Fixedratio – Mission Million Money Management Course

$797.00 Original price was: $797.00.$45.00Current price is: $45.00.

Fixedratio Mission Million Money Management Course [Download]

📚 PROOF OF COURSE

What is Fixedratio Mission Million Money Management:

The Mission Million Money Management Course, crafted by the renowned trader Ryan Jones, is a transformative online program designed to empower traders with the knowledge and skills necessary for effective money management in the volatile trading market. Over a comprehensive 10-week period, this course demystifies the complexities of the financial markets, offering step-by-step guidance on implementing sound money management practices and strategic trading decisions.

At the heart of the course is the Fixed Ratio strategy, a unique approach developed by Ryan Jones to maximise trading efficiency and profitability. Unlike traditional trading education that focuses merely on the ‘what,’ this course emphasizes the ‘how,’ providing actionable insights and methodologies to alter one’s trading perspective fundamentally.

Ideal for novice and experienced traders, the Mission Million Money Management Course is more than just a learning experience; it’s a journey towards trading mastery guided by one of the industry’s most successful practitioners. With Ryan Jones at the helm, participants are not just learning; they are adopting a mindset geared towards sustainable success in the trading world.

What you will learn in Fixedratio Course:

The Mission Million Money Management Course, designed by Ryan Jones, is structured into a series of engaging and informative lessons. Each lesson is crafted to build upon the last, ensuring a comprehensive understanding of money management in trading. Here’s what you will learn:

- Lesson 1 & 2 – Building the Foundation for Success: These initial lessons lay the groundwork for successful trading, emphasizing the importance of a solid foundation in understanding the markets and money management principles.

- Lesson 3 – Anti-Martingale Approach: Dive into the Anti-Martingale strategy, learning how it contrasts with traditional approaches and how it can be used to minimize risk while maximizing potential gains.

