The Wall Street Quants BootCamp

$5,997.00 Original price was: $5,997.00.$19.00Current price is: $19.00.

The Wall Street Quants BootCamp Course [Instant Download]

What is The Wall Street Quants BootCamp?

The Wall Street Quants BootCamp teaches you how to become a professional quant trader through algorithmic trading and statistical analysis.

This 12-week program shows you how to develop profitable trading strategies using Python coding and advanced statistical techniques. You’ll learn directly from experienced quants who work at major hedge funds like Point72 and Millennium.

You’ll build real trading algorithms and test them in crypto markets, gaining hands-on experience that top trading firms want. The program prepares you for high-paying positions at hedge funds and quantitative trading firms.

📚 PROOF OF COURSE

What you’ll learn from The Wall Street Quants BootCamp:

The Wall Street Quants BootCamp teaches you practical trading skills that top hedge funds use. Here’s what you’ll learn:

- Python for Trading: Learn to code trading algorithms and analyze market data using key Python tools

- Statistical Arbitrage Strategies: Create profitable trades using mean-reversion and momentum techniques

- Portfolio Management: Master risk control and trading cost analysis

- Real Trading Experience: Build and run automated trading systems with Python

- Interview Success: Practice with 500+ real quant interview questions

- Career Growth: Get resume help and guidance from successful quants who manage $3B+

When you finish, you’ll have real trading results and a project portfolio to show employers. This hands-on experience helps you stand out in job applications.

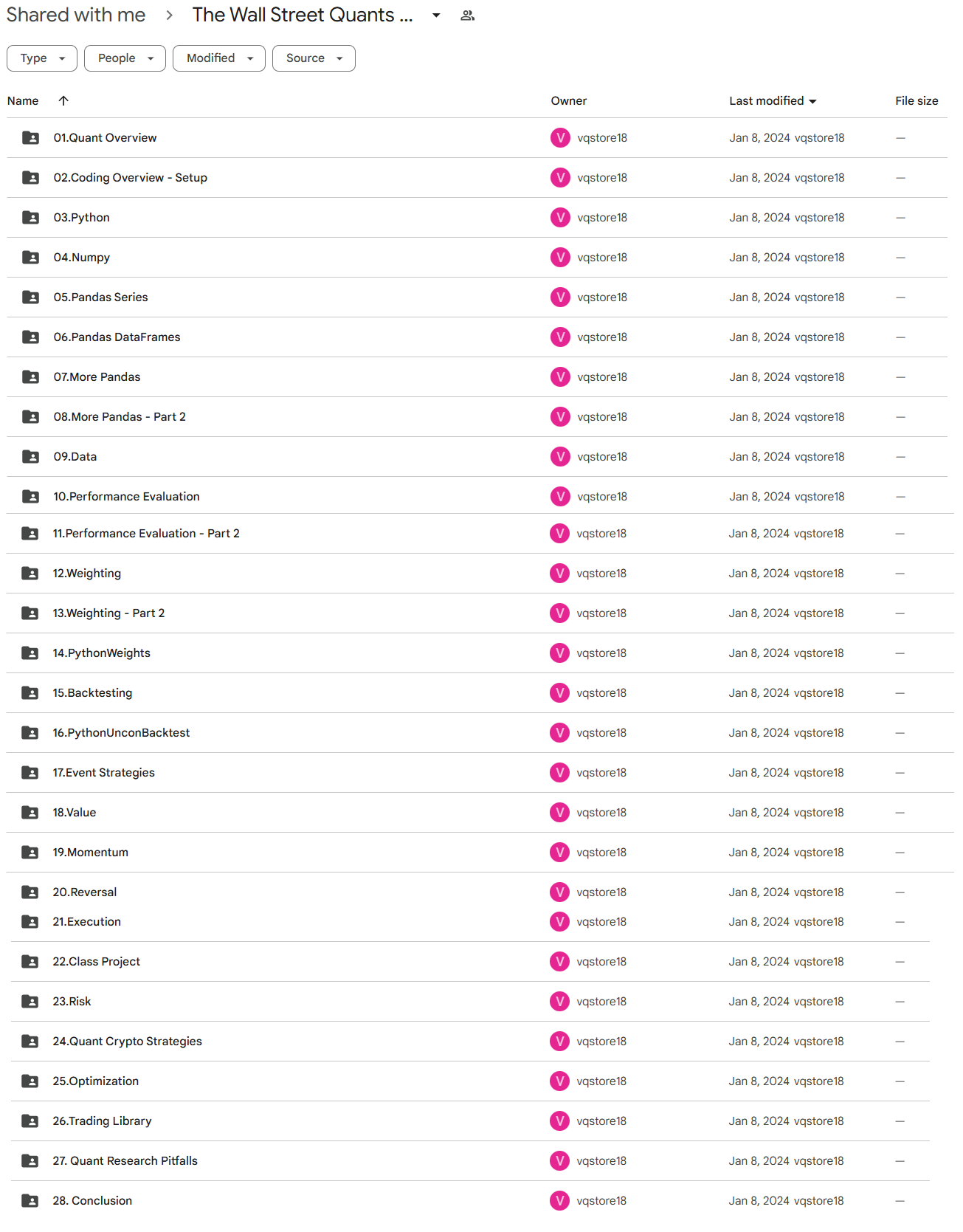

The Wall Street Quants BootCamp Curriculum:

This comprehensive curriculum provides a structured approach to quantitative trading, progressing from fundamental programming skills through advanced trading strategies and implementation. The program integrates theoretical knowledge with practical application, emphasizing systematic trading approaches.

✅ Section 1: Foundations

This section establishes the foundational knowledge required for quantitative trading. Students learn core concepts of quantitative analysis and the programming environment setup necessary for the course.

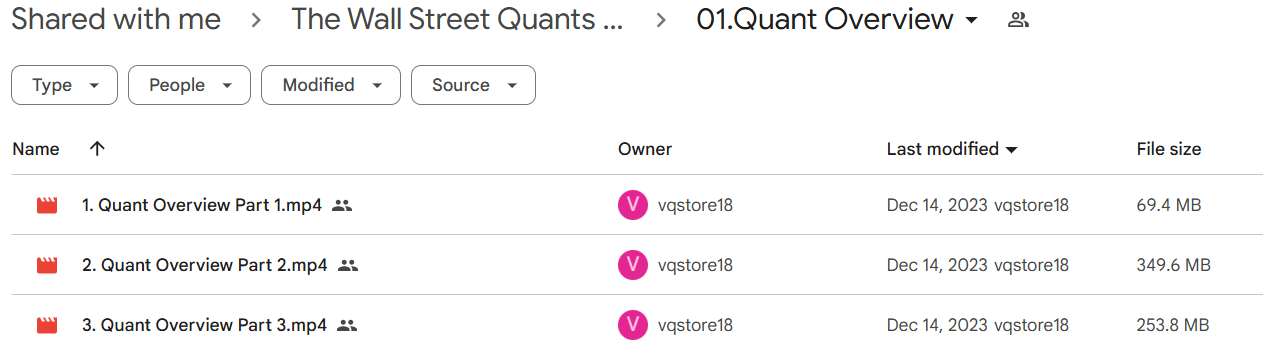

Module 1.1: Quant Overview

Introduction to quantitative trading concepts and methodologies through a three-part video series that establishes the theoretical framework for the course.

Module 1.2: Development Environment

Setup and configuration of the Python development environment, including documentation and practical setup guides. This module ensures students have the necessary technical infrastructure.

✅ Section 2: Programming Fundamentals

This section covers essential Python programming concepts required for quantitative trading applications.

Module 2.1: Python Basics

Comprehensive coverage of Python fundamentals including variables, data types, control structures, and functions. The module includes interactive Jupyter notebooks for hands-on practice and a quiz to assess understanding.

Module 2.2: Scientific Computing

Introduction to NumPy for scientific computing, covering array operations, indexing, and linear algebra concepts essential for quantitative analysis.

✅ Section 3: Data Analysis Tools

This section focuses on data manipulation and analysis tools crucial for quantitative trading.

Module 3.1: Pandas Series

Detailed exploration of Pandas Series objects, including construction, manipulation, and analysis techniques. Students learn to handle time-series data effectively.

Module 3.2: Pandas DataFrames

Advanced data manipulation using Pandas DataFrames, covering construction, analysis, and alignment operations essential for market data analysis.

✅ Section 4: Advanced Data Operations

This section builds upon basic data analysis skills with more sophisticated techniques.

Module 4.1: Extended Pandas

Advanced Pandas operations including handling missing values, categorical data, and time series analysis. The module includes practical exercises and homework assignments.

