David Frost – Lazy Gap Trader Course

$199.00 Original price was: $199.00.$19.00Current price is: $19.00.

[Download] David Frost – Lazy Gap Trader Course

📚 PROOF OF COURSE

What is Lazy Gap Trader Course:

The Lazy Gap Trader course, crafted by expert trader David Frost, offers a deep dive into the world of day trading.

This course will equip you with robust strategies for navigating bull and bear markets effectively. Focusing on morning gap trades and the gap-fill approach provides a clear path to consistent trading profits.

With 17 comprehensive videos, real-world examples, and step-by-step guidelines, this course is more than just theory; it’s a practical toolkit for real market success. Whether you’re a beginner or an experienced trader, the Lazy Gap Trader course is tailored to enhance your trading skills and decision-making abilities in the dynamic world of stocks.

Read more: David Frost Lazy Emini Trader Master Class

What you will learn in Lazy Gap Trader Course course:

In the Lazy Gap Trader course, you’ll gain insights into:

- Identifying High-Probability Trading Opportunities: Learn to spot the most promising morning gap trades and how to capitalize on them.

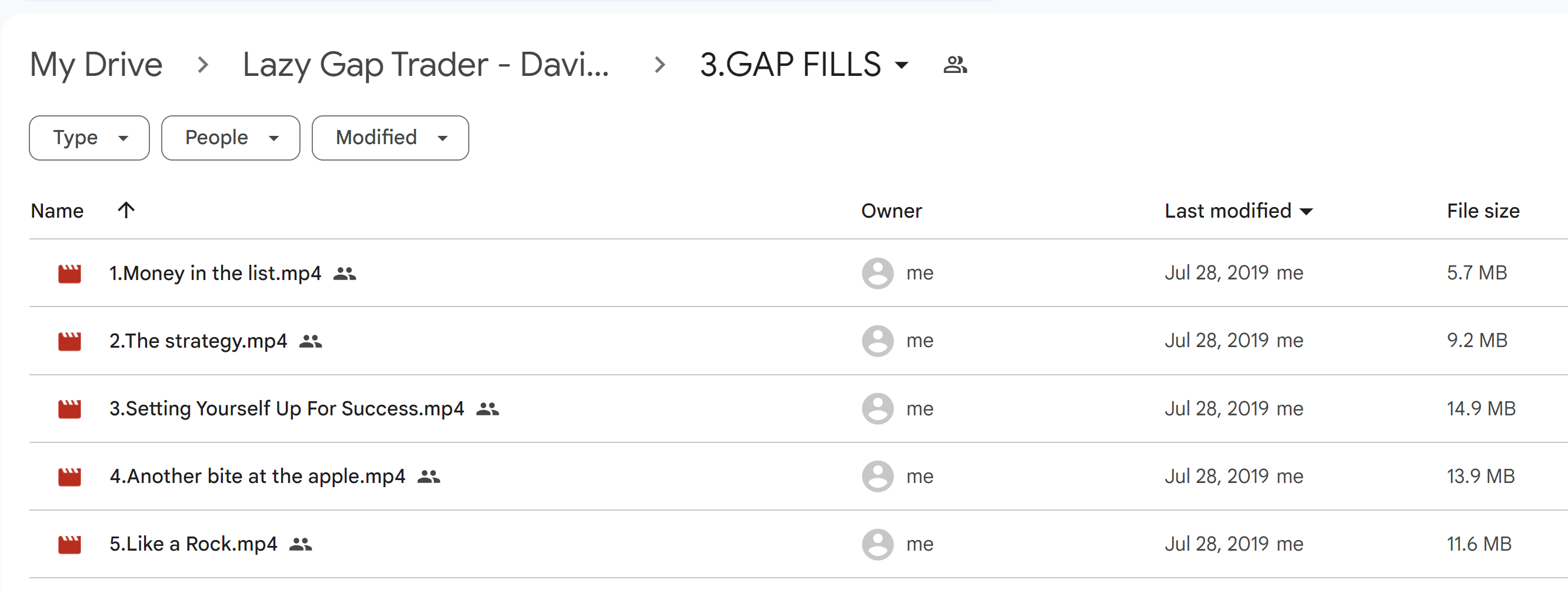

- Mastering the Gap Fill Strategy: Understand the mechanics of the gap fill strategy and how to apply it for daily trading success.

