Surplus Recovery Sprint To Success

$497.00 Original price was: $497.00.$52.00Current price is: $52.00.

Surplus Recovery Sprint To Success Course [Instant Download]

What is Surplus Recovery Sprint To Success:

Surplus Recovery Sprint To Success is a course teaches you how to start a tax sale surplus recovery business. You’ll learn to find and claim unclaimed funds from property tax sales.

The course covers a proven 4-step process for surplus recovery. It includes an operations manual, video library, phone scripts, and legal documents.

Expert support helps you begin this profitable venture. The program suits both experienced real estate investors and newcomers, showing you how to earn money while helping others.

📚 PROOF OF COURSE

What you will learn in Surplus Recovery Sprint To Success:

The Surplus Recovery Sprint To Success course offers a complete package to launch your surplus recovery business. Here’s what you’ll gain:

- Master the 4-step process of surplus recovery through a detailed operations manual

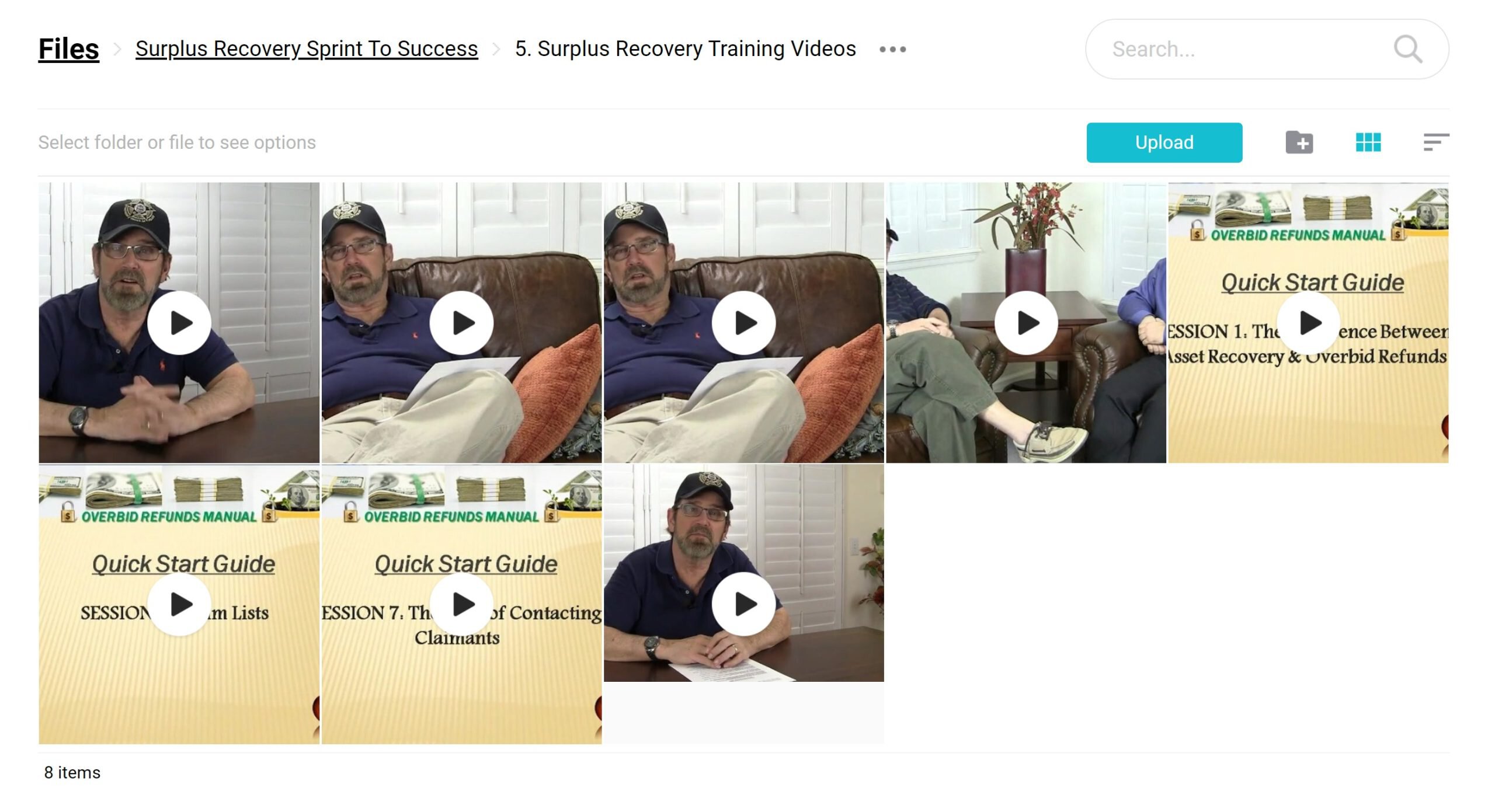

- Access a comprehensive video library for visual guidance on every step

- Learn effective communication with clients using provided phone scripts and recordings

- Utilize attorney-prepared legal document templates for all necessary agreements

- Receive unlimited email support from industry experts

- Discover how to find Surplus Lists for any U.S. county

- Get a customized, print-ready postcard template proven to be effective

- Obtain a custom company logo for branding across various mediums

- Benefit from 25 free skip traces done by the Surplus Recovery team

- Participate in a one-on-one custom strategy session (limited time offer)

- Launch your business with a credibility-boosting custom website

This course empowers you to tap into the billions of unclaimed funds, offering a unique opportunity in the world of real estate investing.

