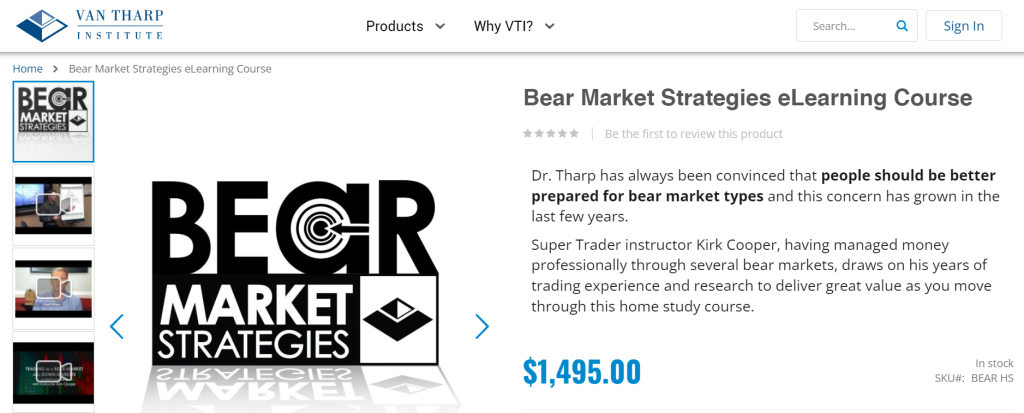

(NEW) Bear Market Strategies by Van Tharp Institute

$1,495.00 Original price was: $1,495.00.$14.00Current price is: $14.00.

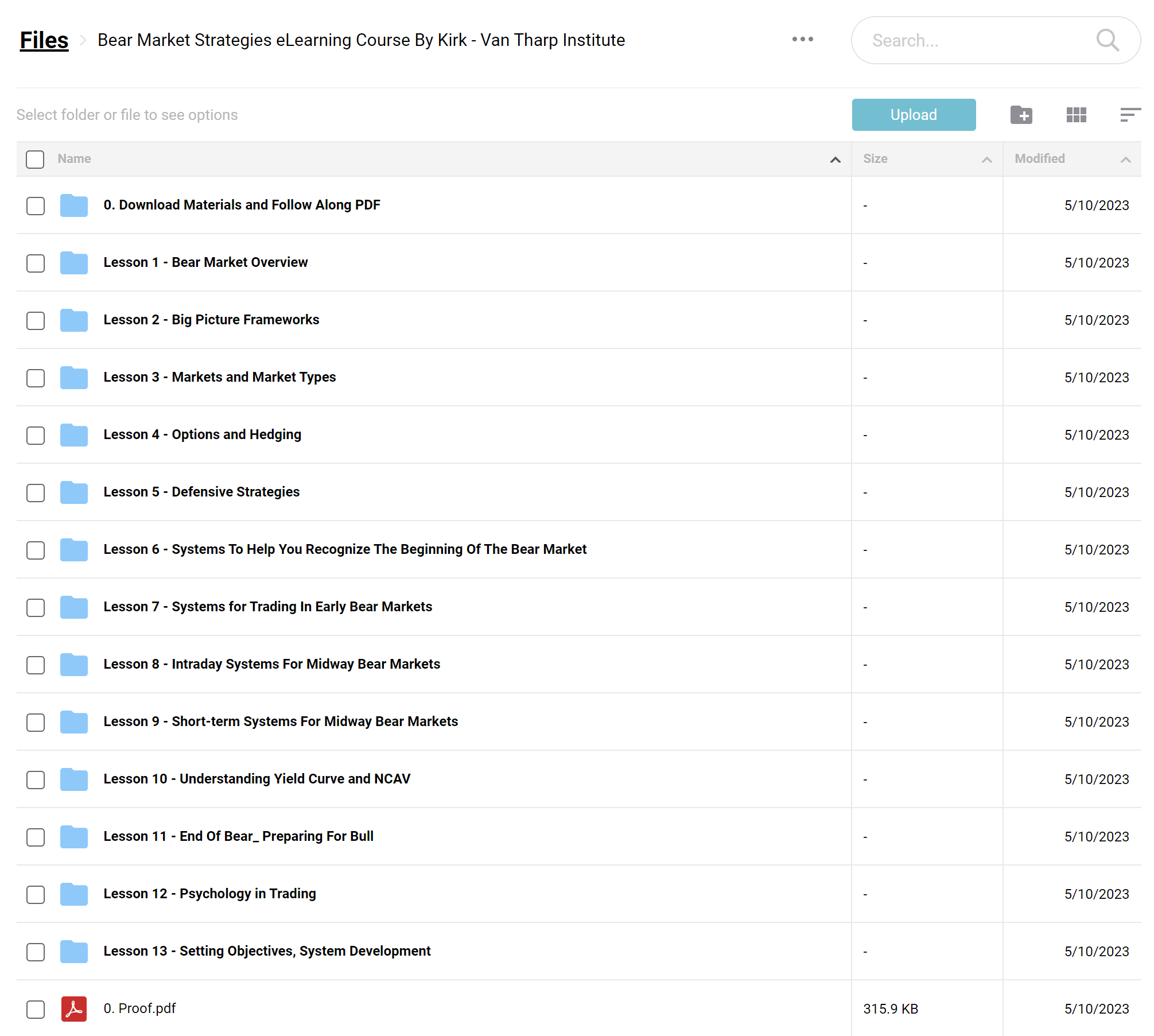

[Download] Bear Market Strategies eLearning Course of Van Tharp Institute

📚 PROOF OF PRODUCT:

What is Bear Market Strategies

The Concern of a Bear Market

Dr. Tharp has always been convinced that people should be better prepared for bear market types, especially given the recent trends. With his vast experience of managing money through several bear markets, Super Trader instructor Kirk Cooper brings immense value to this home study course.

Do you recall the market situation of 2008-2009? The year 2020 is hinting at a similar scenario. While many view such market conditions as a crisis, the prepared ones see it as an opportunity. This course will guide you on navigating and profiting from such bear markets, whether they are broad or specific to a sector or symbol.

The Importance of Being Prepared

Bear markets, though infrequent, offer lucrative trading conditions for those who are ready. This course emphasizes the need to be proactive rather than reactive, highlighting the potential benefits even in down markets of specific sectors or instruments.

The Role of Experts

Dr. Tharp and Kirk Cooper stress the importance of preparing for bear markets. Their combined expertise and research form the backbone of this course, ensuring participants receive top-notch guidance.

Key Considerations for Traders

Market Predictability

With central banks playing a significant role in the global economic environment, predicting market movements becomes challenging. This section delves into potential triggers for a bear market and the importance of being prepared rather than caught off-guard.

Strategies for Bear Markets

For those who are unprepared, the default strategy might be to move to cash. However, bear markets offer some of the best trading conditions for the informed trader. This section explores the various methods one can employ during a bear market and the recovery phase.

Questions to Ponder

Before diving into bear market trading, it’s crucial to self-reflect. This section presents a series of questions to gauge one’s readiness and understanding of bear markets.

Course Content Overview

Core Objectives:

The primary aim of this course is to equip participants with the knowledge and tools necessary to thrive during a bear market or downturn. By the end of the course, participants will be able to:

Understand the Bear Market:

- Grasp the fundamental concept of a bear market.

- Recognize the true nature of a bear market and the various methods to define and gauge its type.

- Discern the onset of a bear market type and predict its potential conclusion.

Trading Strategies:

- Acquire multiple trading strategies tailored for bear market scenarios.

- Understand the significance of options and hedging during bear market types.

Comprehensive Learning Outcomes:

This home study course offers a holistic approach to understanding bear markets. Participants will:

- Bear Market Overview: Gain a panoramic perspective of bear markets, assessing the current scenario from a historical standpoint.

- Identification and Definition: Utilize various methodologies to identify and define bear markets.

- Psychological Aspects:

- Delve into the psychology behind bear markets.

- Understand the personal psychological adjustments necessary to capitalize on bear markets.

- Historical Analysis: Examine real-world trading experiences from notable bear markets, including those from 1987, 1998, 2000, and 2008, Japan’s lost decade in the 90s, and the Oil crisis of 2014-2015.

- Options and Hedging:

- Grasp basic strategies involving options that are beneficial during bear markets.

- Comprehend fundamental hedging strategies.

- Preparedness:

- Equip oneself with the knowledge to trade effectively during bear markets.

- Develop a systematic process plan.

- Set clear objectives for bear market scenarios.

- Design Position Sizing Strategies tailored for bear markets.

Who teaches this course

Kirk Cooper: A Blend of Experience and Expertise

Kirk Cooper stands out as a seasoned professional in the financial realm. Registered in Canada as both a Portfolio Manager and a Commodity Trading Manager, he brings a unique blend of practical experience and academic prowess.

- Educational Background: Kirk holds a Degree in Mathematics and a Master’s Degree in Psychology. His focus on behavioral finance, risk management, and market psychology equips him with a deep understanding of the intricacies of trading.

- Professional Milestones: With over 25 years in the financial markets, Kirk has donned multiple hats – from being a proprietary trader at Deutsche Bank Canada to co-founding a fund that yielded an annualized return of over 18% over four years. His journey from managing assets worth billions to founding a hedge fund showcases his versatility and depth of knowledge.

- A Commitment to Teaching: Kirk’s association with the Van Tharp Institute and his role as a Super Trader instructor underline his commitment to sharing his knowledge and helping others navigate the complex world of trading.

Be the first to review “(NEW) Bear Market Strategies by Van Tharp Institute” Cancel reply

Related products

Forex Trading

Crypto Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.