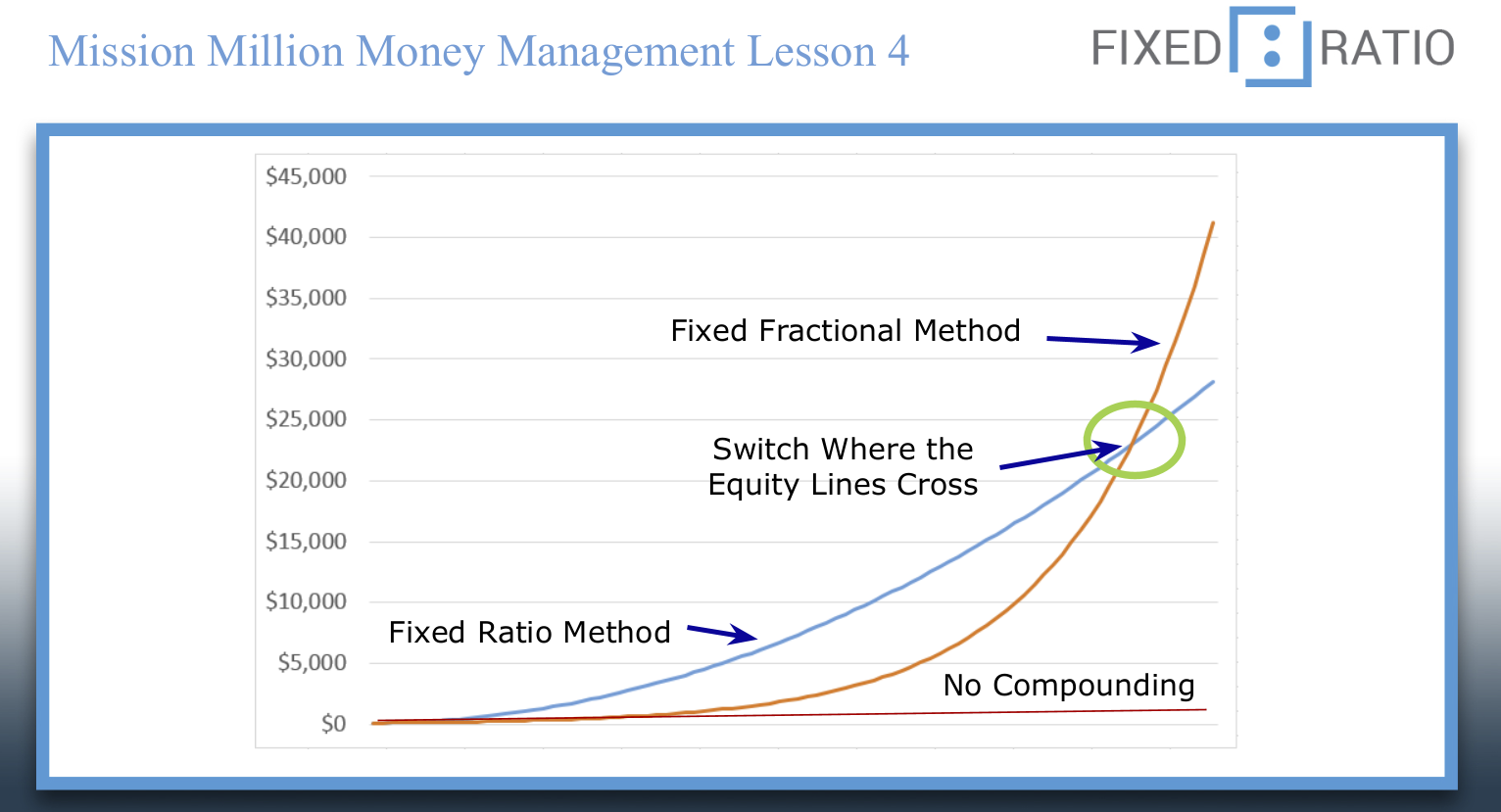

- Lesson 4 – Fixed Fractional Method: Explore the Fixed Fractional Method, a crucial technique for determining how much of your portfolio to risk in any given trade.

- Lesson 5 – Fixed Ratio Method: Uncover the details of the Fixed Ratio Method, Ryan Jones’ signature strategy that balances risk and reward by adjusting the leverage based on performance.

- Lesson 6 – Applied Fixed Ratio: Learn how to apply the Fixed Ratio Method in real trading scenarios, ensuring you understand its practical application.

- Lesson 7 – Strategy Analysis: This lesson focuses on analyzing various trading strategies to identify their strengths and weaknesses, helping you choose the right strategy for your trading style.

- Lesson 8 – Portfolio Analysis: Understand how to analyze and manage a portfolio of trades, ensuring diversification and risk management across different market conditions.

