George Antone – The Bankers Code Home Study

$997.00 Original price was: $997.00.$14.00Current price is: $14.00.

George Antone The Bankers Code Home Study Course [Instant Download]

What is George Antone The Bankers Code Home Study?

George Antone The Bankers Code Home Study is a course that teaches you how to become a private lender and create passive income using banking strategies.

The course shows the exact methods banks use to create wealth and shows you how to use these same strategies with your own money.

You’ll learn how to start lending money like a bank, earning interest and building cash flow without the usual risks of stocks or real estate.

This step-by-step program focuses on changing you from a regular investor into a private lender using your self-directed IRA or 401(k). It teaches the basic banking mindset that allows you to reduce risk while maximizing returns through smart lending practices.

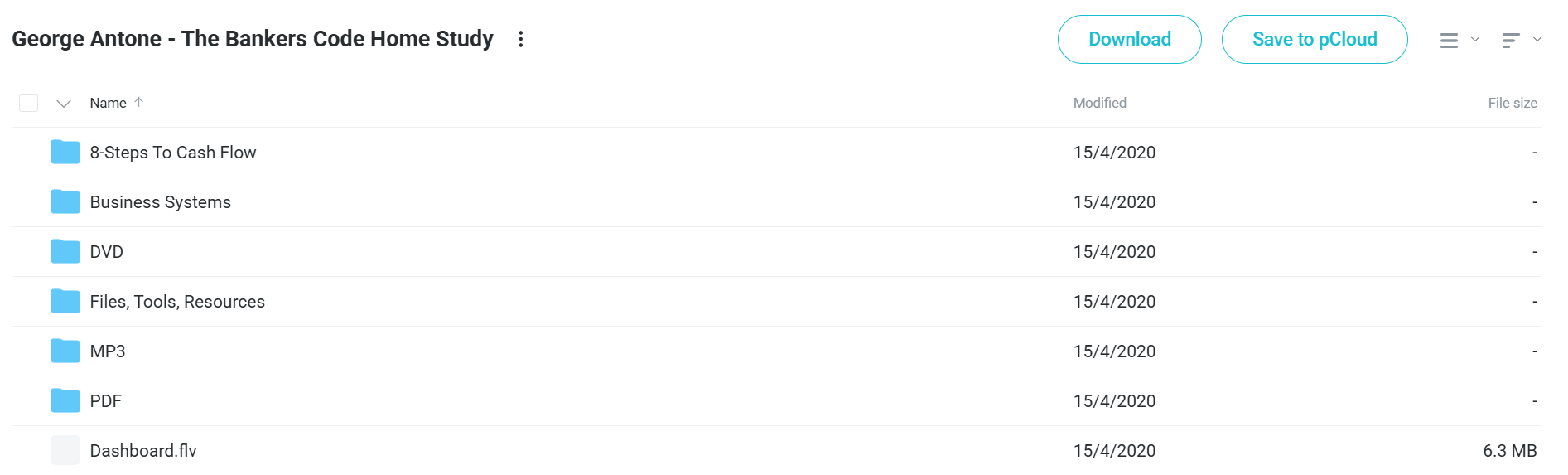

📚 PROOF OF COURSE

What you’ll learn in The Bankers Code Home Study Course:

This complete program teaches you private lending and banking strategies to build lasting wealth. Here’s what you’ll learn:

- Banking mindset: Master how bankers think differently and adopt their wealth-building approach

- Private lending fundamentals: Learn to participate in private lending and generate steady passive income

- Risk reduction: Follow 7 key rules to minimize risk while maximizing returns

- Team building: Identify the 5 critical people needed for your private lending success

- Income generation: Discover 3 essential activities that let you create money on demand

- Wealth strategies: Use powerful wealth building strategies that bankers have used for centuries

After completing this course, you’ll have all the tools and knowledge to start your private lending business and create lasting passive income.

