Jason Palliser – Tax Delinquent Blueprint 2022

$3,997.00 Original price was: $3,997.00.$19.00Current price is: $19.00.

Jason Palliser Tax Delinquent Blueprint 2022 Course [Instant Download]

What is Tax Delinquent Blueprint Course?

The Tax Delinquent Blueprint 2022 teaches proven strategies for finding and flipping tax delinquent properties while helping distressed homeowners resolve tax debt issues. This online training program is designed by Jason Palliser, a full-time real estate investor with over 20 years of experience.

Jason’s unique Tax Assistance program sets this course apart from the competition. By offering a solution to homeowners severely behind on their property taxes, investors can generate high response rates and create a win-win situation for both parties. The Tax Delinquent Blueprint 2022 provides a step-by-step process for implementing this strategy and securing profitable deals.

Throughout the course, Jason shares his expertise in marketing and lead generation, drawing from his experience of buying and selling properties in 138 cities. With the right approach, investors can decrease their marketing budget and achieve better results by targeting the right audience with the most effective messaging.

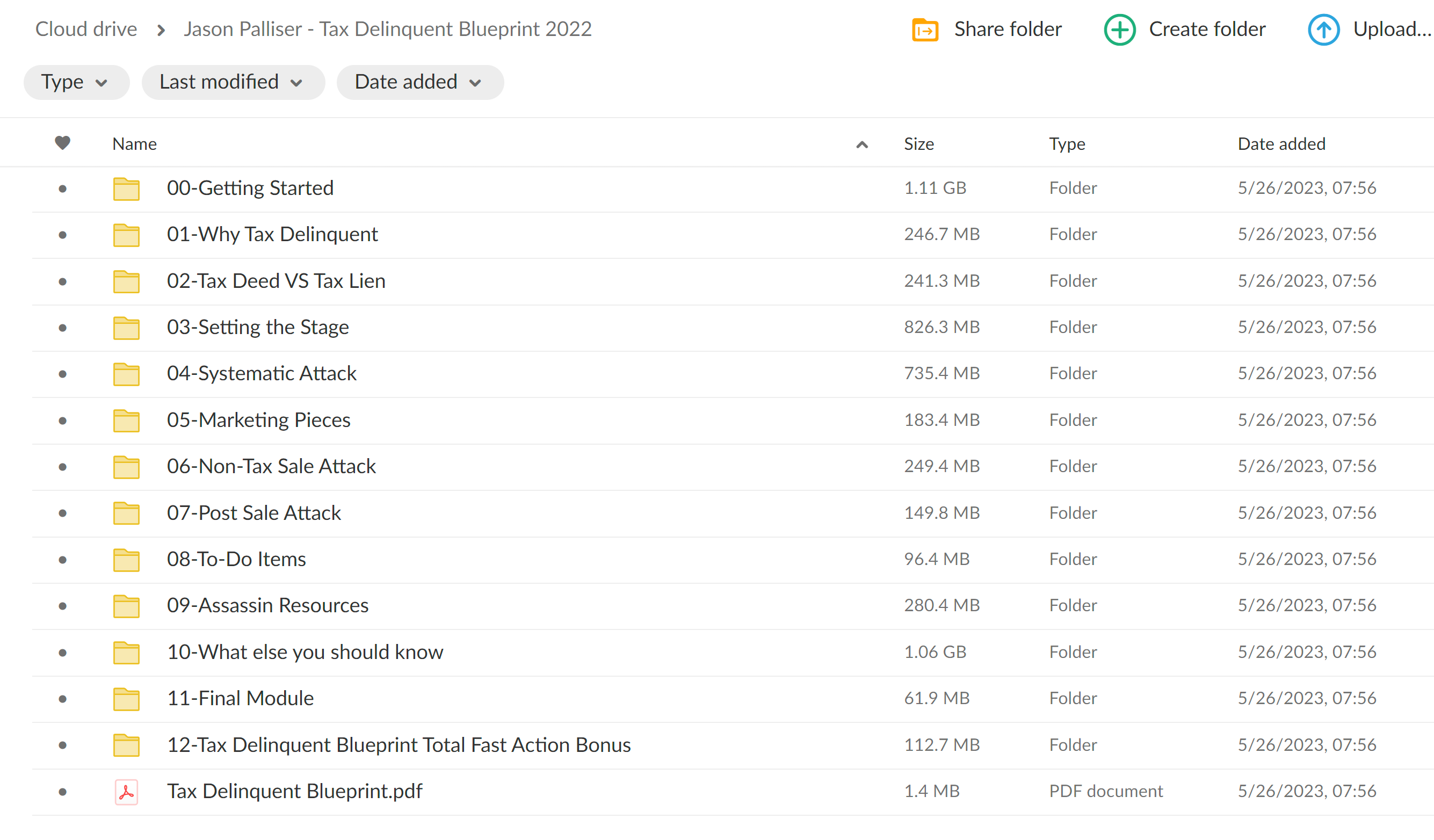

📚 PROOF OF COURSE [Size 5.28 GB]

What you will learn in Tax Delinquent Blueprint 2022:

In the Tax Delinquent Blueprint 2022, you’ll gain valuable insights and practical skills to succeed in tax delinquent real estate investing. Here’s what you can expect to learn:

- Proven strategies for finding and flipping tax delinquent properties

- How to implement a Tax Assistance program to help distressed homeowners

- Techniques to beat out the competition and generate high response rates

- List stacking methods to refine your target audience and reduce marketing costs

- Effective direct mail marketing pieces that attract motivated sellers

- Case studies demonstrating successful wholesale deals and profits

- Virtual wholesaling strategies to invest in multiple markets

By the end of this course, you’ll be equipped with the knowledge and tools necessary to confidently navigate the world of tax delinquent real estate investing and build a profitable business.

Tax Delinquent Blueprint 2022 Course Curriculum:

Getting Started

- Welcome to the Tax Delinquent Blueprint (20:58)

- Stay on track (9:31)

- $37,000 Wholesale Profit – Case Study (23:21)

- $62,000 on one deal – Case Study (24:35)

- $7,000 in one hour – Case Study (17:29)

- TDB Getting Started Checklist

Lesson 1: Why Tax Delinquent

- Lesson 1: Why Tax Delinquent (15:15)

Lesson 2: Tax Deed VS Tax Lien

- Lesson 2: Tax Deed VS Tax Lien (15:01)

- Lesson 2 Downloads

Lesson 3: Setting the Stage

- Lesson 3: Setting the Stage (32:10)

- Lesson 3: Calling the county (17:38)

- Lesson 3: Downloads (1:05)