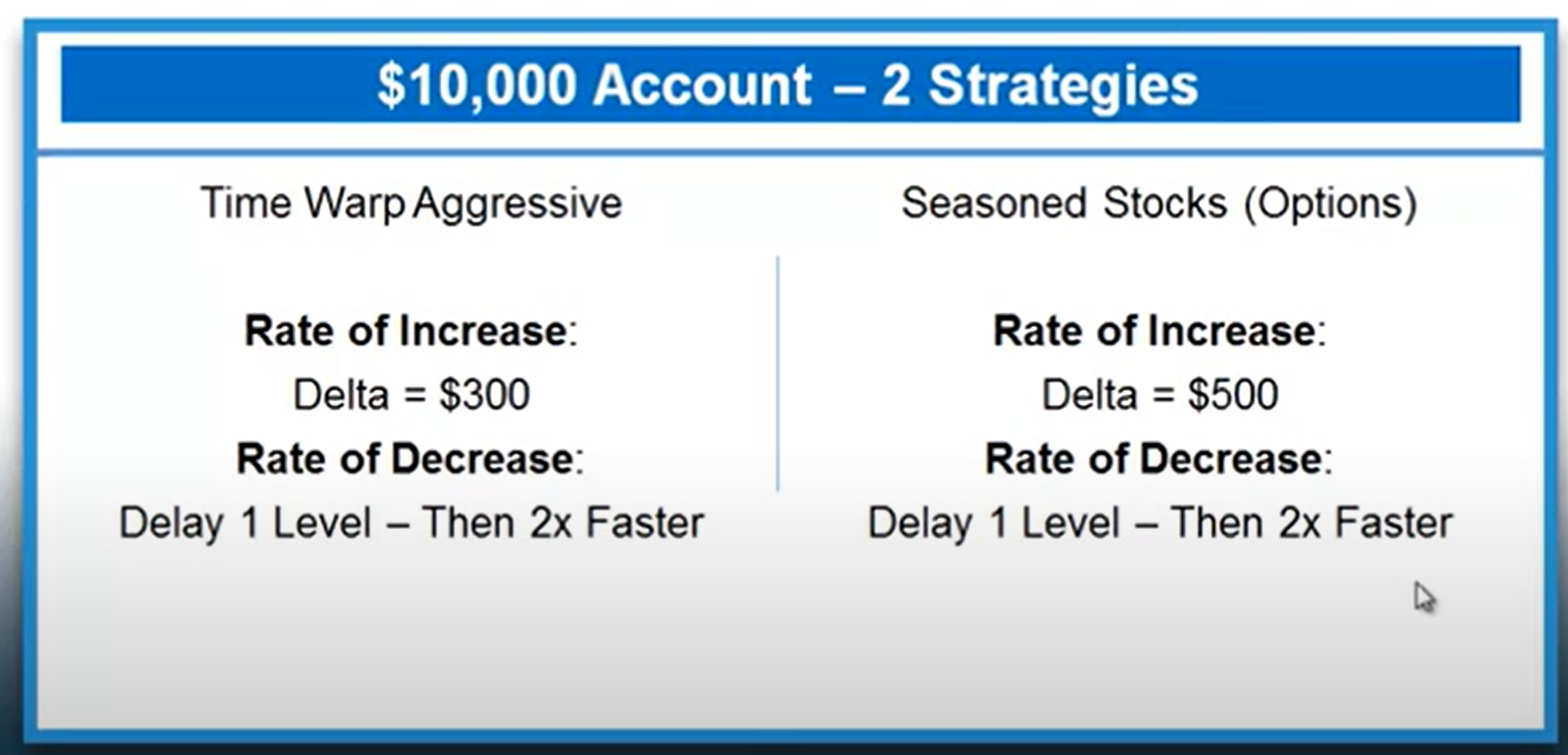

- Lesson 9 – Rate of Decrease: Delve into the Rate of Decrease concept, a key aspect of the Fixed Ratio Method that helps manage risk as your portfolio grows.

- Lesson 10 – Putting Everything Together: This final lesson synthesizes all the concepts covered in the course, showing you how to integrate them into a cohesive trading plan.

- Webinar: The course includes a webinar component, offering a deeper dive into the topics covered in the lessons and providing an opportunity for live Q&A.

Through these lessons, you will gain a comprehensive understanding of money management strategies that can help you navigate the complexities of trading, manage risk effectively, and position yourself for long-term success in the markets.

Who is Ryan Jones?

Ryan Jones is a big name in trading. He’s known for making smart moves that turn small amounts of money into much more. For example, he once grew $15,000 to over $107,000, showing he really knows his stuff. He even set a record by making a 600% profit in just 73 days during a trading contest.

Ryan believes that being good at trading isn’t just about having a good plan. It’s also about managing your money wisely. That’s why he came up with the Fixed Ratio method. This method helps traders make more money while keeping risks low.

He started Fixedratio, a website where he teaches others how to trade better. One of his courses, the Mission Million Money Management Course, teaches important trading skills and money management.

Ryan is not just smart; he’s also a great teacher. He makes complicated trading ideas easy to understand. People look up to him because he shows that with the right knowledge and tools, anyone can succeed in trading.

1 review for Fixedratio – Mission Million Money Management Course

Add a review Cancel reply

Related products

Crypto Trading

Trading Courses

Forex Trading

Trading Courses

Stock Trading

Trading Courses

Trading Courses

Options Trading

Anonymous (verified owner) –

Ideal!