The Bankers Code Home Study Course Curriculum:

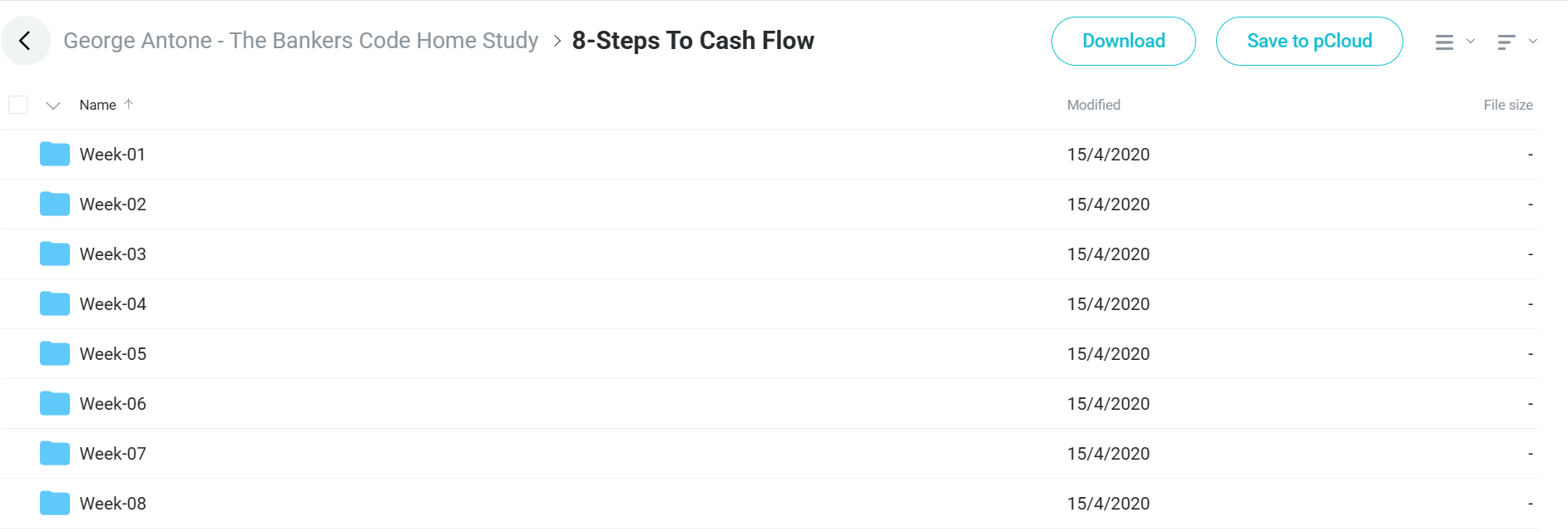

✅ 8-Steps To Cash Flow (Main Program)

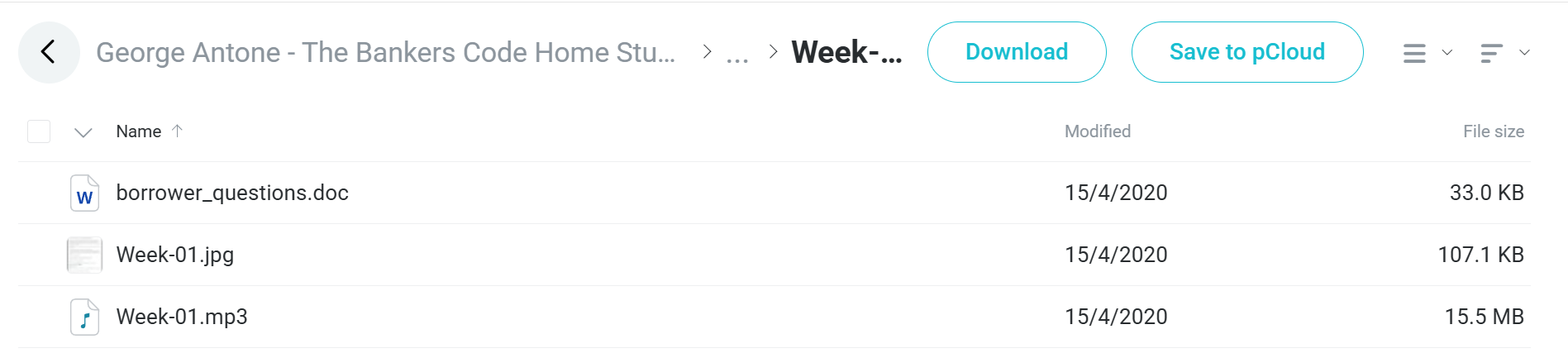

Week 1 – Foundation and Borrower Relationships This introductory week establishes the core principles of the banking model and how to identify qualified borrowers. Students learn essential questions to ask potential borrowers and understand the fundamental differences between traditional lending and private money lending. The module sets the groundwork for building a sustainable lending business.

