David Vallieres – Tradingology Complete Options Course

$597.00 Original price was: $597.00.$13.00Current price is: $13.00.

[Instant Download] David Vallieres – Tradingology Complete Options Course

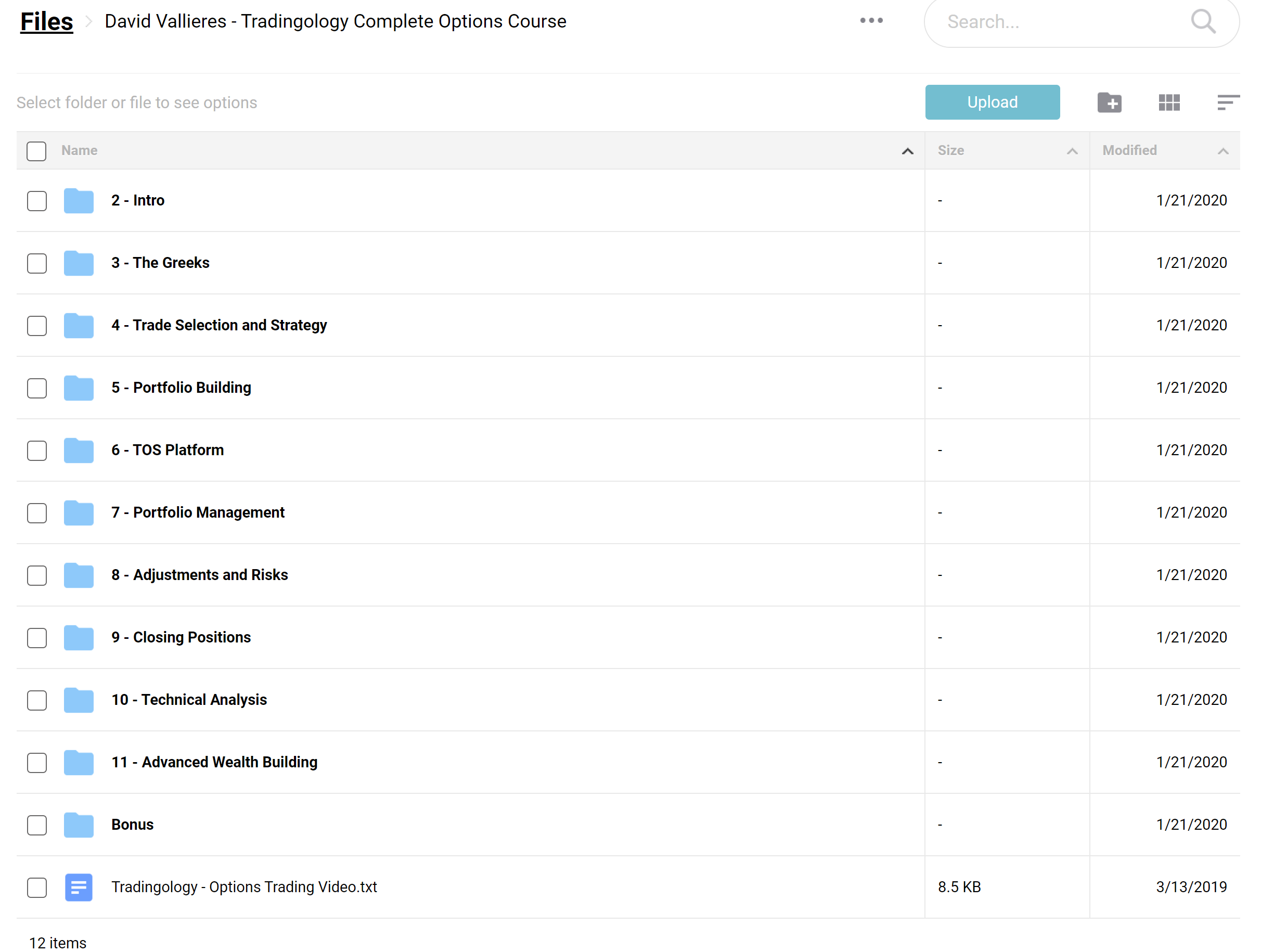

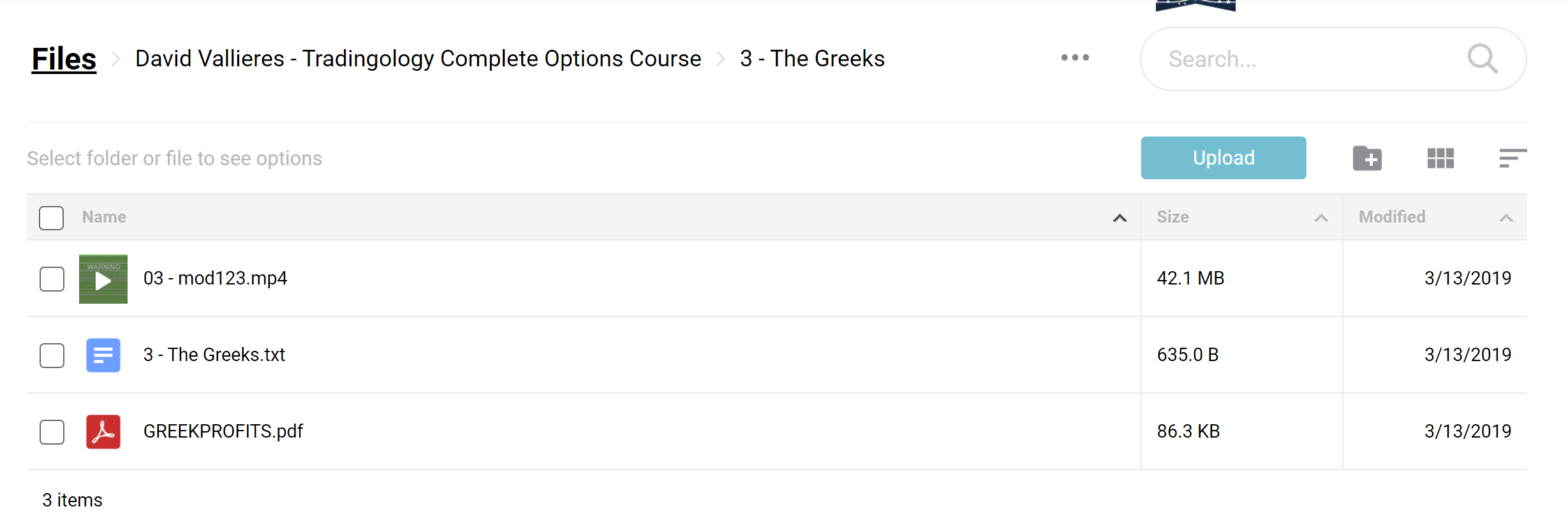

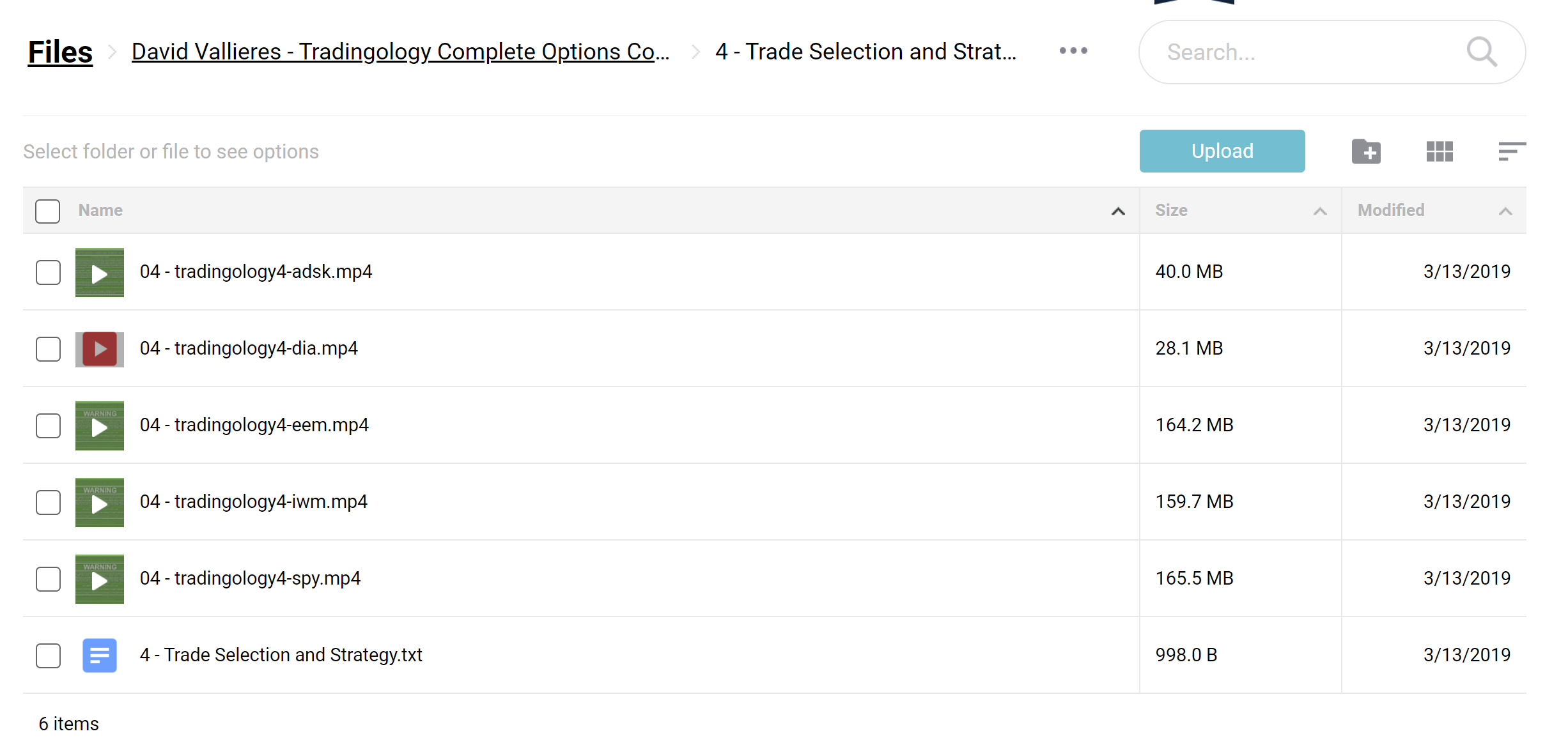

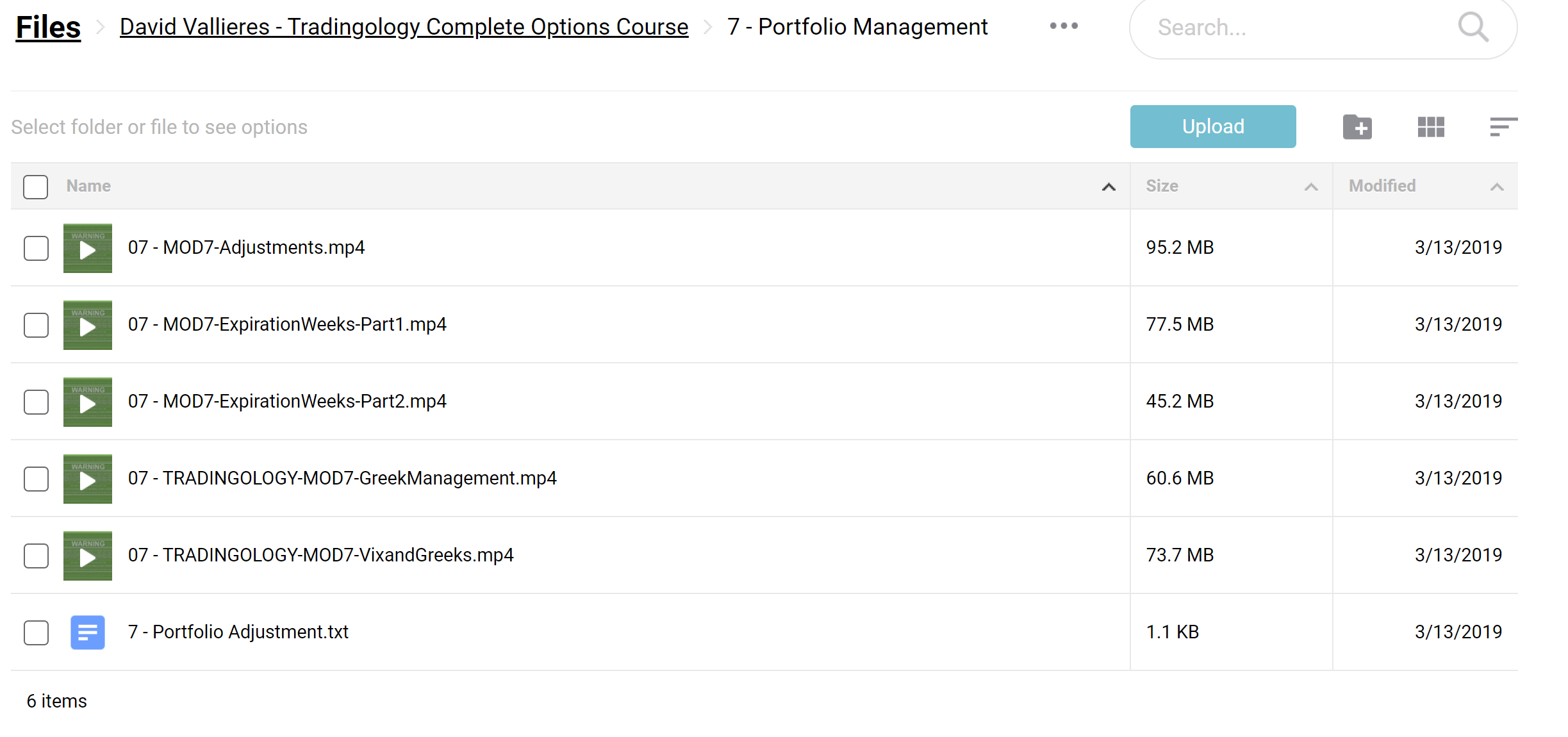

📚 PROOF OF COURSE

What is Tradingology Complete Options Course:

In the “Tradingology Complete Options Course,” David Vallieres deeply understands options trading.

This course is a journey through the essentials of options trading, emphasizing risk management and strategic portfolio diversification. It’s designed to transform beginners into informed traders.

With a focus on practical skills and real-world applications, students learn to navigate the complexities of the market with confidence. This course is not just about theories; it’s about applying knowledge to make intelligent trading decisions.

