OnlyPropFirms – The 2-Hour Trading Day Course

$199.00 Original price was: $199.00.$14.00Current price is: $14.00.

Patrick Wieland The 2-Hour Trading Day Course [Instant Download]

What is OnlyPropFirms The 2-Hour Trading Day Course:

The 2-Hour Trading Day Course teaches you how to trade futures profitably in just 2 hours per day using momentum trading strategies.

This comprehensive program shows you how to leverage prop firms to trade without risking your own capital, while mastering market analysis and risk management.

Created by successful trader Patrick Wieland, the course provides a step-by-step system for consistent trading profits, backed by live trade breakdowns and practical examples.

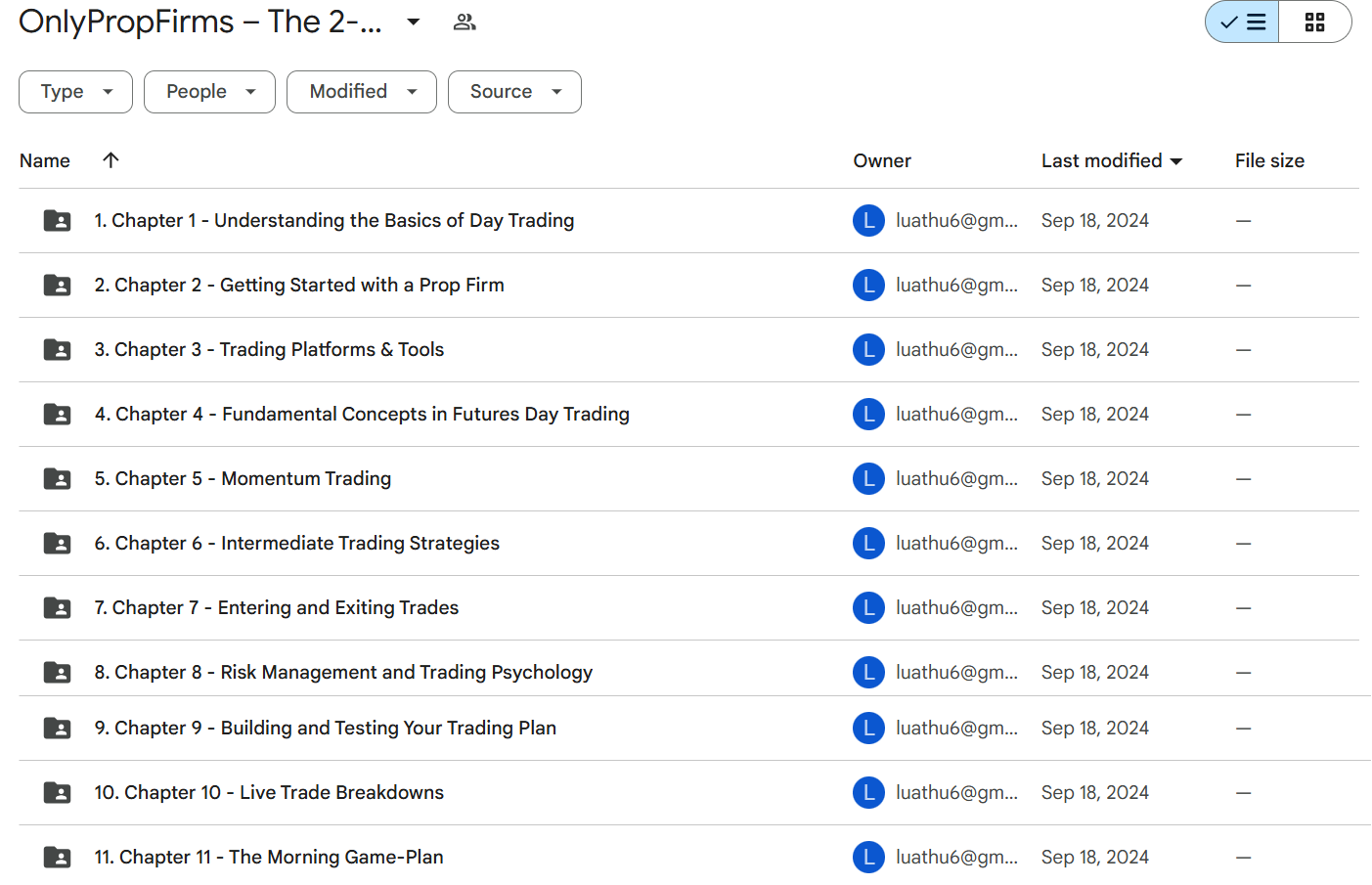

📚 PROOF OF COURSE

What you’ll learn in The 2-Hour Trading Day Course:

This comprehensive trading course teaches you everything needed to become a successful futures trader. Here’s what you’ll master:

- Market Analysis: Learn to read market structure and identify profitable trading opportunities

- Momentum Trading: Master proven strategies for capturing market moves

- Risk Management: Develop skills to protect your capital and maximize profits

- Prop Firm Success: Navigate evaluations and trade with funded accounts

- Trading Psychology: Build mental resilience for consistent performance

- Morning Routine: Implement a powerful 10-step morning game plan

By the end of this course, you’ll have a complete trading system that only requires 2 hours per day to execute successfully.

The 2-Hour Trading Day Course Curriculum:

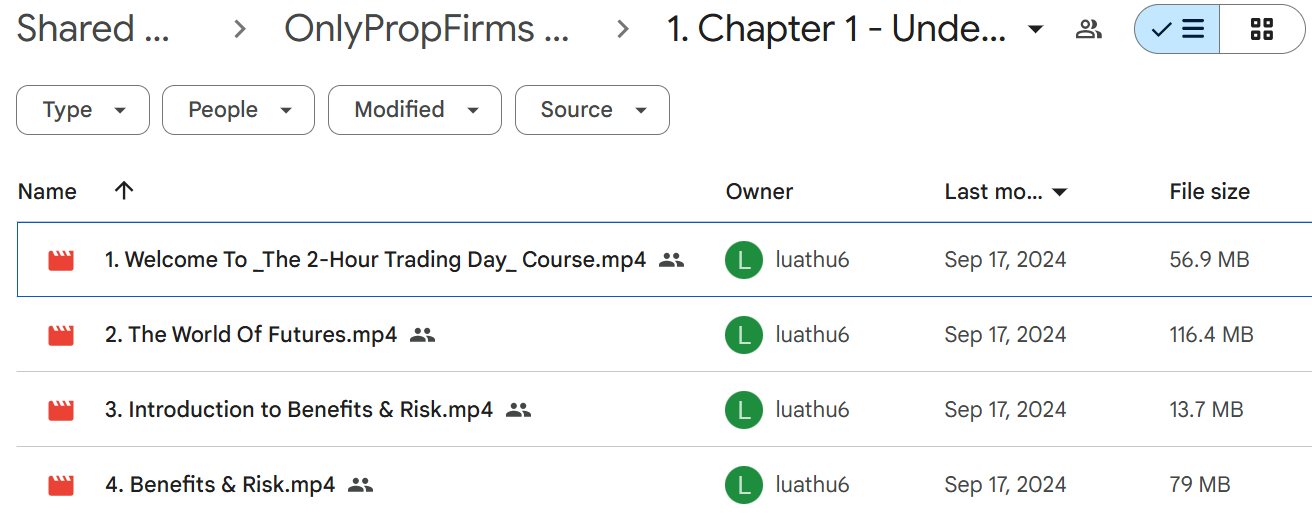

✅ Section 1: Understanding The Basics Of Day Trading

This section introduces students to the fundamentals of day trading and the futures market. Students learn essential concepts about trading benefits and associated risks, establishing a strong foundation for their trading journey.

Module 1.1: Introduction To Day Trading

- Welcome to The 2-Hour Trading Day Course (Video)

- The World of Futures (Video)

- Introduction to Benefits & Risk (Video)

- Benefits & Risk (Video)

✅ Section 2: Getting Started With A Prop Firm

This section explores the role of proprietary trading firms in day trading. Students learn about prop firms’ structure and advantages, helping them understand this unique trading opportunity.

Module 2.1: Prop Firm Fundamentals

- What are Prop Firms? (Video)

- The Benefits of Trading With a Prop Firm (Video)

✅ Section 3: Trading Platforms & Tools

This section covers the essential technology and tools needed for successful day trading. Students learn to select and utilize appropriate trading platforms and charting software.

