Karlton Dennis – Tax Strategy Crash Course

$497.00 Original price was: $497.00.$12.00Current price is: $12.00.

Karlton Dennis Tax Strategy Crash Course [Instant Download]

What is Karlton Dennis Tax Strategy Crash Course?

Karlton Dennis Tax Strategy Crash Course teaches you how to legally cut your taxes using proven strategies that most people don’t know.

You’ll learn to read tax returns, find hidden deductions, and understand tax forms that can save you thousands every year.

The course works for W-2 employees, 1099 contractors, and business owners who want to keep more of their money. Dennis has helped clients save over 8 figures in taxes, and now you can use the same strategies to build wealth through smart tax planning.

📚 PROOF OF COURSE

What you’ll learn in Tax Strategy Crash Course:

This complete tax training covers everything from basic forms to advanced business strategies. Here’s what you’ll learn:

- Tax form training: Learn to read and understand 1040, W-2, W-4, and advanced schedules that most people find confusing.

- Deduction strategies: Discover itemized deductions, medical expenses, and charitable contributions that can lower your taxes.

- Business tax planning: Master Schedule C, business income reporting, and entity structures like LLCs and corporations.

- Advanced tax forms: Understand C-Corporations, partnerships, and complex tax entities used by successful businesses.

- Inside tax returns: Learn what tax professionals see when they review your return and find missed opportunities.

- Legal tax reduction: Apply proven methods to cut your tax liability using strategies wealthy people use.

You’ll gain the same tax code knowledge that rich people use to protect their income. The course includes access to a Discord community where you can connect with other tax savers for ongoing support.

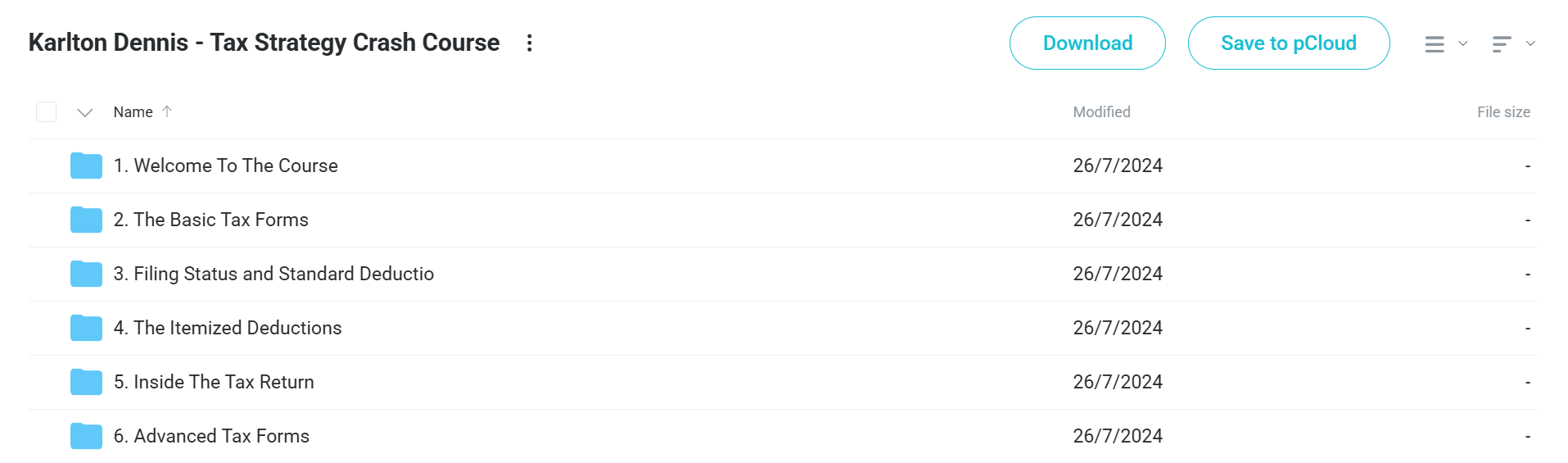

Tax Strategy Crash Course Course Curriculum:

✅ Module 1: Welcome To The Course

Students get a complete roadmap of the learning journey ahead and understand how each section builds on previous ideas. This introduction sets clear expectations and learning goals for mastering tax strategy basics.

