Fotis Trading Academy – Global Macro Pro Trading Course

$3,495.00 Original price was: $3,495.00.$12.00Current price is: $12.00.

Fotis Trading Academy Global Macro Pro Trading Course [Instant Download]

What is Global Macro Pro Trading Course?

Fotis Trading Academy Global Macro Pro Trading is a course that teaches you how to trade like hedge fund professionals using economic analysis and technical systems.

You learn to read economic indicators, central bank policies, and market sentiment to predict price movements before they happen.

The course combines global macro fundamentals with proprietary F1 and Recon trading systems for forex, stocks, and commodities. You get professional risk management tools and learn to treat trading as a business, not gambling.

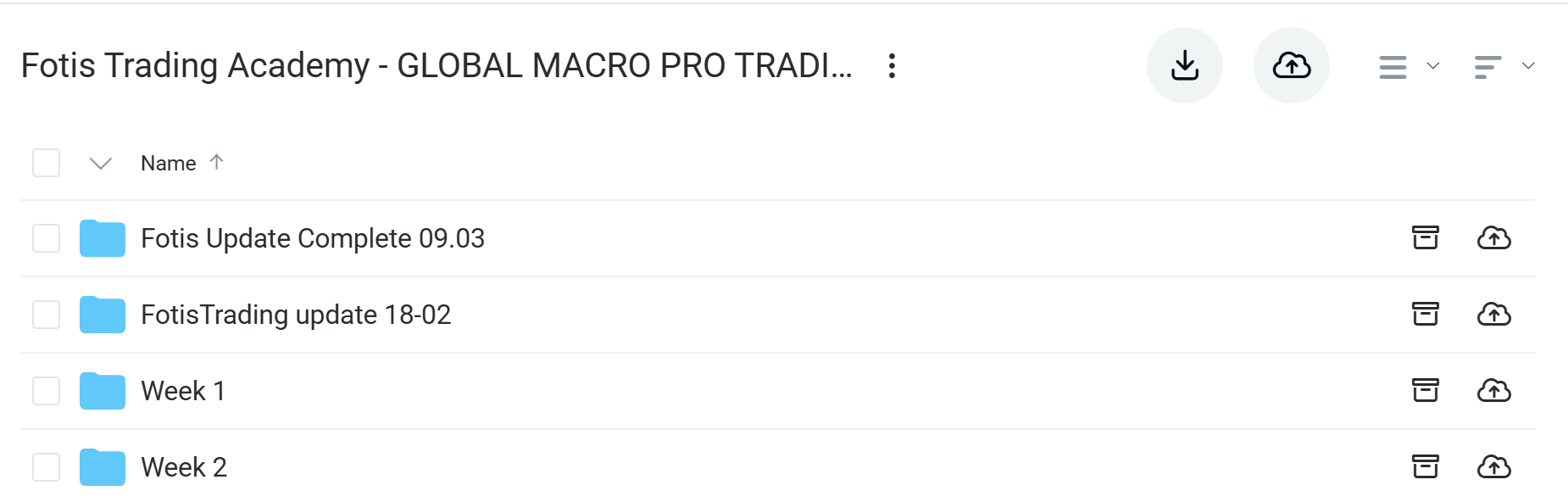