Module 3.1: Platform Selection And Usage

- Introduction to Platforms (Video)

- Choosing a Trading Platform (Video)

- Charting Software (Video)

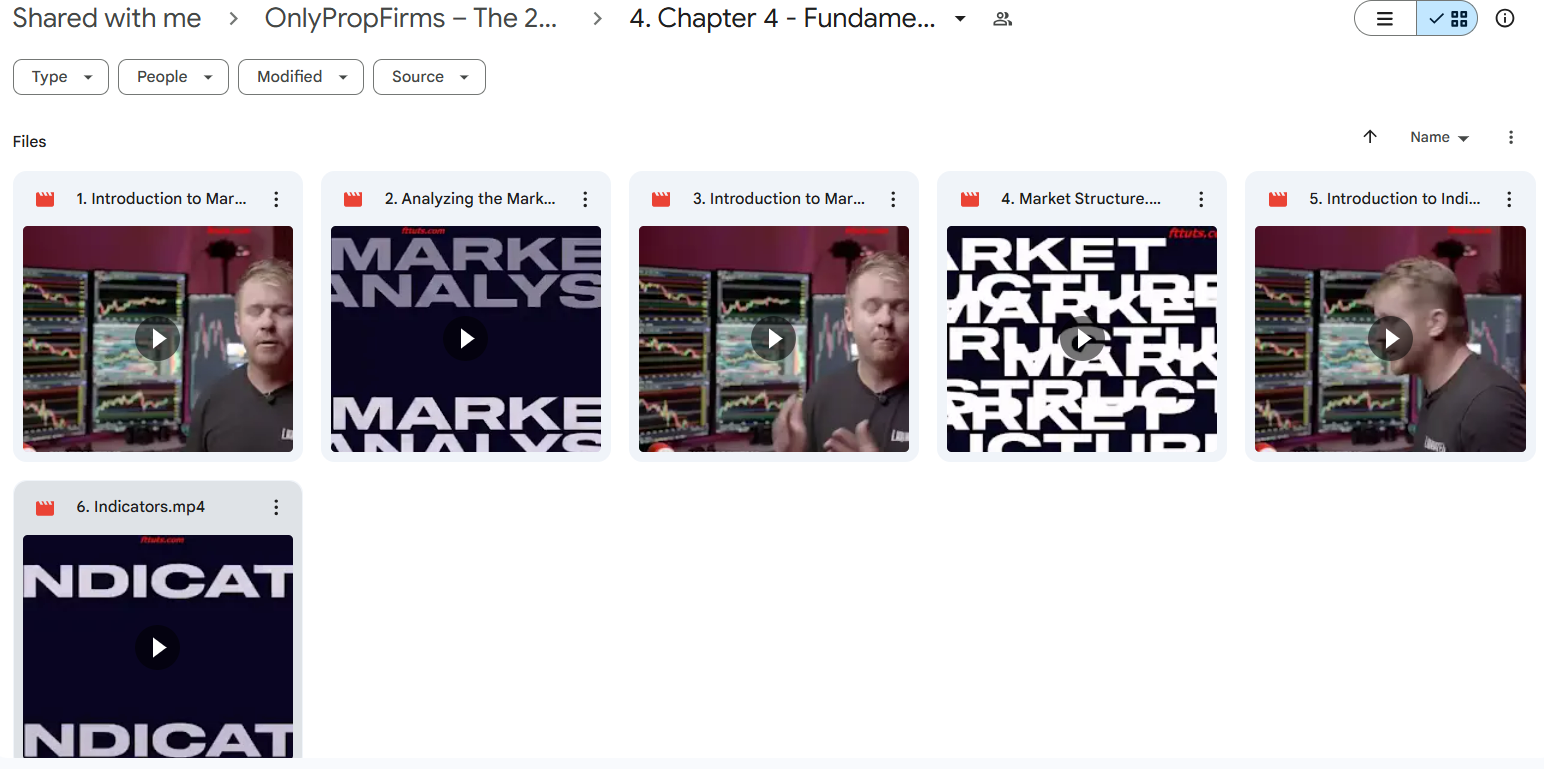

✅ Section 4: Fundamental Concepts In Futures Day Trading

This section delves into core trading concepts and analysis methods. Students learn market structure, analysis techniques, and the role of indicators in trading decisions.

