StockBee Bootcamp – European Members – March 2023

$600.00 Original price was: $600.00.$12.00Current price is: $12.00.

StockBee Bootcamp European Members Course [Instant Download]

1️⃣. What is StockBee Bootcamp European Members?

StockBee Bootcamp European Members is a trading program that teaches trading strategies for all market conditions.

In this course, you’ll learn how to spot market patterns, find good entry points early, and trade with less risk while making more profit.

Created by Pradeep “Easyguru” Bonde, this program shows you how to swing trade effectively whether you can watch the market during trading hours or only check after work.

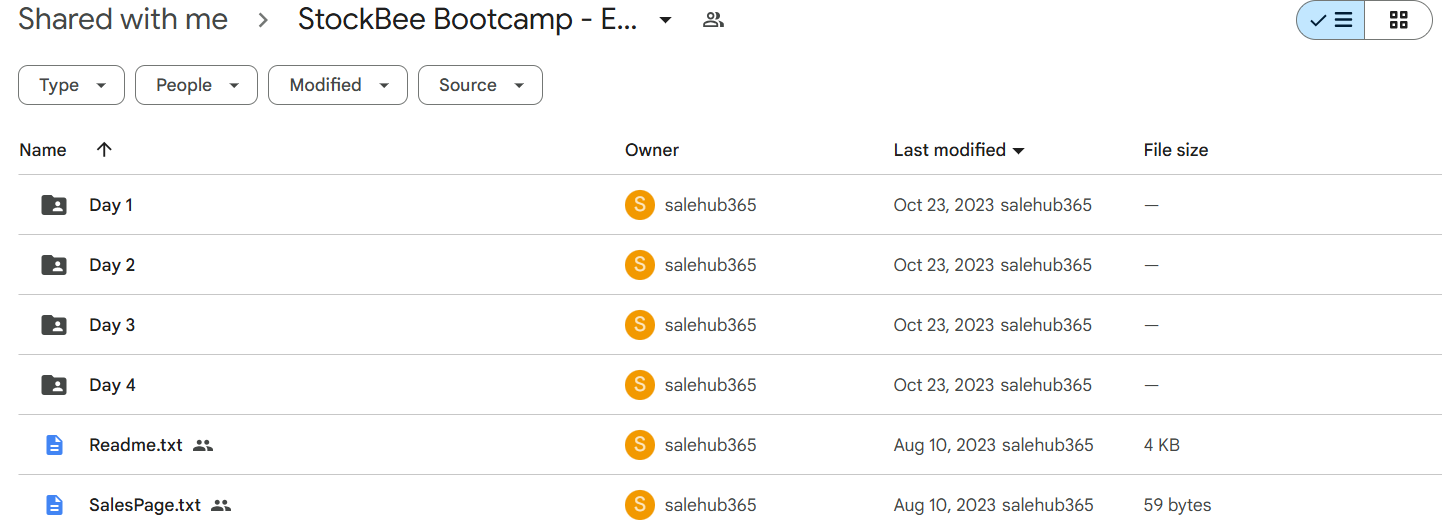

📚 PROOF OF COURSE

2️⃣. What you’ll learn in European Members:

StockBee Bootcamp European Members offers a complete system for profitable trading in any market. Here’s what you’ll learn:

- Market structure analysis to find high-probability trades early

- Momentum burst strategies for both bullish and bearish markets

- Episodic Pivot (EP) setups that have helped traders make life-changing profits

- Trade management techniques to increase win rates and protect your money

- Process loops to turn knowledge into consistent, repeatable results

- Swing trading approaches for both active traders and working professionals

This course connects theory with practice, showing you how to use these strategies in real markets. By the end, you’ll have a complete trading system that works in any market.

3️⃣. European Members Course Curriculum:

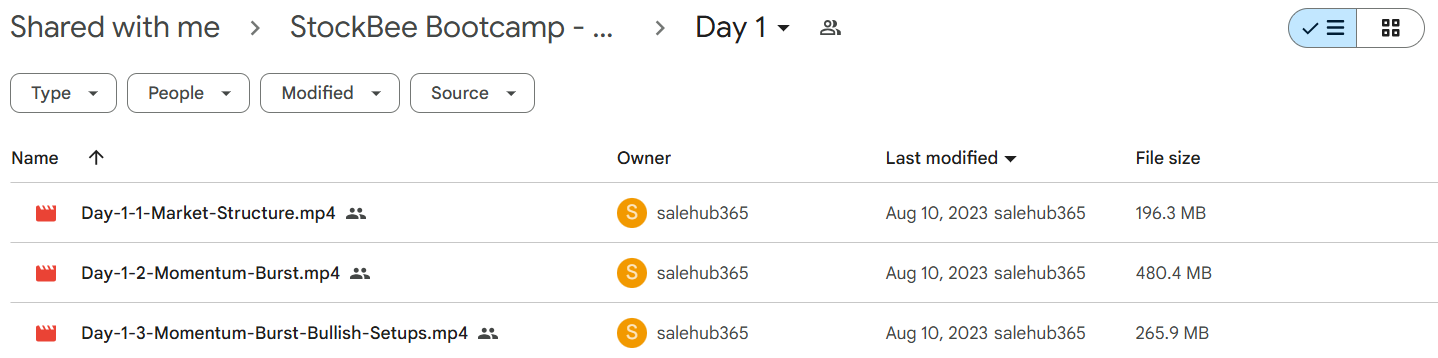

✅ Day 1: Market Structure & Momentum Foundations

Day 1 establishes the essential groundwork by exploring market structure principles that govern price action across different timeframes. Students learn to identify and analyze momentum burst patterns, the core strategy of the StockBee methodology.

The day begins with a thorough examination of market structure components, including support/resistance levels, trend identification, and volume analysis. The second session introduces momentum burst theory, explaining how explosive price movements create profitable trading opportunities. The final session focuses specifically on bullish momentum setups, teaching students how to recognize and capitalize on upward price movements with precision timing.

✅ Day 2: Advanced Price Action Patterns

Day 2 expands the trading arsenal by introducing three powerful price action patterns that complement the momentum burst strategy. Students learn to identify specific market conditions that signal high-probability trade opportunities.

The bottom bounce pattern teaches students how to identify stocks that have reached a temporary bottom and are poised for a recovery, capturing profits from the subsequent upward movement. The consolidation pattern session demonstrates how to trade sideways price action, recognizing the telltale signs of energy building before a breakout. The continuation pattern wraps up the day by showing students how to identify and trade sustained trends for maximum profit potential.

✅ Day 3: Trade Management & Strategy Refinement

Day 3 shifts focus from entry strategies to the crucial aspects of trade management and strategy optimization that lead to consistent profitability. Students learn psychological tools and technical indicators to maximize gains while minimizing risk.

The first session covers comprehensive trade management techniques, including position sizing, stop-loss placement, and scaling strategies to protect capital and maximize returns. The high win-rate session reveals advanced filtering methods to select only the highest probability setups, significantly increasing overall trading performance. The nuances session addresses subtle market conditions and adjustments that separate professional traders from amateurs, teaching students how to adapt strategies to changing market environments.

