Hooked on Overages – Rick Dawson & Bob Diamond

$497.00 Original price was: $497.00.$48.00Current price is: $48.00.

Hooked on Overages Course by Rick Dawson & Bob Diamond [Instant Download]

📚 PROOF OF COURSE

What is Hooked on Overages Course:

The Hooked on Overages course, led by experts Rick Dawson & Bob Diamond, offers a unique journey into the world of tax sale overages.

This course gives you the knowledge and tools to navigate and profit from unclaimed tax sale funds. It’s more than just a real estate course; it’s a comprehensive guide to understanding and leveraging the intricacies of tax lien overages.

By focusing on practical strategies and real-world applications, this course aims to resolve common challenges faced in the real estate market, offering a path to success and financial growth.

What you will learn in Hooked on Overages course:

- Understanding Tax Sale Overages: Grasp the basics of tax lien overages and their role in real estate.

- Legal Frameworks and Compliance: Navigate the legalities and ensure full compliance in claiming overages.

- Effective Strategies: Learn proven methods for identifying and claiming unclaimed tax sale funds.

- Real-World Applications: Apply your knowledge in practical scenarios to maximize your success.

- Risk Management: Understand how to minimize risks and maximize returns in the overage business.

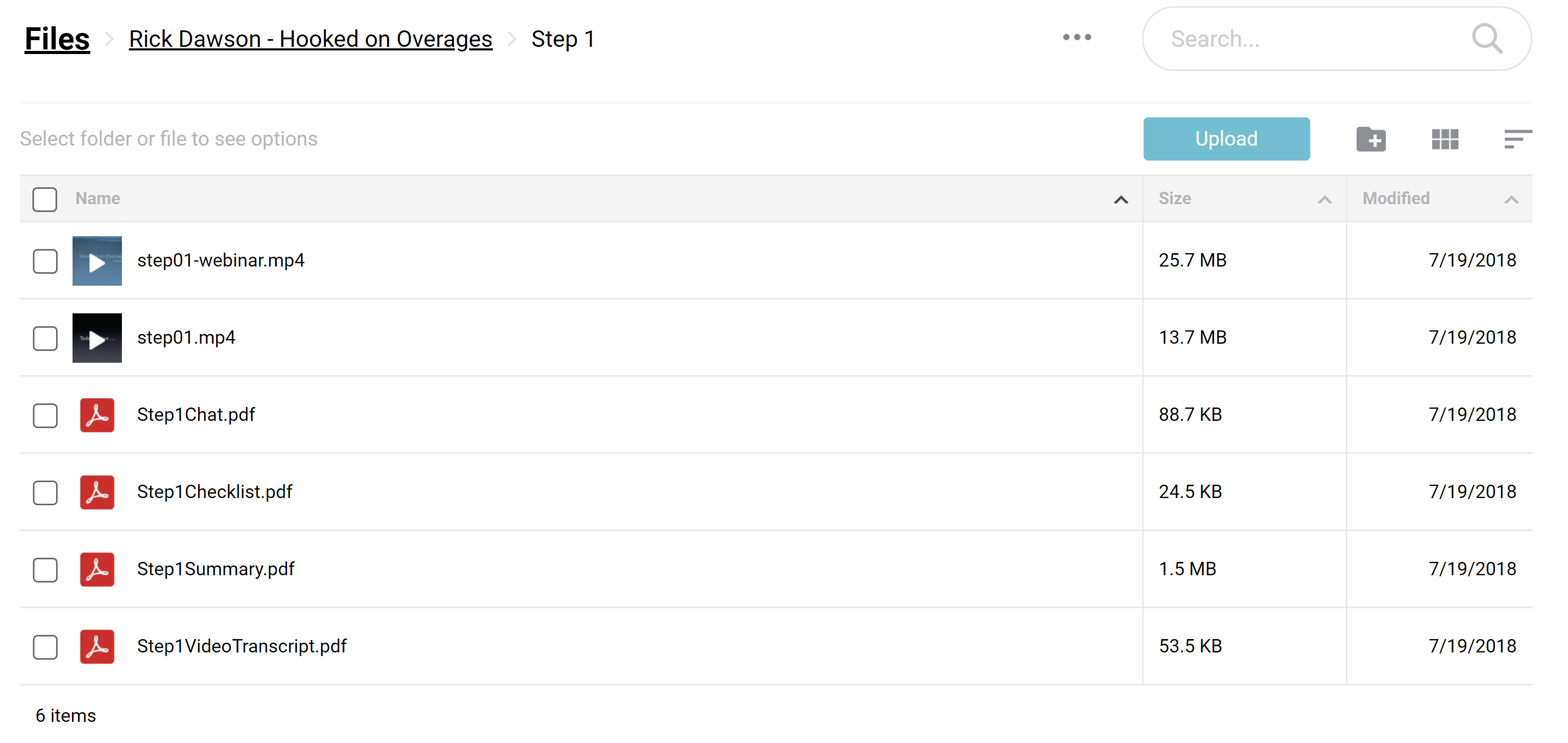

Hooked on Overages Course curriculum:

Module #1: FOUND MONEY

Discover the world of unclaimed tax sale overages. Learn how these funds accumulate at county treasurers’ offices and how regularly scheduled tax sales continuously create new overage opportunities.

Module #2: GETTING LEGAL

Understand the legalities of the found money game. This module answers key questions about overages, legal limitations, and licensing requirements.

Module #3: THE LIST

Master the art of acquiring lists of unclaimed tax sale overages. Learn professional tactics for obtaining these lists and how to effectively handle rejections.

