Advanced 11-Hour Options Workshop (Basecamptrading)

$497.00 Original price was: $497.00.$39.00Current price is: $39.00.

[Download] Basecamptrading – Advanced 11-Hour Options Workshop (Dave Aquino)

📚 PROOF OF COURSE

Basecamptrading Advanced 11-Hour Options Workshop Overview:

The Advanced 11-Hour Options Workshop, crafted by veteran trader Dave Aquino, is a comprehensive course designed to deepen their understanding of options trading.

In this course, you’ll explore advanced strategies and techniques to navigate and profit in volatile markets.

It’s tailored to provide practical, real-world knowledge, equipping you with the skills to make informed trading decisions and manage risks effectively.

Whether you’re looking to refine your trading approach or expand your expertise, this workshop offers valuable insights into the nuanced world of options trading.

Read more: Base Camp Trading – Explosive Growth Options – Stocks (EGOS) Program – EGOS MINI BUNDLE)

What you will learn in this course:

In the Basecamptrading Advanced 11-Hour Options Workshop, you’ll learn:

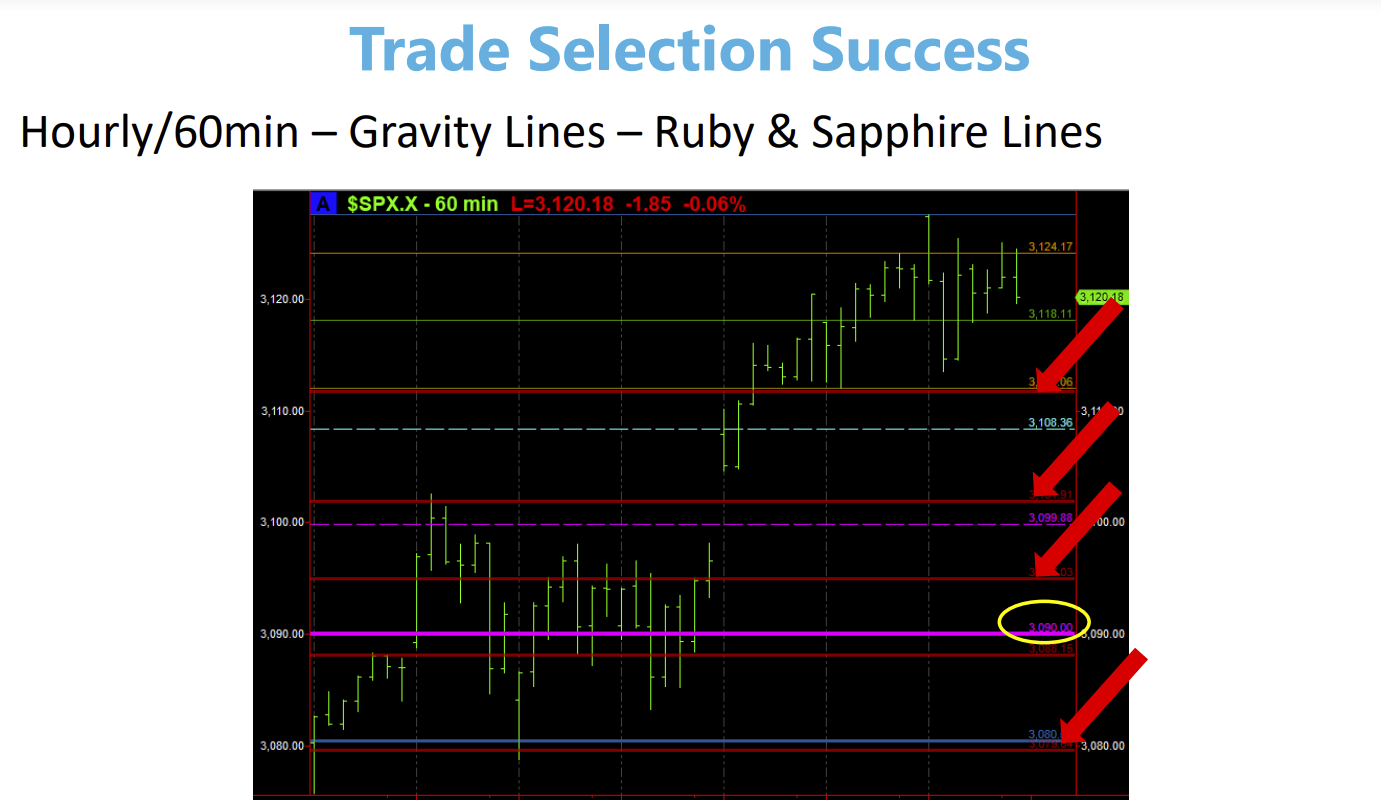

- How to identify and capitalize on market volatility for options trading.

