Aeromir – The A14 Weekly Option Strategy Workshop

$700.00 Original price was: $700.00.$12.00Current price is: $12.00.

Amy Meissner A14 Weekly Option Strategy Workshop [Instant Download]

What is A14 Weekly Option Strategy Workshop:

Aeromir’s The A14 Weekly Option Strategy Workshop teaches you how to trade weekly butterfly spreads for consistent profits without predicting market direction.

This market-neutral strategy uses simple entry rules and daily adjustments that work for any account size. Amy’s live trading results show a 229% profit in 15 months using this exact method.

You’ll learn precise entry timing, adjustment techniques, and exit rules to manage trades effectively. The workshop breaks down advanced concepts into clear, actionable steps for both new and experienced options traders.

📚 PROOF OF COURSE

What you’ll learn in A14 Weekly Option Strategy Workshop:

The A14 Weekly Option Strategy Workshop shows you a proven system to make consistent income from options trading. Here’s what you’ll learn:

- Advanced BWB Strategy: Master the A14 Weekly Butterfly spread – the core strategy that powers this system

- Trading Rules: Learn exactly when to enter and exit trades for the best results

- Protection Plan: Use simple daily checks to keep your trades safe and profitable

- Advanced Methods: Take your trading to the next level with professional techniques

- Account Growth: Learn how to size your trades correctly and compound your profits

The workshop gives you step-by-step guidance to trade this high-probability strategy with confidence. Each concept builds on the last, making it easy to follow and implement.