The welcome session shows the hands-on approach used throughout the course, focusing on real-world examples over theory.

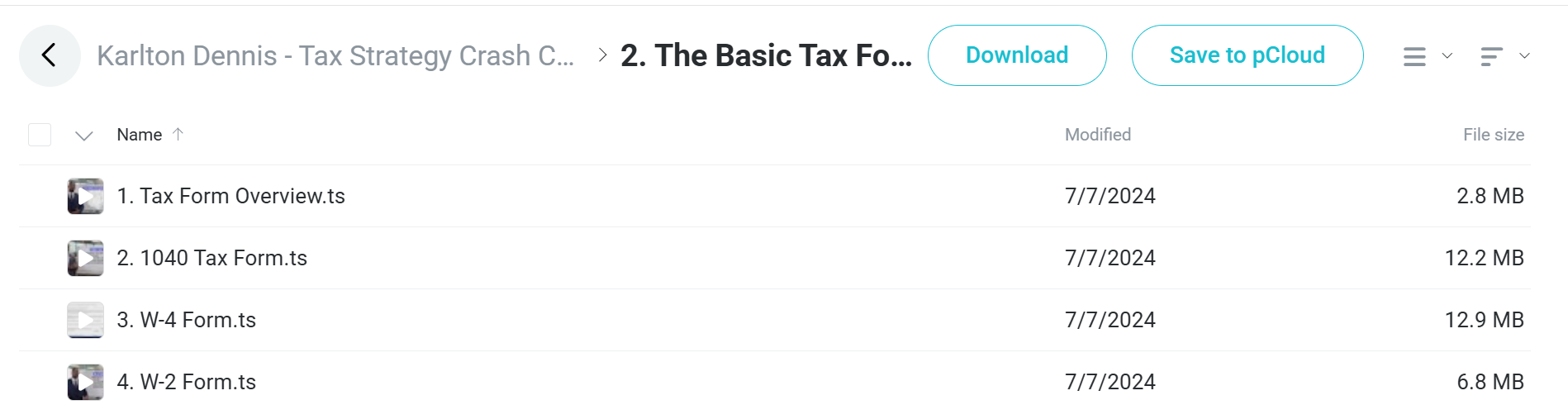

✅ Module 2: The Basic Tax Forms

Students master the four main tax documents that form the foundation of individual tax preparation. The module makes the scary Form 1040 easier by breaking it down into manageable parts and explaining what each line means.

Key areas include understanding how W-4 choices directly affect take-home pay and year-end tax bills. Students learn to read and check W-2 information for mistakes, making sure wages, withholdings, and benefits are reported correctly.

The Tax Form Overview gives a visual map showing how different forms connect within the bigger tax system.