- Advanced strategies for defending 11-Hour Options Trades.

- Techniques for managing credit spreads at critical times of the day.

- Application of Delta Neutral Overweight Trades in real-world scenarios.

- Step-by-step guidance on applying and removing Delta Neutral Protection trades.

This course is designed to empower you with the knowledge and skills for consistent trading success.

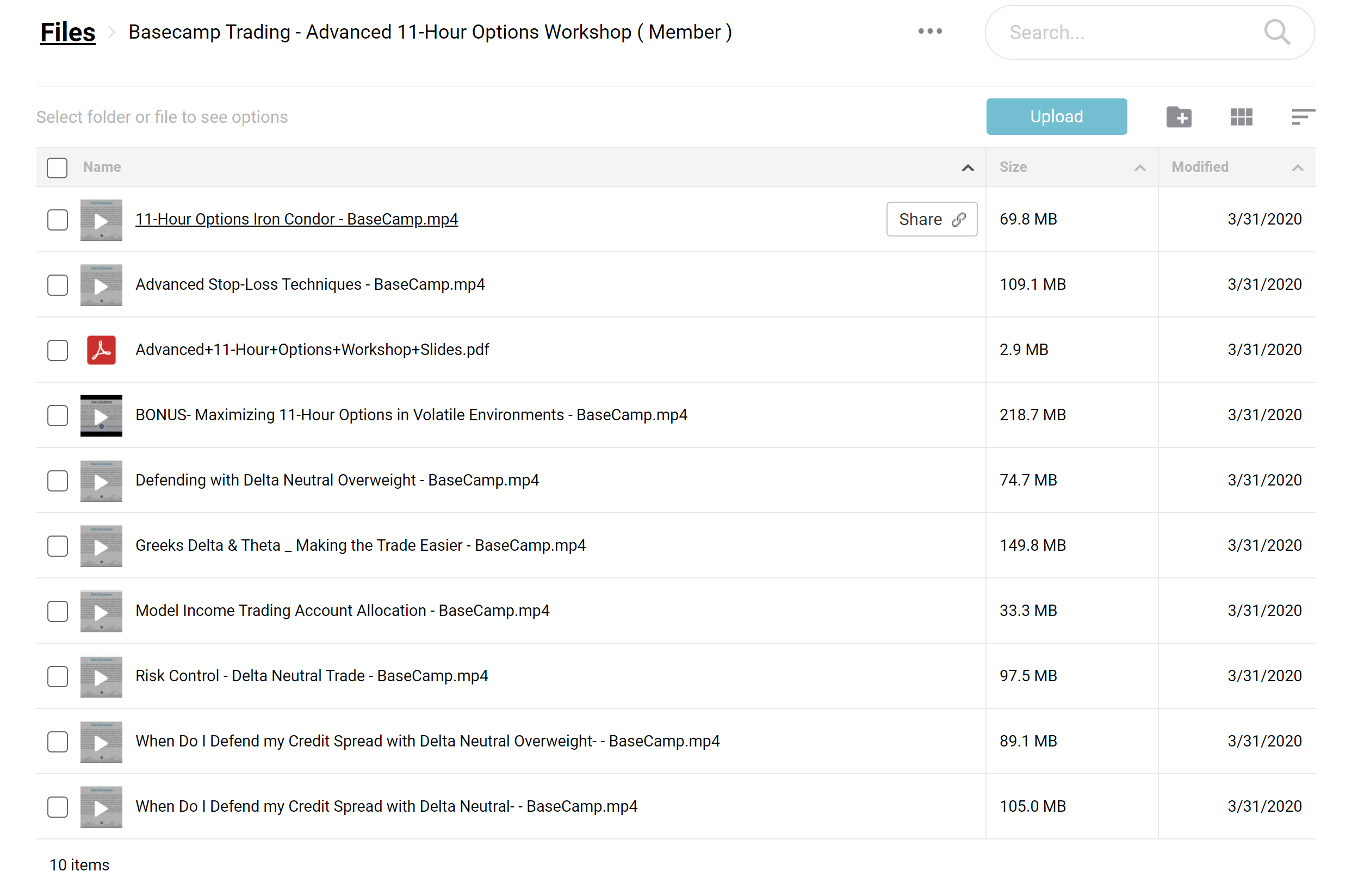

Advanced 11-Hour Options Workshop Curriculum:

This workshop covers various topics, from the fundamental concepts of options trading to advanced techniques, ensuring a holistic learning experience.

