Learning

Is Business Credit Mastery Worth Investment?

If you’re looking for a business credit course, you might have heard of Colin Matthew. It’s getting a lot of talk lately. But you may ask, what’s it all about? and Is Business Credit Mastery Worth Investment? I’ve checked it out thoroughly. Here’s a straightforward breakdown to help you decide if it’s a good fit for you:

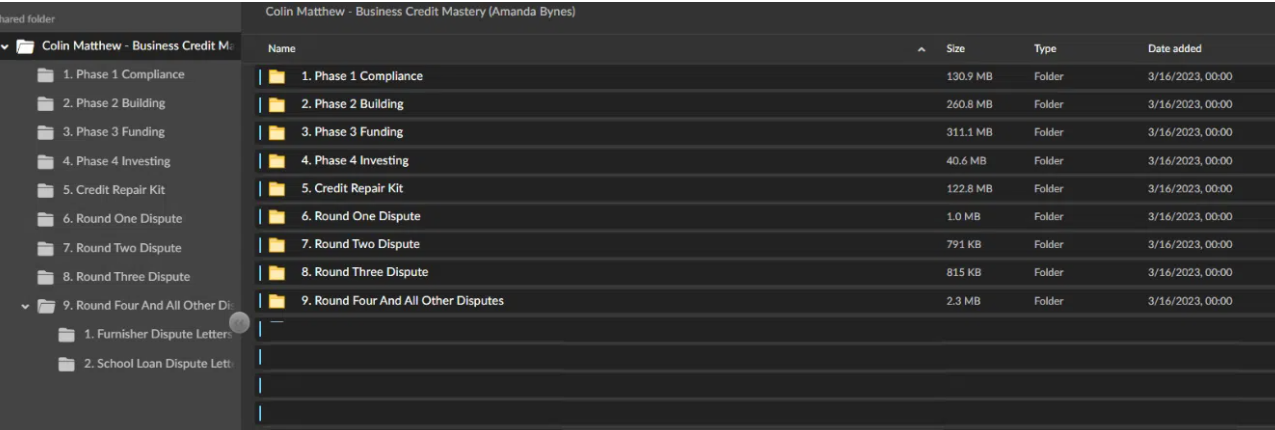

1. Business Credit Masterty Course Overview

- Course Size: 812 Mb

- Price: $997 (One-time Payment, no Extra hidden fee)

- Description: Entrepreneurs, Real Estate Investors, and Business Owners are invited to explore the “Business Credit Mastery” by Colin Matthew. This course promises to unlock $100,000 in 0% Business Credit in as little as 7 days, even without an established business. It provides guidance on acquiring business credit and investing in passive income-producing assets like Real Estate and Automated Walmart Stores using Other People’s Money (OPM).

- Course Structure: The course is divided into 4 Modules with 30+ Video Lessons. It also includes Colin’s $247,000 Funding Case Study from October 2021, where he establishes and funds a new company from scratch in two weeks. Additionally, the course offers Colin’s Lender Database, which provides references to NO-DOCUMENT lenders, enabling funding for a new business without revenues.

👉 Read More Colin Matthew Business Credit Mastery Course

2. Understanding the Importance of Business Credit

Before diving into the course review, it’s essential to understand the significance of business credit. Business credit is not just a number; it reflects your company’s or person financial reputation. Here are some compelling statistics that underscore its importance:

- Business Credit in the U.S.: There are 28.8 million small business owners in the U.S., and business credit plays a pivotal role in their operations.

- Funding Challenges: 27% of businesses needed help to secure the funding they needed, which hindered their growth.

- Mixing Personal and Business Finances: 46% of small businesses use personal credit cards, blurring the lines between personal and business expenses.

- Loan Denials: 20% of small business loans get denied due to business credit issues.

- Awareness Gap: 45% of small business owners must know they have a business credit score.

3. Who is Colin Matthew?

Colin Matthew is a seasoned entrepreneur and expert in business finance. He created the “Business Credit Mastery” course to help businesses understand and improve their financial standing. His course offers practical steps to secure and manage business credit effectively.

Social Proof:

Colin’s expertise is evident in his strong online presence. He has a significant following on platforms like Instagram, with over 12.9K followers, and YouTube, where he has 11.6K subscribers. These numbers show that many trust his advice and find value in his content.

Is Colin Matthew a Scam?

From the information available, Colin Matthew seems genuine and dedicated to helping businesses with their finances. However, always do your own research before making any decisions.

4. How Does Business Credit Mastery Work?

Colin Mattew – Business Credit Mastery course is structured systematically, ensuring that participants understand the concepts and apply them practically.

