Price Action Trading Institute – Trading with Rayner

$997.00 Original price was: $997.00.$12.00Current price is: $12.00.

Rayner Teo Price Action Trading Institute Course [Instant Download]

What is Rayner Teo Price Action Trading Institute?

Price Action Trading Institute is a trading course teaches you how to read charts and make profitable trades without using indicators.

The program shows you how to identify support and resistance levels, understand candlestick patterns, and manage trading risk properly. You learn to make trading decisions by reading pure price movement on charts.

Rayner’s system teaches you to build consistent trading strategies for breakouts, pullbacks, and trend continuation. You get step-by-step methods to analyze market structure and execute trades with proper position sizing and stop loss placement.

📚 PROOF OF COURSE

What you’ll learn in Price Action Trading Institute:

This complete course teaches you everything needed to become a successful price action trader. Here’s what you’ll master:

- Support and resistance analysis: Learn to find key levels where price reacts and how to predict when they’ll break

- Candlestick pattern recognition: Master reading price charts like a pro using powerful candlestick formations

- Entry and exit strategies: Discover pullback and breakout techniques to enter trades at good prices with high probability setups

- Risk management systems: Learn proper stop loss placement, position sizing, and trade management to protect your money

- Complete trading strategies: Get proven strategies for false breaks, counter trends, breakouts, and trend continuation setups

- Trading plan development: Build your own systematic trading approach with clear rules and consistent execution

The course combines theory with practical examples and real trading scenarios. You’ll learn to trade confidently in different market conditions using only price action analysis.

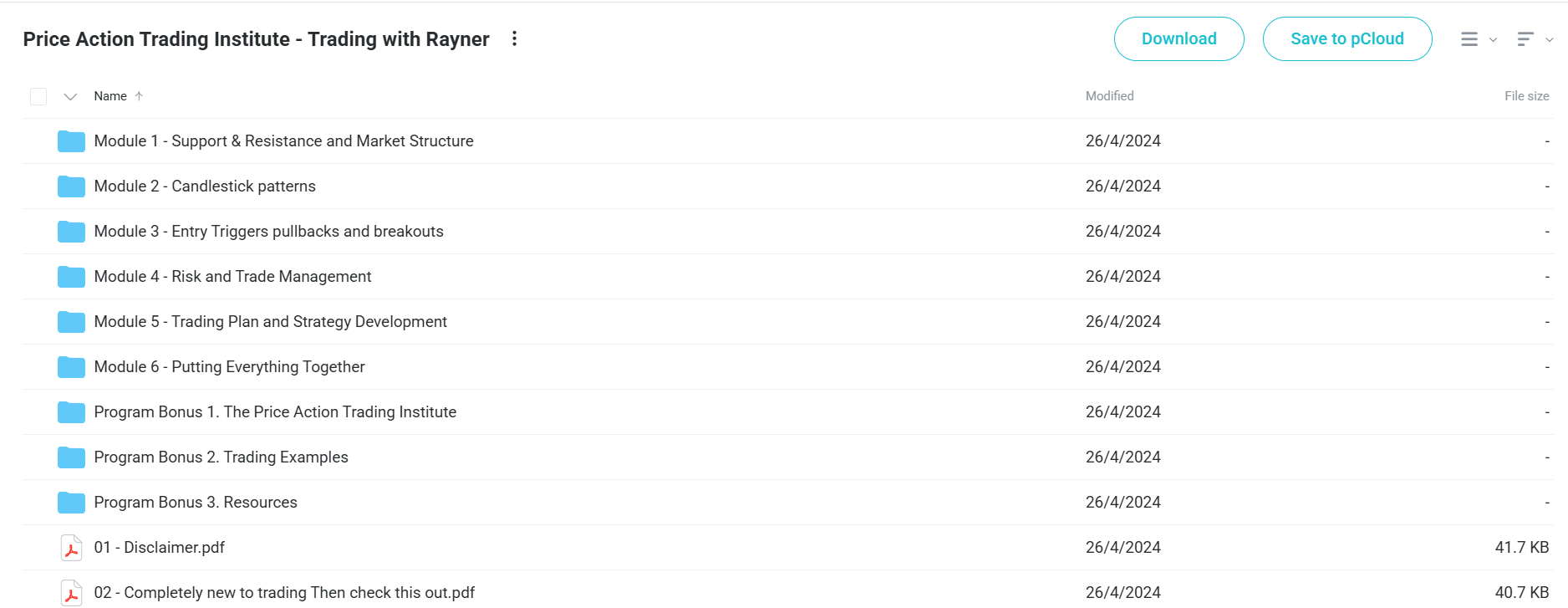

Price Action Trading Institute Course Curriculum:

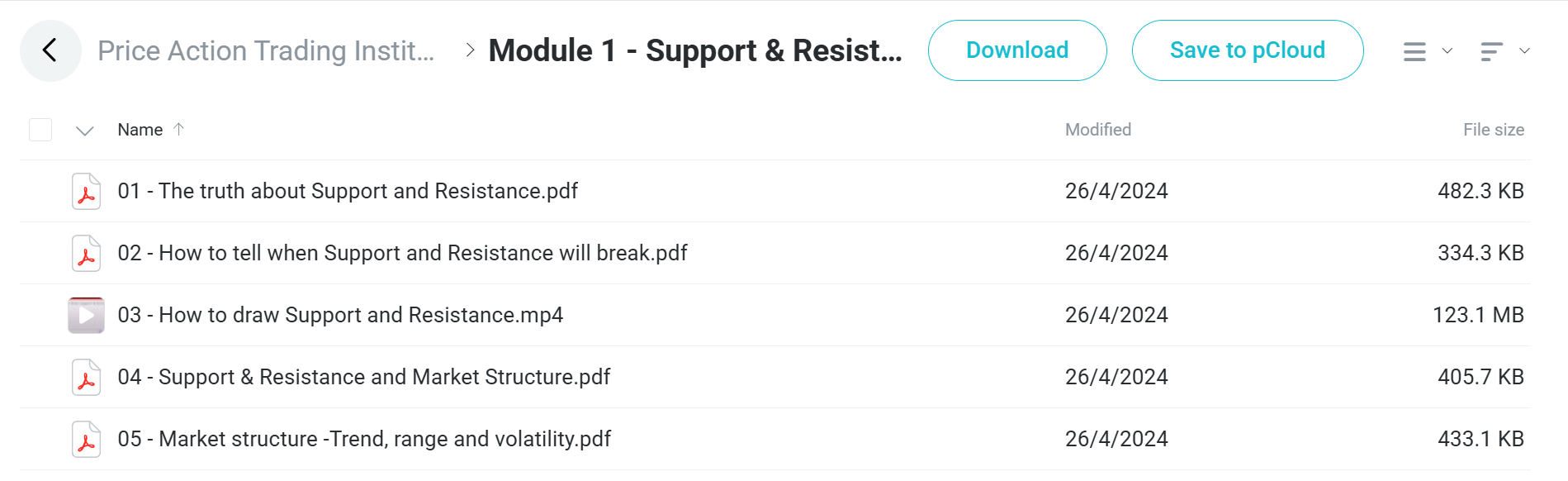

✅ Module 1: Support & Resistance and Market Structure

This basic module explains one of the most important ideas in chart reading by teaching students the real truth about support and resistance levels beyond simple straight lines. Students learn better ways to find when these levels will hold or break, along with proper methods for drawing useful support and resistance areas on any time chart.

The module introduces market structure basics, covering how trends, ranges, and price swings form the backbone of all price movement. Students learn to read market phases and understand how support/resistance levels work with overall market structure, setting the foundation for all future trading strategies.

✅ Module 2: Candlestick Patterns and Price Reading

Students master reading candlestick patterns like professional traders, moving beyond basic pattern spotting to understanding the thinking and market feeling behind each formation. The module shows advanced ways to read price charts, teaching students to see the story that price action tells about buying and selling pressure.

A big focus is placed on the Pinbar pattern, one of the most reliable price action signals, with detailed instruction on finding them, understanding context, and best entry methods. Students learn a powerful risk-to-reward improvement method that can greatly increase winning rates while keeping good risk management.