Key components of the course include:

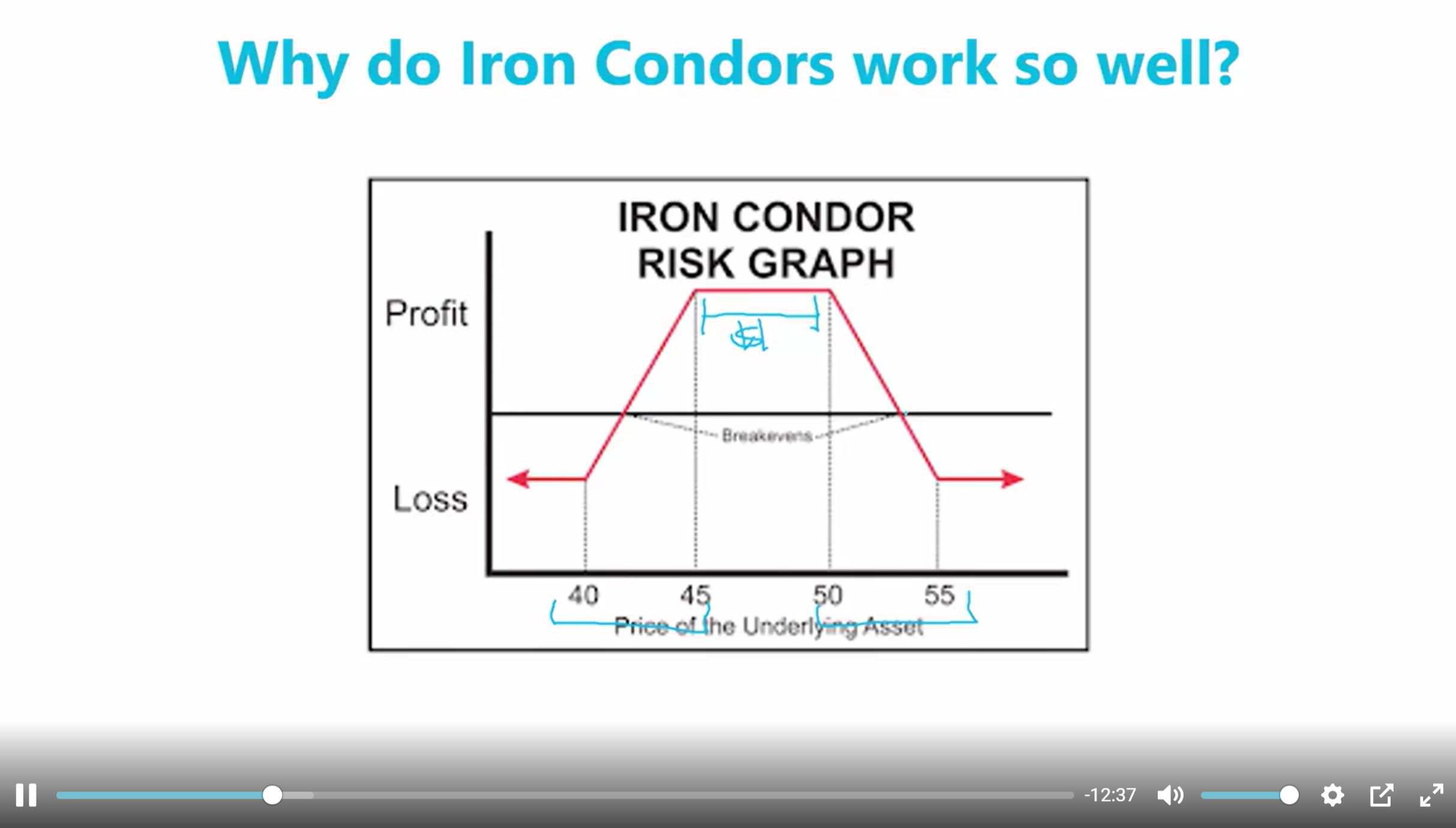

- 11-Hour Options Iron Condor: Dive deep into this strategy to understand how to maximize profits and minimize risks.