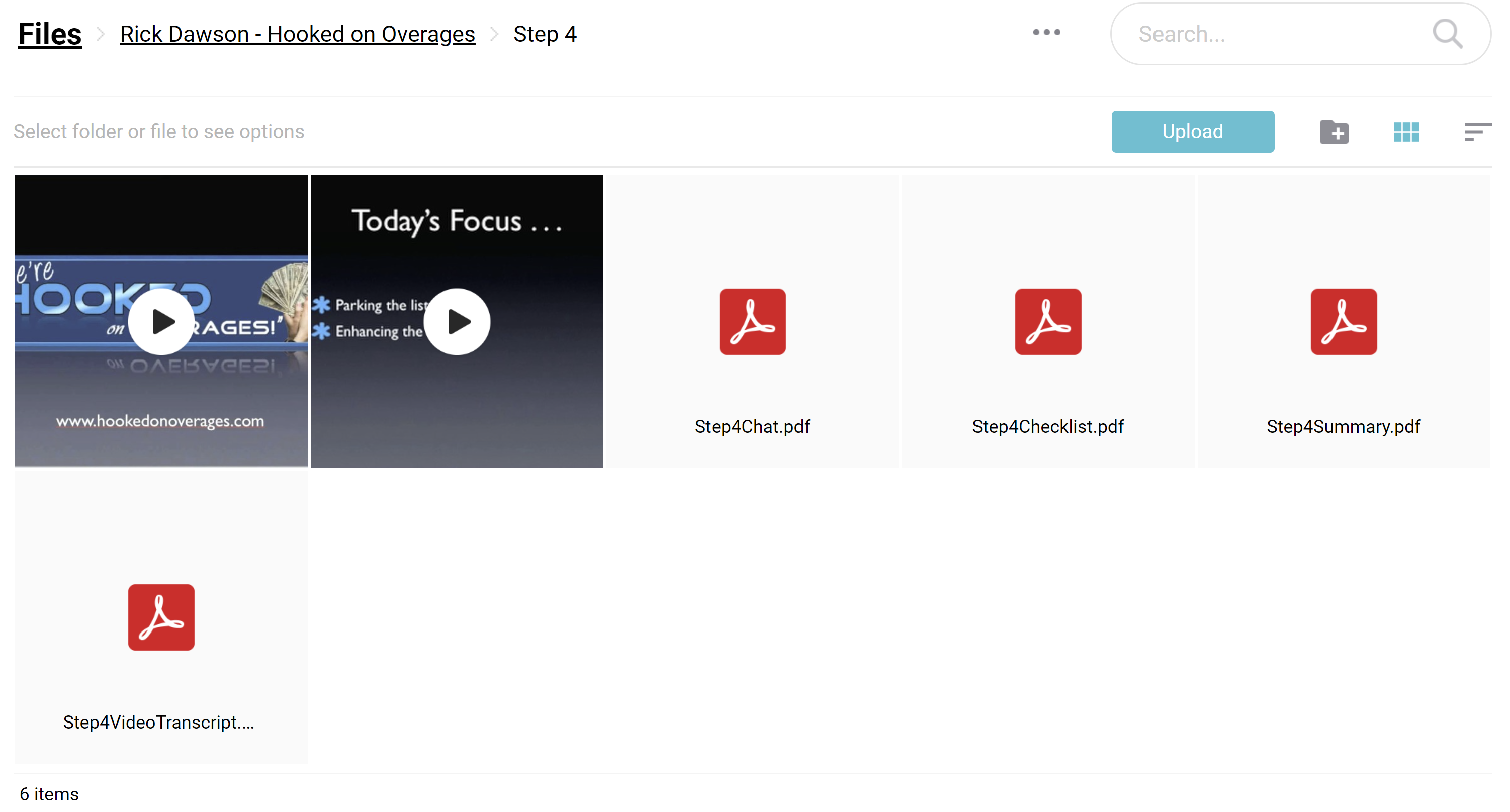

Module #4: LIST STRATEGIES

Tackle the challenge of managing a flood of information from unclaimed tax sale overages. Explore how to use online customer relationship tools to stay organized.

Module #5: CRUSHING THE LIST

Learn the right approach to working through your list of claims, avoiding common mistakes, and focusing on the most promising claims.