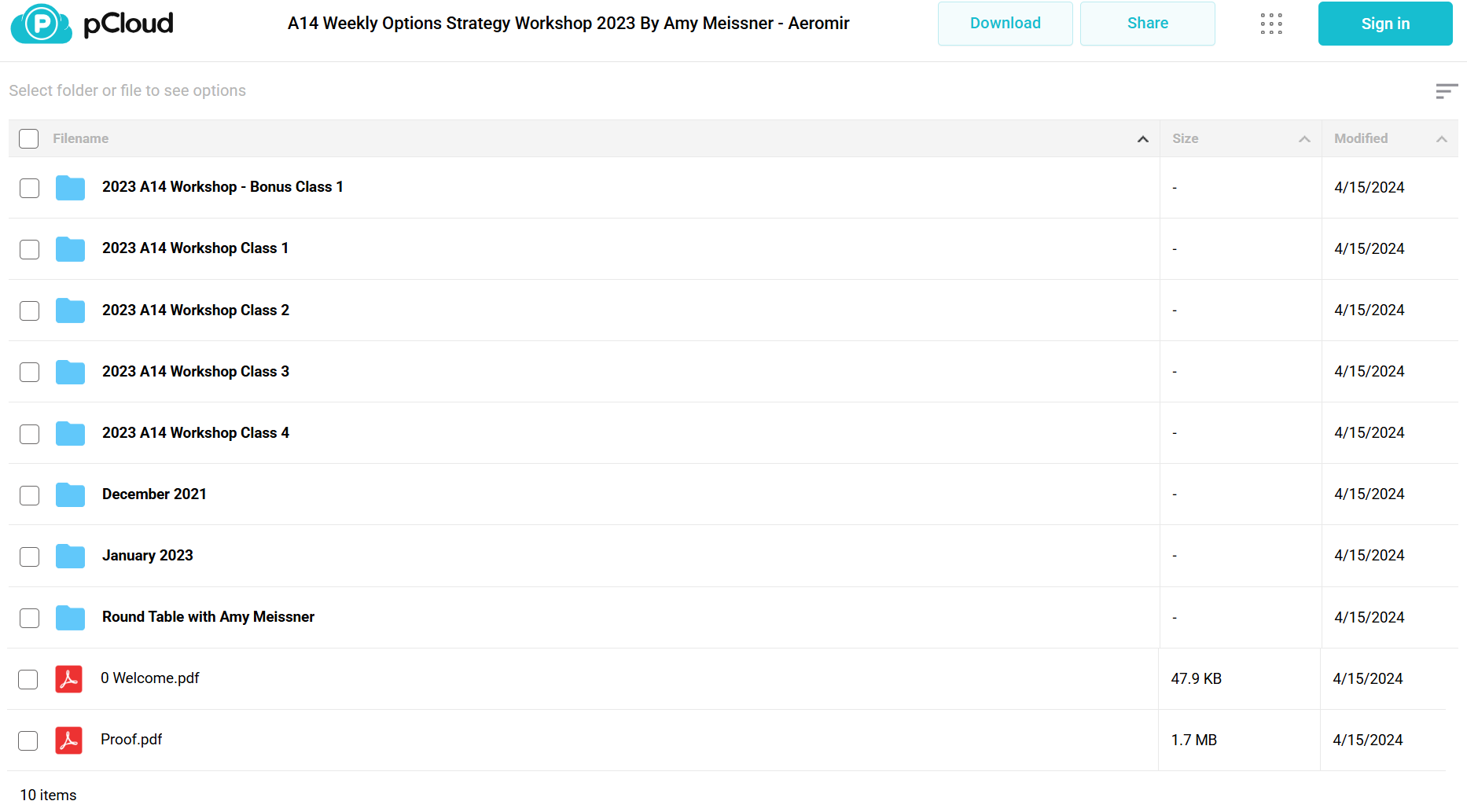

A14 Weekly Option Strategy Workshop Course Curriculum:

✅ Section 1: Workshop Foundations

The core workshop series provides comprehensive training in the A14 options trading strategy. Each class builds upon previous knowledge while incorporating practical applications and real-time market analysis.

Module 1.1: Class One Fundamentals

Introduction to core A14 strategy concepts and foundational principles. Students receive comprehensive slides, audio recordings, and video instruction with interactive Q&A sessions.

Class Materials:

- Workshop Class 1 Video (Primary instruction)

- A14 Class 1 Slides (PDF reference material)

- Interactive Chat Log (Student engagement record)

- Question and Answer Documentation (Implementation guidance)

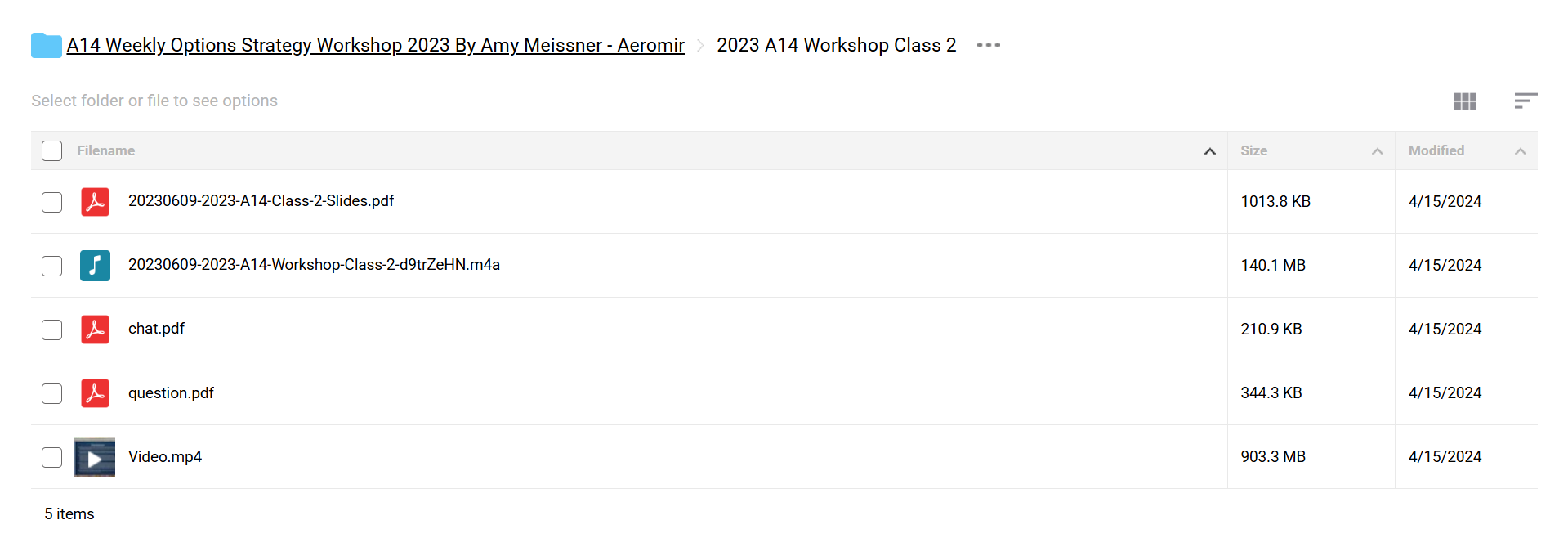

Module 1.2: Class Two Advanced Concepts

Builds upon foundational knowledge with advanced strategy applications. Students learn sophisticated trade selection and management techniques.

Class Materials:

- Workshop Class 2 Video (Advanced instruction)

- A14 Class 2 Slides (PDF reference material)

- Interactive Discussion Log (Strategy refinement)

- Student Questions and Solutions (Practical application)

Module 1.3: Class Three Implementation

Focuses on practical strategy execution and real-market applications. Students learn to identify and execute high-probability trading opportunities.