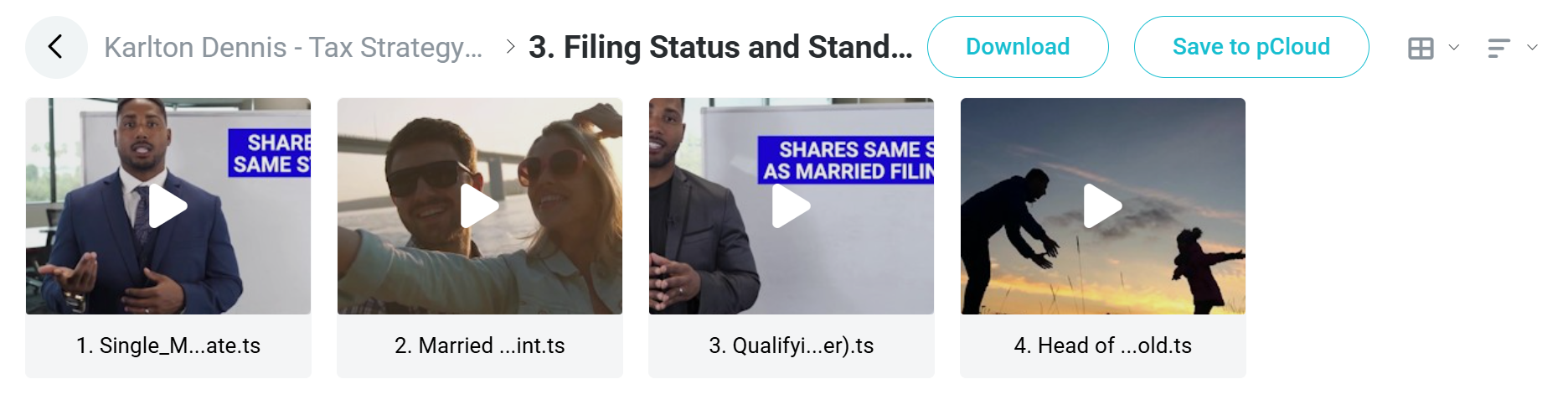

✅ Module 3: Filing Status and Standard Deduction

Students discover how choosing your filing status can greatly change your tax bill and available deductions. Each filing status gets detailed review with specific examples showing when each option saves the most tax money.

The Single and Married Filing Separate lessons show hidden benefits and possible problems of filing independently. Married Filing Joint coverage explores income averaging benefits and shared responsibility issues.

Advanced topics include Qualifying Widow(er) status requirements and the complex Head of Household rules, with focus on dependency tests and household support rules.

✅ Module 4: The Itemized Deductions

Students learn the smart decision-making process between standard and itemized deductions through detailed cost-benefit analysis. This module changes students from passive deduction-takers to active tax planners who optimize their deduction strategy.

Medical and Dental Expenses coverage includes often-missed deductible expenses and strategies for grouping medical costs in high-expense years. The SALT (State and Local Tax) Deductions lesson addresses the $10,000 limit and workaround strategies for high-tax states.

Charitable Contributions instruction covers valuation methods for non-cash donations and advanced giving strategies. The Mortgage Interest Deduction lesson explores home loan debt limits, home equity loan restrictions, and points deduction timing.

✅ Module 5: Inside The Tax Return

Students develop skills in completing and understanding the most common tax schedules that attach to Form 1040. This hands-on module provides practical experience with real-world tax situations across different income types.

Schedule A mastery helps students properly report and maximize itemized deductions while avoiding common mistakes. Schedule B coverage includes foreign account reporting requirements and the often-overlooked nominee income situations.

Schedule C turns students into confident business tax preparers, covering profit and loss reporting, business expense categories, and home office deduction calculations. Schedule D instruction makes capital gains taxation clear, including wash sale rules and tax-loss harvesting strategies.

Schedule E opens the world of passive income taxation, covering rental property depreciation, partnership distributions, and S-corporation pass-through items. Schedule F provides specialized knowledge for farm income reporting and farm-specific deductions.

✅ Module 6: Advanced Tax Forms

Students move up to advanced business entity taxation with focus on smart tax planning for different business structures. This advanced module prepares students for complex business tax situations and multi-entity taxation.

C-Corporation taxation covers double taxation ideas, reasonable pay requirements, and strategies for reducing corporate tax burden. Students learn accumulated earnings tax effects and timing strategies for distributions.

Partnership taxation instruction includes complex allocation methods, basis calculations, and the details of partnership distributions. Students master K-1 reporting requirements and understand how partnership income flows through to individual returns.

Who is Karlton Dennis?

Karlton Dennis is a top tax strategist and CEO of Tax Alchemy. He helps high-income earners and business owners cut their taxes legally. Dennis has saved clients over 8 figures through smart tax planning.

He graduated from Cal Poly San Luis Obispo in Kinesiology before becoming an entrepreneur. Dennis started in fitness and sales, then found his passion for tax strategy and wealth building.

Dennis joined his mother’s tax firm, Karla Dennis and Associates Inc. He used his business skills and tax knowledge to grow the family company into a leading tax advisory firm.

As a serial entrepreneur, Dennis built multiple businesses while becoming a top tax advisor. He speaks at major events and creates courses that teach people to build wealth through tax planning.

His clients include successful entrepreneurs like Charlie Chang, Hunter Ceroy, and Chad Wesley Smith. These clients have saved hundreds of thousands using Dennis’s tax strategies.

Be the first to review “Karlton Dennis – Tax Strategy Crash Course” Cancel reply

Related products

Property Management

Real Estate

Reviews

There are no reviews yet.