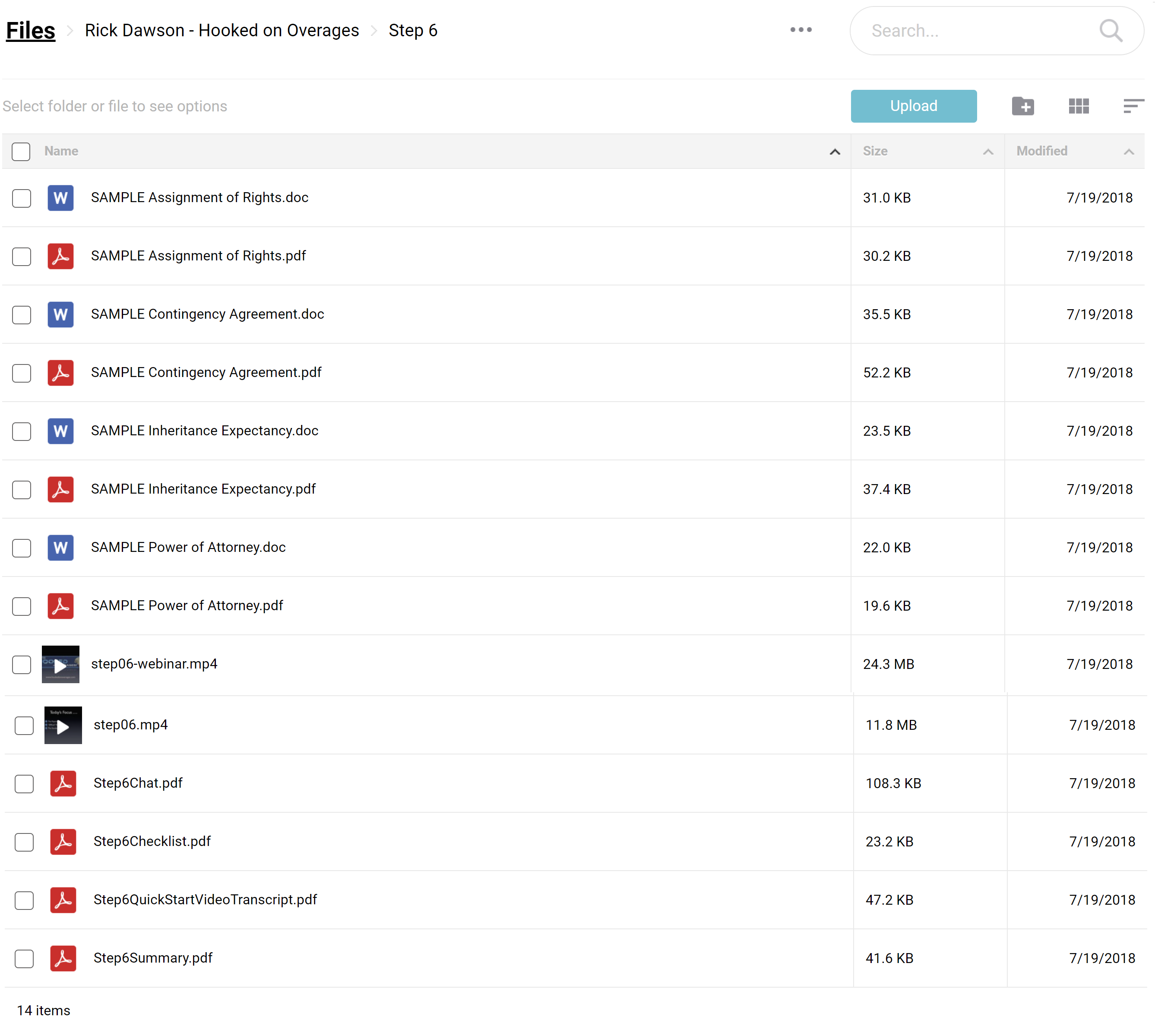

Module #6: DOC’D UP

Gain access to essential documents and learn how they interplay to facilitate successful recovery of tax sale overages.

Module #7: INSTANT “CRED”

Build and maintain credibility in the overage business. This module provides a checklist to ensure you’re perceived as a trustworthy professional.

Module #8: THE HUNT

Develop skills in tracking down claimants using both paid and free online services, and learn the most effective ways to use these tools.

Module #9: SHOULDER TAPPING

Understand the nuances of making the first contact with claimants, exploring various communication methods and their unique aspects.

Module #10: “MAGIC WORDS”

Learn the exact words to use during initial phone calls to claimants to ensure successful claim recovery.

Module #11: CLAIMS CITY, USA

Focus on claim processing, a critical aspect of the business. Learn how to get claims signed up and approved efficiently.

Module #12: READY, FIRE, AIM

Finalize your preparation for entering the overage business, emphasizing the importance of action over perfection.

Additional Resources:

- The “27 Day” QuickStart Guide

- 12 Comprehensive Training Modules

- Bonus Videos

- Access to a Private “Member’s Only” Website

- Guides to Overage Laws and Public Records across 50 States

- Real Telephone Scripts

- Professional Marketing Letters and Email Templates

- Comprehensive Documentation

This curriculum provides a detailed and structured approach to mastering the tax sale overage business.

Who is Rick Dawson & Bob Diamond?

Rick Dawson and Bob Diamond are distinguished figures in the real estate and financial sectors, known for their expertise in tax sale overages and wealth management.

Rick Dawson deeply understands tax liens and tax deeds, focusing on the niche area of “Overages.” His strategic insights have been instrumental in transforming tax sale auction approaches.