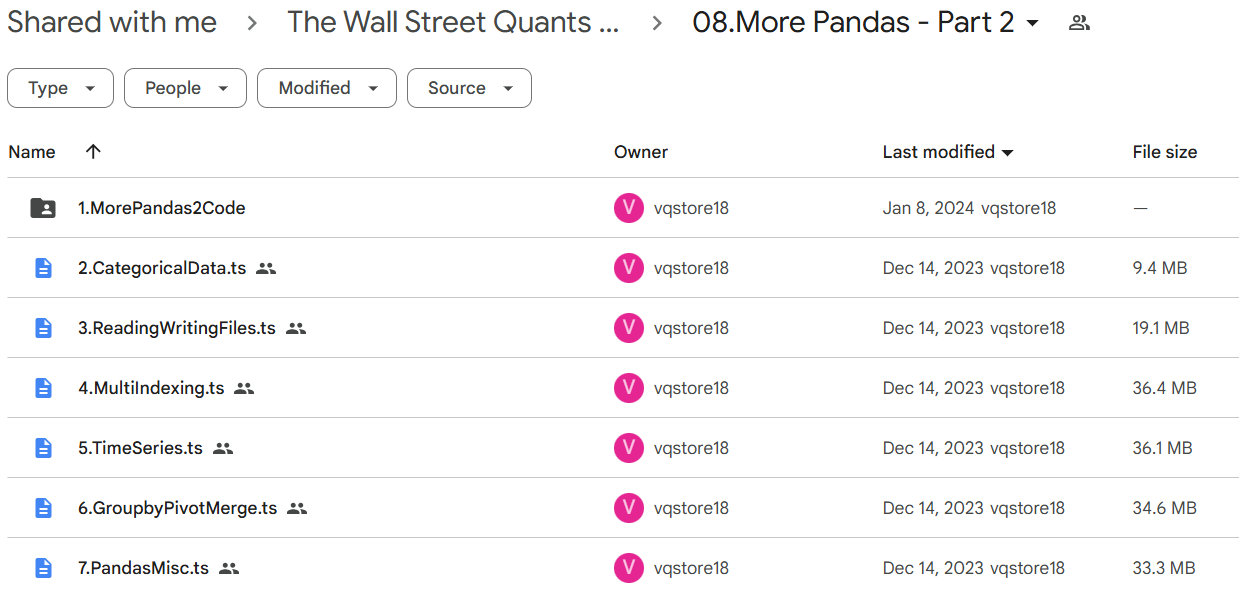

Module 4.2: Data Integration

Techniques for working with multiple data sources, including group operations, pivoting, and merging datasets. Emphasis on practical applications in market analysis.

✅ Section 5: Performance Analytics

This section covers essential metrics and methodologies for evaluating trading strategy performance.

Module 5.1: Basic Metrics

Introduction to key performance metrics including Sharpe ratios, alpha, and beta calculations. Students learn to evaluate trading strategy effectiveness.

Module 5.2: Advanced Analytics

Detailed coverage of regression analysis, drawdown calculations, and performance purification techniques. The module emphasizes practical implementation of theoretical concepts.

✅ Section 6: Strategy Development

This section focuses on the development and implementation of trading strategies.

Module 6.1: Portfolio Construction

Comprehensive coverage of weighting methodologies, correlation analysis, and portfolio optimization techniques. Students learn to construct robust trading portfolios.

Module 6.2: Strategy Types

Exploration of various trading strategies including event-driven, value, momentum, and reversal approaches. Each strategy type is examined with practical implementation considerations.

✅ Section 7: Implementation

This section covers the practical aspects of strategy implementation and execution.

Module 7.1: Trading System Development

Detailed coverage of the trading library, including system architecture, API integration, and execution management. Students learn to build complete trading systems.

Module 7.2: Risk Management

Analysis of risk factors, including factor models and risk analysis techniques. The module emphasizes practical risk management implementation.

✅ Section 8: Advanced Topics

This section covers specialized areas and advanced concepts in quantitative trading.

Module 8.1: Optimization

Advanced optimization techniques including convex optimization and its applications in finance. The module includes both theoretical foundations and practical implementation.

Module 8.2: Cryptocurrency Trading

Specialized coverage of quantitative trading strategies for cryptocurrency markets. Students learn to adapt traditional strategies to digital asset markets.

The curriculum concludes with coverage of common research pitfalls and best practices in quantitative trading. Students learn to avoid overfitting and maintain robust research practices. The program emphasizes practical implementation throughout, with regular homework assignments and projects to reinforce learning.

What is Wall Street Quants?

Wall Street Quants was created by experienced traders from top hedge funds to teach real quant trading skills.

The team includes senior quants from Point72, Millennium, and SIG who manage over $3 billion. They specialize in high-frequency trading, statistical arbitrage, and portfolio management.

They focus on practical skills rather than just theory. Students learn current trading techniques and strategies that work in today’s markets.

Their graduates now work at leading firms like Citadel, WorldQuant, Schonfeld, and Jump Trading, proving the program’s success in launching quant trading careers.

Be the first to review “The Wall Street Quants BootCamp” Cancel reply

Related products

Trading Courses

Forex Trading

Forex Trading

Trading Courses

Trading Courses

Forex Trading

Trading Courses

Reviews

There are no reviews yet.