Dave Van Horn – Wealth Building with Defaulted 2nd Mortgages

$497.00 Original price was: $497.00.$29.00Current price is: $29.00.

Dave Van Horn Wealth Building with Defaulted 2nd Mortgages [Instant Download]

What is Wealth Building with Defaulted 2nd Mortgages:

Dave Van Horn’s course, Wealth Building with Defaulted 2nd Mortgages, teaches investors how to generate passive income through note investing. The course covers core principles like due diligence, risk management, and borrower communication.

Dave provides strategies to identify profitable opportunities and mitigate risks. Ideal for both beginners and seasoned investors, this course equips you to diversify your portfolio and achieve financial freedom.

📚 PROOF OF COURSE

What you will learn in Wealth Building with Defaulted 2nd Mortgages:

In the Wealth Building with Defaulted 2nd Mortgages course, you will learn:

- The core principles of note investing

- How to invest in performing and non-performing notes

- Strategies for finding and bidding on non-performing notes

- The importance of due diligence and risk management

- Effective borrower management and communication techniques

- How to recapitalize and restructure defaulted notes

- Real-life case studies and examples from Dave’s experience

The course also includes:

- Sample documents and templates used by Dave’s company, PPR

- Detailed interviews with PPR Asset Managers

- A comprehensive glossary of industry terms

By the end of the course, you’ll have a solid understanding of how to successfully invest in defaulted second mortgages and create a profitable, sustainable investing business.

Wealth Building with Defaulted 2nd Mortgages Course Curriculum:

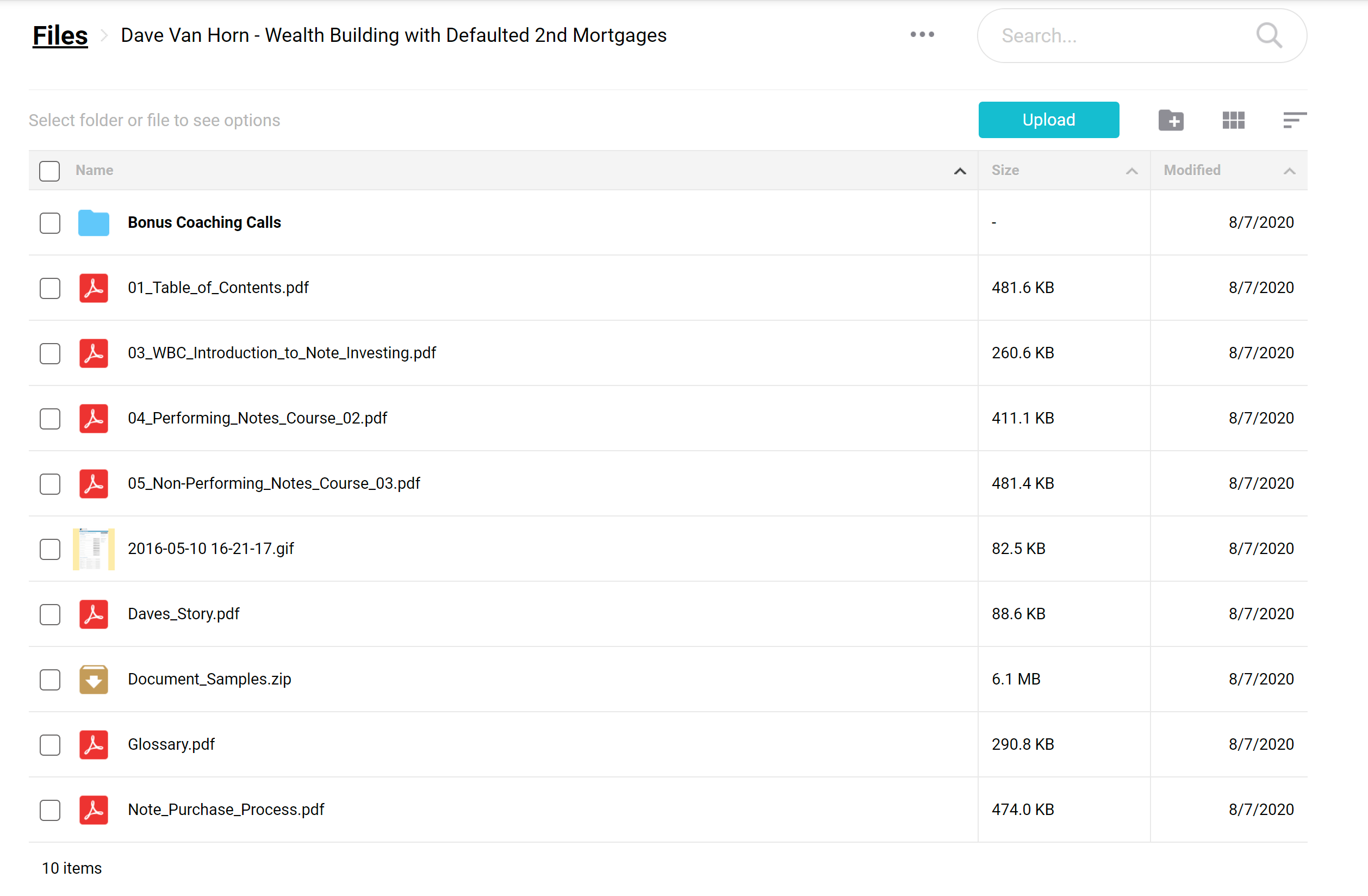

✅ Course files:

- Table of Contents.pdf

- WBC Introduction to Note Investing.pdf

- Performing Notes Course 02.pdf

- Non-Performing Notes Course 03.pdf

- Daves Story.pdf

- Document Samples.zip

- Glossary.pdf

- Note Purchase Process.pdf

✅ Table of contents:

Dave’s Story

Introduction to Note Investing

- Section 1: Introduction to Investing

- Section 2: Welcome to the World of Note Investing

- Section 3: The Life Cycle of an Institutional Note

Performing Note Course

- Section 1: Investing in Performing Notes

- Section 2: Sources of Capital For Performing Notes

- Section 3: The Financials of Performing Note Investing

- Section 4: Managing Risk and Buyer Concerns

- Section 5: FAQ’s With Performing Notes

Non-Performing Note Course

- Section 1: How to Find Non-performing Notes

- Section 2: Considerations When Bidding on NPN’s

- Section 3: Note Contracts

- Section 4: Due Diligence

- Section 5: Analyzing Non-performing Notes

- Section 6: Risk Management

- Section 7: Borrower Management

- Section 8: Recapitalization

- Section 9: Conclusion

- Section 10: FAQ’s with Non-Performing Notes

Note Purchase Process

Glossary

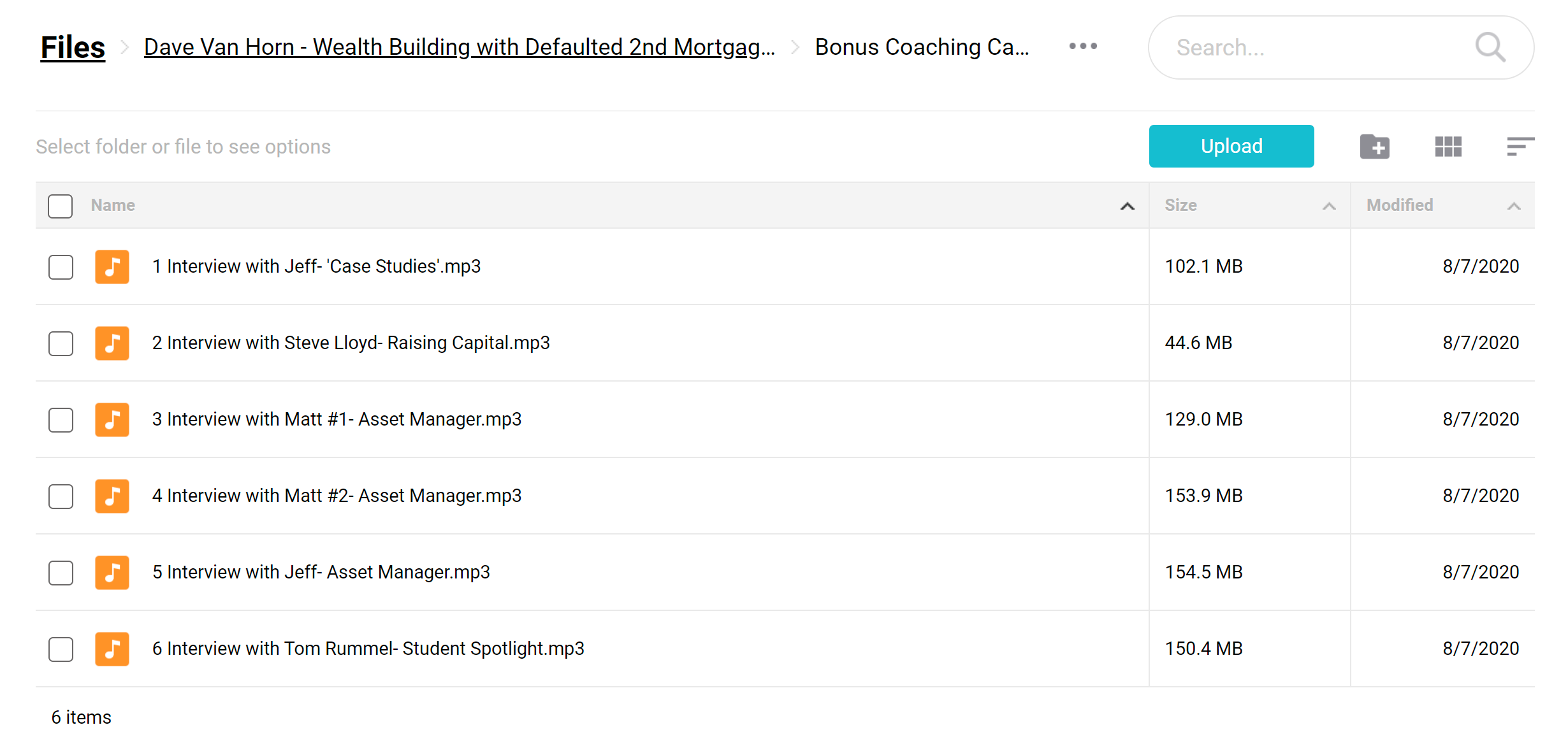

✅ Bonus Coaching Call:

- Interview with Jeff- ‘Case Studies’.mp3

- Interview with Steve Lloyd- Raising Capital.mp3

- Interview with Matt #1- Asset Manager.mp3

- Interview with Matt #2- Asset Manager.mp3

- Interview with Jeff- Asset Manager.mp3

- Interview with Tom Rummel- Student Spotlight.mp3

Who is Dave Van Horn?

Dave Van Horn is a highly respected real estate investor, fund manager, and educator with over two decades of experience in the industry. As the founder and Executive Chairman of PPR, a real estate and mortgage fund manager, Dave has successfully navigated the world of note investing, helping countless investors achieve their financial goals.

The prestigious Forbes Finance Council, an invitation-only community for executives in finance, has recognized Dave’s expertise and leadership. He is also the author of “Real Estate Note Investing,” published in 2018 by BiggerPockets Publishing, which has helped countless readers understand the intricacies of note investing.

Throughout his career, Dave has been featured on numerous podcasts and regularly contributed to the BiggerPockets community, sharing his knowledge and insights with aspiring investors. His passion for educating others and his commitment to transparency have earned him a reputation as a trusted authority in the real estate investing world.

With his wealth of experience and proven track record of success, Dave Van Horn is uniquely qualified to guide investors through note investing, helping them build wealth and achieve financial freedom.

Be the first to review “Dave Van Horn – Wealth Building with Defaulted 2nd Mortgages” Cancel reply

Related products

Real Estate

Real Estate

Commercial Real Estate

Real Estate

Real Estate

Investment Management

Reviews

There are no reviews yet.