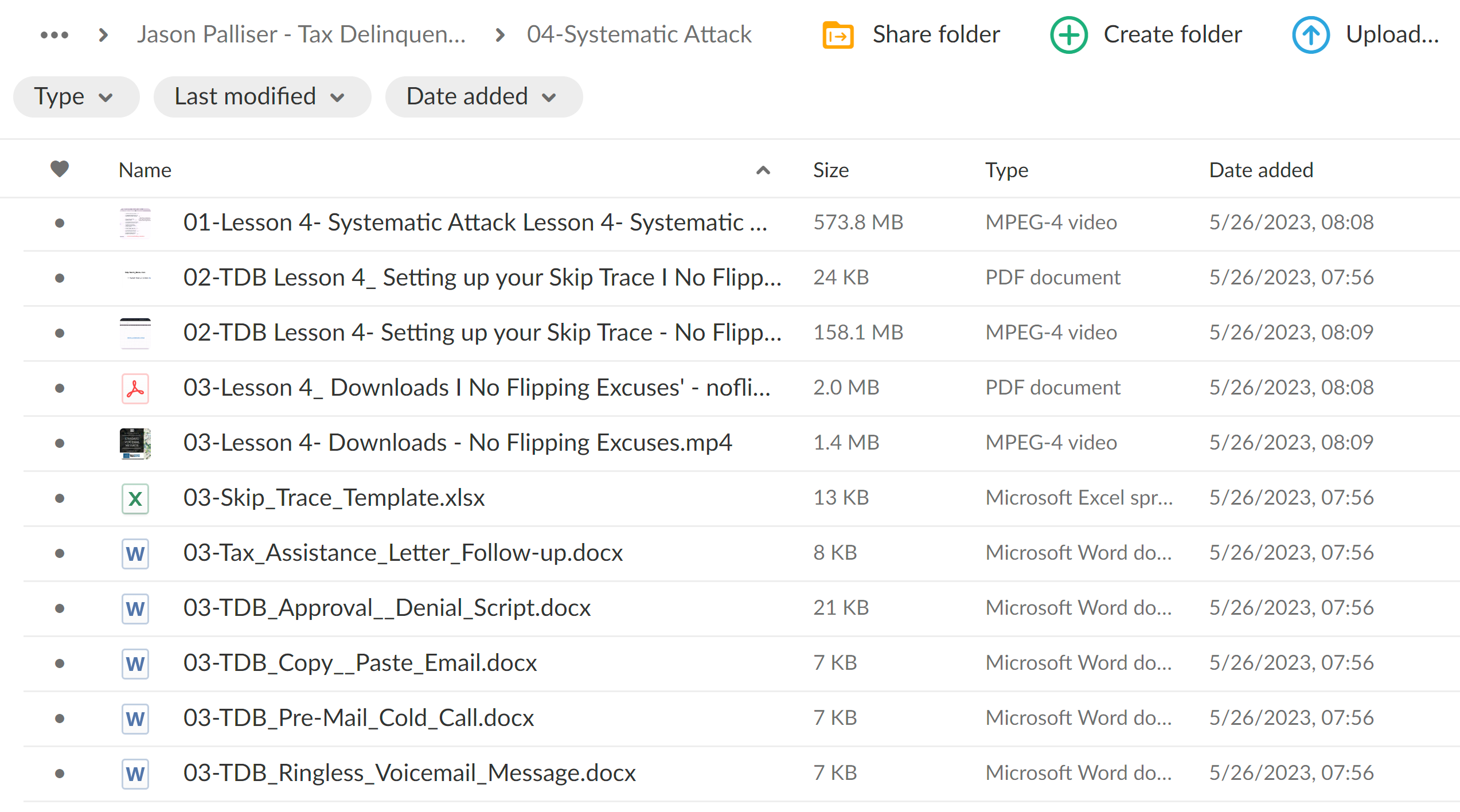

Lesson 4: Systematic Attack

- Lesson 4: Systematic Attack (55:00)

- TDB Lesson 4: Setting up your Skip Trace (9:48)

- Lesson 4: Downloads (0:29)

Lesson 5: Marketing Pieces

- Lesson 5: Marketing Pieces (33:13)

- Lesson 5: Downloads (6:39)

Lesson 6: Non-Tax Sale Attack

- Lesson 6: Non-Tax Sale Attack (14:44)

Lesson 7: Pre-Tax Attack (Out of Time)

- Lesson 7: Pre-Tax Attack (Out of Time) (13:45)