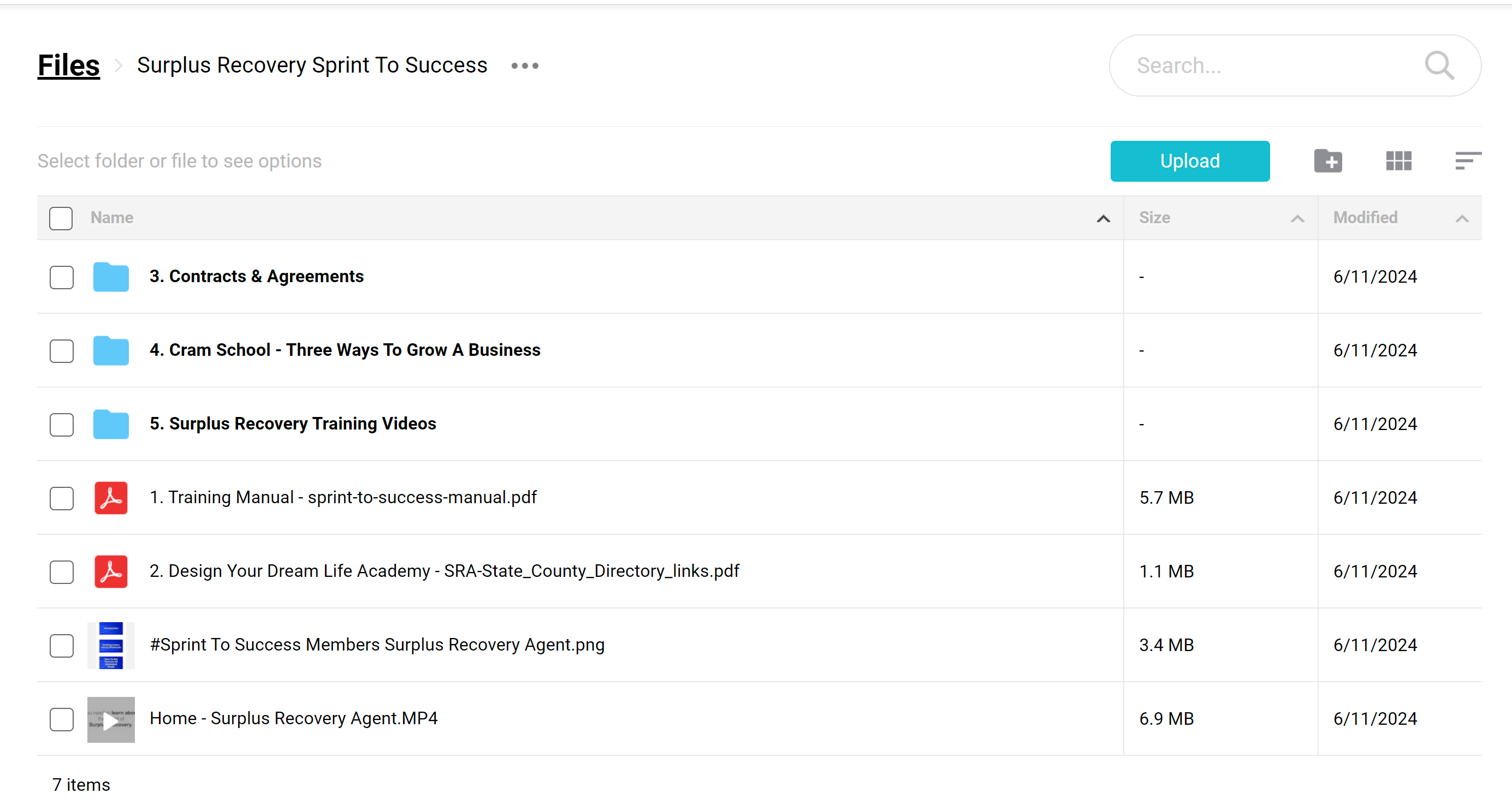

Surplus Recovery Sprint To Success Course Curriculum:

The Surplus Recovery Sprint To Success course curriculum is designed to provide comprehensive training in tax sale surplus recovery. It includes:

- Home – Surplus Recovery Agent.MP4

- Training Manual – Sprint To Success Manual (202 pages)

- Contracts & Agreements

- Cram School – Three Ways To Grow A Business

- Surplus Recovery Training Videos (8 Videos)

- Design Your Dream Life Academy – SRA-State County Directory Links (243 pages)

This curriculum offers a mix of theoretical knowledge and practical tools to help you establish and grow your surplus recovery business effectively.

4️⃣. Who is Surplus Recovery?

Surplus Recovery is a leading tax sale surplus recovery organization founded by Josh F. and Steve M. Josh F. has over 10 years of experience in the industry, ensuring successful outcomes for clients.

The company’s expert team stays current with legal changes in tax sale surplus recovery. They operate on a contingency basis, only charging fees upon successful fund recovery.

Surplus Recovery goes beyond fund recovery, offering training programs to help others enter this field. Their proven track record and expertise have established them as a trusted name in the industry.

The company aims to educate and empower individuals, enabling them to make a positive impact while building a profitable business in tax sale surplus recovery.

Be the first to review “Surplus Recovery Sprint To Success” Cancel reply

Related products

Real Estate

Property Management

Reviews

There are no reviews yet.