Gary Norden – Market Making Scalping Manual

$999.00 Original price was: $999.00.$89.00Current price is: $89.00.

Gary Norden Market Making Scalping Manual Course [Instant Download]

What is Market Making Scalping Manual?

Gary Norden’s Market Making Scalping Manual teaches you how to trade futures like a professional market maker. The course shows you how to profit from bid-ask spreads by reading order flow in real-time.

This is a chart-free trading approach that focuses on market depth and order book analysis. You’ll learn to execute 20-30 trades per hour using institutional-level scalping techniques.

The manual reveals specific methods for queue position management, spread trading, and adapting to market volatility that Norden developed over decades of trading at major banks.

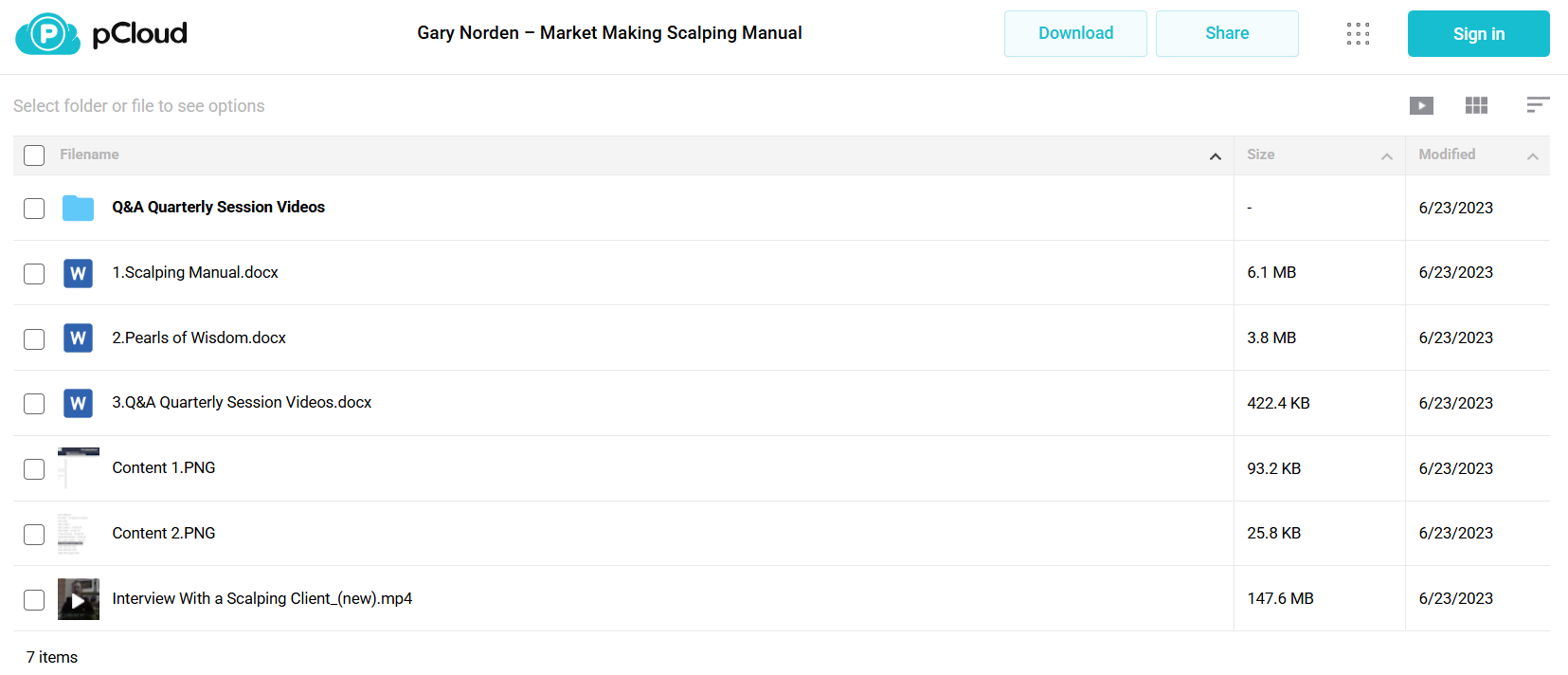

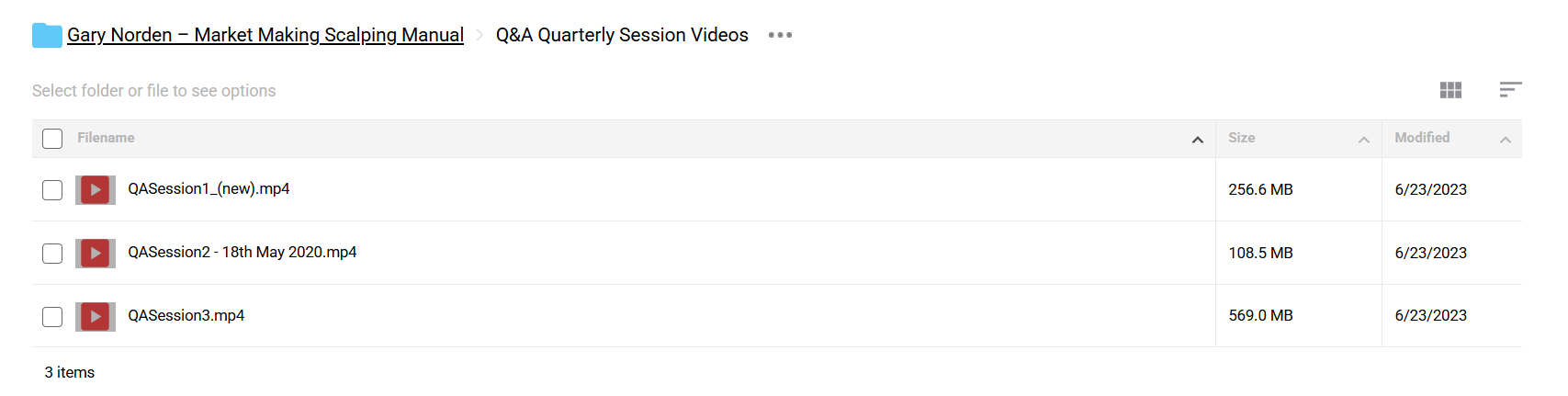

📚 PROOF OF COURSE

What you’ll learn in Market Making Scalping Manual:

This manual shows you how market makers trade futures professionally. Here’s what you’ll learn in MP4s & Docx:

- Trading Order Flow: Learn to read and use bid-offer spreads to find trading opportunities

- Smart Order Placement: Get better trade entries by understanding queue positions

- Market Speed Adjustments: Learn when to trade fast or slow based on market conditions

