Freedom Team Trading – Financial Freedom Mastery Course

$297.00 Original price was: $297.00.$12.00Current price is: $12.00.

Freedom Team Trading Financial Freedom Mastery Course [Instant Download]

What is Freedom Team Trading Financial Freedom Mastery?

Financial Freedom Mastery is a trading course by Freedom Team Trading. It teaches advanced strategies to help you make money in the market.

The comprehensive program covers day trading, swing trading, and institutional-level analytical techniques using volume profile and price action.

Jordan F. leads this course. It helps struggling traders become disciplined professionals. The course uses proven trading systems and advanced options strategies.

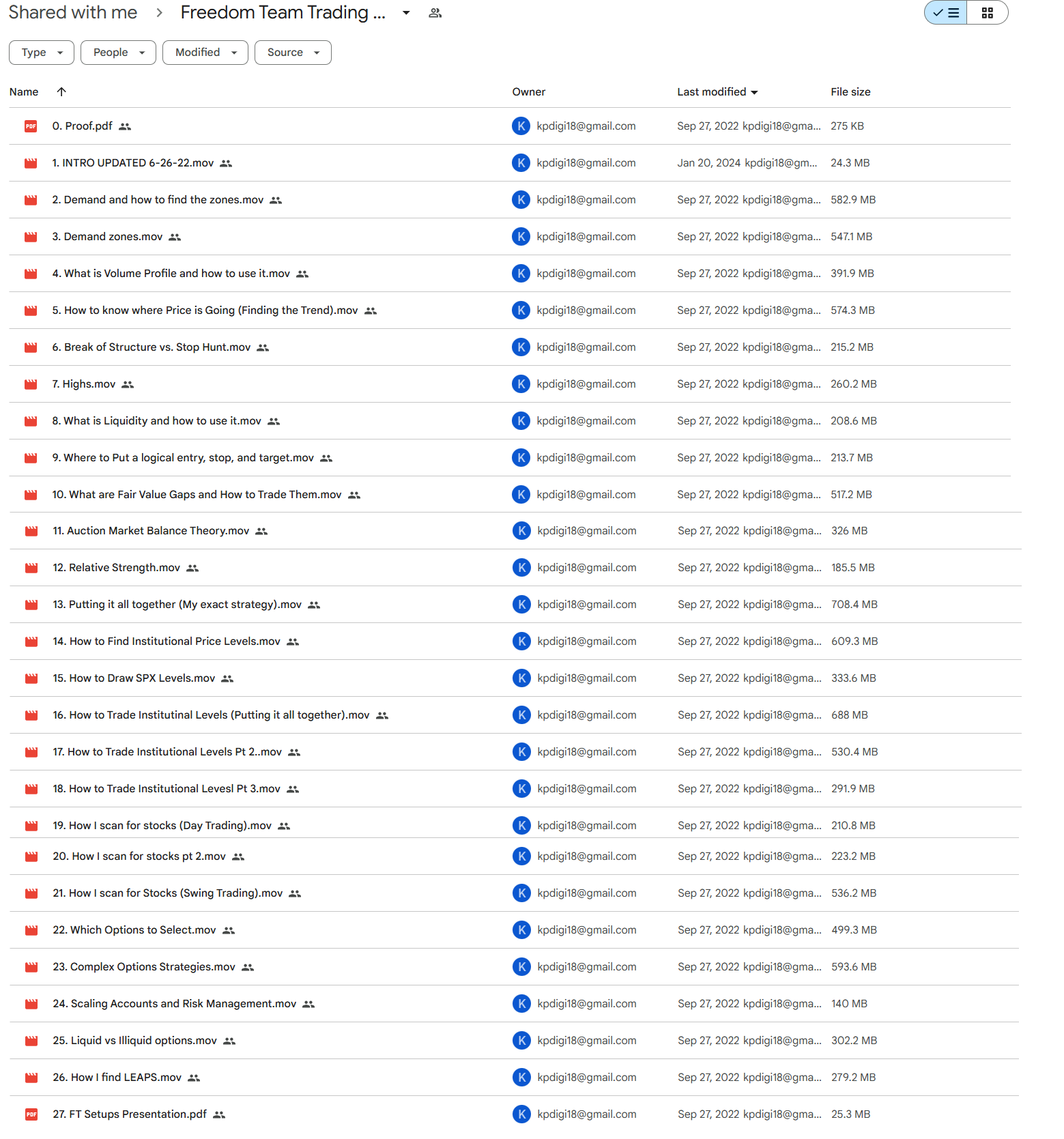

📚 PROOF OF COURSE

What you’ll learn in Financial Freedom Mastery:

The Financial Freedom Mastery Course teaches you how to trade profitably in any market condition. Here’s what you’ll learn:

- Market Analysis: Learn volume profile and how institutional traders read price levels

- Trading Strategies: Master day and swing trading with clear entry and exit rules

- Options Trading: Learn profitable options strategies and long-term LEAPS trading

- Risk Control: Learn how to grow your account safely and size your positions right

- Chart Reading: Master demand zones and how to spot market reversals

- Trade Finding: Use our exact scanner settings to find the best trading opportunities

You’ll learn through real trading examples that show you exactly how to apply these strategies in live markets.

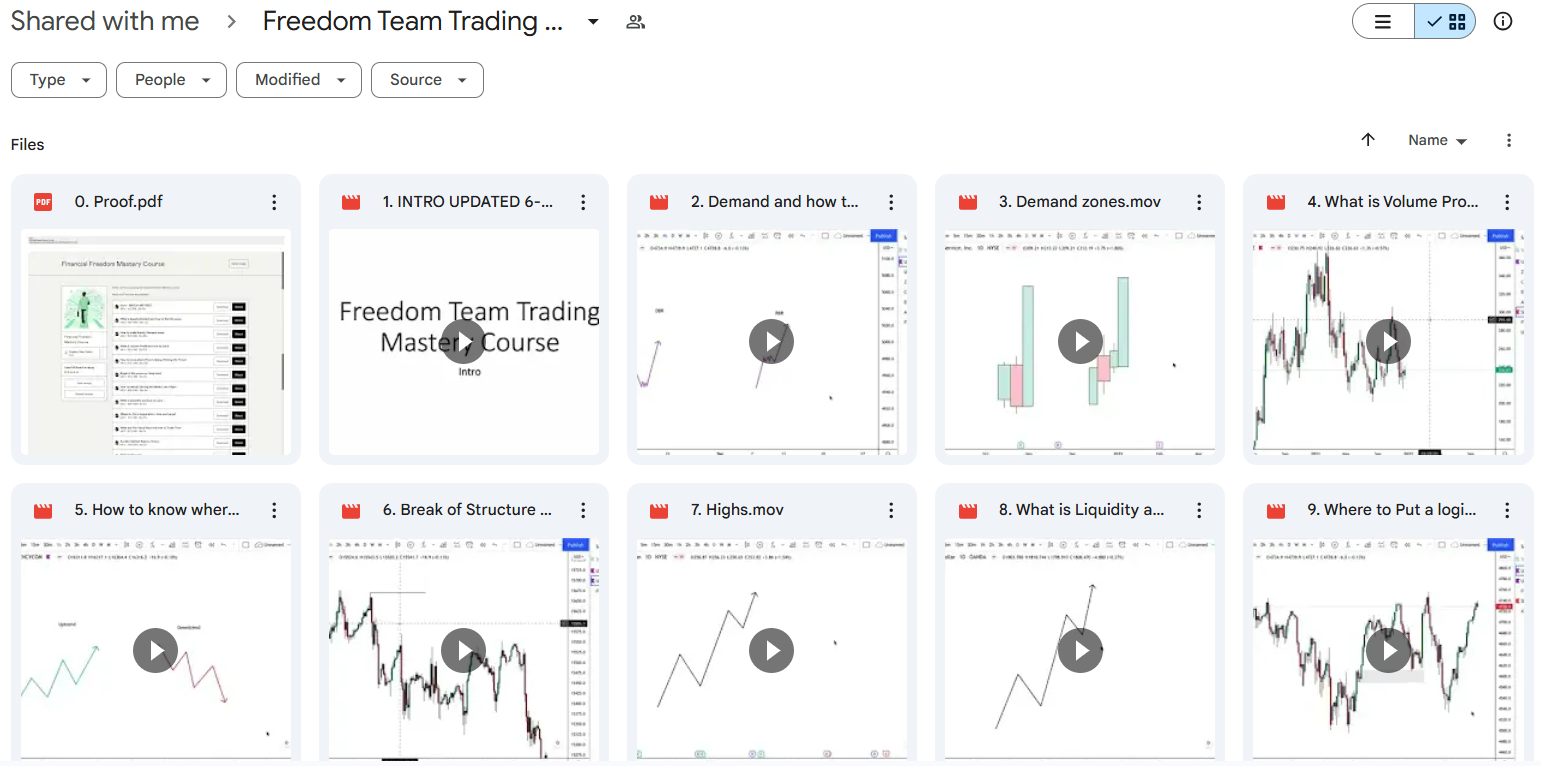

Freedom Team Trading Financial Freedom Curriculum:

✅ Section 1: Trading Foundations

This section introduces core market concepts and establishes the foundational knowledge required for institutional-level trading. Students learn essential market mechanics and analysis techniques.

Market Introduction

Comprehensive overview of market fundamentals and proven trading concepts. Includes verification of methodologies and introductory principles. (PDF, MOV)

- Proof Documentation (PDF)

- Introduction to Institutional Trading (MOV)

✅ Section 2: Technical Analysis Fundamentals

This section covers essential technical analysis tools and concepts. Students learn to identify and analyze key market structures and indicators.

Demand Analysis

Detailed exploration of demand zones and their significance in trading decisions. Students learn to identify and utilize demand zones effectively. (MOV)

- Finding Trading Zones (MOV)

- Understanding Demand Zones (MOV)

Advanced Technical Tools

In-depth coverage of volume profile analysis and trend identification. Focus on practical application of technical indicators. (MOV)

- Volume Profile Analysis (MOV)

- Trend Identification Techniques (MOV)

- Market Structure Analysis (MOV)

✅ Section 3: Market Structure and Liquidity

This section focuses on understanding market dynamics and liquidity concepts. Students learn to identify and capitalize on market movements.

Market Dynamics

Comprehensive analysis of market structure, liquidity, and price action. Includes practical applications of market concepts. (MOV)

- Market Structure Breaks (MOV)

- Liquidity Analysis (MOV)

- Entry and Exit Strategies (MOV)

✅ Section 4: Advanced Trading Concepts

This section explores sophisticated trading theories and their practical applications. Students learn institutional-level trading approaches.

Advanced Market Theory

Deep dive into market auction theory and relative strength analysis. Focuses on institutional trading methods. (MOV)

- Fair Value Gap Trading (MOV)

- Auction Market Theory (MOV)

- Relative Strength Analysis (MOV)

✅ Section 5: Institutional Trading Methods

This section covers professional-grade trading strategies and implementation. Students learn to identify and trade institutional price levels.

Institutional Strategy Implementation

Comprehensive coverage of institutional trading methods and price level analysis. Includes multiple implementation phases. (MOV)

- Institutional Price Levels (MOV)

- SPX Level Analysis (MOV)

- Advanced Trading Implementation (MOV)

✅ Section 6: Stock Selection and Options Trading

This section focuses on stock screening methods and options trading strategies. Students learn both day trading and swing trading approaches.

Stock Selection Strategies

Detailed coverage of stock scanning and selection methods for different trading timeframes. (MOV)

- Day Trading Scan Methods (MOV)

- Swing Trading Selection (MOV)

Options Trading

Advanced options trading strategies and implementation methods. Includes risk management and account scaling. (MOV)

- Options Strategy Selection (MOV)

- Complex Options Trading (MOV)

- Risk Management (MOV)

- LEAPS Trading Strategies (MOV)

The curriculum concludes with a comprehensive setup presentation that integrates all concepts. (PDF)

What is Freedom Team Trading?

Jordan F. founded Freedom Team Trading to help traders make consistent profits in the markets.

He teaches institutional-level trading strategies that combine technical analysis with advanced options trading.

The team focuses on real trading examples and proven setups. Their methods have helped many students move from struggling to profitable trading.

The Financial Freedom Mastery Course shows you exactly how to trade like professional traders. Students learn practical strategies they can use immediately in the markets.

Be the first to review “Freedom Team Trading – Financial Freedom Mastery Course” Cancel reply

Related products

Trading Courses

Forex Trading

Forex Trading

Trading Courses

Stock Trading

Investment Management

Forex Trading

Base Camp Trading – Explosive Growth Options – Stocks (EGOS) Program – EGOS MINI BUNDLE)

Options Trading

Reviews

There are no reviews yet.