial factors in building strong business credit. The module concludes with instructions on opening a business bank account that will support credit-building activities.

✅ Module 3: Getting Access to Your Business Credit Reports

This module teaches students how to establish their business with major credit bureaus and access their business credit reports. Understanding these reports is essential for monitoring credit-building progress.

Students learn the specific processes for registering their business with various credit bureaus to ensure their credit-building activities are properly tracked and reported. The module also provides detailed instructions on how to obtain and interpret business credit reports from different agencies, giving students the tools to monitor their progress and make informed decisions about future credit applications.

✅ Module 4: Getting Access to Business Funding

This action-oriented module guides students through a strategic, staged approach to applying for business credit lines. It outlines a systematic process for building business credit through increasingly valuable tradelines.

The module begins with important instructions that set students up for success in their credit applications. It then introduces a three-stage approach to building business credit: starting with foundational tradelines that are easier to obtain, progressing to intermediate options that offer more substantial credit, and culminating with premium tradelines that provide significant business funding. Each stage includes specific resources and recommendations for optimal results.

✅ Module 5: Avoiding Denials, Fixing Mistakes & Reading the Reports

This module teaches students how to interpret business credit reports from all three major bureaus and address any errors that might negatively impact their credit profile.

Students receive detailed guidance on reading and understanding Dun & Bradstreet, Experian, and Equifax business credit reports. Each report has unique characteristics and scoring methods that students must understand to effectively build their business credit. The module concludes with strategies for identifying and fixing errors in credit reports and avoiding common pitfalls that lead to credit denials.

✅ Bonus Module: Business Credit Industry Hacks

This advanced module reveals specialized strategies for leveraging business credit in various aspects of personal and business finance, including vehicle purchases, real estate acquisition, and covering personal expenses.

Students learn how to transfer personal vehicles under business credit, potentially improving their financial position. The module also teaches how to purchase multiple vehicles through business credit to create additional income streams. Advanced techniques include using business credit to cover personal expenses legally and ethically, and strategies for purchasing real estate with zero down payment by leveraging business credit resources.

Who is Oz Konar?

Oz Konar is an entrepreneur and business expert in the business lending industry. He founded Business Lending Blueprint, an INC5000 company, and is a leading authority in business credit.

Konar started in sales and marketing before finding a gap in business lending in 2013. He first created Local Marketing Stars, a marketing agency, then shifted to business lending education.

His main program, Business Lending Blueprint, has helped thousands of entrepreneurs build successful loan brokerages. The company has grown rapidly, earning a spot on the INC5000 list of fastest-growing private companies.

Oz shares his knowledge on various platforms, including his YouTube channel with success stories and training videos. His teaching combines real experience with simple strategies that help business owners get funding.

Through Business Credit Success Blueprint, Oz teaches entrepreneurs how to build and use business credit without personal guarantees, helping them create sustainable businesses with proper funding.

Be the first to review “Oz Konar – Business Credit Success Blueprint” Cancel reply

Related products

Business Credit

Business Credit

Business & Finance

Business Credit

Business Credit

Business Credit

Business Credit

Reviews

There are no reviews yet.