- Navigating Market Trends: Acquire skills to analyze market trends and make informed trading decisions.

- Effective Risk Management: Learn how to manage risks and maximize your trading potential.

- Practical Application: Through real examples and a detailed analysis, you’ll see these strategies in action, enhancing your learning experience.

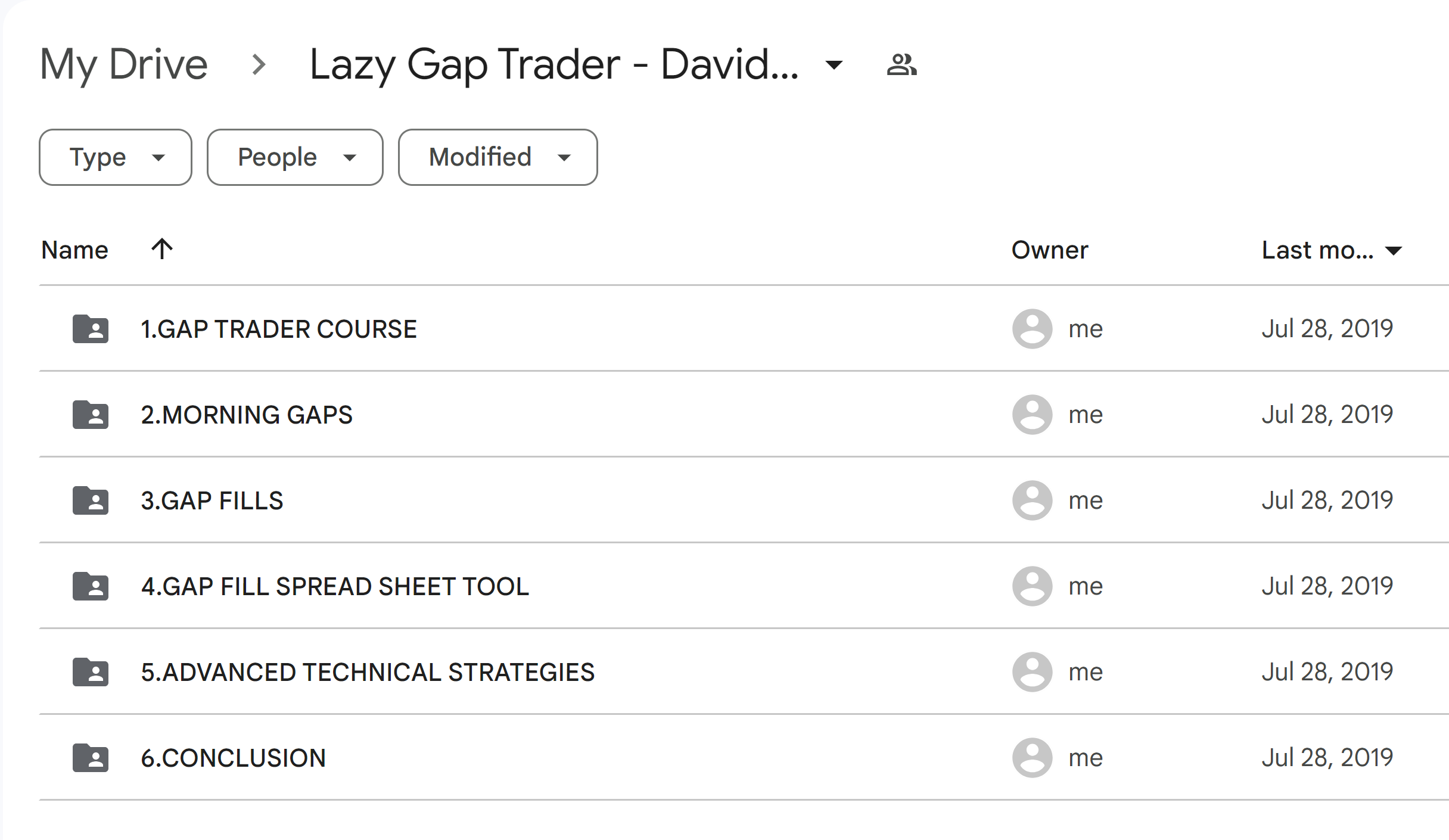

Lazy Gap Trader Course Course curriculum:

The Lazy Gap Trader course includes:

- Module 1: GAP TRADER COURSE

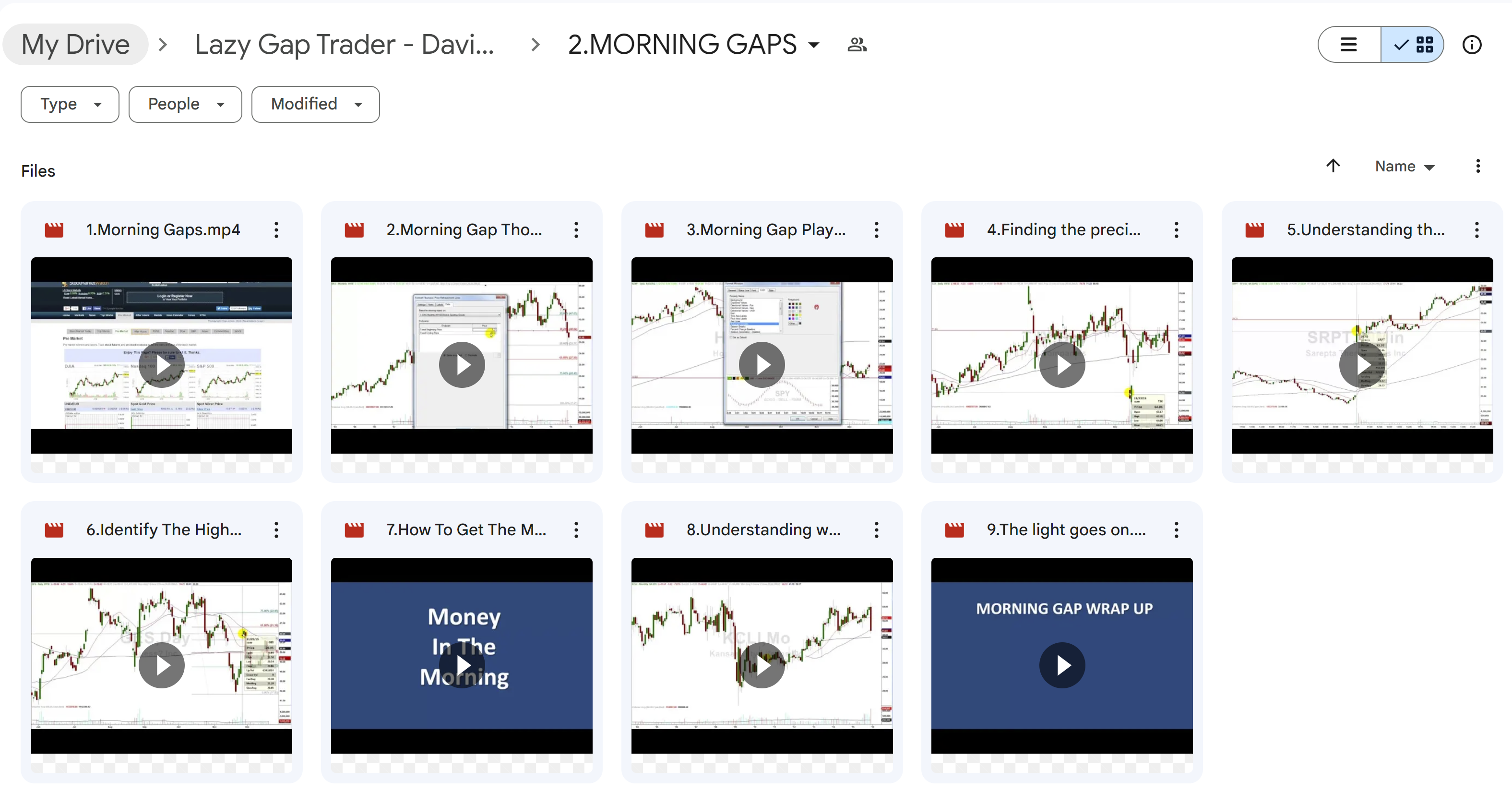

- Module 2: MORNING GAPS

- Module 3: GAP FILLS

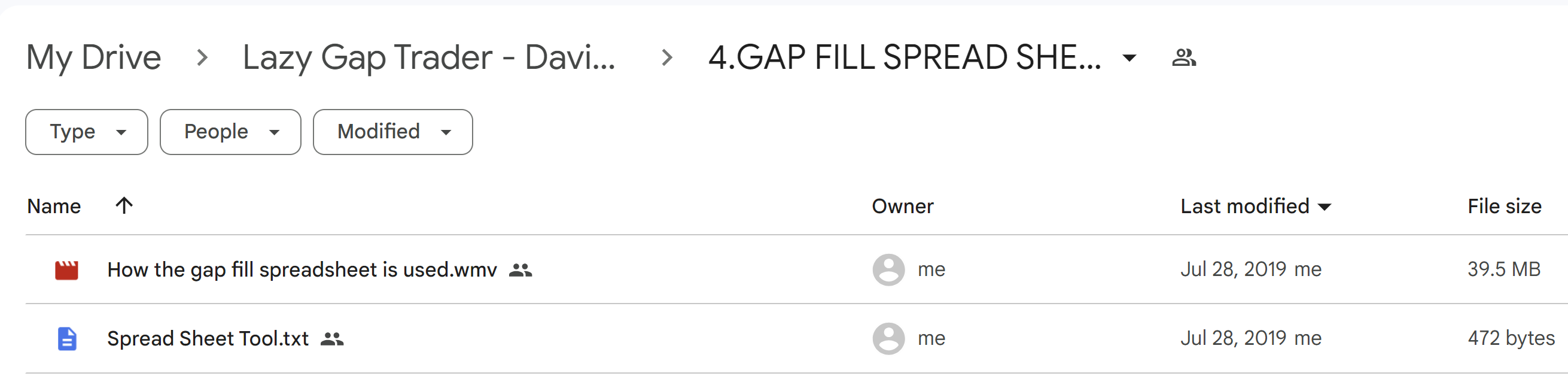

- Module 4: GAP FILL SPREAD SHEET TOOL

- Module 5: ADVANCED TECHNICAL STRATEGIES

- Module 6: CONCLUSION

Who should take Lazy Gap Trader Course?

The Lazy Gap Trader course is designed for a diverse range of participants, making it suitable for:

- Aspiring Day Traders: Individuals looking to enter the world of day trading will find this course an invaluable starting point.

- Experienced Traders: Seasoned traders seeking to refine their strategies and learn new techniques will benefit greatly.

- Risk-Averse Investors: Those interested in learning controlled, risk-managed trading methods.

- Financial Enthusiasts: Anyone with an interest in understanding market dynamics and trading psychology.

Be the first to review “David Frost – Lazy Gap Trader Course” Cancel reply

Related products

Day Trading

Day Trading

Day Trading

Day Trading

Day Trading

Day Trading

Day Trading

Reviews

There are no reviews yet.