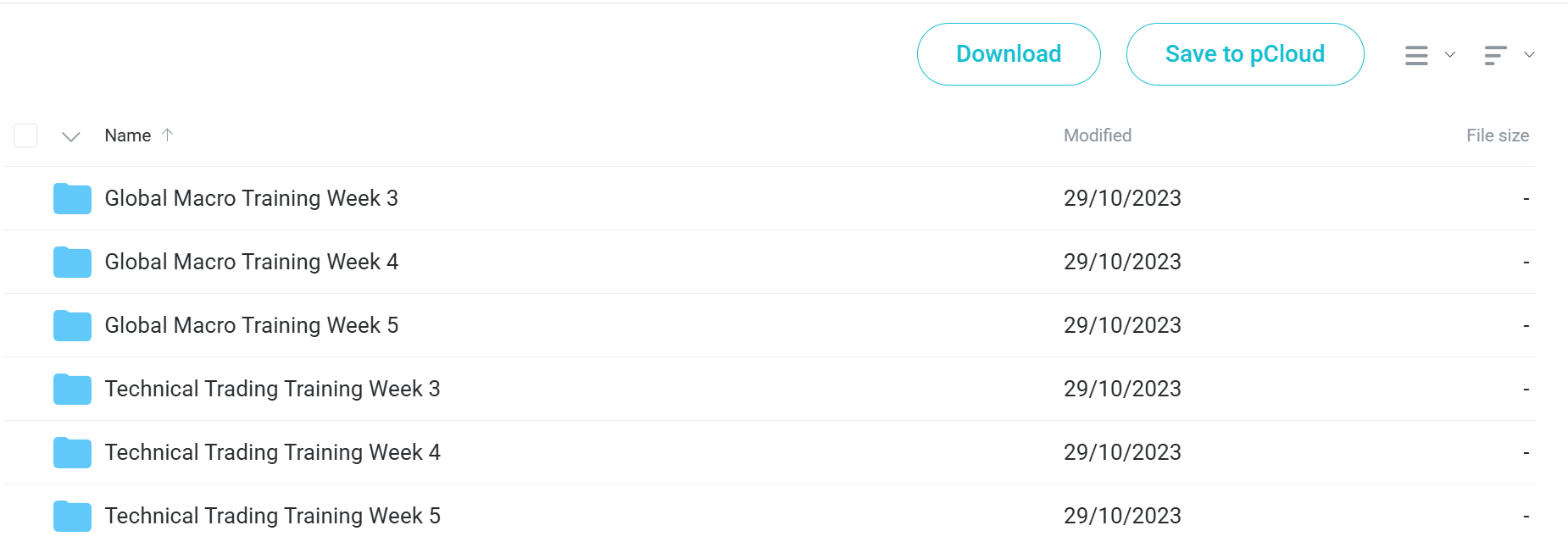

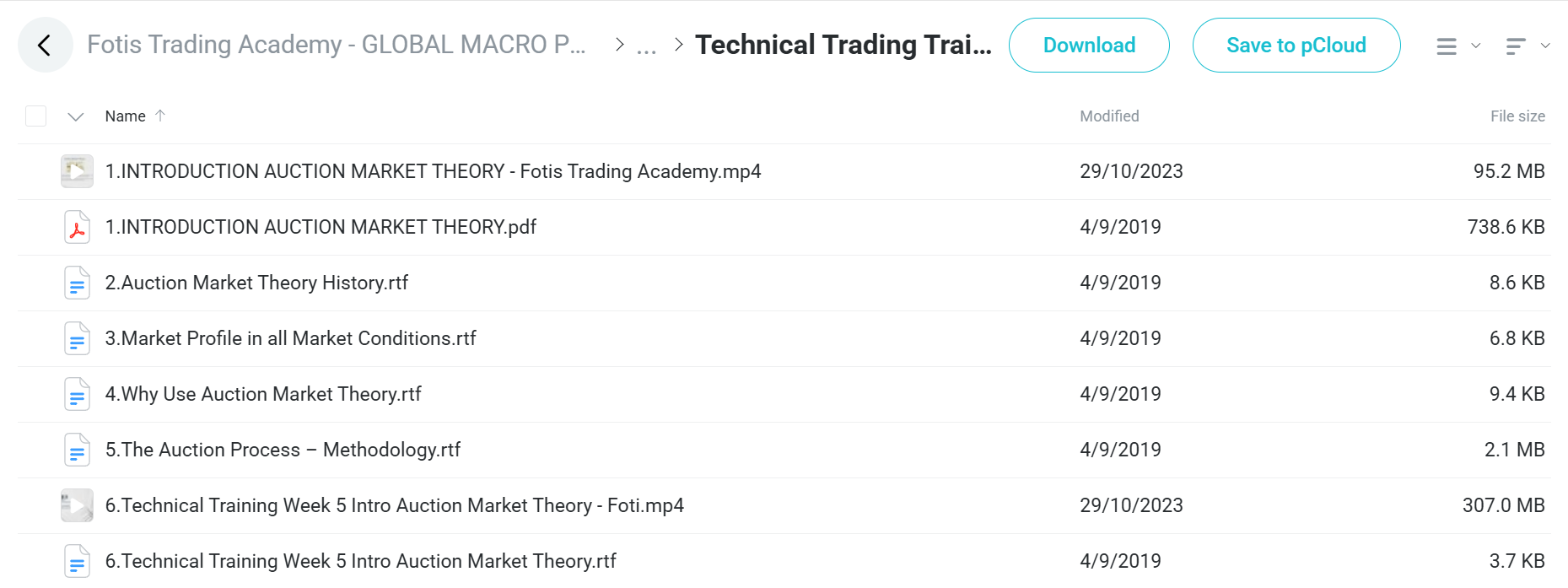

📚 PROOF OF COURSE

What you’ll learn in Fotis Trading Academy Global Macro Course:

This complete trading education teaches both global macro fundamentals and advanced technical analysis. Here’s what you’ll learn:

- Global macro analysis: Read economic indicators like GDP and inflation data. Understand how central bank policies affect currency prices and stock markets across different countries.

- Technical trading systems: Master the F1 system and Recon indicators used by hedge funds. Learn auction market theory to spot where big money is buying and selling.

- Risk management: Control position sizing and calculate risk-reward ratios properly. Use professional money management tools to protect your trading account from big losses.

