No Bs Day Trading (U.S Markets Webinar 2016)

$1,400.00 Original price was: $1,400.00.$9.00Current price is: $9.00.

No BS Day Trading (U.S Markets Webinar 2016) [Instant Download]

What is No Bs Day Trading:

No BS Day Trading teaches about US markets trading. It offers live webinars and prep materials.

The next webinar is from October 31 to November 15, 2019. It covers an FOMC meeting week and employment data release. It’s best not to trade early in FOMC weeks.

Students get Webinar Primer Videos when they sign up. These advanced tutorials should be studied before live sessions. Sign up early (2 weeks before) as there’s a lot of content.

For those wanting to start sooner, recorded April sessions are available. These cover successful trades in treasury futures and E-mini S&P 500. Or you can study the Primer Videos on your own before joining October’s live sessions.

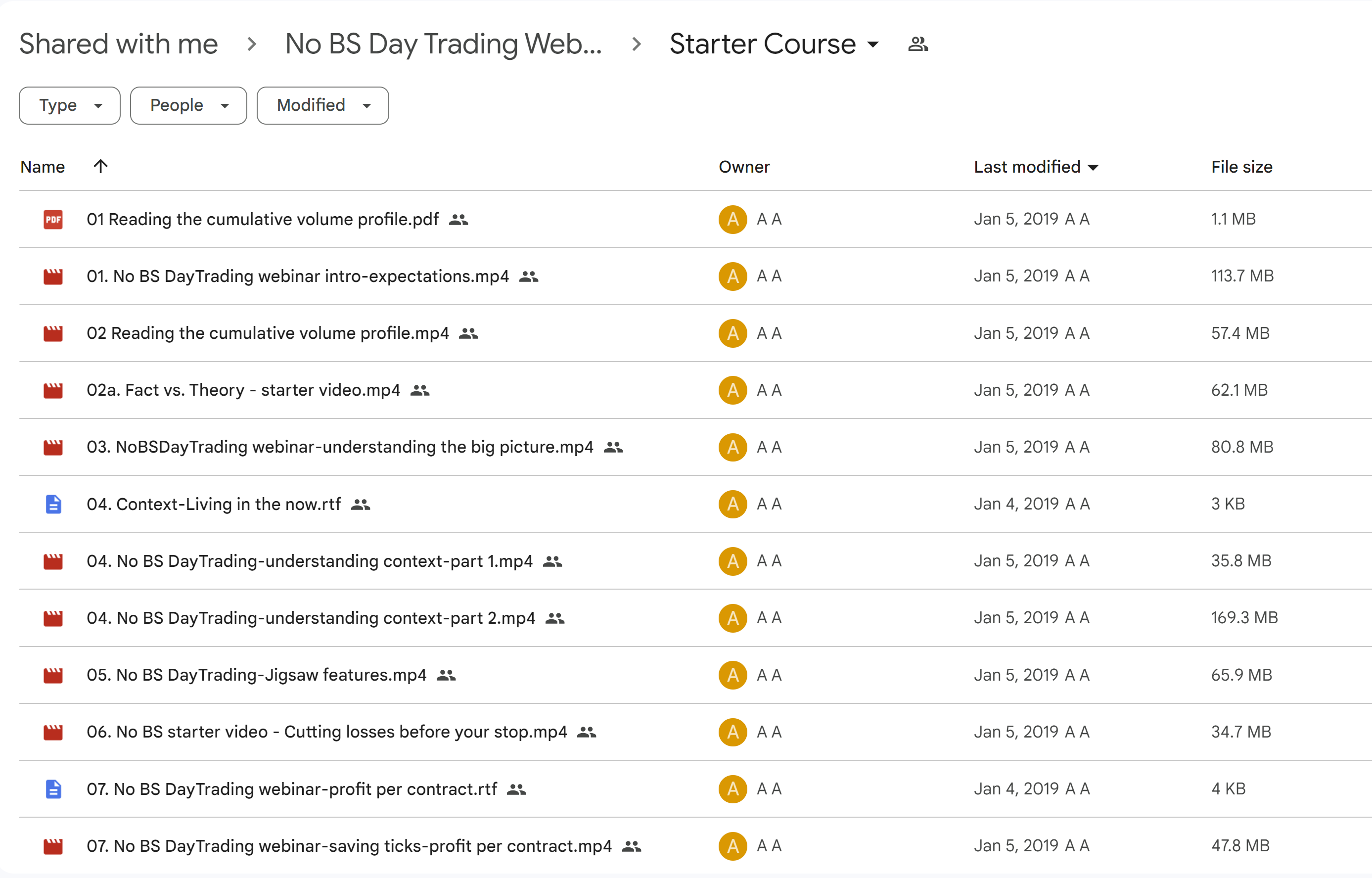

📚 PROOF OF COURSE

No BS Day Trading Webinar Curriculum

The U.S. webinar mainly focuses on U.S. treasury markets. It covers the 10-year (ZN), 30-year (ZB), 5-year (ZF), and Ultra Bond (UB), plus the E-mini S&P 500 (ES).

Why Treasuries?

Treasuries are easier to understand, offer better risk-reward, and have lower fees. They’re good for new scalpers or traders.

Primer Videos

These videos cover basic to advanced trading ideas. They include over 30 hours of lessons and trade examples. Every video is useful, with no extra stuff.

Topics Covered

Videos discuss scalping basics, trading for a living, understanding the big picture, and knowing your opponents. They also cover context, volume profiles, momentum, risk-reward, and more.

Scalping Demos

The webinar shows real-time scalping with real money. It explains the day’s context, trade setup, and reasons for entry and exit.

Scalping Strategies The videos show many strategies like:

- As she goes setup

- Fade trade retracement

- The Lure

- Reversal setups

- Breaking highs and lows

- Playing a range

- Playing the bounce

- Run over by a train

- Run over by a steamroller

- Stop runs

- The Smackdown

- Hitting a wall

- When to not join an iceberg

- ES setups

- Handling market madness

- Managing trades correctly

These strategies help with different market situations.

Who should take No Bs Day Trading Course:

No BS Day Trading is for traders at all skill levels. It teaches you how to trade in U.S. markets effectively. Here’s who should take this course:

- Beginners: New traders who want to learn about U.S. markets. You’ll learn the basics of quick trades and day trading, and how U.S. treasury markets work.

- Intermediate Traders: Those with some experience who want to learn more. You’ll improve your trading methods and get better at making choices based on market info.

- Advanced Traders: Experienced traders looking to try new markets. You’ll learn advanced quick trading skills and the details of U.S. treasury market trading.

This course helps traders at all levels improve their skills and understand U.S. markets better.

Be the first to review “No Bs Day Trading (U.S Markets Webinar 2016)” Cancel reply

Related products

Forex Trading

Forex Trading

Forex Trading

Best 100 Collection

Forex Trading

Forex Trading

Reviews

There are no reviews yet.