Axia Futures – The Footprint Edge Course

$1,031.00 Original price was: $1,031.00.$19.00Current price is: $19.00.

Axia Futures The Footprint Edge Course [Instant Download]

What is The Footprint Edge Course:

Axia Futures The Footprint Edge Course teaches futures trading using the Footprint tool. It focuses on understanding market movements and making smart decisions.

The course covers market liquidity, cryptocurrency trading, and provides practical lessons with real-world examples. It’s designed to take traders from basics to professional level in futures trading.

What is a Footprint Chart in Trading?

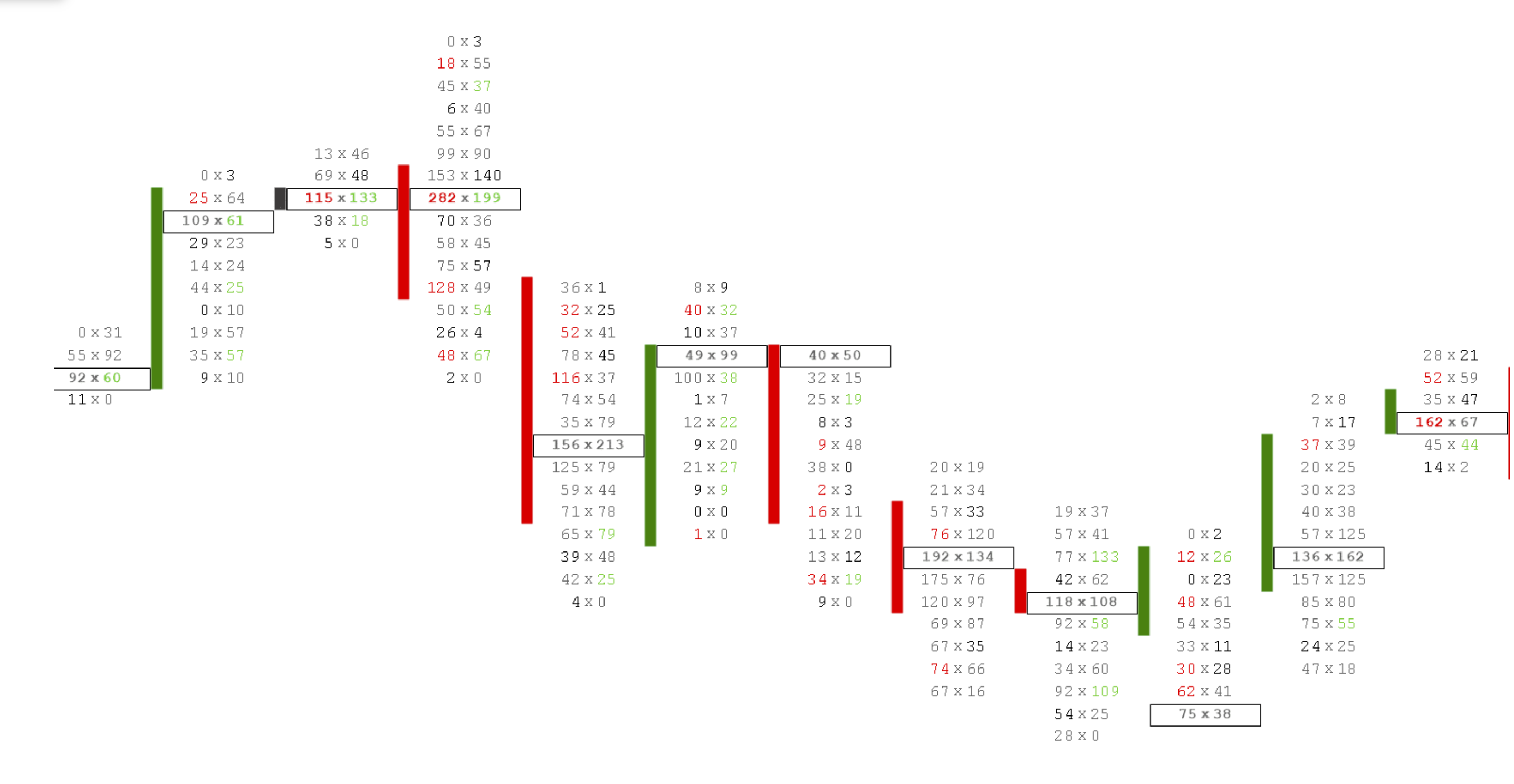

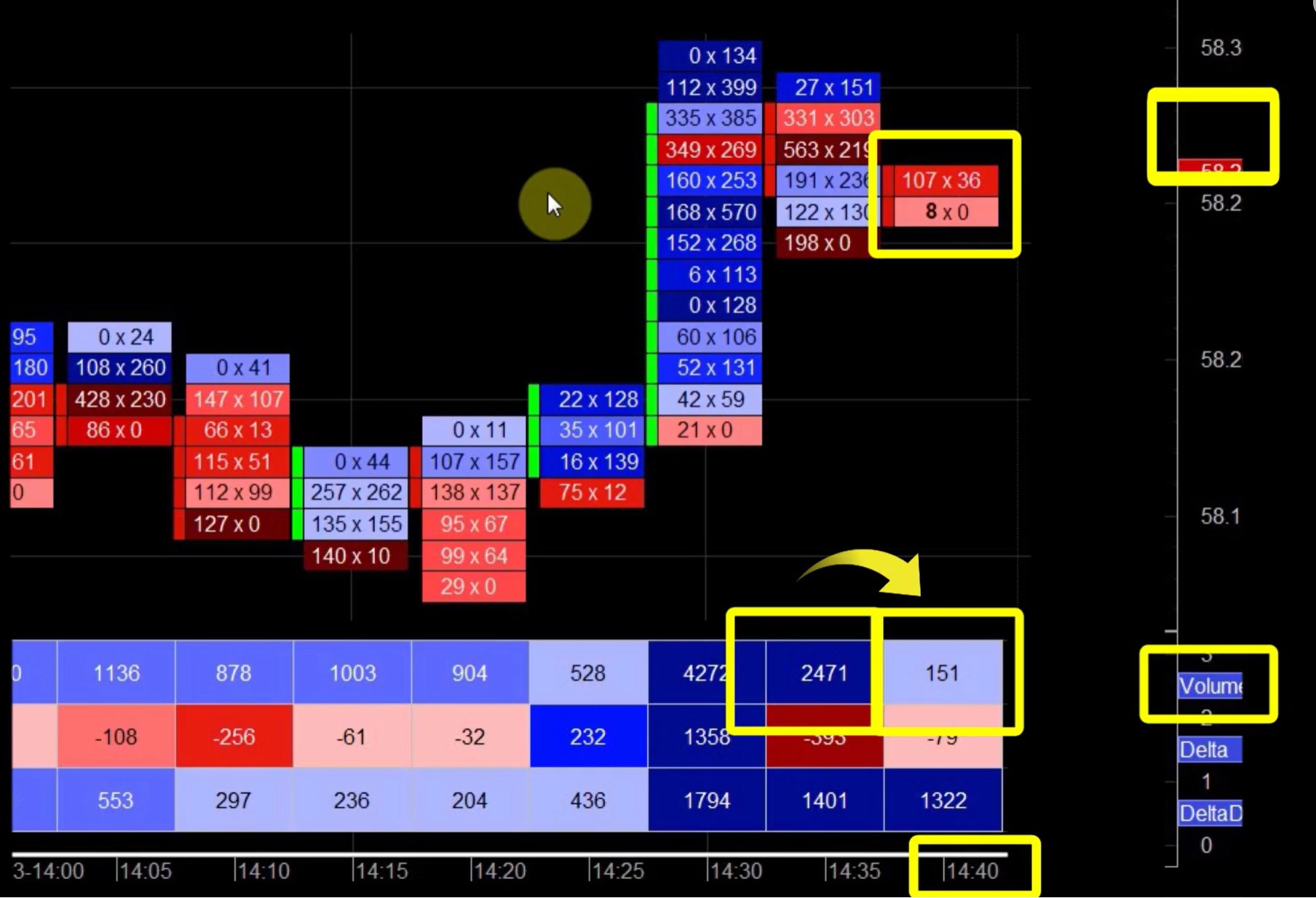

A Footprint Chart shows detailed order flow and market dynamics in trading. It displays price, volume, and bid/ask volume at each price point.