- Advanced Stop-Loss Techniques: Learn to protect your investments with cutting-edge stop-loss strategies.

- Comprehensive Course Slides: Gain access to detailed workshop slides for a thorough understanding of each concept.

- Bonus Material on Volatile Environments: Special sessions focusing on trading options in unpredictable markets.

- Defending Strategies with Delta Neutral Overweight: Master defending your positions in various market conditions.

- Understanding Greeks – Delta & Theta: Simplify your trades by comprehending these critical options metrics.

- Model Income Trading Account Allocation: Learn how to allocate your trading account for optimal income generation.

- Risk Control with Delta Neutral Trades: A focused module on managing risks effectively in options trading.

- Strategies for Defending Credit Spreads: Detailed insights on when and how to defend your credit spreads.

This workshop is structured to impart knowledge and provide practical, actionable strategies you can apply in real-world trading scenarios. It’s an ideal blend of theoretical knowledge and practical application, tailored for novice and experienced traders.

Advanced 11-Hour Options Workshop reviews:

The Advanced 11-Hour Options Workshop, led by Dave Aquino, has garnered attention for its in-depth coverage and practical approach to options trading. Below is a summary of participant feedback, highlighting critical aspects of the course.

Real-World Application and Relevance

- Practical Strategies: Students appreciate the course’s focus on real-world trading strategies. The sections on Iron Condors and delta-neutral strategies are particularly praised for their applicability in daily trading.

- Statistics and Success Rates: Many participants reported a noticeable improvement in their trading success, with some citing specific earnings and win rates.

Course Content and Structure

- Comprehensive Material: The workshop’s comprehensive approach, including detailed modules like ‘Risk Control’ and ‘Advanced Stop-Loss Techniques’, receives positive feedback for thoroughness.

- Presentation Quality: The clarity and quality of the course slides and materials are frequently mentioned, aiding in understanding complex concepts.

Instructor Expertise and Engagement

- Expert Guidance: Dave Aquino’s expertise, with over 20 years of experience, is a highlight for many. His ability to break down complex strategies into understandable segments is highly valued.

- Interactive Learning: The bonus live sessions are noted for enhancing the learning experience, providing an opportunity for real-time interaction and queries.

Student Reviews and Ratings

John Doe: “As a seasoned trader, I found the workshop refreshing and insightful. The Delta Neutral Overweight strategy was a game-changer for me. ⭐⭐⭐⭐”

Jane Smith: “This course is necessary for anyone serious about options trading. The Iron Condor module alone is worth the investment. ⭐⭐⭐⭐⭐”

Alex Johnson: “Initially overwhelmed, but the step-by-step approach made complex strategies manageable. Great for intermediate traders. ⭐⭐⭐⭐”

Overall Course Assessment

The Advanced 11-Hour Options Workshop stands out for its depth of content and practical application. While it demands a certain level of pre-existing knowledge in options trading, its structured approach makes complex strategies accessible and applicable. The course is particularly beneficial for those looking to enhance their risk management techniques and understand advanced options strategies.

Who is Dave Aquino?

Dave Aquino stands as a pinnacle in options trading, with a career spanning over two decades. His journey began at Merrill Lynch, where he honed his skills before moving to Vanguard Asset Management. Here, he specialized in options income strategies and managed assets worth over $650 million.

His expertise isn’t just in trading but also in imparting this knowledge effectively. As a partner at MicroQuant, Dave dedicates himself to educating others in options trading, drawing on his vast experience and deep understanding of the market.

His workshops, particularly the Advanced 11-Hour Options Workshop, reflect his commitment to helping others succeed in trading. His approach is practical and insightful, making complex concepts accessible to traders of all levels.

Be the first to review “Advanced 11-Hour Options Workshop (Basecamptrading)” Cancel reply

Related products

Options Trading

Options Trading

Options Trading

Options Trading

Options Trading

Trading Courses

Options Trading

Reviews

There are no reviews yet.