Week 2 – System Implementation Week 2 focuses on establishing your lending infrastructure and operational systems. Students begin implementing the practical aspects of running a private lending business, though the content appears lighter, suggesting this is primarily a transitional week preparing for more intensive material.

Week 3 – Hard Money Lending Mastery This pivotal week dives deep into hard money lending strategies with extensive resources including HML questions, broker directories, and process flowcharts. Students master the art of working with hard money brokers and understanding the complete lending ecosystem. The bonus call provides additional insights into advanced lending techniques.

Week 4 – Marketing and Lead Generation Students learn to attract borrowers through strategic Craigslist advertising and other marketing channels. The module includes sample ads, posting strategies, and scripts for responding to borrower inquiries. This week transforms students from passive learners to active marketers generating real lending opportunities.

Week 5 – Capital Sources and Funding This crucial week reveals various sources of funding for your lending operations. Students discover how to leverage other people’s money (OPM) to scale their lending business without using personal capital. The module demystifies capital raising and provides actionable strategies for funding deals.

Week 6 – Deal Processing and Documentation Week 6 covers the technical aspects of processing loans, including preliminary title reports, escrow procedures, and proper documentation. Students learn to navigate the closing process professionally while protecting their interests. The module ensures students can execute deals with confidence and legal compliance.

Week 7 – Closing and Completion This week focuses on successfully closing loans and managing the final stages of transactions. Students master the art of deal completion, ensuring smooth closings and satisfied borrowers. The module emphasizes best practices for maintaining professional relationships post-closing.

Week 8 – Advanced Strategies and Scaling The final week synthesizes all previous learning into a cohesive business model. Students learn to scale their operations, implement advanced strategies, and build a sustainable lending empire. This culminating module transforms students from beginners to confident private lenders.

✅ Business Systems Module

Finance Systems This section teaches students to implement professional financial tracking and reporting systems. Students learn to manage cash flow, track ROI, and maintain accurate financial records essential for a lending business. The module ensures students can make data-driven decisions about their lending portfolio.

Management and KPIs Students discover how to track key performance indicators (KPIs) specific to private lending. The module provides worksheets and tools for monitoring business health, measuring success metrics, and identifying areas for improvement. This systematic approach ensures sustainable business growth.

Marketing and Sales Automation This comprehensive section covers automated marketing systems including email autoresponders and sales funnels. Students learn to create passive lead generation systems that continuously attract qualified borrowers. The module emphasizes efficiency through automation while maintaining personal touch points.

Operations Infrastructure The operations module provides complete organizational systems including filing structures, loan tracking spreadsheets, and operational checklists. Students receive templates for organizing their business professionally from day one. This infrastructure supports scalable growth without operational chaos.

Team Building Students learn when and how to build a support team for their lending business. The module covers hiring strategies, delegation principles, and team management specific to private lending operations. This prepares students for inevitable business expansion.

DVD Training Series The 10-part DVD series provides visual learning experiences covering all aspects of The Bankers Code system. Each DVD builds upon previous content, offering case studies, live examples, and detailed walkthroughs of complex concepts. This multimedia approach reinforces key principles through different learning modalities.

Audio Training Library The extensive MP3 collection includes 13 CD sets plus bonus materials like “The Bankers Code Live 3 Day” event recordings. Students can absorb content during commutes or workouts, maximizing learning efficiency. The audio format allows for repeated exposure to critical concepts, enhancing retention and implementation.

✅ Tools and Resources Section

Getting Started Resources This foundational toolkit provides immediate action items including Craigslist best practices and typical capital-raising conversations. Students receive proven templates and scripts to begin implementation immediately. The resources eliminate guesswork and accelerate initial success.