Class Materials:

- Workshop Class 3 Video (Implementation guidance)

- Advanced A14 Workshop Slides (PDF reference material)

- Strategy Discussion Archive (Real-time applications)

- Implementation Q&A Guide (Execution focus)

Module 1.4: Class Four Portfolio Management

Advanced portfolio management and trade tracking instruction. Includes detailed trade logging and compound interest calculations.

Class Materials:

- Workshop Class 4 Video (Portfolio instruction)

- Trade Logs and Reports (CSV data analysis)

- Compound Interest Calculator (Excel tool)

- Advanced Q&A Documentation (Portfolio optimization)

✅ Section 2: Bonus Content and Special Topics

This section provides supplementary training and specialized topic coverage to enhance strategy mastery.

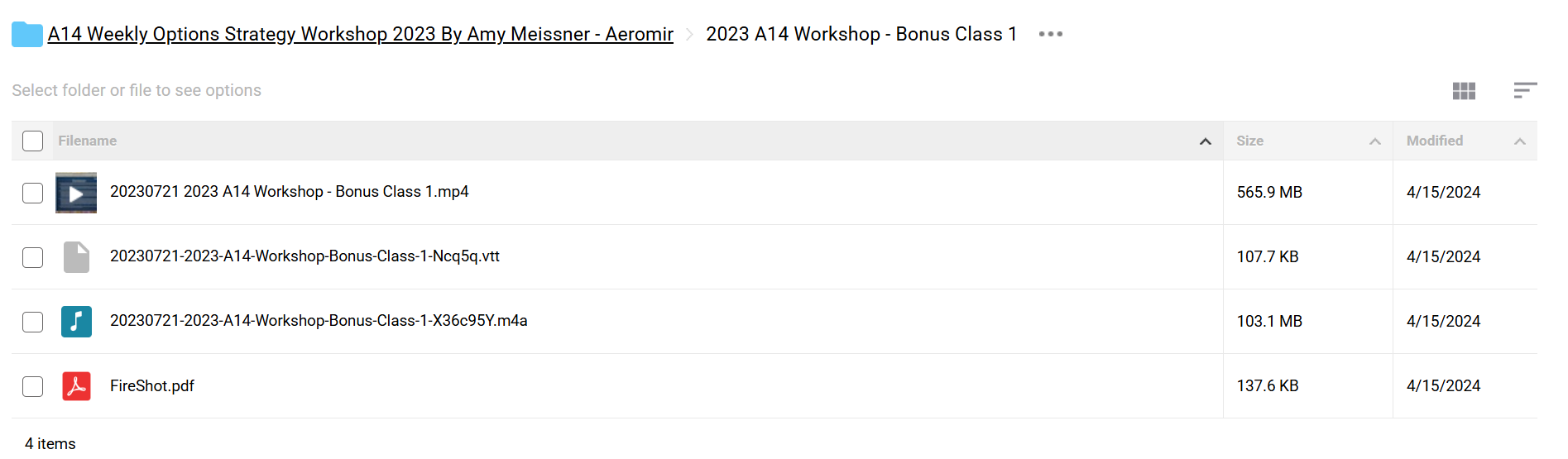

Module 2.1: Bonus Class

Additional strategy refinement and advanced applications. Includes comprehensive video instruction and supporting documentation.

Special Topics Coverage:

- PDT Rule Management for Options Spreads (Video guide)

- Round Table Discussion with Amy Meissner (Expert insights)

- Historical Case Studies from December 2021 (Strategy evolution)

✅ Section 3: Supporting Resources

Essential reference materials and welcome documentation to ensure student success throughout the program.

Welcome Guide (PDF)

Comprehensive introduction to the workshop structure and learning objectives.

Strategy Verification (PDF)

Documentation of strategy effectiveness and historical performance.

The curriculum integrates theoretical knowledge with practical application through multiple learning formats. Students receive video instruction, written materials, calculation tools, and interactive Q&A support. Each component builds toward mastery of the A14 options trading strategy while emphasizing risk management and consistent execution.

What is Amy Meissner?

Aeromir Corporation, based in Colorado Springs, specializes in options, futures, and forex trading education. Founded by Tom Nunamaker, a veteran trader and retired Air Force pilot, Aeromir’s mission is to empower traders through expert-led, interactive training.

Aeromir’s team comprises seasoned professionals managing portfolios worth millions, ensuring top-tier guidance for students. With a focus on practical strategies and real-world results, Aeromir has become a trusted name in trader education.

Be the first to review “Aeromir – The A14 Weekly Option Strategy Workshop” Cancel reply

Related products

Forex Trading

Trading Courses

Best 100 Collection

Stock Trading

Trading Courses

Forex Trading

Crypto Trading

Reviews

There are no reviews yet.