MarketGauge – Real Motion Trading Course

$997.00 Original price was: $997.00.$45.00Current price is: $45.00.

MarketGauge Real Motion Trading Course [Instant Download]

What is Marketgauge Real Motion Trading Course?

Real Motion Trading, developed by James Kimball, is a powerful training course that combines unique indicators and comprehensive video training to help traders excel in financial markets. The course provides tools and strategies to identify hidden strengths, weaknesses, and opportunities in the market.

The course includes proprietary indicators compatible with MT5, NinjaTrader, and TradeStation… allowing traders to visualize hidden strength or weakness during market trends. By identifying unknown weakness and resistance, traders can anticipate short and long-term tops and buying opportunities near bottoms before market reversals.

Real Motion Trading teaches traders how to calculate expected market highs and lows in advance, which often differ from price swing highs and lows. This insight empowers traders to make well-informed decisions and stay ahead of the curve.

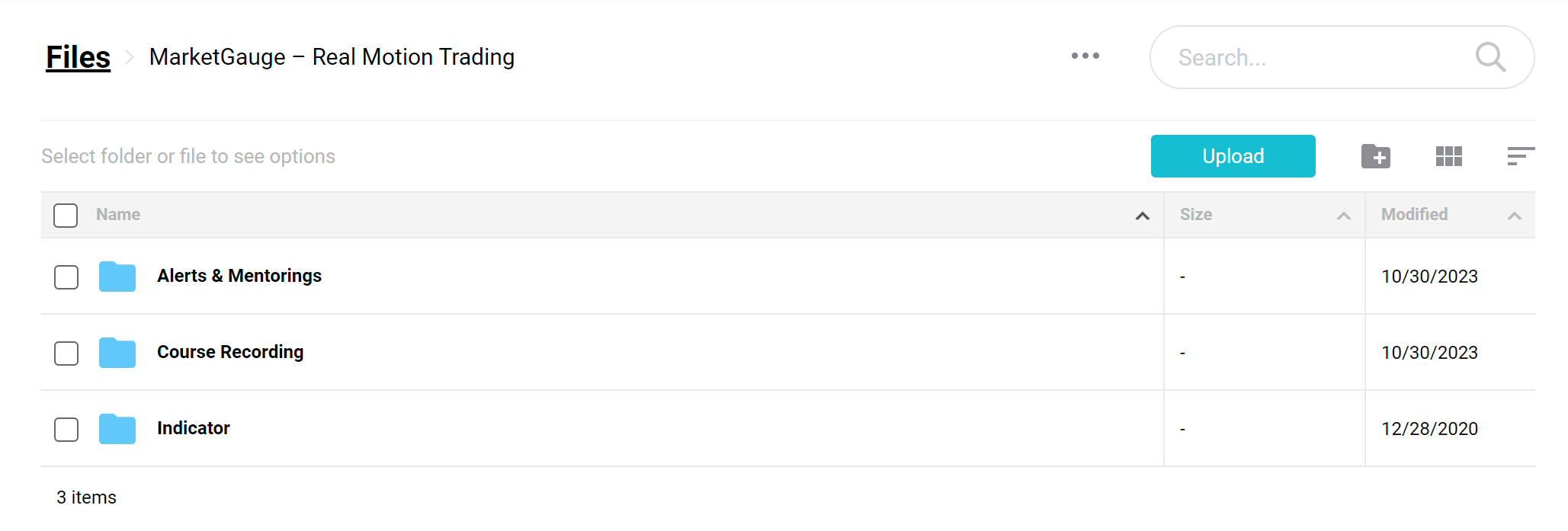

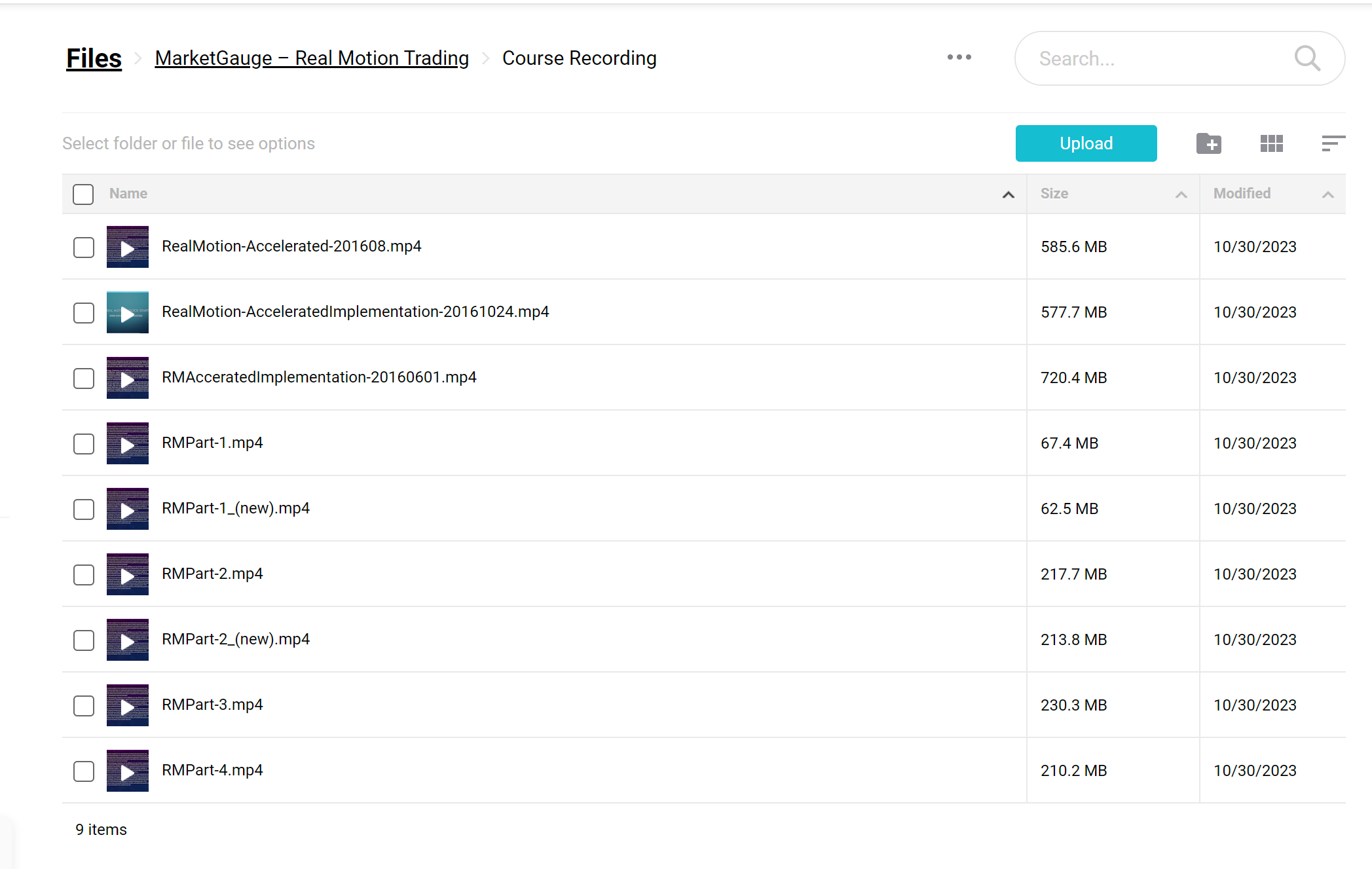

📚 PROOF OF COURSE

What includes in Real Motion Trading Course:

Real Motion Trading is a comprehensive course that provides you with unique indicators and powerful strategies to help you succeed in the financial markets. Here’s what you’ll learn:

✅ Real Motion Trading gives you unique indicators that enable you to:

- See the HIDDEN STRENGTH (or weakness) during market trends, that other traders cannot see, so you know the best trends to follow.

- See UNKNOWN weakness and resistance that creates short and long-term tops. And the same is true for buying opportunities near bottoms (before the market reverses).

- Calculate (in advance!) expected market highs and lows that are often different than the price swing highs and lows!

✅ The Real Motion Trading Course will teach you Trading Strategies for:

- Entering on pull backs for low-risk high-reward trend trades

- Momentum driven trend breakouts for instant gratification trades

- Shorting low-risk reversals at “overbought” highs

- Buying low-risk reversals at “oversold” lows

✅ Explosive compression or “squeeze” play breakouts!

By the end of this course, you’ll have the tools and knowledge you need to identify hidden market opportunities, anticipate market movements, and make informed trading decisions.

