Steve Nison – The Candlesticks MegaPackage Training Program

$1,189.00 Original price was: $1,189.00.$59.00Current price is: $59.00.

[Download] Steve Nison The Candlesticks MegaPackage Training

📚 PROOF OF COURSE

What is Steve Nison Candlesticks MegaPackage?

The Candlesticks MegaPackage Training Program by Steve Nison is a comprehensive course designed for traders who want to master candlestick charting. Steve Nison, the pioneer of bringing candlestick patterns to the Western world, leads this program. Here’s what makes this course essential for traders:

- In-Depth Exploration: The course dives deep into candlestick patterns, teaching you the basics and advanced techniques. This means you’ll learn everything from recognizing patterns to understanding what they signify in the trading world.

- Practical Application: It’s not just theory. You’ll see how these patterns work in real-world trading scenarios. This experimental approach helps you apply what you learn directly to your trading activities.

- Skill Development: The program focuses on developing your skills in interpreting market trends and managing risks. This is crucial for making informed trading decisions, especially in volatile markets.

- A blend of Techniques: Steve Nison combines technical analysis with practical trading insights. This blend ensures you get a well-rounded understanding of how candlestick patterns influence market movements.

- For All Traders: Whether you’re a beginner or an experienced trader, this program has something for you. It’s designed to enhance your trading skills, regardless of your current level of expertise.