This reveals buying and selling pressure by showing contracts traded at each price.

Traders use it for short-term trading to identify trends, reversals, and support/resistance levels accurately.

👉 Read more: Axia Futures – Trading with Price Ladder and Order Flow Strategies

📚 PROOF OF PRODUCTS

What you will learn from The Footprint Edge Course:

The Footprint Edge Course teaches advanced futures trading skills. Here’s what you’ll learn:

- The Footprint tool: Learn how to use it for order flow analysis.

- Market liquidity: Understand how to use market liquidity in your trading strategies.

- Order flow vs technical analysis: See how order flow analysis can be better than traditional technical analysis.

- Cryptocurrency trading: Learn specific strategies for trading crypto futures.

- Live trading practice: Apply what you learn in real market situations.

- Risk management: Learn how to handle risks in futures trading.

This course gives you a full understanding of futures trading, helping you make smart decisions and create strong trading strategies.

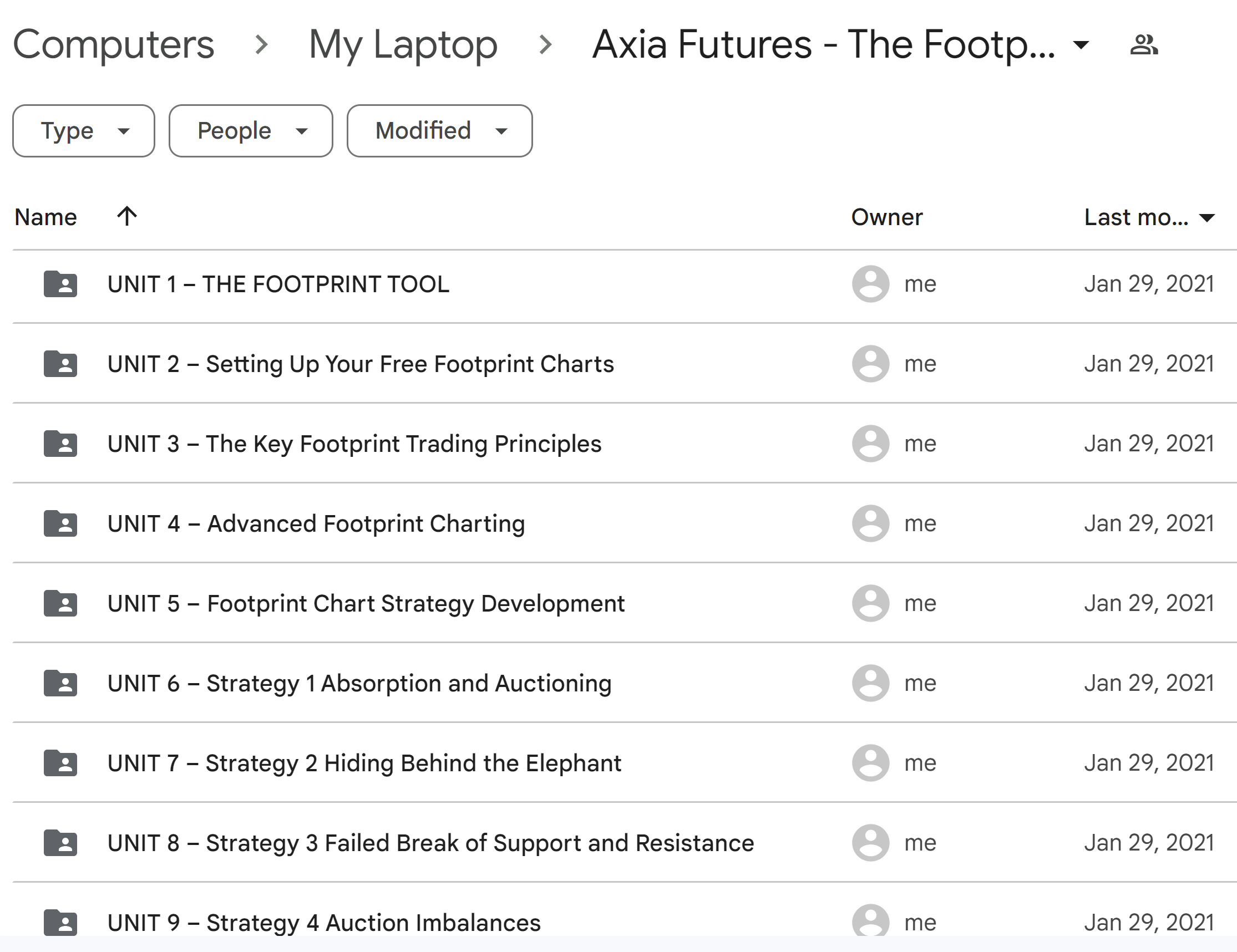

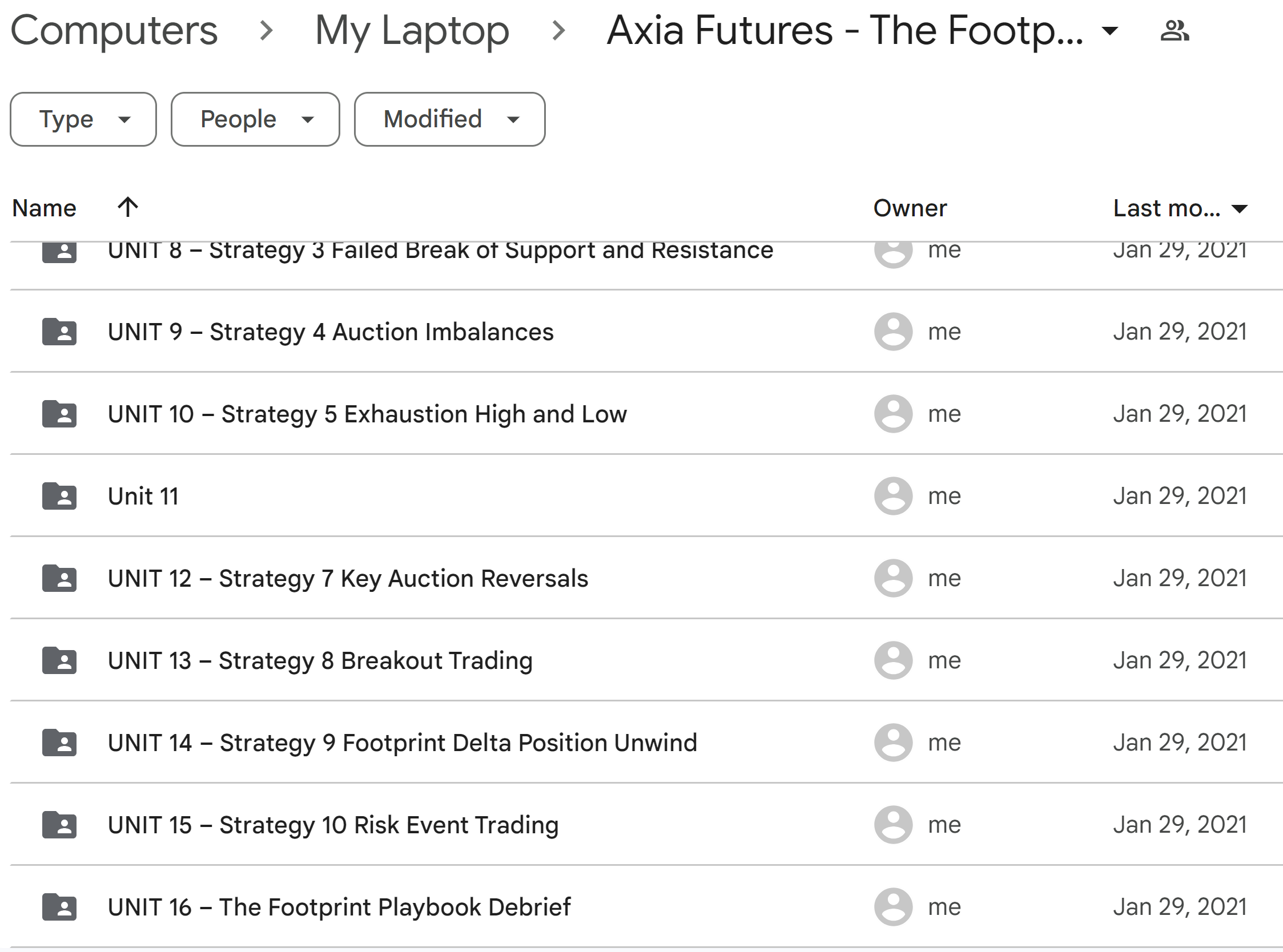

The Footprint Edge Course curriculum:

The Footprint Edge Course includes 16 units:

- UNIT 1 – THE FOOTPRINT TOOL

