Raghee Horner – Ultimate Day Trading Strategy (Elite Package)

$997.00 Original price was: $997.00.$29.00Current price is: $29.00.

Raghee Horner Ultimate Day Trading Strategy Course [Instant Download]

1️⃣. What is Ultimate Day Trading Strategy?

Ultimate Day Trading Strategy teaches you how to trade a specific 2-hour window from 9:30-11:30 AM Eastern, focusing on a predictable morning pattern that delivered 10X account growth in 45 days.

The strategy uses VWAP Max indicators to identify high-probability setups during this morning window. You’ll learn to spot the same trading opportunities as institutional players.

You can apply this method to trade futures, stocks, options, or ETFs with just 4 trading days per week. The system is designed for consistent profits while trading less than 10 hours weekly.

📚 PROOF OF COURSE

2️⃣. What you’ll learn in Ultimate Day Trading Strategy:

The Ultimate Day Trading Strategy shows you how to profit from the best trading hours of the day. Here’s what you’ll learn:

- Trading the Morning Pattern: Master the powerful 2-hour pattern between 9:30-11:30 AM ET for consistent profits

- VWAP Max Tools: Use Raghee’s custom indicators to spot institutional money flow and market direction

- Protect Your Money: Learn exact entry points, exits, and stop-losses to keep your trading account safe

- Trade Any Market: Use the same strategy for futures, stocks, options, and ETFs

- Smart Position Sizing: Know exactly how much to trade, whether you have a small or large account

- Real Trading Sessions: Watch Raghee trade live and learn how she handles real market conditions

You’ll get a clear, step-by-step trading plan that takes just 2 hours each day. The strategy turns complex markets into simple, repeatable trades.

3️⃣. Ultimate Day Trading Strategy Course Curriculum:

✅ Section 1: Strategy Fundamentals

The foundation of this trading curriculum introduces students to essential market analysis concepts and technical indicators. This comprehensive introduction establishes the framework for understanding market dynamics and developing a systematic trading approach.

Module 1.1: Core Strategy Development

This module guides traders through the fundamental building blocks of successful trading, from watchlist creation to understanding market psychology. Students learn to develop a structured approach to market analysis and trading decisions.

- Watchlist and Best Days (Video)

- Core Indicators (Video)

- Price Movement Ranges (Video)

- Directional Bias (Video)

- Sectors and Psychological Levels (Video)

Module 1.2: Advanced Trading Mechanics

Advancing beyond fundamentals, this module covers sophisticated trading concepts including setup identification, wave analysis, and options trading mechanics. Students learn practical implementation of trading strategies.

- Setups and Fades (Video)

- Candles and Waves (Video)

- Entry and Options Chain (Video)

- Risks and Stops (Video)

- Setting Targets and Trade Management (Video)

✅ Section 2: Technical Setup

This section provides detailed instruction for implementing the trading system across different platforms. Students learn to configure their trading environment for optimal execution of the strategy.

Module 2.1: Platform Configuration

Comprehensive setup guides for both TradeStation and ThinkOrSwim platforms, including custom indicators and workspace configurations.

- Chart Setup Application (Video)

- VWAP Trio Implementation (Video)

- Technical Configuration (Video)

- Platform-Specific Indicators (TradeStation and TOS files)