Financial Calculators and Tools Students access professional-grade calculators for leverage analysis, LTV calculations, mortgage payments, and yield computations. These tools enable accurate deal analysis and professional presentations to borrowers and investors. The calculators ensure profitable decision-making on every transaction.

Legal Documents Library The comprehensive document collection includes deed templates, trust documents, escrow instructions, and various note formats. Students receive professionally drafted templates adaptable to different lending scenarios. This legal foundation protects students while streamlining transaction processing.

PDF Resources

The manual and supplementary PDFs provide written reinforcement of audio/video content. “Secrets To Building Massive Cash Flow” and “The Bank Replacement Report” offer additional strategies and market insights. These resources serve as permanent reference materials for ongoing business operations.

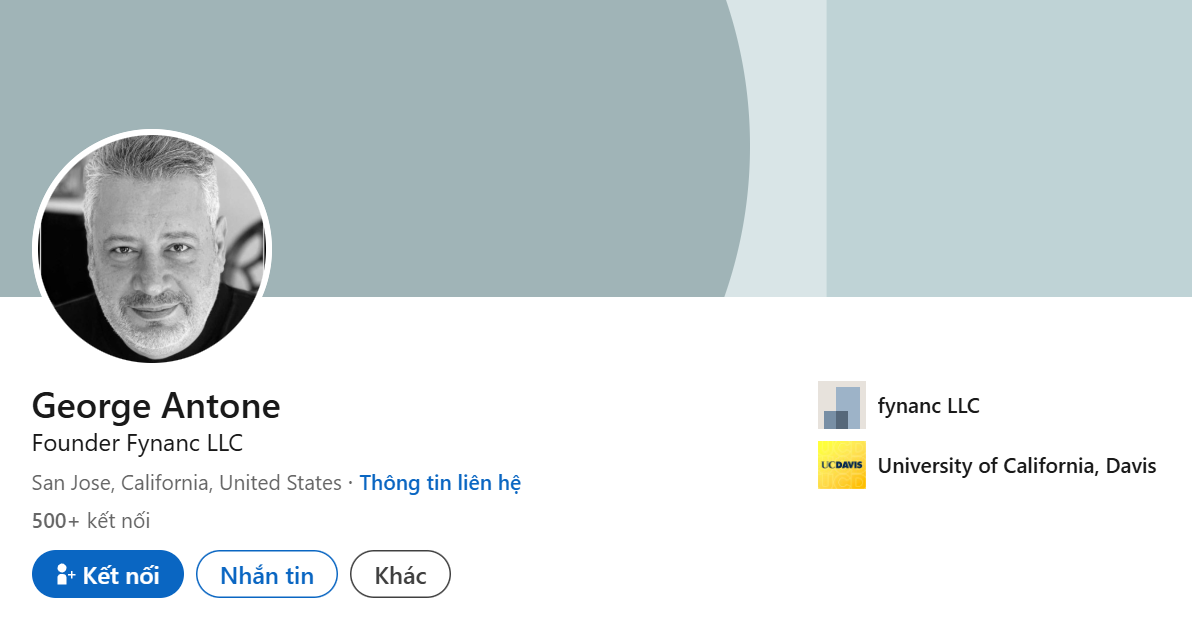

Who is George Antone?

George Antone is a financial educator and bestselling author specializing in wealth-building through private lending. He founded Wealth Classes LLC and created The Banker’s Code methodology.

Antone wrote “The Banker’s Code: The Most Powerful Wealth-Building Strategies Finally Revealed,” which explains banking practices in simple terms. His work teaches people to think like bankers and create passive income through private lending.

With years of experience, Antone developed training programs that turn complex banking concepts into practical strategies. He shows people how to use self-directed IRAs and 401(k)s to build lending businesses.

Through his courses and books, Antone has helped thousands understand how banks make money and use these same strategies. His practical approach makes banking concepts easy to understand for all investors.

Be the first to review “George Antone – The Bankers Code Home Study” Cancel reply

Related products

Business Credit

Business Credit

Business Credit

Business Credit

Business Credit

Business & Finance

Business & Finance

Business Credit

Reviews

There are no reviews yet.