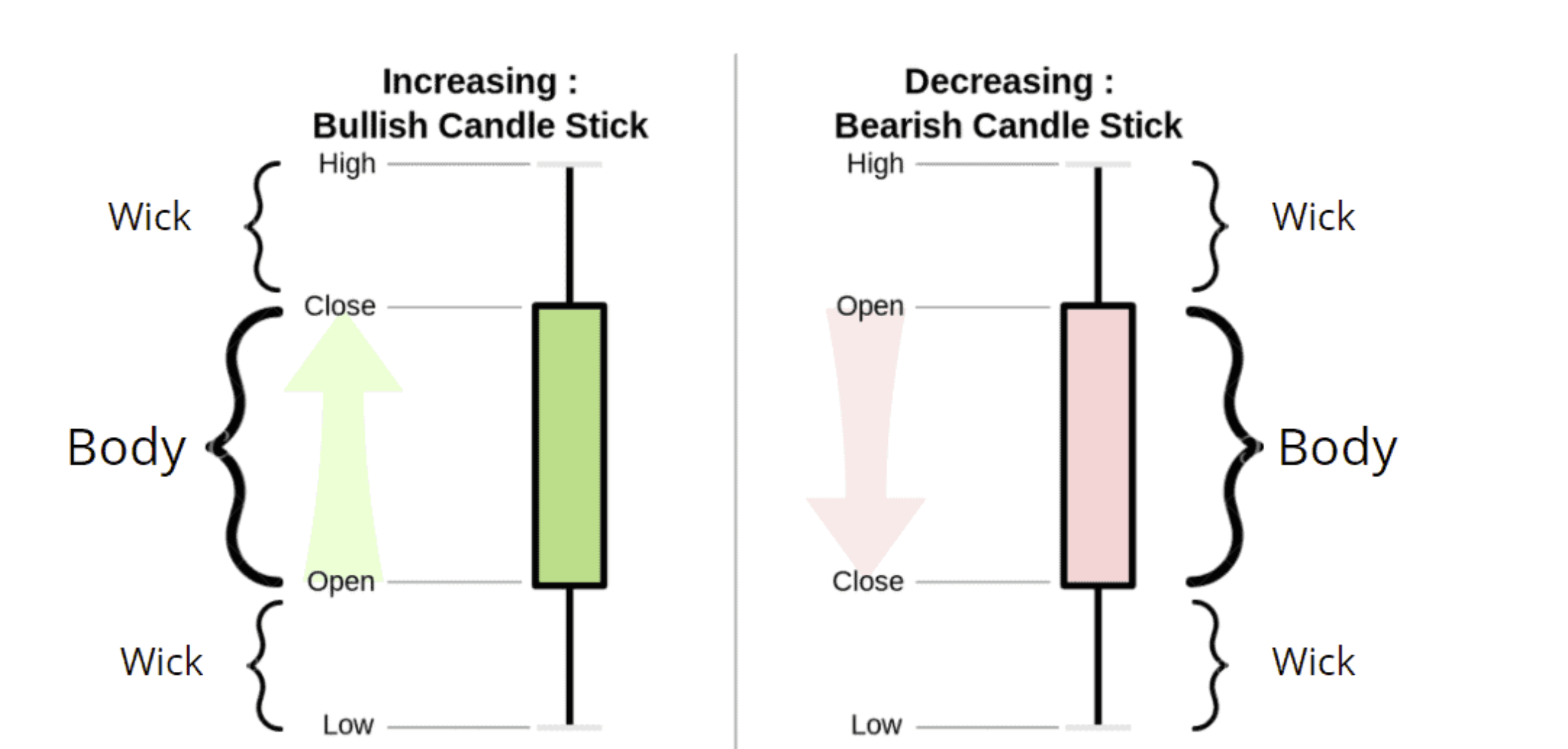

What is a Candlestick in Trading?

A candlestick in trading is like a storyteller of the stock market. It’s a type of chart used to show the price movement of an asset, like stocks or forex, over time. Each candlestick looks like a candle with a wide part, called the ‘body,’ and thin lines sticking out from the top and bottom, known as ‘wicks’ or ‘shadows.’

The candlestick’s body shows the asset’s opening and closing prices within a specific time frame, like a day or an hour. If the closing price is higher than the opening, the body is often coloured green or white, showing that the market is bullish, meaning prices went up. If it’s the other way around, the body might be red or black, indicating a bearish market where prices fell.

The wicks represent the highest and lowest prices during that period. They tell us how far prices have swung high or low, giving a sense of the market’s volatility.

In essence, candlesticks give traders a quick visual snapshot of the market’s behaviour, helping them make informed decisions based on how prices move. They’re like a language of the markets, and once you learn to read them, they can reveal a lot about what might happen next in the stock or forex market.

What you will learn in Candlesticks MegaPackage:

- Understanding Candlestick Patterns: Grasp the fundamentals of candlestick patterns and their significance in the trading world.

- Market Analysis Techniques: Learn how to analyze market trends and movements using candlestick charts.

- Risk Management Strategies: Gain insights into effective risk management techniques to protect your investments.

- Trading Psychology: Explore the psychological aspects of trading and how they impact decision-making.

- Practical Application: Apply candlestick charting techniques in various market scenarios for stocks, forex, and more.

What is included in the Steve Nison Courses Collection:

The Candlesticks MegaPackage Training Program includes:

✅ Course No.1: Secrets to Become a Samurai Trader

✅ Course No.2: Candle Charting Essentials and Beyond

- Steve Nison – Candle Charting Essentials and Beyond

- Steve Nison – Candlesticks Re-Ignited

✅ Course No.3: Profiting in Forex + Bonus

✅ Course No.4: Profiting With Japanese Candlestick

✅ Course No.5: Steve Nison & Ken Calhoun – Short-Term Traders Secrets: Candlesticks Gaps Breakout Patterns Revealed

✅ Course No.6: Stock Trading Success by Steve Nison & Ken Calhoun

✅ Course No.7: Steve Nison – Candlestick Secrets for Profiting in Options

Who is Steve Nison?

Steve Nison, the CEO and Founder of Candlecharts is widely recognized as the first to introduce candlestick charting to the Western world. With over 30 years of real-world experience in candlesticks and Western technical analysis, Nison has established himself as a leading authority in the field. His expertise is not just theoretical; he has been an advisor to top institutional firms and has spoken at prestigious institutions like the World Bank and the Federal Reserve.

Nison’s contributions to the trading world extend beyond his teaching. He is the author of three best-selling books on candlestick charting, translated into over 20 languages, demonstrating his global influence. His insights have been featured in renowned publications like the Wall Street Journal and Barron’s, and he is a celebrated member of the Traders’ Hall of Fame.

What sets Steve Nison apart is his commitment to preserving the authenticity of candlestick charting techniques. He has spent years researching original Japanese sources and working with top Japanese traders to ensure the integrity of his teachings. Nison’s approach is not just about learning the patterns; it’s about understanding their historical context and practical application in modern trading.

In summary, Steve Nison is not just an expert in candlestick charting; he is a pioneer who has played a pivotal role in integrating these powerful techniques into Western trading practices.

1 review for Steve Nison – The Candlesticks MegaPackage Training Program

Add a review Cancel reply

Related products

Trading Courses

Trading Courses

Trading Courses

Forex Trading

Trading Courses

Trading Courses

Forex Trading

Mobeen Y. (verified owner) –

Highly impressed by the service I was provided . Easy to get hold of the seller who replied very promptly. This will be my go to place in future for buying any courses for sure as they are authentic and provide great service.