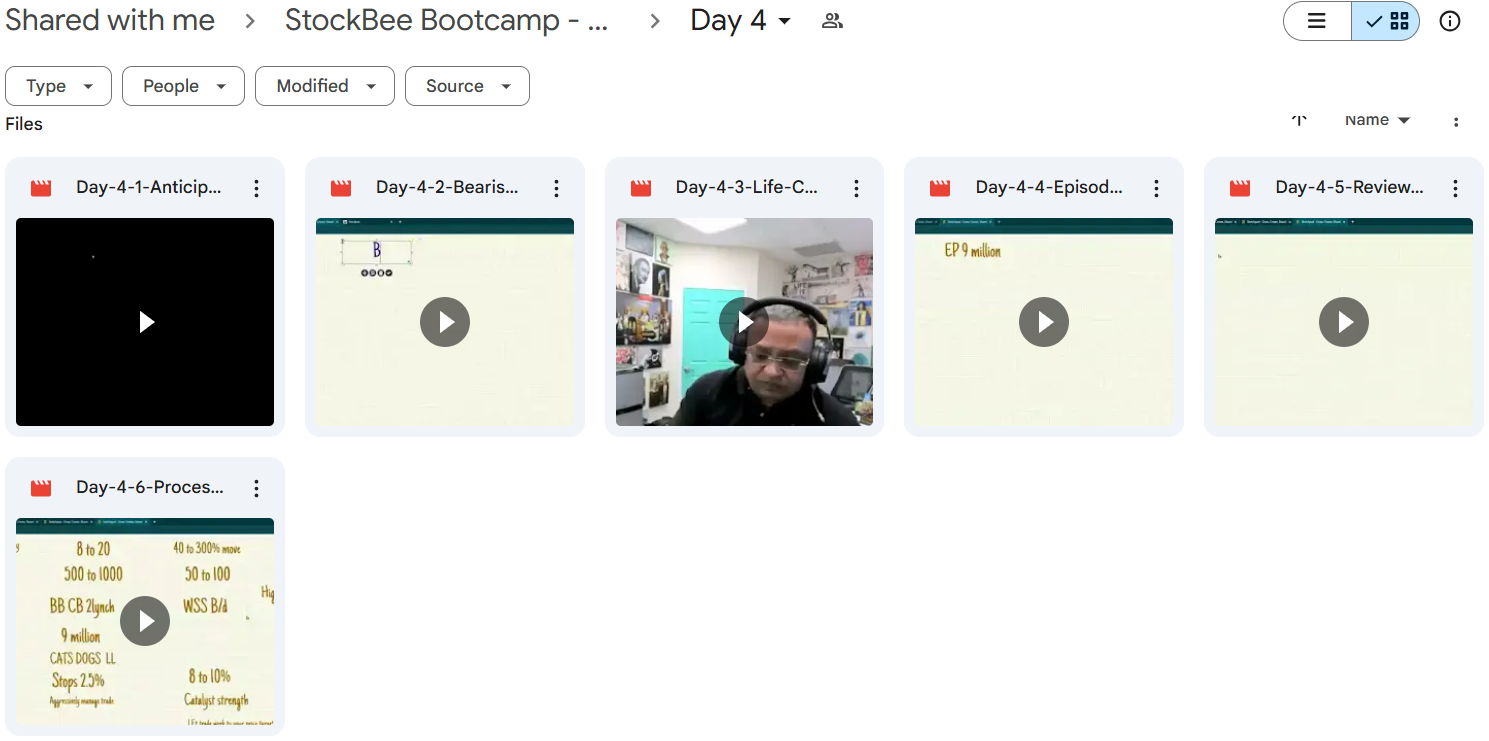

✅ Day 4: Advanced Concepts & Integration

The final day introduces breakthrough concepts and ties the entire methodology together into a cohesive trading system. Students learn how to anticipate market movements and capitalize on rare but extremely profitable trading opportunities.

The anticipation session teaches students how to identify potential momentum bursts before they occur, positioning themselves ahead of major price movements. The bearish momentum burst session covers the opposite side of the market, showing how to profit from downward price action. The episodic pivots sessions reveal the StockBee methodology for identifying life-changing trading opportunities, supported by a real-world case study of a $9 million trade.

The course concludes with a comprehensive review of all strategies and a session on the process loop methodology, providing students with a systematic approach to continually refine their trading skills through deliberate practice and performance analysis.

4️⃣. Who is Pradeep Bonde?

Pradeep Bonde, known as “Easyguru,” has over 20 years of experience trading U.S. stocks. He founded Stockbee, a respected trading education platform and community.

Pradeep created the “Episodic Pivot” (EP) setup, which finds big stock moves triggered by specific events. Famous trader Kristjan Kullamägi (Qullamaggie) credits huge profits to the EP setup he learned from Pradeep.

Through Stockbee, Pradeep shares blog posts, videos, and tools to help traders succeed. He focuses on practical skills over theory and teaches strong risk management.

The March 2023 European Members Bootcamp shows Pradeep’s goal of making quality trading education available to everyone, no matter where they live or when they can trade.

5️⃣. Who should take StockBee Bootcamp Course?

StockBee Bootcamp European Members is for serious traders who want better results. The course is perfect for:

- Working professionals who need trading strategies that work around full-time jobs with limited time to watch markets.

- Active traders looking for a clear system to find good setups in any market.

- Intermediate traders struggling with consistency who need a proven process loop.

- European traders dealing with time zone challenges when trading U.S. markets.

- Anyone wanting to learn the powerful Episodic Pivot (EP) setup that has created life-changing profits.

This bootcamp is especially valuable if you’ve tried other trading courses but still aren’t making consistent money. The clear approach and focus on practical use make it perfect for dedicated traders ready to improve their results.

6️⃣. Frequently Asked Questions:

Q1: What are the best trading strategies for beginners?

Beginners should focus on simple strategies like trend following, moving averages, and breakout trading. Risk management and discipline are key to success.

Q2: How does European trading differ from U.S. trading?

European trading has different market hours, regulatory environments, and economic influences. Liquidity and volatility can also vary based on regional market activity.

Q3: What is swing trading and how does it work?

Swing trading involves holding positions for several days to weeks to capture short- to medium-term price moves. Traders use technical and fundamental analysis to find opportunities.

Q4: How can I reduce risk in swing trading?

Use stop-loss orders, position sizing, and risk-reward ratios. Diversifying trades and following a tested strategy can also help minimize losses.

Q5: What are the most important indicators for swing trading?

Popular indicators include moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and volume analysis to identify trends and reversals.

Be the first to review “StockBee Bootcamp – European Members – March 2023” Cancel reply

Related products

Forex Trading

Base Camp Trading – Explosive Growth Options – Stocks (EGOS) Program – EGOS MINI BUNDLE)

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.