The module ends with complete training on entry triggers, giving students multiple proven ways to time trade entries with accuracy and confidence.

✅ Module 3: Entry Triggers, Pullbacks and Breakouts

This module teaches two basic trading approaches that form the core of most profitable trading strategies. Students learn pullback trading methods that let them enter trending markets at cheaper prices, getting the most profit potential while keeping risk low.

The pullback section includes special training on moving averages, helping students figure out which moving average periods work best for different market conditions and trading styles. Students discover how to use moving support and resistance levels created by moving averages to improve entry timing.

Breakout trading gets complete coverage, teaching students how to trade with momentum correctly while avoiding the common traps that catch most breakout traders. The module focuses on the importance of context, volume analysis, and proper breakout confirmation methods.

✅ Module 4: Risk and Trade Management

This important module covers the most important part of trading success – proper risk and trade management. Students learn smart stop-loss placement methods that prevent unnecessary losses while keeping appropriate risk levels for long-term account safety.

Trade exit strategies get detailed attention, with multiple approaches taught for different market conditions and trading goals. Students learn how to exit trades systematically to create steady income while letting winners run for maximum profit potential.

The risk management section gives a complete framework for surviving and doing well in trading over decades, not just months. Students learn position sizing calculations, account risk management, and the mental aspects of staying disciplined during both winning and losing periods.

Advanced trade management methods are covered extensively, including multiple ways for trailing stop-losses using previous candle highs/lows, ATR (Average True Range), and breakeven management strategies that lock in profits while allowing for continued upside potential.

✅ Module 5: Trading Plan and Strategy Development

Students learn four complete trading strategies that can be used across all markets and timeframes. The False Break strategy teaches students to profit from failed breakout attempts, turning market tricks into profitable opportunities with high risk-to-reward ratios.

Counter Trend trading is covered with specific focus on timing and context, helping students identify when markets are stretched too far and ready for reversals. The Breakout strategy gets advanced treatment with multiple confirmation methods and entry improvements.

Trend Continuation strategies complete the strategy toolkit, teaching students to identify and profit from the restart of established trends after temporary pauses. Each strategy includes detailed setup rules, entry triggers, stop-loss placement, and profit target guidelines.

The module ends with complete instruction on developing personal trading strategies and creating detailed trading plans that match individual risk comfort, schedule, and market preferences.

✅ Module 6: Putting Everything Together

The final module combines all previous learning into a clear trading framework that students can use right away. Students learn to analyze market phases including accumulation, distribution, advancing, and declining phases, giving context for strategy selection and trade timing.

Practical guidance is given on avoiding missed opportunities through systematic market scanning and preparation methods. Students learn to improve their trading performance through advanced ideas including market correlation analysis and multi-timeframe confirmation methods.

The module includes essential practical skills such as trade journaling methods for continuous improvement, chart saving and organization techniques for efficient market analysis, and workflow optimization for consistent daily trading routines.

Who is Rayner Teo?

Rayner Teo is a former proprietary trader and founder of TradingwithRayner, one of the top trading education platforms online. He built his reputation through years of professional trading and helping thousands of traders worldwide.

Rayner started as a proprietary trader, trading with institutional capital and learning advanced market analysis techniques. This real experience gave him deep insights into how markets actually work.

He founded TradingwithRayner to share practical trading knowledge with retail traders. His platform now serves traders in over 100 countries with millions of followers on YouTube and social media.

Rayner is known for his clear teaching style that focuses on practical techniques over complicated indicators. His approach uses price action analysis, proper risk management, and systematic trading strategies.

His content has helped thousands of traders improve their results through proven methods that work in real markets. Rayner continues to trade actively while teaching others to achieve consistent profits.

Be the first to review “Price Action Trading Institute – Trading with Rayner” Cancel reply

Related products

Trading Courses

Trading Courses

Forex Trading

Trading Courses

Forex Trading

Base Camp Trading – Explosive Growth Options – Stocks (EGOS) Program – EGOS MINI BUNDLE)

Trading Courses

Forex Trading

Reviews

There are no reviews yet.