Module 4.1: Market Analysis And Structure

- Introduction to Market Analysis (Video)

- Analyzing the Market (Video)

- Introduction to Market Structure (Video)

- Market Structure (Video)

- Introduction to Indicators (Video)

- Indicators (Video)

✅ Section 5: Momentum Trading

This section focuses on momentum trading strategies and pattern recognition. Students learn to identify and trade various market patterns and movements.

Module 5.1: Momentum Strategies And Patterns

- Introduction to the Momentum Trading Strategy (Video)

- Momentum Trading Strategy (Video)

- What Are Bear Flags & Bull Flags? (Video)

- Bear & Bull Flags (Video)

- Introduction to Gap Fills (Video)

- Understanding Gap Fills (Video)

- Introduction to The 15 Minute Opening Range (Video)

- The 15 Minute Opening Range (Video)

✅ Section 6: Intermediate Trading Strategies

This section advances into more complex trading patterns and breakout strategies. Students learn to identify and capitalize on various market movements.

Module 6.1: Advanced Pattern Recognition

- What is a Breakout? (Video)

- Breakouts (Video)

- Introduction to Patterns (Video)

- Pattern Recognition (Video)

✅ Section 7: Entering And Exiting Trades

This section teaches precise trade execution techniques. Students learn timing strategies for entries and exits, along with effective trade management methods.

Module 7.1: Trade Execution

- Introduction to Entering & Exiting Trades (Video)

- Timing Entries (Video)

- Managing Trades (Video)

- Little Yellow Line (Video)

- Planning Exits (Video)

- Identifying Consolidation (Video)

✅ Section 8: Risk Management And Trading Psychology

This section covers crucial aspects of trading psychology and risk management. Students learn to control emotions and implement proper risk management techniques.

Module 8.1: Risk And Psychology

- Introduction to Risk Management (Video)

- How to Manage Risk (Video)

- Contract Sizing (Video)

- Introduction to Trading Psychology (Video)

- Trading Psychology (Video)

- Patience (Video)

- Managing Emotion (Video)

✅ Section 9: Building And Testing Your Trading Plan

This section guides students through creating and validating their trading strategy. Students learn to develop and test their personalized trading approach.

Module 9.1: Strategy Development

- Introduction to Trading Plans (Video)

- Create a Trading Plan (Video)

- Introduction to Backtesting (Video)

- Backtesting Strategies (Video)

✅ Section 10: Live Trade Breakdowns

This section provides real-world trading examples and analysis. Students observe and learn from actual trading scenarios and outcomes.

Module 10.1: Real Trading Examples

- Live Trade Breakdown #1-6 (Video Series)

- Passing Apex Evaluation – BONUS (Video)

✅ Section 11: The Morning Game-Plan

This section concludes with essential preparation strategies. Students learn a systematic approach to preparing for each trading day.

Module 11.1: Daily Preparation

- 10 Step Morning Game Plan (Video)

Each section includes comprehensive video lessons designed for practical application. The curriculum progresses logically from fundamental concepts to advanced trading strategies, emphasizing both technical skills and psychological preparation.

Who is Patrick Wieland?

Patrick Wieland is a futures trader and founder of OnlyPropFirms. He’s spent nearly a decade trading futures and shares his live trades on YouTube.

As a successful prop firm trader, Patrick shows his actual trading results and teaches others his methods. His YouTube channel has grown through his honest approach to showing both wins and losses.

OnlyPropFirms, his trading education platform, helps traders find prop firm opportunities and learn proven strategies. The site offers market updates, trading lessons, and an economic calendar.

Patrick has taught thousands of students how to trade futures profitably. He breaks down complex trading concepts into simple, actionable steps.

Be the first to review “OnlyPropFirms – The 2-Hour Trading Day Course” Cancel reply

Related products

Trading Courses

Investment Management

Trading Courses

Trading Courses

Forex Trading

Forex Trading

Options Trading

Best 100 Collection

Reviews

There are no reviews yet.