What you will learn in Tradingology Options course:

- Understanding the Basics: Grasp the fundamentals of options trading.

- Risk Management: Learn to manage risks effectively for long-term success.

- Strategic Trading: Master the art of selecting the right trades.

- Portfolio Diversification: Discover how to diversify your portfolio across various securities and time frames.

- Utilizing Trading Platforms: Gain proficiency in using the ThinkOrSwim platform for trade analysis.

- Making Adjustments: Learn the skill of making trade adjustments to turn potential losses into profits.

- Closing Positions: Strategies for closing positions to maximize profits.

Tradingology Complete Options Course Course curriculum:

- Module 0: Introduction to Trading as a Business & Trading with Confidence.

- Module 1-2-3: Understanding and Managing by ‘The Greeks’.

- Module 4: Trade Selection and Strategy.

- Module 5: Building a Profitable Portfolio.

- Module 6: Mastering the ThinkOrSwim Platform.

- Module 7: Portfolio Management by The Greeks, Adjustments, VIX, and More.

- Module 8: The Art of Adjustments – The Secret Key.

- Module 9: Closing Positions for Maximum Profit.

- Module 10: The Big Picture – Technical Analysis.

- Module 11: Advanced Techniques and Explosive Wealth Building Strategies.

Who teaches Tradingology Complete Options Course?

David Vallieres is a seasoned trader with over 50 years of combined experience in trading and investing. As the founder of Tradingology.com, he has dedicated his career to educating traders and investors.

Vallieres stands out for his practical approach to trading, focusing on risk management, leverage, and market mechanics.

His expertise lies in the art and science of trading, particularly in equity/ETF options.

Despite not being a registered investment advisor, his insights come from real-world experience, making him a valuable mentor for retail traders.

Vallieres’ philosophy is grounded in educating members about the realities of trading, emphasizing that success in trading requires more than just following advice; it requires a deep understanding of market dynamics and risk.

👉 Read more: David Vallieres – The Better Butterfly Course

Be the first to review “David Vallieres – Tradingology Complete Options Course” Cancel reply

Related products

Options Trading

Options Trading

Anton Kreil – Professional Options Trading Masterclass (POTM)

Best 100 Collection

Options Trading

Options Trading

Options Trading

![[Bundle] Best 14 Dan Sheridan Courses](https://coursehuge.com/wp-content/uploads/2023/09/Bundle-Best-14-Dan-Sheridan-Courses-300x300.jpg)

Reviews

There are no reviews yet.