- Risk Control: Handle your positions safely in quick-moving markets

- Fast Trading Skills: Learn to make 20-30 profitable trades each hour

- Reading Markets: Spot good trades by watching the order book

By the time you finish, you’ll know how to trade futures without charts, just like professional market makers do.

Who is Gary Norden?

Gary Norden started trading at 18 as the youngest trader at Yamaichi Securities in London. At 23, he became Head of LIFFE Options at NatWest, where he led the bank to become a market leader.

His career includes managing major trading portfolios at ING and years of successful trading on the LIFFE floor. He now advises investment banks, hedge funds, and exchanges.

Norden is setting up his own hedge fund, NN² Capital, focused on market making. His blend of bank trading and personal trading success makes him a top expert in market making and scalping.

Be the first to review “Gary Norden – Market Making Scalping Manual” Cancel reply

Related products

Trading Courses

Trading Courses

Trading Courses

Forex Trading

Forex Trading

Base Camp Trading – Explosive Growth Options – Stocks (EGOS) Program – EGOS MINI BUNDLE)

Trading Courses

Trading Courses

![Mike Aston - Learn to Trade [Trading Template]](https://coursehuge.com/wp-content/uploads/2023/09/Mike-Aston-Learn-to-Trade-Trading-Template-300x300.jpg)

Reviews

There are no reviews yet.