- UNIT 2 – Setting Up Your Free Footprint Charts

- UNIT 3 – The Key Footprint Trading Principles

- UNIT 4 – Advanced Footprint Charting

- UNIT 5 – Footprint Chart Strategy Development

- UNIT 6 – Strategy 1 Absorption and Auctioning

- UNIT 7 – Strategy 2 Hiding Behind the Elephant

- UNIT 8 – Strategy 3 Failed Break of Support and Resistance

- UNIT 9 – Strategy 4 Auction Imbalances

- UNIT 10 – Strategy 5 Exhaustion High and Low

- Unit 11 – Strategy 6 The Initiative Drive

- UNIT 12 – Strategy 7 Key Auction Reversals

- UNIT 13 – Strategy 8 Breakout Trading

- UNIT 14 – Strategy 9 Footprint Delta Position Unwind

- UNIT 15 – Strategy 10 Risk Event Trading

- UNIT 16 – The Footprint Playbook Debrief

This course structure teaches strategies and gives real-world practice, providing a complete learning experience.

Who is Axia Futures?

Axia Futures is a London-based trading education company. They teach using methods from top futures day traders.

The company’s core is the AXIA Trading Team, managed by AXIA MARKETS PRO, an FCA-regulated firm with roots in CME and LCH trading pits since 1984.

AXIA FUTURES and AXIA MARKETS PRO joined to form AXIA TRADING GROUP, offering proprietary trading services and trader training.

They have offices in London, Wrocław, and Limassol, with modern training facilities for futures trading education.

Axia Futures aims to develop skilled traders through expert education and market understanding.

Who should take Axia Futures Course?

The Axia Futures Footprint Edge Course is for many types of people:

- New traders: People just starting in futures trading who want to learn step-by-step.

- Experienced traders: Those who already trade but want to learn more about order flow analysis and new trading strategies.

- Finance workers: People in finance jobs who want to know more about markets and trading methods.

- Trading fans: Anyone interested in futures trading who wants to learn from pro traders.

This course helps all these people improve their trading skills, no matter their experience level.

1 review for Axia Futures – The Footprint Edge Course

Add a review Cancel reply

Related products

Trading Courses

Trading Courses

Futures Trading

Best 100 Collection

Trading Courses

Forex Trading

Options Trading

Trading Courses

![Mike Aston - Learn to Trade [Trading Template]](https://coursehuge.com/wp-content/uploads/2023/09/Mike-Aston-Learn-to-Trade-Trading-Template-300x300.jpg)

Anonymous (verified owner) –

Good course