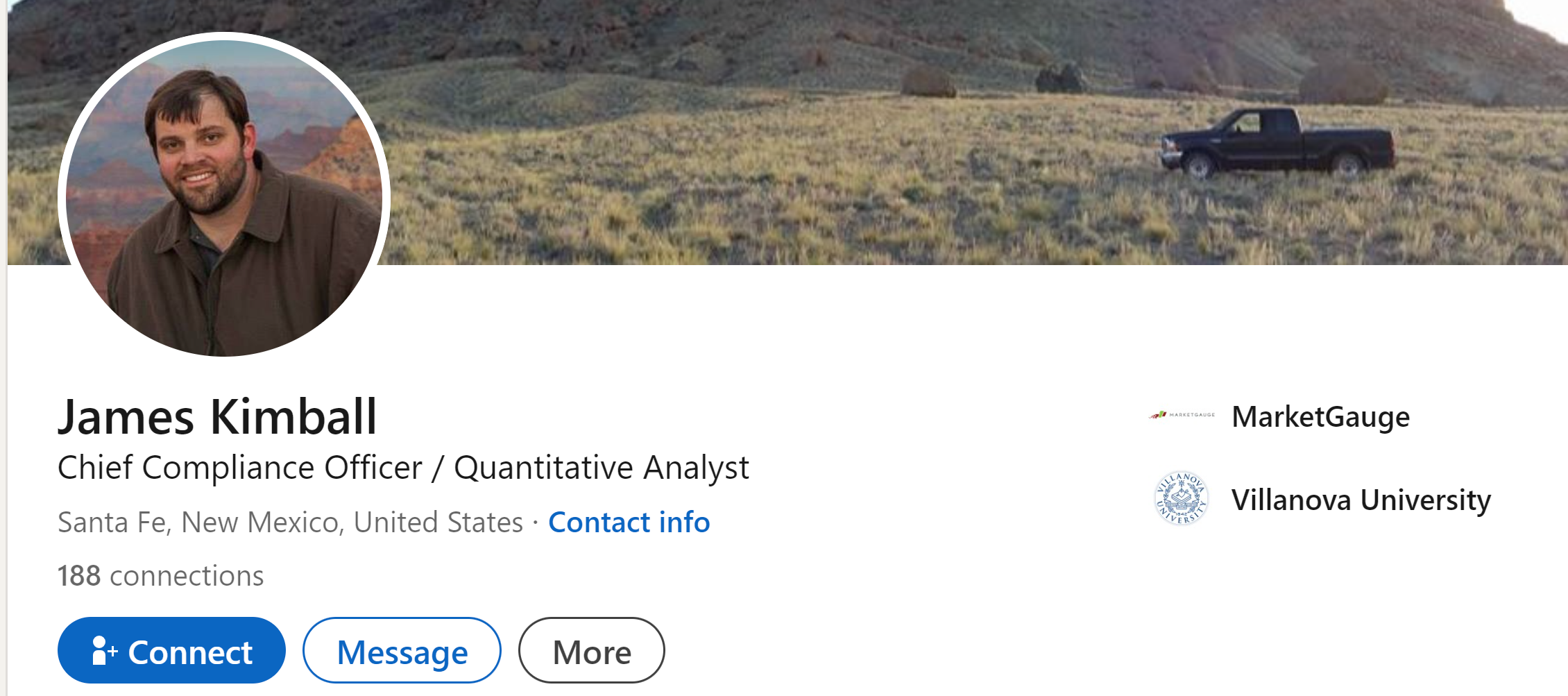

Who is James Kimball (MarketGauge)?

James Kimball is a highly experienced and accomplished professional in the financial markets, with over a decade of expertise as an independent trader and developer of statistical and automated trading systems. His passion for finance stems from his background in public policy and economics, which has equipped him with a unique perspective on the intricate interplay of global and macroeconomic factors that shape the markets daily.

James’s academic achievements are a testament to his dedication and skill. While studying public policy at Patrick Henry College, he excelled as a member of the competitive debate team, securing numerous top 3 finishes in events across the United States through the National Educational Debate Association. In 2005, James was honored as a research fellow with the Ludwig von Mises Institute, and his research paper was published in the prestigious Quarterly Journal of Austrian Economics (Vol. 8 No.3).

As a FINRA Series 65 Registered Investment Advisor Representative and a FINRA Series 24 General Securities Principal, James serves as an Investment Advisor and Chief Compliance Officer with Market Gauge Asset Management, LLC. His educational background includes a Master of Science degree in Finance from Villanova University and a Bachelor of Arts degree in Government with an emphasis in Public Policy from Patrick Henry College.

James’s diverse skill set, coupled with his passion for the high-desert landscapes of his home in Santa Fe, New Mexico, makes him a well-rounded and insightful mentor in the world of trading.

Be the first to review “MarketGauge – Real Motion Trading Course” Cancel reply

Related products

Forex Trading

Trading Courses

Forex Trading

Trading Courses

Trading Courses

Forex Trading

Forex Trading

Reviews

There are no reviews yet.