- Market psychology: Build the right trader mindset and emotional control needed for steady profits. Learn to stay calm during market stress and avoid emotional trading mistakes.

- Trading business setup: Create step-by-step trading plans and daily routines like professional traders. Set up your trading office and keep proper trade records.

- Live market practice: Apply strategies using real market examples and case studies. Watch live trading sessions to see how professionals analyze and execute trades.

The course turns everyday traders into professional-level investors using proven hedge fund strategies and exclusive trading tools.

Global Macro Pro Trading Course Curriculum:

✅ Getting Started Foundation

This introductory module establishes the business mindset required for professional trading success. Students learn to set up their trading office environment, develop consistent daily routines, and implement proper trade recording systems.

The section emphasizes treating trading as a legitimate business venture while introducing basic money management principles. A custom risk management tool is provided along with training on the academy’s support system for ongoing mentorship.

✅ Global Macro Training (Weeks 1-6)

The macro fundamentals curriculum begins with intermarket analysis and the top-down approach to market evaluation. Students explore how monetary policies from major central banks (EU, US, China) influence global currency flows and emerging market dynamics.

Week 2 focuses on creating comprehensive business and trade plans while understanding BRIC nations’ impact on global markets. Advanced topics include sentiment analysis, bond market mechanics, interest rate effects on forex, and understanding quantitative easing policies.

Later weeks cover capital flow identification, carry trade strategies, yield curve analysis, and the critical “Risk On/Risk Off” market regimes. The module culminates with business cycle effects, sector performance analysis, and practical implementation of macro theories through live trading examples.

✅ Technical Trading Course (Weeks 1-8)

The technical curriculum starts in the “Rookies Corner” with essential candlestick patterns, support and resistance levels, and correlation analysis. Students master trend lines, channels, triangle breakouts, and classic reversal patterns like double tops and bottoms.

Marc’s M2 Method introduces a systematic approach to technical analysis with template-based trading strategies. Real case studies demonstrate how the method generated thousands of pips in profit, with weekly analysis examples showing consistent application.

The course progresses to Fotis’s proprietary F1 trend trading system, complete with custom indicators and templates. Students learn the three-step trading process and how to combine fundamental analysis with technical signals for optimal entry and exit timing.

✅ Advanced Auction Market Theory (Weeks 5-8)

This sophisticated module introduces auction market theory and Market Profile analysis as professional trading tools. Students learn the historical development of these concepts and their application across different market conditions.

The methodology section covers the auction process in detail, teaching students to read market sentiment through volume and price action. Live webinars demonstrate Market Profile charts in real trading scenarios with downloadable templates for immediate application.

Advanced sessions include “Fotis Uncut” for unfiltered market analysis and specialized risk management techniques. The module emphasizes practical application through multiple live trading sessions showing theory in action.

✅ Risk Management & Trade Execution

Integrated throughout the course, this critical component teaches position sizing, risk-reward calculations, and trade allocation strategies. Students receive proprietary risk management software with comprehensive training on its application.

The “Holy Grail” risk management sessions reveal professional-level position management techniques. Live trading demonstrations show how to manage risk during market rallies, corrections, and sentiment shifts while maintaining consistent profitability.

✅ Specialized Training Modules

The Forex Options Trading Course provides comprehensive coverage of options strategies, including put/call mechanics, hedging techniques, and Greek calculations. Students learn to trade trends using options while understanding premium valuation and various trading strategies.

Additional specialized topics include credit rating agencies’ impact on markets, global imbalances, supranational organizations’ roles, and commodity demand analysis. These modules provide deeper context for macro trading decisions.

✅ Live Application & Ongoing Support

Throughout the program, live webinars and Q&A sessions provide real-time market analysis and student support. The course includes extensive case studies, trade monitoring systems, and examples of successful implementations of the taught strategies.

Regular market updates and “uncut” analysis sessions give students access to professional-level market commentary and decision-making processes. The program emphasizes continuous learning through homework assignments and progress monitoring systems.

What is Fotis Trading Academy?

Fotis Trading Academy was founded in 2014 by Fotis Papatheofanous, MBA. He currently works as an FX Portfolio Manager at a multimillion-dollar hedge fund and is a recognized expert in Global Macro analysis.

Fotis started his career in private banking and hedge funds. He has worked as an investment consultant, asset manager, and proprietary trader with years of real market experience.

He has written books on investing, including one that shows how to use Global Macro principles to get an edge in FX markets.

The academy teaches retail traders how to trade like professionals using global macro fundamentals combined with advanced technical methods. Over 2,300 students have joined to improve their trading results.

Be the first to review “Fotis Trading Academy – Global Macro Pro Trading Course” Cancel reply

Related products

Forex Trading

Best 100 Collection

Trading Courses

Trading Courses

Forex Trading

Trading Courses

Trading Courses

Trading Courses

Reviews

There are no reviews yet.