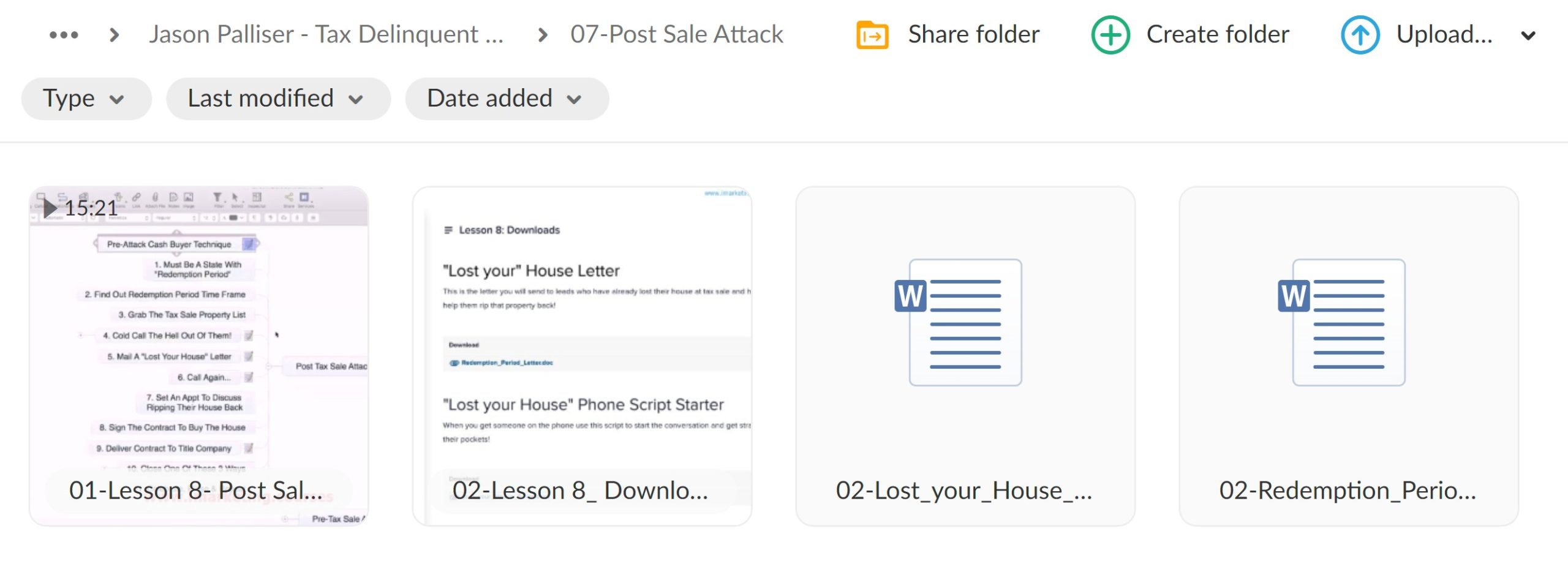

Lesson 8: Post Sale Attack

- Lesson 8: Post Sale Attack (15:21)

- Lesson 8: Downloads

Lesson 9: To-Do Items

- Lesson 9: To-Do Items (10:02)

Lesson 10: Assassin Resources

- Lesson 10: Assassin Resources (8:03)

- Lesson 10: Setting up Ringless Voicemail (14:07)

- Lesson 10: Google Voice (16:07)

Lesson 11: What else you should know

- Lesson 11: Acronyms (4:50)

- Lesson 11: Exit Strategies (29:19)

- Lesson 11: Contract Downloads

- Lesson 11: Virtually Wholesaling (86:21)

- Tax Delinquent Blueprint Final Exam

- Congratulations and next steps (5:17)

Who is Jason Palliser?

Jason Palliser is a highly accomplished full-time real estate investor with over 20 years of experience in the industry. As a hedge fund acquisition consultant, he has bought and sold properties in an impressive 138 cities, demonstrating his extensive knowledge and expertise in the field. Jason is widely recognized as the nation’s leading expert in marketing and lead generation for real estate investing.

In addition to his successful investing career, Jason has made significant contributions to the real estate community. He built and sold REI BlackBook, a real estate automation company that provides systems and marketing solutions for investors. This venture showcases Jason’s entrepreneurial spirit and his ability to create innovative tools that benefit the industry.

Throughout his career, Jason has closed over 3,200 investment transactions, a testament to his skill, dedication, and understanding of the real estate market. His vast experience and proven track record make him an invaluable resource for both new and experienced investors looking to excel in the world of tax delinquent real estate investing.

2 reviews for Jason Palliser – Tax Delinquent Blueprint 2022

Add a review Cancel reply

Related products

Real Estate

Investment Management

Dave Van Horn – Wealth Building with Defaulted 2nd Mortgages

Real Estate

Real Estate

Real Estate

Commercial Real Estate

remo (verified owner) –

affordable and efficient… would definitely buy other products from CourseHuge

Trinton C. (verified owner) –

Great