Here’s a brief overview of how the course is structured:

Phase 1: Compliance

This phase lays the foundation for the entire course. It introduces participants to the business credit world and provides essential tools to start the journey. Key modules include:

- Welcome and Introduction

- Making Your Investment Back

- Personalized Funding Action Plan

- Business Funding Essentials

- Setting up Phone Listings, Business Addresses, and Websites

- Incorporation and EIN Acquisition

Phase 2: Building

Here, participants delve deeper into building a robust business credit profile. The modules focus on:

- Funding Accelerator Toolkit

- Business Bank Account Setup

- Acquiring a DUNS Number and Paydex Score

- Engaging with Tier 1 Vendors

- Exploring Store Cards, Bridge Loans, and more

Phase 3: Funding

This phase is all about leveraging the built credit profile to secure funding. It covers:

- Six-Figure Credit Card Strategy

- Comprehensive Credit Card Master Database

- Exploring Various Business and Charge Cards

- Credit Card Liquidation Strategies

- Understanding Loans, Financing, LOCs, and Inquiry Removal

- No PG Vehicle Guide and Case Studies

Phase 4: Investing

The final phase equips participants to know how to invest the secured funds wisely. It includes:

- Investing Fundamentals

- 4-Step Real Estate Investing

- Mergers & Acquisitions and Amazon Automation

The “Business Credit Mastery” course offers a holistic approach, guiding participants from understanding business credit to securing funds and finally investing them effectively.

5. My Experience with Business Credit Mastery

Now, let’s talk about the Business Credit Mastery course. The course promises insights into building and leveraging business credit. Here’s what I found:

- Comprehensive Content: The course is detailed, offering step-by-step guidance on building business credit from scratch.

- Real-world Examples: Colin provides practical steps with examples, making applying the knowledge in real-world scenarios easier.

- Focus on 0% Interest: One of the highlights is the emphasis on securing substantial amounts, like $100,000, at 0% interest. This is a game-changer for businesses, especially startups.

| What I Like | What I Don’t Like |

|---|---|

| The phased approach makes it easy to follow and ensures a systematic learning process. | Some modules might benefit from being further broken down for even more clarity. |

| Comprehensive coverage of topics from basics to advanced strategies. | Some sections, especially in the investing phase, might feel a bit overwhelming for absolute beginners. |

| Real-world examples and actionable steps provided throughout the course. | The course might require frequent updates to stay relevant with changing financial landscapes. |

| Clear focus on both building credit and effectively investing the secured funds. | Some modules might feel a bit lengthy and could benefit from concise summaries. |

| Inclusion of tools and resources, like the Funding Accelerator Toolkit, adds immense practical value. | A more interactive or visual component, like webinars or infographics, could enhance understanding. |

Student reviews about Business Credit Mastery

The “Business Credit Mastery” course has received a range of feedback from its participants. These reviews offer a mix of experiences and insights that can be helpful for those considering enrolling.

6. Is Business Credit Mastery Worth Investment?

Based on my experience and the current business landscape, here’s my take:

- Practical Value: The course offers actionable steps, not just theoretical knowledge. If followed diligently, businesses can build a robust credit profile.

- Return on Investment: Considering the potential of securing significant funds at 0% interest, the course can pay for itself multiple times.

- Empowerment: With the knowledge from this course, businesses can separate personal and business finances, reducing personal liability and enhancing financial health.

7. Conclusion

Business credit is the lifeline of any enterprise. It’s not just about securing loans; it’s about building a trustworthy financial reputation. The Business Credit Mastery course by Colin Matthew provides the tools and knowledge to achieve this. It’s a worthy investment for those serious about mastering the intricacies of business credit.

8. Frequently Asked Questions:

Q1: What is business credit?

Business credit records a company’s financial responsibility based on its borrowing and repayment history. Like personal credit, it helps lenders, suppliers, and other entities determine how trustworthy a business is regarding financial commitments. A good business credit score can make it easier for a company to get loans, secure better terms with suppliers, and even attract potential partners or investors.

Q2: How is business credit different from personal credit?

While business and personal credit provide a snapshot of financial responsibility, they serve different purposes. Personal credit is tied to an individual and their finances, while business credit relates to a company’s economic behaviour. Business credit can impact a company’s ability to secure loans, terms with suppliers, and more.

Q3: Why do you need business credit?

Business credit is essential as it reflects a company’s financial reputation. A good business credit score can help secure loans, get better terms with suppliers, and attract potential partners or investors. It also allows business owners to separate personal and business finances.

Q4: How do you create a business credit?

Building business credit involves several steps, including setting up a business entity, obtaining an EIN, opening a business bank account, and establishing credit lines with vendors. Over time, timely payments and responsible financial behaviour contribute to a favourable business credit profile.

Q5: Do businesses have their credit?

Yes, businesses have their credit profiles separate from the personal credit of the owners. This credit profile is built based on the company’s financial activities, including borrowing and repayment behaviours.