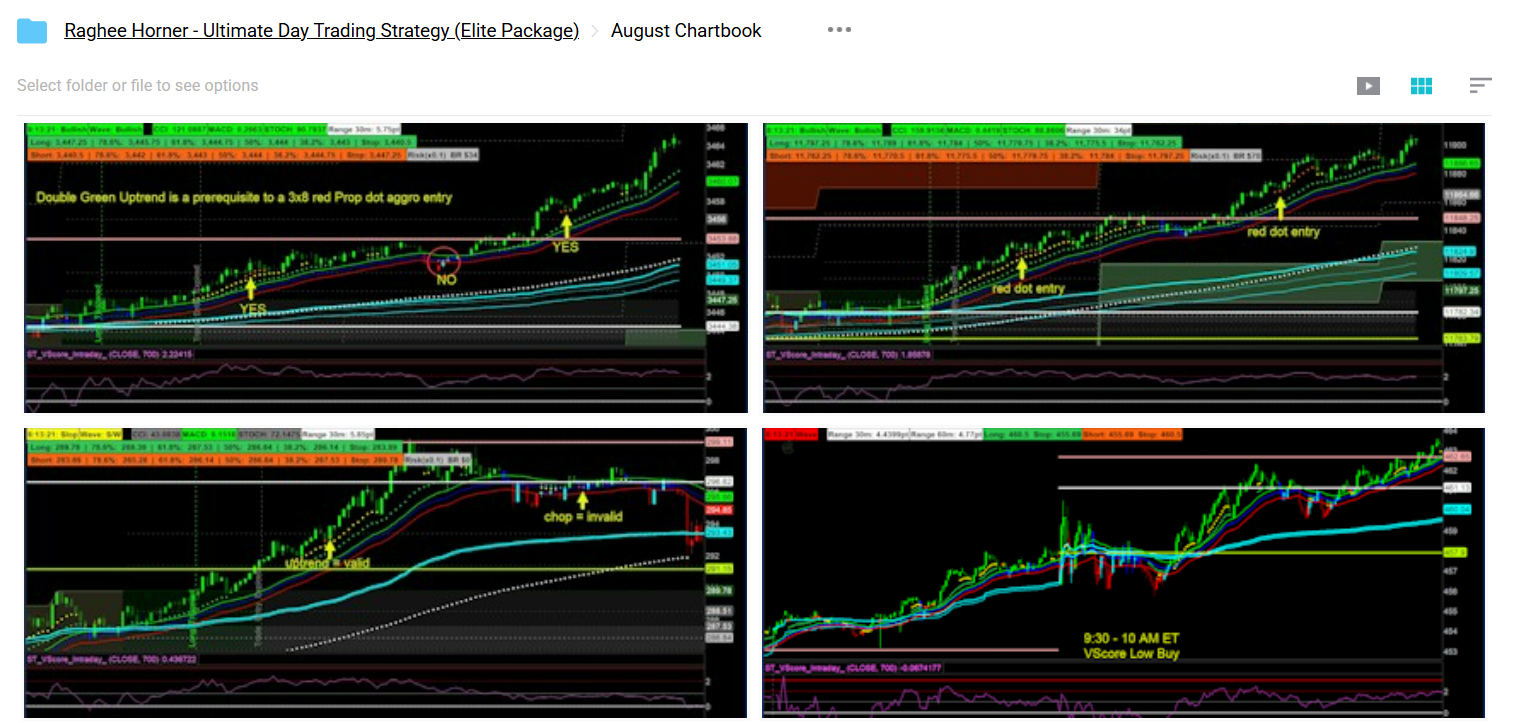

✅ Section 3: Trade Examples and Analysis

A detailed collection of real-world trading examples across various market conditions, organized by month to show strategy adaptation over time.

Module 3.1: July Trading Analysis

Extensive collection of trade examples focusing on various setups including VScore, Breach Retreat, and options strategies across different securities.

- Multiple trading scenarios documented through annotated charts

- Emphasis on major indices (ES, NQ, RTY) and leading stocks

- Detailed analysis of entry points, management decisions, and outcomes

Module 3.2: August Trading Analysis

Continuation of practical examples with enhanced focus on specific setups and risk management scenarios.

- Advanced setup identification and execution examples

- Multiple market scenarios across different instruments

- Integration of multiple technical indicators for trade confirmation

✅ Section 4: Live Trading Sessions

Real-time application of trading concepts through recorded trading sessions, providing practical context for strategy implementation.

Module 4.1: Professional Trading Sessions

Live trading demonstrations showing real-time decision making and trade management.

- Morning Trading Sessions (Video)

- Bonus Session Recordings (Video)

- Trade Analysis and Commentary (Video)

✅ Section 5: Risk Management and Documentation

Essential trading documentation and risk management protocols that form the foundation of consistent trading performance.

Module 5.1: Trading Guidelines

Comprehensive documentation covering risk management, trade planning, and strategy implementation.

- Five Steps to Managing Risk (PDF)

- Trading Plan Template (PDF)

- VWAP Implementation Guide (PDF)

- Daily Routine Checklist (Text)

- Directional Bias Framework (PDF)

The curriculum concludes with extensive reference materials including indicator settings, platform-specific configurations, and detailed trading notes, ensuring students have all necessary resources for successful strategy implementation.

4️⃣. Who is Raghee Horner?

Raghee Horner has been trading profitably for over 30 years and leads Futures Trading at Simpler Trading. She’s never blown up a trading account in her entire career.

She started young, charting mutual funds at age 15. This early start helped her develop the systematic trading methods she uses today.

She created the GRaB and Wave Premium Indicators, which many traders use worldwide. Her trading covers futures, forex, stocks, and options, using exponential moving averages and color-coded candles to find trends.

Raghee’s success comes from putting risk management first. Her trading style combines technical analysis and price action to remove emotions from trading decisions.

5️⃣. Who should take Raghee Horner Course?

The Ultimate Day Trading Strategy helps you make more while trading less. The course is perfect for:

- Working Professionals who can only trade 2 hours each morning before work

- Day Traders wanting to focus on the most profitable morning hours

- Market Traders looking to trade futures, stocks, options, and ETFs with one strategy

- Safety-First Traders who want to protect their account while growing profits

- Chart Traders interested in using professional-level VWAP indicators

You can start with a small account or large portfolio – the strategy works for both. Raghee shows you how to adjust position sizes to match your account.

6️⃣. Frequently Asked Questions:

Q1: What is the best two-hour window for day trading?

The most effective time for day trading is between 9:30 a.m. and 11:30 a.m. ET when market volatility and volume are at their peak.

Q2: Why focus on a specific two-hour window?

Trading within this window helps capture high-probability setups while avoiding midday market stagnation and unnecessary risks.

Q3: What strategies work best for two-hour trading?

Momentum trading, VWAP strategies, and breakout trades are particularly effective within this timeframe due to strong market activity.

Q4: Can beginners trade effectively in just two hours a day?

Yes! With the right strategy, beginners can capitalize on predictable market patterns without needing to monitor charts all day.

Q5: What markets are best suited for this trading approach?

This strategy works well for futures, stocks, ETFs, and options, as they exhibit clear trends and liquidity during the two-hour window. You’ll have access to a community of learners and direct support from the instructor to help you with any questions you may have.

Be the first to review “Raghee Horner – Ultimate Day Trading Strategy (Elite Package)” Cancel reply

Related products

Forex Trading

Forex Trading

Trading Courses

Forex Trading

Trading Courses

Trading Courses

Trading Courses

Forex Trading

Reviews

There are no reviews yet.