Marcus Barney – Recession Proof Extreme 2022

$10,000.00 Original price was: $10,000.00.$32.00Current price is: $32.00.

Marcus Barney Recession Proof Extreme 2022 [Instant Download]

📚 PROOF OF COURSE

What is Recession Proof Extreme 2022:

Marcus Barney’s Recession Proof Extreme 2022 is a comprehensive financial literacy program designed to help entrepreneurs navigate economic challenges and achieve financial success. This multi-faceted course offers a wealth of knowledge and strategies, empowering individuals to take control of their financial future.

Through Recession Proof Extreme 2022, participants gain invaluable insights into credit repair, tradeline business, personal and business funding, and innovative strategies for wealth creation. Marcus Barney, a renowned financial expert and successful entrepreneur, shares his expertise and proven methods to help students build a solid financial foundation and thrive in any economic climate.

By enrolling in this program, you’ll unlock the tools and resources needed to clean up your credit report, establish a perfect credit score, and leverage your credit to access funding opportunities. Additionally, you’ll learn how to create and operate a profitable credit repair business and scale and automate a tradeline business for substantial passive income.

What you will learn in Recession Proof Extreme 2022:

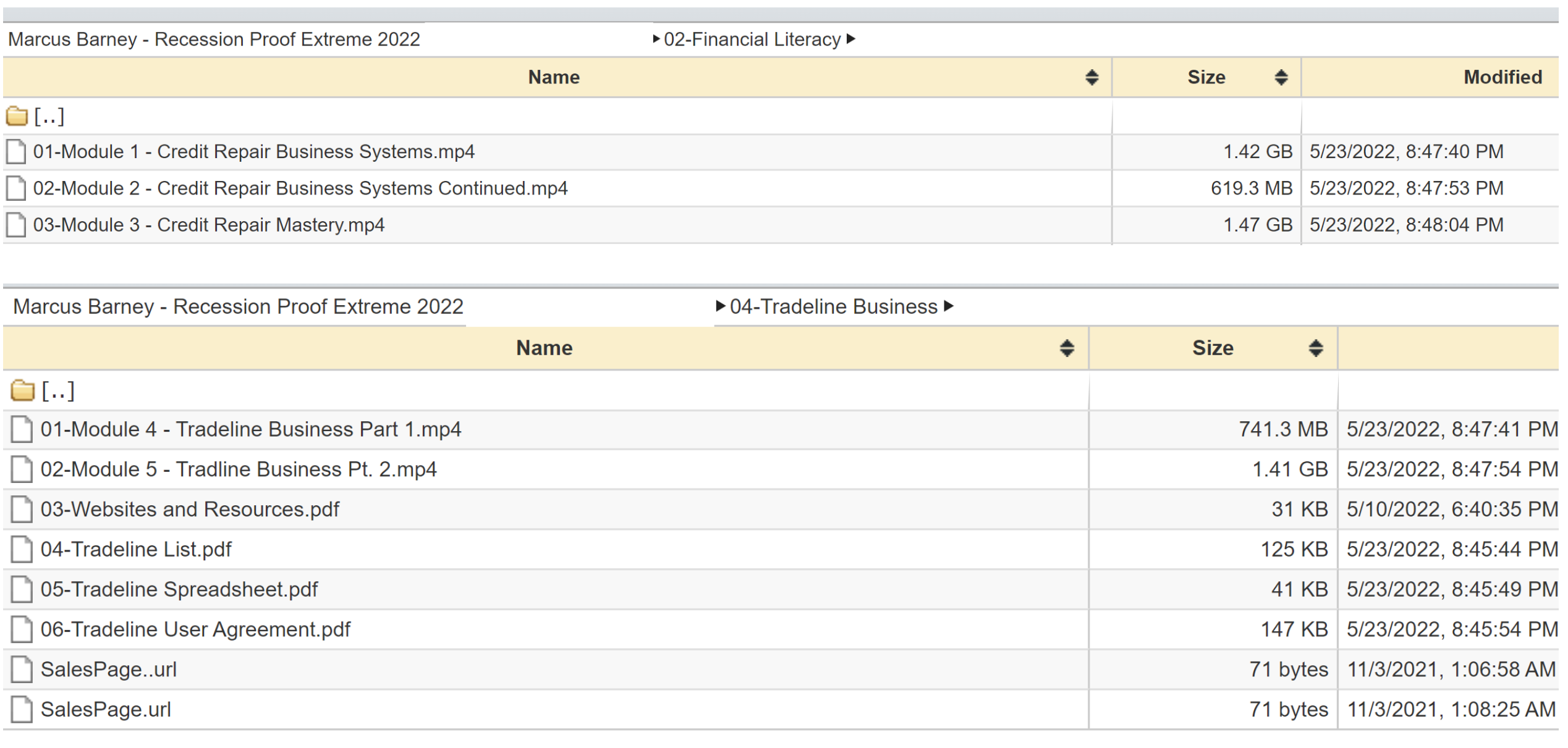

✅ Financial Literacy:

- Properly clean a credit report in 14-60 days

- Build a perfect credit report (750+)

- Structure a credit report for funding and hit all data points

- Create and operate a credit repair business

- Market and automate your credit repair business

✅ Tradeline Business:

- Select the best cards for a tradeline business

- Secure your tradelines against theft or fraud

- Protect your tradelines against risk management

- Scale and automate your tradeline business up to $180,000 net per year

- Market and build a clientele

✅ Personal & Business Funding:

- Create and market a funding company

- Obtain 12 credit card formulas with only 4 inquiries

- Obtain up to $250,000 with personal credit

- Build and establish business credit with and without a personal guarantee

- Obtain up to $250,000 in interest-free business credit for 12-18 months

✅ Strategies & Luxury Car Hacks:

- Manufacture spend $100,000 in a day

- Travel for free and get 60-70% off hotels

- Obtain any vehicle for 6-12 months and pay only pennies

- Leverage credit to avoid paying for groceries, toiletries, clothes, or utility bills

- Hide credit card utilization

- Use a credit card for your home down payment

- Purchase investment properties with $25k+ in equity for zero dollars out of pocket

- Avoid paying mortgage payments

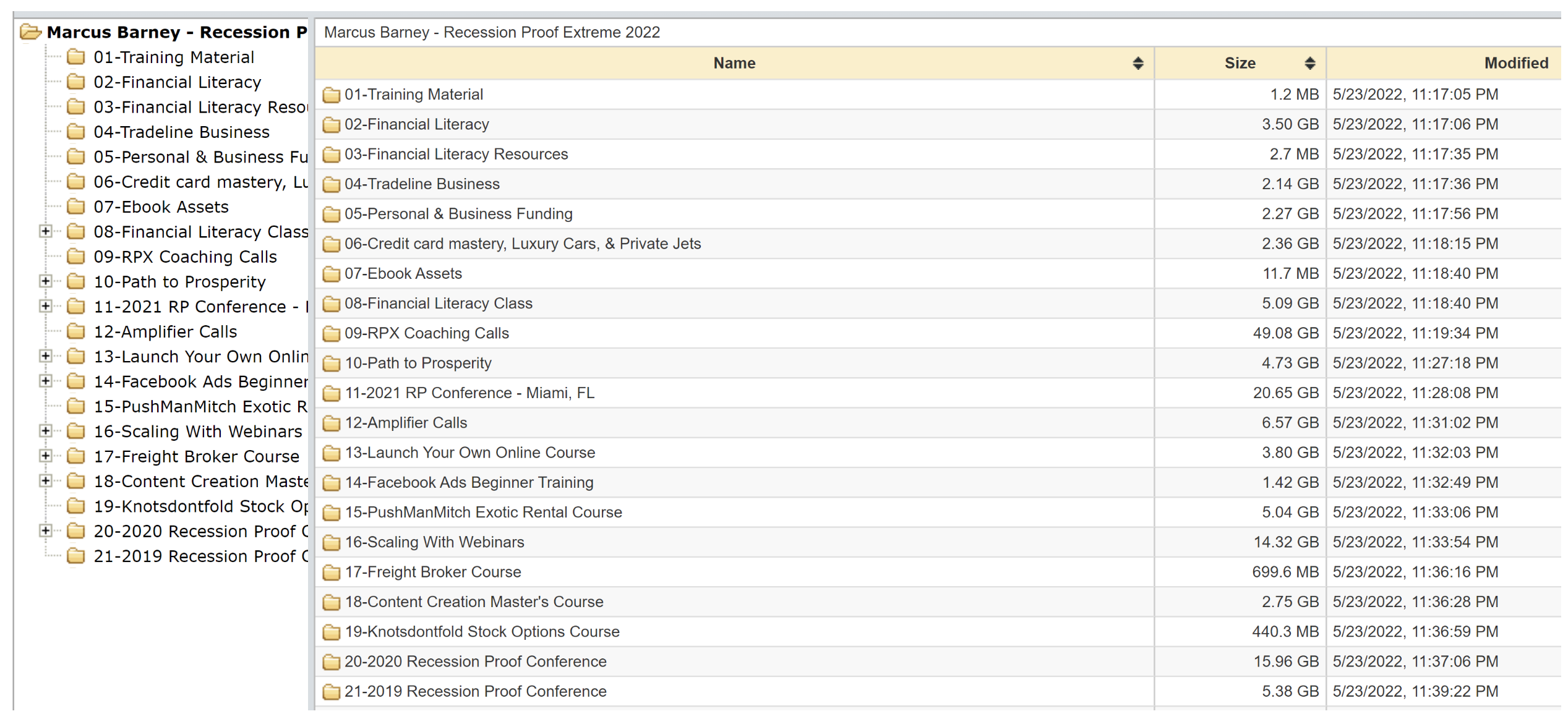

Recession Proof Extreme 2022 Course Curriculum:

- Module 01: Training Material

- Module 02: Financial Literacy

- Module 03: Financial Literacy Resources

- Module 04: Tradeline Business

- Module 05: Personal & Business Funding

- Module 06: Credit Card Mastery, Luxury Cars, & Private Jets

- Module 07: Ebook Assets

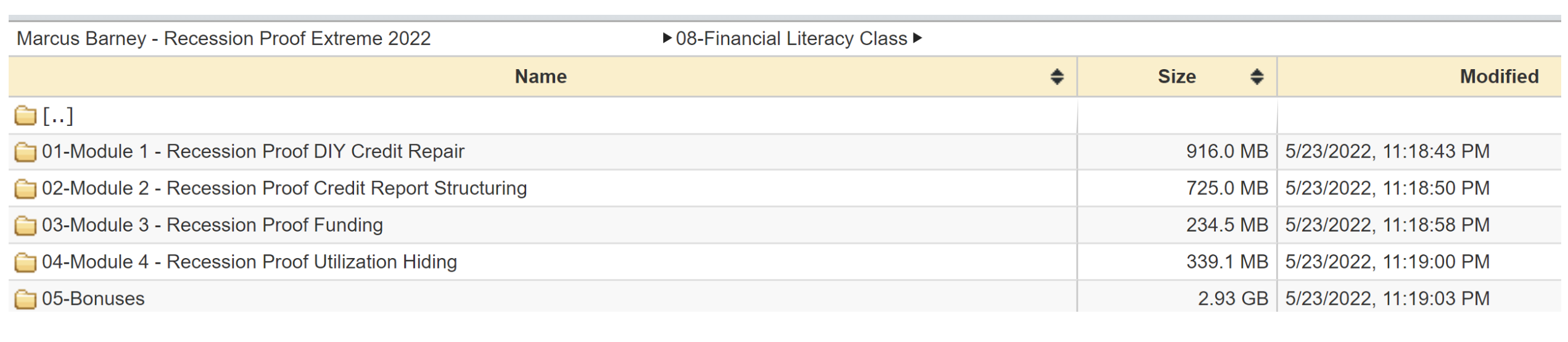

- Module 08: Financial Literacy Class

- Module 09: RPX Coaching Calls

- Module 10: Path to Prosperity

- Module 11: 2021 RP Conference – Miami, FL

- Module 12: Amplifier Calls

- Module 13: Launch Your Online Course

- Module 14: Facebook Ads Beginner Training

- Module 15: PushManMitch Exotic Rental Course

- Module 16: Scaling With Webinars

- Module 17: Freight Broker Course

- Module 18: Content Creation Master’s Course

- Module 19: Knotsdontfold Stock Options Course

- Module 20: 2020 Recession Proof Conference

- Module 21: 2019 Recession Proof Conference

The Recession Proof Extreme 2022 course covers various topics, from financial literacy and credit repair to business funding and luxury car hacks. With 21 comprehensive modules, students access a wealth of knowledge and resources to help them achieve their financial goals.

In addition to the core curriculum, the program includes valuable extras such as coaching calls, conference recordings, and supplementary courses on topics like Facebook ads, freight brokering, and stock options trading. Recession Proof Extreme 2022 equips students with the tools and strategies needed to succeed in any economic environment by providing a holistic approach to financial education.

Who is Marcus Barney?

Marcus Barney, also known as Him500, is a highly accomplished entrepreneur, financial literacy expert, and the founder and CEO of Recession Proof, a multi-million dollar financial education company. With a passion for empowering others to achieve financial success, Marcus has dedicated his career to providing individuals with the tools, strategies, and resources needed to navigate any economic climate.

Born and raised in Atlanta, Georgia, Marcus faced his share of challenges growing up. However, he refused to let his circumstances define him and focused on educating himself and developing a strong work ethic. Through perseverance and determination, Marcus built a successful career in the financial industry, working with top companies and gaining invaluable experience.

Recognizing the need for accessible financial education, particularly within the African American community, Marcus founded Recession Proof. His company has helped countless entrepreneurs and individuals improve their credit scores, secure business funding, and create multiple income streams. Marcus’s expertise has been sought after by major corporations and financial institutions, cementing his reputation as a leading industry authority.

In addition to his work with Recession Proof, Marcus is a sought-after speaker, coach, and mentor. He has shared the stage with renowned entrepreneurs and featured in numerous media outlets for his insights on financial literacy and wealth creation. Marcus’s commitment to giving back to his community is evident through his philanthropic endeavors and dedication to providing accessible financial education to those who need it most.

With a proven track record of success and a passion for helping others achieve financial freedom, Marcus Barney is a true visionary in economic education. His teachings have transformed the lives of countless individuals, and his legacy continues to inspire and empower aspiring entrepreneurs across the globe.

Be the first to review “Marcus Barney – Recession Proof Extreme 2022” Cancel reply

Related products

Business Credit

Business Credit

Business Credit

Business & Finance

Business Credit

Business Credit

Reviews

There are no reviews yet.