AXIA Futures – Elite Trader Blueprint

$1,499.00 Original price was: $1,499.00.$23.00Current price is: $23.00.

AXIA Futures Elite Trader Blueprint Course [Instant Download]

What is AXIA Futures Elite Trader Blueprint:

AXIA Futures Elite Trader Blueprint teaches you professional futures trading using order flow analysis, profile strategies, and footprint trading.

The course shows you how to read market dynamics through 30 proven strategies, covering profile trading, footprint analysis, and order flow patterns.

You’ll learn to trade like institutional traders, with specific focus on game planning, pattern recognition, and news trading edge development. Created by FCA-regulated AXIA Futures, the program breaks down complex trading concepts into practical, actionable methods.

📚 PROOF OF COURSE

What you’ll learn from Axiafutures Elite Trader Blueprint:

Elite Trader Blueprint teaches you futures trading using methods from successful traders. Here’s what you’ll learn:

- Market Reading: Learn to read profile and footprint charts to find the best trade entries

- Order Flow Trading: Master how to spot and trade institutional order flow patterns

- Trading Patterns: Identify high-probability trade setups using proven patterns

- Risk Control: Learn proper position sizing and how to use different order types

- Trading Psychology: Use visualization and review techniques to improve your trading

- News Trading: Learn how to trade during major market news events safely

Whether you’re new to trading or already trading futures, this course helps you develop professional trading skills using proven methods.

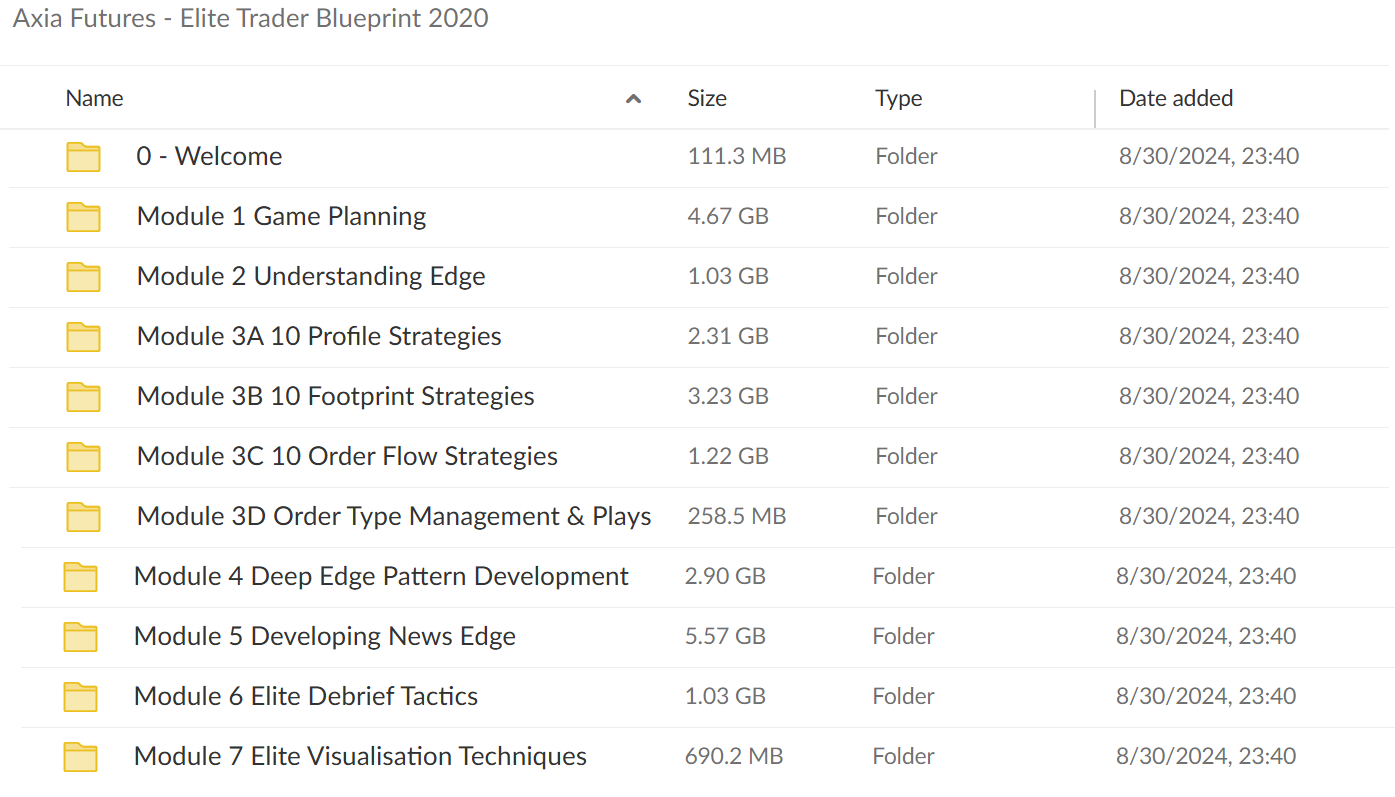

Course Structure:

- Welcome

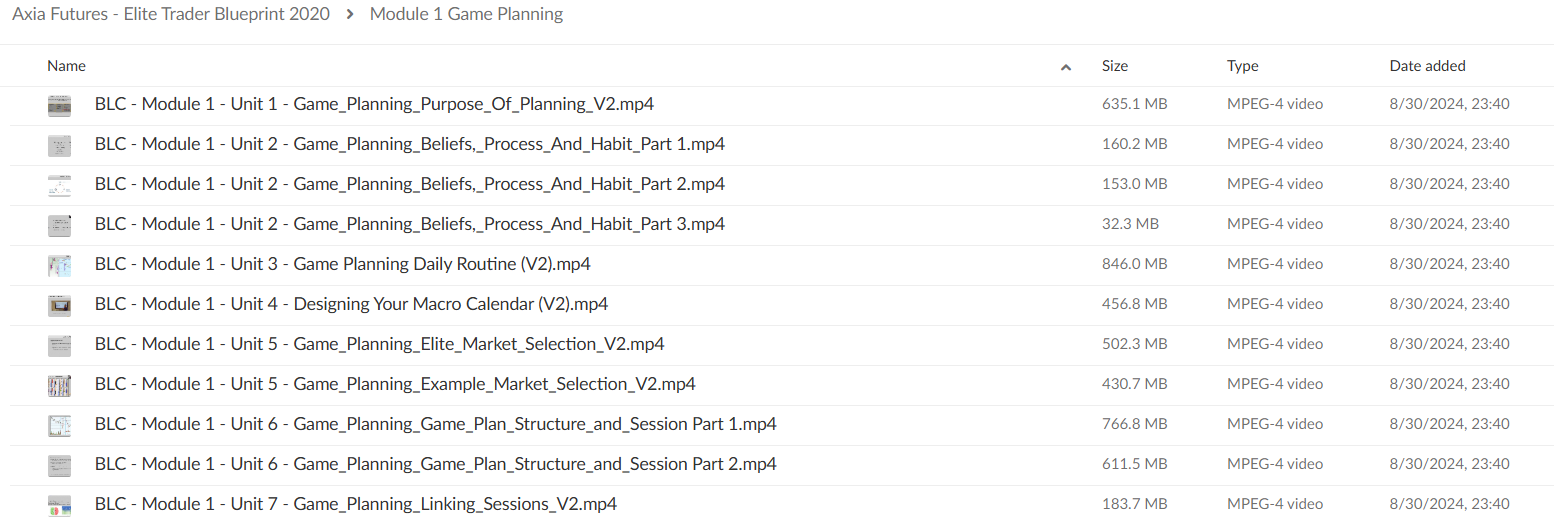

- Module 1: Game Planning

- Module 2: Understanding Edge

- Module 3A: 10 Profile Strategies

- Module 3B: 10 Footprint Strategies

- Module 3C: 10 Order Flow Strategies

- Module 3D: Order Type Management & Plays

- Module 4: Deep Edge Pattern Development

- Module 5: Developing News Edge

- Module 6: Elite Debrief Tactics

- Module 7: Elite Visualisation Techniques

- Conclusion

Each module builds on the previous one, giving you a complete trading system. You’ll learn both the ‘why’ and ‘how’ of successful futures trading, with practical examples and real market scenarios.

What is AXIA Futures?

AXIA Futures is a London trading education firm regulated by the Financial Conduct Authority (FCA). They teach futures trading based on methods used by successful traders.

The firm trains traders using real market strategies, not just theory. Their methods come from studying how top futures traders actually trade in the markets.

They’ve helped many traders learn professional trading skills through their practical training approach. All their courses focus on real trading techniques you can use in the markets.

AXIA Futures stands out because they’re FCA-regulated, which means they must maintain high standards in their training. This gives students confidence they’re learning reliable trading methods.

Be the first to review “AXIA Futures – Elite Trader Blueprint” Cancel reply

Related products

Crypto Trading

Forex Trading

Forex Trading

Trading Courses

Options Trading

Trading Courses

Trading Courses

Trading Courses

Reviews

There are no reviews yet.