Bob Diamond, recognized as one of the top Wealth Managers in Chicagoland by Chicago Magazine in November 2010, brings a wealth of financial and estate planning knowledge. Since 1995, he has provided solutions for the self-employed and small business owners. His firm, Diamond Financial Services, Inc., is known for helping individuals and businesses pursue their financial goals. The firm offers various financial products and services, emphasizing sound financial solutions to help clients achieve their objectives.

CFD Investments, Inc., a Registered Broker/Dealer and a member of FINRA & SIPC, offers securities. Diamond Financial Services, Inc. is not owned or controlled by the CFD Companies.

Rick and Bob have developed the “Hooked on Overages” course, combining their real estate acumen and financial expertise. This course is a comprehensive guide to understanding and leveraging tax sale overages for beginners and experienced investors. Their holistic approach covers every aspect of the business, from legal compliance to effective wealth management strategies.

Their contribution to the real estate investment community has been significant, with many students successfully navigating the complexities of tax sale overages under their guidance.

2️⃣. Who is this course for?

- Aspiring Real Estate Investors: Ideal for individuals looking to enter the real estate market with a unique investment strategy.

- Experienced Investors: Perfect for seasoned investors seeking to diversify their portfolio and explore new avenues in real estate.

- Legal Professionals: Lawyers or legal consultants interested in understanding the legal aspects of tax sale overages.

- Financial Advisors: Professionals advising clients on investment opportunities, especially in real estate and tax-related fields.

- Entrepreneurs: Business-minded individuals looking for innovative ways to generate income in the real estate sector.

4 reviews for Hooked on Overages – Rick Dawson & Bob Diamond

Add a review Cancel reply

Related products

Real Estate

Real Estate

Real Estate

Real Estate

Real Estate

Anonymous (verified owner) –

Just what I was looking for!

Brian (verified owner) –

awesome

Sarah T. (verified owner) –

Content is amazing!

David Kerr (verified owner) –

Audio on first webinar is bad